Recent Articles from MarketMinute

MarketMinute is a dynamic online platform dedicated to delivering real-time stock news and market insights to investors and enthusiasts alike. Operated by FinancialContent, a leading digital publisher in financial news, the website offers up-to-the-minute updates on stock movements, corporate earnings, analyst ratings, and macroeconomic trends that shape the financial landscape.

Website: https://www.marketminute.com

As we move into the second month of 2026, the financial community has coalesced around a singular, aggressive target for the U.S. stock market: a 15% growth in earnings per share (EPS) for the S&P 500. This benchmark is not merely an optimistic forecast but is increasingly viewed

Via MarketMinute · February 11, 2026

As of February 11, 2026, the corporate landscape is undergoing its most significant transformation in half a decade. After two years of high interest rates and regulatory gridlock that chilled the market, 2026 has emerged as the year of the "Strategic Rebound." With the Federal Reserve stabilizing interest rates following

Via MarketMinute · February 11, 2026

As of February 11, 2026, the American real estate market is grappling with a profound "regime change" in monetary policy. The recent nomination of Kevin Warsh as Chairman of the Federal Reserve has introduced a dual-track strategy that is sending shockwaves through the housing sector. While the central bank has

Via MarketMinute · February 11, 2026

The departure of Gary Gensler and the subsequent appointment of Paul S. Atkins as Chair of the Securities and Exchange Commission (SEC) has signaled a fundamental transformation in U.S. financial regulation. As of February 11, 2026, the era of "regulation by enforcement" that characterized the previous administration has been

Via MarketMinute · February 11, 2026

The federal government has fully implemented the so-called "Trump Accounts" reporting rule. As of February 11, 2026, every federal agency is now mandated to provide a granular, real-time accounting of every dollar spent and every personnel hour logged. This initiative, which began as a campaign promise to "drain the swamp"

Via MarketMinute · February 11, 2026

As of February 11, 2026, the global energy market has become a theater of conflicting forces, leaving investors and analysts grappling with unprecedented volatility. On one side, the U.S. administration’s aggressive "Drill, Baby, Drill" policy has unleashed a torrent of new domestic production, pushing West Texas Intermediate (WTI)

Via MarketMinute · February 11, 2026

As the Trump administration enters its second year, a seismic shift in the American legal and economic landscape is reaching a fever pitch. What began as a series of "Day One" executive orders has evolved into a massive, coordinated legal offensive by U.S. corporations to dismantle the regulatory framework

Via MarketMinute · February 11, 2026

The digital asset market has entered a new epoch this week as Bitcoin (BTC) shattered previous records, briefly touching the $150,000 milestone. This historic surge comes on the heels of a definitive pivot in Washington D.C., where the new administration has begun the formal process of integrating Bitcoin

Via MarketMinute · February 11, 2026

In a dramatic shift that has caught many Wall Street analysts off guard, the first two weeks of February 2026 have witnessed a historic "Great Rotation" within the equity markets. The Russell 2000 Index (IWM), which tracks domestic small-cap companies, has staged its most aggressive rally in decades, significantly outperforming

Via MarketMinute · February 11, 2026

As of February 11, 2026, the American consumer is sending a split message to Wall Street. Despite a grueling 43-day federal government shutdown that paralyzed the economy late last year and a "flat" retail sales report for December 2025, consumer spending has shown a gritty, if uneven, resilience. While headline

Via MarketMinute · February 11, 2026

The artificial intelligence super-cycle, which has propelled equity markets to record highs for over three years, hit a significant roadblock on February 11, 2026. In a day characterized by high-volume selling and a sharp pivot in investor sentiment, the tech-heavy Nasdaq Composite plunged 3.8%, marking its worst single-session performance

Via MarketMinute · February 11, 2026

The global financial markets are currently reeling from the "Warsh Shock," a violent repricing of risk that has seen the 10-year Treasury yield surge past the critical 4.5% threshold. This dramatic move follows the nomination of Kevin Warsh to succeed Jerome Powell as Chair of the Federal Reserve on

Via MarketMinute · February 11, 2026

WASHINGTON D.C. — In a sweeping transformation of the federal government not seen in decades, the Office of Budget, Balance, and Bureaucratic Accountability (OBBBA) has initiated a massive "operational efficiency" review, marking the formal beginning of what Wall Street is calling the "Great Regulatory Purge." This aggressive restructuring, authorized under

Via MarketMinute · February 11, 2026

As of February 11, 2026, the global economy is navigating the aftershocks of a geopolitical standoff that nearly dismantled the post-war trade order. The "Greenland Tariff Escalation," a high-stakes diplomatic confrontation sparked by the United States’ aggressive pursuit of the world’s largest island, has shifted from an imminent trade

Via MarketMinute · February 11, 2026

In a historic session that has redefined the boundaries of the precious metals market, spot gold surged to a fresh all-time high of $5,087.10 on February 11, 2026. This monumental ascent past the $5,000 psychological barrier marks a watershed moment for global finance, driven by an aggressive

Via MarketMinute · February 11, 2026

The nomination of Kevin Warsh to succeed Jerome Powell as Chair of the Federal Reserve has triggered what analysts are now calling the "Warsh Shock." Announced on January 30, 2026, the transition marks the most radical shift in U.S. monetary policy in decades. By moving away from the "data-dependent"

Via MarketMinute · February 11, 2026

On February 11, 2026, the financial world woke up to a statistical earthquake that has fundamentally rewritten the narrative of the American economy. The Bureau of Labor Statistics (BLS) released its final benchmark revision for the 2025 calendar year, revealing that 400,000 fewer jobs were created than previously reported.

Via MarketMinute · February 11, 2026

The U.S. labor market delivered a jarring "double-take" to investors on February 11, 2026, as the Department of Labor released a January jobs report that was simultaneously robust and sobering. US employers added a surprising 130,000 jobs in the first month of the year, crushing the consensus forecast

Via MarketMinute · February 11, 2026

The S&P 500 Index retreated further from its historic peaks on Wednesday, closing at 6,914.75, a decline of 0.39% for the session. This pullback marks a significant cooling period for a market that only weeks ago, on January 28, 2026, celebrated a record-shattering high of 7,

Via MarketMinute · February 11, 2026

The Dow Jones Industrial Average (DJIA) surrendered its hard-won psychological high ground on Wednesday, February 11, 2026, sliding back below the 50,000-point milestone. The blue-chip index fell 188 points, or 0.38%, to close at 49,999.24, ending a brief tenure above the historic mark and signaling a

Via MarketMinute · February 11, 2026

The financial services landscape of February 2026 has been defined by a ruthless "survival of the smartest," as the era of the fintech unicorn has officially given way to the era of the vertically integrated mega-bank. Driven by a persistent valuation reset and the desperate need for advanced artificial intelligence

Via MarketMinute · February 11, 2026

Astera Labs (Nasdaq: ALAB) has solidified its position as the primary barometer for the next phase of the artificial intelligence revolution. In its latest Q4 earnings report, released yesterday, February 10, 2026, the connectivity specialist shattered analyst expectations and provided a 2026 revenue outlook that suggests the 'AI Supercycle' is

Via MarketMinute · February 11, 2026

The U.S. financial landscape is undergoing a tectonic shift as the "One Big Beautiful Bill Act" (OBBBA), signed into law on July 4, 2025, begins to exert its full influence on the equity markets. For the first time in over a decade, the long-dormant Russell 2500 index—representing the

Via MarketMinute · February 11, 2026

As of February 11, 2026, the global energy landscape finds itself trapped in a high-stakes waiting game. Despite a cooling U.S. labor market and "weaker than expected" retail sales, oil prices remain stubbornly resilient, underpinned by a thick layer of geopolitical anxiety. The primary driver is the ongoing diplomatic

Via MarketMinute · February 11, 2026

The global race for artificial intelligence supremacy has officially moved from the silicon of the data center to the shale of the American heartland. On February 2, 2026, the energy sector witnessed a seismic shift as Devon Energy (NYSE: DVN) announced a definitive agreement to acquire Coterra Energy (NYSE: CTRA)

Via MarketMinute · February 11, 2026

The American consumer is currently living in two different realities. In early 2026, the Conference Board’s Consumer Confidence Index plummeted to a 12-year low of 84.5, a level not seen since the sluggish recovery of 2014. This sharp decline from December’s 94.2 reading has sent shockwaves

Via MarketMinute · February 11, 2026

The optimism that defined the start of the year has met a cold reality this February. As of February 11, 2026, the market’s fervent expectation for a March interest rate cut has all but vanished, replaced by a cautious "hawkish pause" from the Federal Reserve. A paradoxical mix of

Via MarketMinute · February 11, 2026

The global financial landscape has been fundamentally altered this February 2026 as precious metals reach prices once deemed impossible by all but the most fringe analysts. As of February 11, 2026, Gold has solidified its position above the $5,100 per ounce mark, while Silver has surged past $112 per

Via MarketMinute · February 11, 2026

The morning of February 11, 2026, marks the end of a grueling "data blackout" for Wall Street. After a partial government shutdown that began on January 30th paralyzed the Bureau of Labor Statistics (BLS), the highly anticipated January employment situation report has finally been released. The delay, while only five

Via MarketMinute · February 11, 2026

The "Golden Age of SaaS" has met a cold, digital winter. Over the past four months, the software industry has undergone a violent structural repricing, with the S&P 500 software and services index plummeting 26% from its late-October peak. This collapse, now widely referred to by Wall Street traders

Via MarketMinute · February 11, 2026

The American consumer, long the indestructible engine of the global economy, appears to have finally stalled. Data released yesterday by the Department of Commerce revealed that U.S. retail sales remained unchanged in December, posting a 0.0% growth rate that stunned markets and significantly undercut the 0.4% expansion

Via MarketMinute · February 11, 2026

In a move that definitively reshapes the American financial landscape, Capital One Financial Corp (NYSE: COF) has announced the acquisition of fintech unicorn Brex for $5.15 billion. The deal, finalized on January 22, 2026, marks the second massive tectonic shift for the McLean-based bank in less than a year,

Via MarketMinute · February 11, 2026

Alphabet Inc. (NASDAQ:GOOGL) is on the precipice of finalizing its most ambitious acquisition to date, as its $32 billion buyout of the cybersecurity titan Wiz moves into its final stages. On February 10, 2026, the European Commission granted unconditional antitrust approval for the transaction, removing one of the last

Via MarketMinute · February 11, 2026

In a move that fundamentally reshapes the global cybersecurity landscape, Palo Alto Networks (NASDAQ:PANW) officially completed its landmark $25 billion acquisition of CyberArk (NASDAQ:CYBR) on February 11, 2026. The transaction, first announced in mid-2025, represents the largest deal in the history of Palo Alto Networks and marks a

Via MarketMinute · February 11, 2026

In a move that signals the next massive wave of consolidation in the American energy sector, Devon Energy (NYSE: DVN) and Coterra Energy (NYSE: CTRA) have announced a definitive agreement to combine in an all-stock "merger of equals" valued at approximately $58 billion. Announced on February 2, 2026, the transaction

Via MarketMinute · February 11, 2026

As the first quarter of 2026 gets underway, the American economic landscape is being fundamentally reshaped by the "One Big Beautiful Bill Act" (OBBBA). Signed into law by President Trump following a heated legislative battle in late 2025, the sweeping fiscal package has begun to filter through the pockets of

Via MarketMinute · February 11, 2026

In a dramatic shift for the retail brokerage landscape, Robinhood Markets, Inc. (NASDAQ:HOOD) reported its fourth-quarter and full-year 2025 financial results on February 10, 2026. While the company posted a record annual revenue of $4.5 billion and a significant earnings per share (EPS) beat, the market focused on

Via MarketMinute · February 11, 2026

In a striking display of market divergence, the Dow Jones Industrial Average surged to its third consecutive record high on Tuesday, February 10, 2026, momentarily piercing the 50,609 mark intraday. This milestone marks a significant psychological and technical breakthrough for the "blue-chip" index, which has found a second wind

Via MarketMinute · February 11, 2026

As of February 11, 2026, the global financial community is fixated on the S&P 500 (INDEXSP: .INX) as it battles to secure a foothold above the historic 7,000-point milestone. After a relentless multi-year rally fueled by the transition from artificial intelligence speculation to large-scale industrialization, the index has

Via MarketMinute · February 11, 2026

In a move that signals a seismic shift in the financial architecture of Big Tech, Alphabet Inc. (Nasdaq: GOOGL) successfully executed a massive $20 billion bond sale this week to fuel its aggressive expansion into artificial intelligence infrastructure. The offering, which was upsized from an initial $15 billion due to

Via MarketMinute · February 11, 2026

In a landmark procedural victory for the second Trump administration, the U.S. House of Representatives has decisively rejected a multi-pronged effort to block or stall the President’s aggressive new tariff regime. The vote, which took place in early February 2026, effectively clears the legislative path for the "Trade

Via MarketMinute · February 11, 2026

As of February 11, 2026, the marble halls of the Marriner S. Eccles Federal Reserve Building are at the center of a constitutional and economic tug-of-war that has not been seen in over seventy years. With Chairman Jerome Powell’s second term as Chair set to expire on May 15,

Via MarketMinute · February 11, 2026

For nearly a decade, the narrative of the American equity market was one of extreme concentration, where a handful of mega-cap technology titans dictated the fortunes of the entire financial system. However, as of February 11, 2026, that narrative has been decisively upended. Small-cap stocks, long the "fallen angels" of

Via MarketMinute · February 11, 2026

February 11, 2026 — The global economy has entered a precarious state of divergence. As of this week, China continues to battle a relentless deflationary cycle, marked by the 41st consecutive month of falling producer prices. This "exported deflation" is flooding international markets with low-cost goods, yet for the American consumer,

Via MarketMinute · February 11, 2026

As of February 11, 2026, the once-unshakeable confidence in enterprise software as the "gold standard" for private credit is rapidly evaporating. For nearly a decade, Business Development Companies (BDCs) flocked to the software sector, lured by the siren song of "sticky" recurring revenue and high margins. However, a violent correction

Via MarketMinute · February 11, 2026

As the United States grapples with a harsh winter season and an unprecedented surge in energy demand from the burgeoning artificial intelligence (AI) sector, a critical vulnerability has emerged in the nation’s core infrastructure. Recent reports indicate that severe natural gas pipeline restrictions are creating a "choke point" for

Via MarketMinute · February 11, 2026

The global retail landscape received a definitive status report today as Ahold Delhaize (AMS: AD), the Dutch-Belgian retail giant that commands a massive footprint across the United States and Europe, released its full-year 2025 financial results. The report revealed a striking paradox: while net sales surged by 5.9% to

Via MarketMinute · February 11, 2026

The second week of February 2026 has sent a chilling reminder through global equity markets that the "AI Gold Rush" has a darker, more destructive twin: the "AI Crosshairs." In what analysts are now calling "Software-mageddon," a massive rotation out of traditional application software and service-oriented sectors has erased more

Via MarketMinute · February 11, 2026

The Dow Jones Industrial Average has reached a summit once thought to be years away, officially crossing the 50,000-point threshold in a historic trading session on February 6, 2026. This milestone represents more than just a psychological victory for Wall Street; it serves as a definitive signal that the

Via MarketMinute · February 11, 2026

In a powerful display of the technology sector's resilience, the Nasdaq Composite surged 1.17% today, Feb 11, 2026, marking a decisive turning point in what has been a volatile start to the year. This rally was fueled by a "vibe shift" across Wall Street, as investors moved past January's

Via MarketMinute · February 11, 2026

The S&P 500 has spent the early weeks of 2026 dancing on the edge of history, repeatedly testing the psychological and technical barrier of the 7,000 mark. After a relentless climb throughout 2025, the world’s most-watched equity index briefly eclipsed the milestone on January 28, 2026, hitting

Via MarketMinute · February 11, 2026

The wealth management industry faced a brutal reckoning this week as a wave of selling wiped billions in market capitalization from traditional financial institutions. On February 10, 2026, a sector-wide sell-off was triggered by fears that the long-promised "AI disruption" has finally moved from theoretical efficiency gains to a direct,

Via MarketMinute · February 11, 2026

The American economy finds itself balanced on a precarious ledge as of early 2026. New data from the Federal Reserve Bank of New York reveals that total U.S. household debt has surged to a staggering $18.8 trillion, a record high that reflects the growing reliance of American families

Via MarketMinute · February 11, 2026

The ambitious marriage between traditional structured finance and the volatile world of digital assets faced its most harrowing trial this week. On February 11, 2026, the first-ever investment-grade rated Bitcoin-backed bond sale—a $188 million asset-backed security (ABS) orchestrated by investment bank Jefferies Financial Group Inc. (NYSE: JEF)—hit a

Via MarketMinute · February 11, 2026

In a move that signals the most significant realignment of Western energy interests in South America in decades, the U.S. Department of the Treasury has issued General License 48 (GL 48). This landmark policy shift authorizes U.S. companies to resume the delivery of critical oil production equipment, technology,

Via MarketMinute · February 11, 2026

The software sector is currently weathering its most severe valuation crisis in over a decade, as a sudden and aggressive sell-off has wiped out billions in market capitalization. This downturn, triggered by a combination of disappointing corporate IT budget outlooks and a massive capital rotation toward artificial intelligence infrastructure, reached

Via MarketMinute · February 11, 2026

As of February 11, 2026, the global energy landscape is teetering on the edge of a significant supply disruption following a series of aggressive maritime interdictions by the United States. On February 9, US naval forces successfully boarded and seized the Aquila II, a crude oil tanker allegedly part of

Via MarketMinute · February 11, 2026

As of February 11, 2026, a sense of "hard-won equilibrium" has finally settled over the U.S. Treasury market. After years of post-pandemic turbulence, the benchmark 10-year Treasury note yield has found a steady home in a tight corridor between 4.14% and 4.26%. This newfound stability—often referred

Via MarketMinute · February 11, 2026

In a significant pivot that has sent ripples through the fixed-income and equity markets, Dallas Fed President Lorie Logan signaled on February 10, 2026, that the Federal Reserve may be at the end of its easing cycle. Speaking at the FIA-SIFMA Asset Management Derivatives Forum in Austin, Texas, Logan expressed

Via MarketMinute · February 11, 2026

The U.S. labor market kicked off 2026 with a surprising display of resilience, as the January Jobs Report revealed a surge of 130,000 nonfarm payroll positions. This figure, released by the Bureau of Labor Statistics on February 6, 2026, has forced a recalibration of market expectations regarding the

Via MarketMinute · February 11, 2026

The American wheat market faced a wave of selling pressure this week following the release of the U.S. Department of Agriculture’s (USDA) February World Agricultural Supply and Demand Estimates (WASDE) report. The report, a critical barometer for global food commodities, stunned traders by upwardly revising U.S. wheat

Via MarketMinute · February 11, 2026

The global industrial landscape is witnessing an unexpected divergence as aluminum prices surged 5.7% in early February 2026, defying the consolidation seen in other base metals like nickel and zinc. This rally, which pushed prices on the London Metal Exchange (LME) past the critical $3,000 per tonne threshold,

Via MarketMinute · February 11, 2026

The North American cattle industry has entered a state of emergency following the U.S. Department of Agriculture’s (USDA) decision to indefinitely suspend all live cattle imports from Mexico. This drastic measure comes as the New World screwworm (NWS)—a devastating, flesh-eating parasite—has been detected within 200 miles

Via MarketMinute · February 11, 2026

The United States Department of Agriculture (USDA) sent ripples through the agricultural sector this week with its February 2026 World Agricultural Supply and Demand Estimates (WASDE) report, which slashed production forecasts for the poultry industry. Citing a combination of persistent Highly Pathogenic Avian Influenza (HPAI) outbreaks and disappointing hatchery data,

Via MarketMinute · February 11, 2026

The precious metals market has just endured its most violent two-week stretch in modern financial history, as a parabolic rally met the immovable object of institutional deleveraging. In a stunning reversal that analysts are calling the "Great Metal Reset," Gold and Silver plummeted from historic highs in late January and

Via MarketMinute · February 11, 2026

The U.S. cattle market was rocked this week by a sudden and violent sell-off in futures contracts, as a looming labor strike at one of the nation’s largest beef processing facilities sent shockwaves through the Chicago Mercantile Exchange (CME). On February 5, 2026, live and feeder cattle futures

Via MarketMinute · February 11, 2026

In a surprising turn of events for the global agricultural markets, the U.S. Department of Agriculture (USDA) released its February 2026 World Agricultural Supply and Demand Estimates (WASDE) report, delivering a significant boost to the American corn outlook. Defying a prevailing market consensus that expected a neutral to slightly

Via MarketMinute · February 11, 2026

The global copper market is currently navigating a period of intense volatility and strategic consolidation after a historic start to 2026. After surging to a record-breaking peak of over $14,500 per metric ton in late January, the "red metal" has entered a cooling phase as the world’s largest

Via MarketMinute · February 11, 2026

As delegates and energy titans gather in London for the 2026 International Energy Week (IE Week), the mood has shifted from the supply-security anxieties of years past to a starker, more bearish reality. A new consensus has emerged among top analysts and institutional forecasters, placing the outlook for Brent Crude

Via MarketMinute · February 11, 2026

The United States natural gas market is currently navigating a period of extraordinary volatility, transitioning from a historic price surge in January to a rapid cooling phase as of February 11, 2026. Just weeks ago, Winter Storm Fern gripped the nation, driving spot prices to record highs and forcing the

Via MarketMinute · February 11, 2026

On February 10, 2026, Meta Platforms (NASDAQ: META) stands at a pivotal moment. Its stock, trading at $670.72, has recently pulled back from a $744 peak in late January, caught between investor enthusiasm for its AI-led financial surge and deep concerns over its unprecedented $135 billion 2026 capital expenditure

Via MarketMinute · February 10, 2026

The financial world stood still on February 10, 2026, as the S&P 500 Index (INDEXSP: .INX) surged toward the historic 7,000 psychological barrier. After a relentless multi-year rally driven by the industrialization of artificial intelligence and a resilient "soft landing" for the U.S. economy, the index is

Via MarketMinute · February 10, 2026

The Japanese stock market reached a historic milestone on February 10, 2026, as the Nikkei 225 index surged to an all-time high of 58,000, capping a spectacular rally that has fundamentally redefined Japan’s position in the global financial landscape. This surge, fueled by a landslide victory for the

Via MarketMinute · February 10, 2026

In a move that signals a bold new chapter for the cross-border e-commerce and fintech sectors, Affirm (NASDAQ: AFRM) and Wayfair (NYSE: W) announced on February 5, 2026, the official expansion of their long-standing partnership into the United Kingdom and Canada. This strategic rollout enables shoppers in these regions to

Via MarketMinute · February 10, 2026

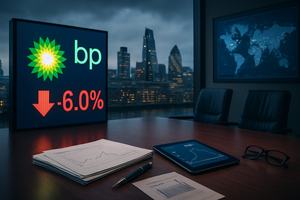

In a move that sent ripples through the global energy sector, BP (NYSE: BP) announced on February 10, 2026, that it would immediately suspend its $750 million quarterly share buyback program. The decision marks a dramatic departure from the company’s recent strategy of aggressive shareholder returns, signaling a pivot

Via MarketMinute · February 10, 2026