TECHNOLOGY (XLK)

139.64

+0.08 (0.06%)

NYSE · Last Trade: Feb 17th, 1:44 PM EST

Detailed Quote

| Previous Close | 139.56 |

|---|---|

| Open | 138.64 |

| Day's Range | 137.02 - 139.75 |

| 52 Week Range | 86.22 - 152.99 |

| Volume | 18,207,731 |

| Market Cap | 443.50M |

| Dividend & Yield | 0.8760 (0.63%) |

| 1 Month Average Volume | 24,153,222 |

Chart

News & Press Releases

Take Control of Your Cash Flow; Energy Stocks on Firefool.com

Via The Motley Fool · February 17, 2026

Globalstar’s this year has been filled with expansions and 5G deployment, raking in investor and retail trader interests.

Via Stocktwits · February 16, 2026

According to a Bloomberg report, the probe focuses on the company’s licensing rules and bundling of services such as Copilot, Office, and Windows with other products.

Via Stocktwits · February 13, 2026

Although investors punished Cisco over its weak 2026 profit guidance, Arista Networks shares jumped 12% after the results.

Via Stocktwits · February 13, 2026

CSCO Stock Tumbles Amid Gross Margin Miss — Why Does The Street See An Upside?stocktwits.com

Via Stocktwits · February 12, 2026

Has HubSpot Stock Finally Bottomed? Retail Traders Eye Nearly 20% Upside After AI-Fueled Outlook Tops Wall Street Estimatesstocktwits.com

Via Stocktwits · February 12, 2026

Apple Reports Temporary Outage Across Apple TV, iTunes Servicesstocktwits.com

Via Stocktwits · February 4, 2026

MSFT Stock Tumbled On Thursday – But Retail Sees The Decline As A Gift To Investorsstocktwits.com

Via Stocktwits · January 30, 2026

Apple stock is seeing a boost from the launch of the latest iteration of its flagship product, which has been well received by consumers in China who, in recent years, have migrated to other China-based mobile manufacturers.

Via Stocktwits · February 12, 2026

Shares are heading for their third straight session of decline as gross margin pressure is growing.

Via Stocktwits · February 11, 2026

In an X post on Wednesday, Gene Munster said that AI inference is just building, and indicated that demand for infrastructure will contribute to Vertiv’s growth.

Via Stocktwits · February 11, 2026

For 2026, Vertiv expects revenue between $13.25 billion and $13.75 billion, implying organic growth in the range of 27% - 29%.

Via Stocktwits · February 11, 2026

ASTS stock’s momentum from last year continues to build after the successful unfolding of the company’s BlueBird 6 satellite.

Via Stocktwits · February 10, 2026

A high-profile treasure hunt drove massive engagement, but not without some embarrassing execution hiccups.

Via Stocktwits · February 9, 2026

Stifel lowered the company’s outlook to ‘Hold’ from ‘Buy,’ and slashed its price target by about 27% to $392, down from $540.

Via Stocktwits · February 5, 2026

The investment has been extremely lucrative in recent years, but many investors shouldn't make an effort to buy shares of the chipmaker.

Via The Motley Fool · February 4, 2026

According to a report from CNBC, Piper Sandler said in a note to investors that it thinks Microsoft is still a big winner in the AI trade.

Via Stocktwits · February 3, 2026

Explore how two popular tech ETFs differ in diversification, holdings, and risk -- key factors for building a resilient portfolio.

Via The Motley Fool · February 1, 2026

JPMorgan Active Bond ETF is an actively managed fund seeking to outperform the Bloomberg U.S. Aggregate Bond Index over multi-year cycles.

Via The Motley Fool · January 29, 2026

The Technology Select Sector SPDR Fund spreads exposure across tech, while the Roundhill Generative AI and Technology ETF concentrates it around AI. This ETF comparison shows why that difference matters when AI valuations come under pressure.

Via The Motley Fool · January 29, 2026

Microsoft reported a marginal decline in the growth of its cloud-computing unit while the company’s capital expenditure increased about 66% year-on-year.

Via Stocktwits · January 28, 2026

Via MarketBeat · January 28, 2026

The company bagged Air Force Research Laboratory’s (AFRL) contract to make different autonomous systems work together.

Via Stocktwits · January 28, 2026

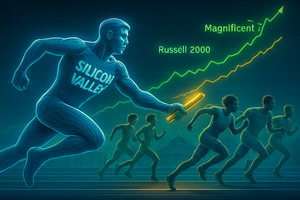

As of January 26, 2026, the financial landscape has undergone a seismic shift, marking the definitive end of the "Magnificent 7" era of uncontested dominance. For the first time in decades, the baton of market leadership has been passed to the small-cap arena in what analysts are calling the "Earnings

Via MarketMinute · January 26, 2026

This ETF tracks a global index excluding U.S. equities, providing diversified exposure to developed and emerging international markets.

Via The Motley Fool · January 23, 2026