Eaton Corp Plc (ETN)

396.09

+0.00 (0.00%)

NYSE · Last Trade: Feb 12th, 5:19 AM EST

Detailed Quote

| Previous Close | 396.09 |

|---|---|

| Open | - |

| Bid | 396.52 |

| Ask | 399.75 |

| Day's Range | N/A - N/A |

| 52 Week Range | 231.85 - 401.00 |

| Volume | 1,633 |

| Market Cap | 153.84B |

| PE Ratio (TTM) | 39.61 |

| EPS (TTM) | 10.0 |

| Dividend & Yield | 4.160 (1.05%) |

| 1 Month Average Volume | 3,206,070 |

Chart

About Eaton Corp Plc (ETN)

Eaton Corp Plc is a global power management company that specializes in providing energy-efficient solutions to help customers manage electrical power more effectively. The company offers a diverse range of products and services across various sectors including electrical distribution, industrial automation, hydraulic systems, and vehicle solutions. Eaton focuses on innovation and sustainability, developing technologies that optimize energy usage, enhance grid reliability, and enable the integration of renewable energy sources. Through its commitment to empowering businesses and communities, Eaton aims to create a more sustainable environment and improve overall operational efficiency. Read More

News & Press Releases

As of February 11, 2026, the global financial community is fixated on the S&P 500 (INDEXSP: .INX) as it battles to secure a foothold above the historic 7,000-point milestone. After a relentless multi-year rally fueled by the transition from artificial intelligence speculation to large-scale industrialization, the index has

Via MarketMinute · February 11, 2026

Gapping S&P500 stocks in Wednesday's sessionchartmill.com

Via Chartmill · February 11, 2026

Today, February 11, 2026, the equity markets witnessed a defining moment in the artificial intelligence (AI) infrastructure cycle as Vertiv Holdings Co. (NYSE: VRT) released its fourth-quarter and full-year 2025 financial results. Long positioned as the "plumbing" of the digital age, Vertiv has transitioned into the premier architect of the AI era. With a staggering [...]

Via Finterra · February 11, 2026

Eaton Corp PLC (NYSE:ETN) Reports Record 2025 Results Despite Q4 Revenue Misschartmill.com

Via Chartmill · February 3, 2026

Although Eaton has outperformed relative to the SPX over the past year, Wall Street analysts maintain a cautiously optimistic outlook about the stock’s prospects.

Via Barchart.com · February 11, 2026

These S&P500 stocks are moving in today's pre-market sessionchartmill.com

Via Chartmill · February 11, 2026

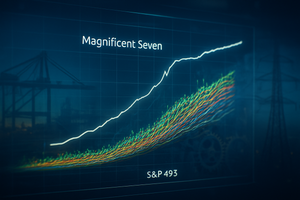

As of February 10, 2026, the long-standing "two-speed" economy that defined the post-pandemic era has finally reached a historic turning point. For years, a handful of mega-cap technology titans—the "Magnificent Seven"—carried the weight of the entire U.S. stock market on their shoulders, while the remaining 493 companies

Via MarketMinute · February 10, 2026

Venture Solar, a leading solar installation company serving the Northeast and Mid-Atlantic, today announced it is rebranding as Venture Home, reflecting the company's evolution from a solar-focused installer to a comprehensive home electrification partner.

Via Get News · February 9, 2026

Intelligent power management company Eaton has once again been named one of the World’s Most Admired Companies by FORTUNE magazine.

By Eaton · Via Business Wire · February 9, 2026

Eaton, Texas Instruments, and Brookfield Renewable are all set to benefit as AI infrastructure spending heats up.

Via The Motley Fool · February 7, 2026

As of February 6, 2026, the dominant narrative on Wall Street has shifted from the virtual to the tangible. After years of dominance by Silicon Valley’s software giants, a powerful "Great Rotation" is underway, with institutional capital aggressively migrating toward the backbone of the physical economy. Investors are increasingly

Via MarketMinute · February 6, 2026

The tech world was sent into a tailspin this week as Amazon.com Inc. (NASDAQ: AMZN) unveiled a staggering $200 billion capital expenditure guidance for 2026, marking the largest single-year investment commitment by any corporation in history. While the retail and cloud giant reported record-breaking quarterly revenue and a significant

Via MarketMinute · February 6, 2026

Data centers need power management and cooling solutions, and this company makes it possible.

Via The Motley Fool · February 5, 2026

Join us as we explore Eaton's potential in the industrial sector and why it received high ratings from our analysts. Is this stock a hidden gem worth your investment?

Via The Motley Fool · February 4, 2026

Intelligent power management company Eaton (NYSE:ETN) today announced that Michael Regelski, senior vice president and chief technology officer, Electrical Sector, will participate in the Barclays 43rd Annual Industrial Select Conference on February 17, 2026, at 1:15 p.m. Eastern time. Regelski will speak to investors in a fireside chat about the company’s Electrical business and how powerful megatrends like electrification, digitalization and AI, reindustrialization and more are driving growth in its markets.

By Eaton · Via Business Wire · February 4, 2026

Eaton (ETN) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 3, 2026

Via Benzinga · February 3, 2026

These S&P500 stocks are moving in today's pre-market sessionchartmill.com

Via Chartmill · February 3, 2026

Merck, PepsiCo, and Eaton Corporation have unveiled their earnings for the fourth quarter of 2025, showcasing their performance against market expectations.

Via Talk Markets · February 3, 2026

Intelligent power management company Eaton Corporation plc (NYSE:ETN) today announced that fourth quarter 2025 earnings per share were $2.91, a fourth quarter record. Excluding charges of $0.25 per share related to intangible amortization, $0.10 per share related to acquisitions and divestitures, and $0.07 per share related to a multi-year restructuring program, adjusted earnings per share of $3.33 were a record.

By Eaton Corporation plc · Via Business Wire · February 3, 2026

Looking back from today, February 2, 2026, the market movements of a year ago highlight a critical turning point in the artificial intelligence revolution. On February 10, 2025, NVIDIA Corporation (NASDAQ: NVDA) shares surged nearly 3%, closing in the $133 range and effectively ending a period of intense market anxiety

Via MarketMinute · February 2, 2026

As of early February 2026, the identity of Tesla, Inc. (NASDAQ: TSLA) has undergone its most radical transformation since the launch of the Model S. Following a fiscal year 2025 that saw the company’s first-ever annual decline in both revenue and profit, CEO Elon Musk has doubled down on

Via MarketMinute · February 2, 2026

This ETF targets a diversified mix of investment grade bonds, aiming to deliver stable income and total return for investors.

Via The Motley Fool · January 31, 2026