WT Offshore (WTI)

1.6400

+0.00 (0.00%)

NYSE · Last Trade: Jan 12th, 6:18 AM EST

Via Benzinga · June 23, 2025

If we let Venezuela supply US oil needs, but nobody else, then we can reduce our trade deficit with Canada. We call this

Via Talk Markets · March 23, 2025

The global financial landscape is navigating a complex period marked by persistent inflation, where a notable divergence in energy price trends is emerging. While crude oil and gasoline prices are showing signs of cooling, offering a potential disinflationary impulse, the costs of natural gas and electricity, particularly for residential consumers,

Via MarketMinute · September 19, 2025

President Trump has had success bringing down oil prices by sheer force of will and keeping traders off balance.

Via Talk Markets · February 27, 2025

US equity futures are higher, reversing much of yesterday's drop, and European bourses are at all time high, as the market braces for NVDA earnings after today’s close.

Via Talk Markets · February 26, 2025

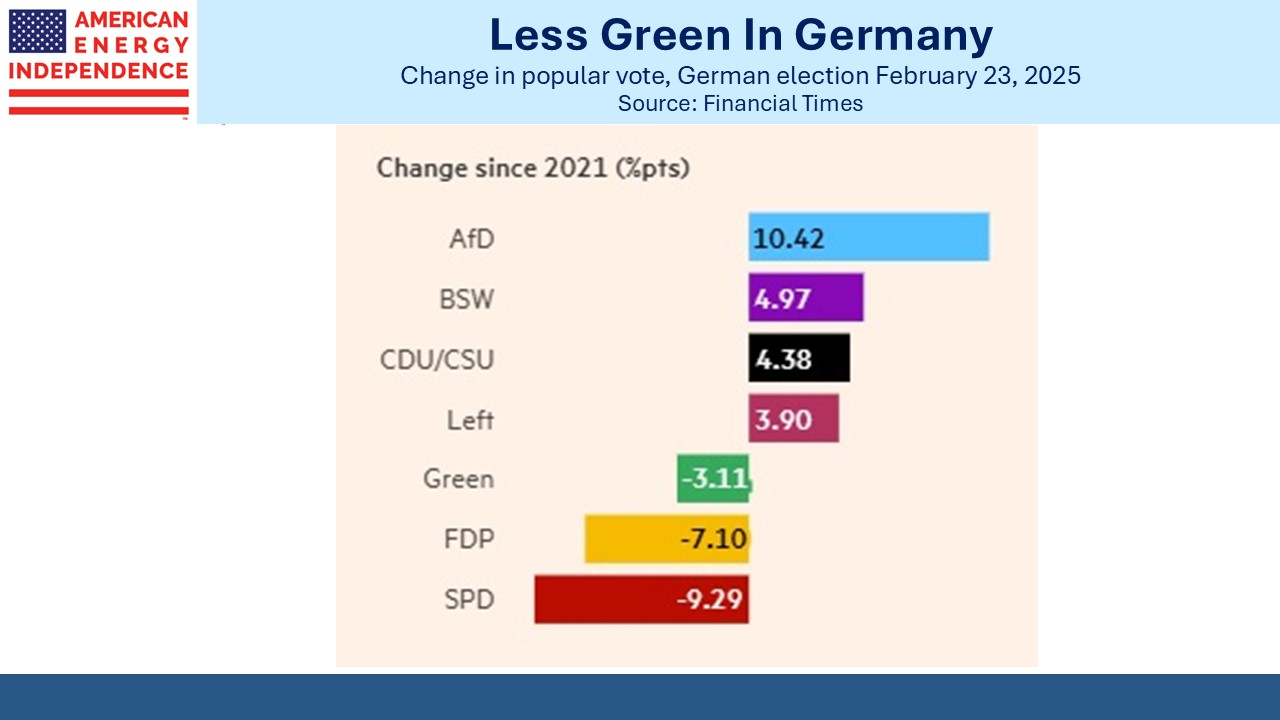

Suppose for a moment that the Sierra Club was a political party, with candidates running and elected officials in government.

Via Talk Markets · February 26, 2025

China's imports of sanctioned oil are rebounding despite trade tensions with the US. Russia reformed a non-sanctioned fleet for its Far East ESPO crude, allowing Kozmino Port loadings to rise.

Via Talk Markets · February 22, 2025

The global oil market seems to be frozen in time. The surge in demand due to cold weather in the United States is a contributing factor as the Energy Information Administration released a report that had icicles hanging from it.

Via Talk Markets · February 21, 2025

Oil prices under the Presidency of Donald J. Trump have entered a new world of stable instability.

Via Talk Markets · February 18, 2025

Otherwise from central banks, the ECB will publish their Economic Bulletin, and we’ll hear from the ECB’s Cipollone and Nagel.

Via Talk Markets · February 13, 2025

Oil prices continued to decline in early trading following reports of upcoming negotiations between the US and Russia to end the war in Ukraine.

Via Talk Markets · February 13, 2025

Oil prices almost had a clear upside breakout missing it by 1 cent ahead of the American Petroleum Institute (API) report that is probably the reason it did not happen.

Via Talk Markets · February 12, 2025

WTI crude oil surges as US labor market data fuels demand optimism. Nonfarm Payrolls miss expectations, but wage growth remains strong. The labor force participation rate edges higher, supporting the energy demand outlook.

Via Talk Markets · February 8, 2025

President Trump is like the pied piper of oil as the market continues to move on the latest Trump Truth Social posts or moves.

Via Talk Markets · February 7, 2025

OPEC's JMMC unlikely to recommend changes to existing production increase plan from April. Voluntary output cuts by eight OPEC+ members will be phased out from April.

Via Talk Markets · February 3, 2025

.thumb.png.c2c06c7d56f2b9239f87ff999c687c68.png)

WTI completed the bullish correction from September 2024 and now turning lower after being resisted at a ket Fibonacci zone.

Via Talk Markets · February 3, 2025

There have been two significant developments that are rocking US equities and sending US yields sharply lower. First, Chinese-made AI has taken the world by storm.

Via Talk Markets · January 27, 2025