Toro Company (The) Common Stock (TTC)

101.66

+1.03 (1.02%)

NYSE · Last Trade: Feb 24th, 10:49 AM EST

The Toro Company has had an impressive run over the past six months as its shares have beaten the S&P 500 by 24.9%. The stock now trades at $98.18, marking a 33.5% gain. This performance may have investors wondering how to approach the situation.

Via StockStory · February 9, 2026

Investors looking for hidden gems should keep an eye on small-cap stocks because they’re frequently overlooked by Wall Street.

Many opportunities exist in this part of the market, but it is also a high-risk, high-reward environment due to the lack of reliable analyst price targets.

Via StockStory · January 22, 2026

A company that generates cash isn’t automatically a winner.

Some businesses stockpile cash but fail to reinvest wisely, limiting their ability to expand.

Via StockStory · January 7, 2026

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at The Toro Company (NYSE:TTC) and the best and worst performers in the agricultural machinery industry.

Via StockStory · December 31, 2025

Via MarketBeat · December 28, 2025

The Toro Company’s third quarter was met with a positive market reaction, as management cited improved execution in its Professional segment and better-than-expected results from snow and underground construction businesses. CEO Rick Olson emphasized operational excellence, noting that “sustained momentum in the underground construction business and better-than-anticipated growth in snow and ice management” helped offset lower volumes in traditional product categories. Management also highlighted successful cost savings from its Amplifying Maximum Productivity (AMP) initiative and a strong cash flow performance, reflecting the company’s ongoing focus on productivity and efficiency.

Via StockStory · December 24, 2025

Outdoor equipment company Toro (NYSE:TTC) reported revenue ahead of Wall Streets expectations in Q3 CY2025, but sales were flat year on year at $1.07 billion. Its non-GAAP profit of $0.91 per share was 4.2% above analysts’ consensus estimates.

Via StockStory · December 18, 2025

Outdoor equipment company Toro (NYSE:TTC) announced better-than-expected revenue in Q3 CY2025, but sales were flat year on year at $1.07 billion. Its non-GAAP profit of $0.91 per share was 4.2% above analysts’ consensus estimates.

Via StockStory · December 17, 2025

Toro Company (TTC) beats Q4 earnings estimates and provides 2026 guidance, driven by strong Professional segment performance and cost-saving initiatives.

Via Chartmill · December 17, 2025

Outdoor equipment company Toro (NYSE:TTC)

will be reporting earnings this Wednesday before market open. Here’s what to expect.

Via StockStory · December 15, 2025

A number of stocks jumped in the afternoon session after the Federal Reserve lowered its benchmark interest rate by a quarter-percentage point, signaling a more accommodative monetary policy.

Via StockStory · December 10, 2025

The world is currently grappling with a potent and dangerous cocktail of climate change impacts and water scarcity, giving rise to a phenomenon dubbed "climateflation." This escalating crisis is driving up global food commodity prices and, critically, pushing millions in Africa to the brink of severe food insecurity, threatening financial

Via MarketMinute · December 12, 2025

Market swings can be tough to stomach, and volatile stocks often experience exaggerated moves in both directions.

While many thrive during risk-on environments, many also struggle to maintain investor confidence when the ride gets bumpy.

Via StockStory · December 1, 2025

Over the past six months, The Toro Company’s shares (currently trading at $71.61) have posted a disappointing 5% loss, well below the S&P 500’s 16.3% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Via StockStory · November 13, 2025

Small-cap stocks can be incredibly lucrative investments because their lack of analyst coverage leads to frequent mispricings.

However, these businesses (and their stock prices) often stay small because their subscale operations make it harder to expand their competitive moats.

Via StockStory · November 7, 2025

While profitability is essential, it doesn’t guarantee long-term success.

Some companies that rest on their margins will lose ground as competition intensifies - as Jeff Bezos said, "Your margin is my opportunity".

Via StockStory · November 4, 2025

Toro Co (TTC) exemplifies quality investing with strong ROIC, low debt, and excellent cash flow conversion, making it a stable long-term portfolio candidate.

Via Chartmill · November 1, 2025

A company that generates cash isn’t automatically a winner.

Some businesses stockpile cash but fail to reinvest wisely, limiting their ability to expand.

Via StockStory · October 22, 2025

The stocks in this article have caught Wall Street’s attention in a big way, with price targets implying returns above 20%.

But investors should take these forecasts with a grain of salt because analysts typically say nice things about companies so their firms can win business in other product lines like M&A advisory.

Via StockStory · October 20, 2025

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at The Toro Company (NYSE:TTC) and the best and worst performers in the agricultural machinery industry.

Via StockStory · September 23, 2025

A highly volatile stock can deliver big gains - or just as easily wipe out a portfolio if things go south.

While some investors embrace risk, mistakes can be costly for those who aren’t prepared.

Via StockStory · September 23, 2025

Industrials businesses quietly power the physical things we depend on, from cars and homes to e-commerce infrastructure. But their prominence also brings high exposure to the ups and downs of economic cycles.

Luckily, the tide is turning in their favor as the industry’s 22.6% return over the past six months has topped the S&P 500 by 6.1 percentage points.

Via StockStory · September 16, 2025

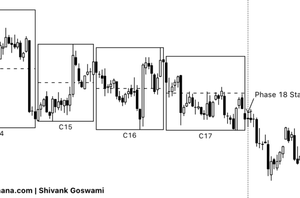

Toro stock has been stuck in Phase 18 for over 700 days. Weak Guna Triads mean no Nirvana ahead, consolidation may last until August 2026.

Via Benzinga · September 10, 2025

A number of stocks fell in the afternoon session after concerns about the health of the U.S. economy grew following a significant downward revision of job market data.

Via StockStory · September 9, 2025

Toro Co. (TTC) is a top dividend stock with a sustainable 1.89% yield, strong profitability, and a solid history of dividend growth, making it a pick for income investors.

Via Chartmill · September 6, 2025