Sprott Physical Gold Trust ETV (PHYS)

30.20

+0.41 (1.38%)

NYSE · Last Trade: Oct 30th, 1:29 PM EDT

SPROTT PHYSICAL GOLD TRUST (PHYS) aligns with Peter Lynch's GARP strategy, offering strong EPS growth, a low PEG ratio, and a debt-free balance sheet.

Via Chartmill · October 14, 2025

New York, NY – October 13, 2025 – Gold and silver have surged to unprecedented record highs this October, captivating financial markets and signaling a profound shift in investor sentiment amidst a landscape of escalating geopolitical tensions, persistent inflation concerns, and a global pivot in monetary policy. With gold breaching the $4,

Via MarketMinute · October 13, 2025

Sprott Physical Gold Trust (PHYS) fits the Peter Lynch GARP strategy with 18.5% EPS growth, a low 0.21 PEG ratio, and zero debt, offering direct gold exposure.

Via Chartmill · September 23, 2025

SPROTT PHYSICAL GOLD TRUST (PHYS) fits Peter Lynch's GARP strategy with a low PEG ratio, strong growth, and zero debt, offering a unique gold investment case.

Via Chartmill · September 2, 2025

Capitalize on the rally in gold prices without having to deal with storing your own bullion by investing in one of these physical gold ETFs.

Via MarketBeat · April 28, 2025

Several different trends emerged this week that may be bearish for gold, so it may be time to lock in your gold gains by selling or hedging.

Via Benzinga · February 14, 2025

Gold offers diverse investment avenues, from tangible assets to mining stocks and ETFs, each with unique characteristics for different investor goals.

Via MarketBeat · January 31, 2025

As we kick off 2025, investors are asking: Where are gold and silver headed? Which stocks to buy on the dip? And will gold hit $3,000 this year?

Via Talk Markets · January 22, 2025

If Chinese demand continues, it could push gold and silver prices up together, making these metals a favorite for investors seeking safe havens amid economic uncertainty.

Via Talk Markets · September 12, 2024

With A-Mark Precious Metals feeding the physical gold rush, speculators need to put AMRK stock on their watch list.

Via InvestorPlace · May 30, 2024

Michael Burry of “The Big Short” is making waves yet again, this time for acquiring gold via the PHYS ETF, currently his biggest stake.

Via InvestorPlace · May 16, 2024

Michael Burry, famous for predicting 2008 crisis, made headlines with his latest 13F filing. He shifted towards commodities & renewable energy and decreased holdings in tech giants.

Via Benzinga · May 16, 2024

While mining specialist Gold Fields is a risky idea, the push by major players into the yellow metal may bode well for GFI stock.

Via InvestorPlace · May 16, 2024

Gold is going to go up again, because the Federal Reserve is now trapped. This week’s CPI report is important, because it showed an uptick in inflation instead of a downtick, coming in at an annualized 3.5% rate, with “supercore” components above 4%.

Via Talk Markets · April 13, 2024

As long as the effects of inflation continue to show up in higher prices for goods and services, a higher nominal gold price can be expected over the long term – eventually.

Via Talk Markets · October 9, 2023

De-dollarization is here, and it’s boosting gold bug morale in a major way.

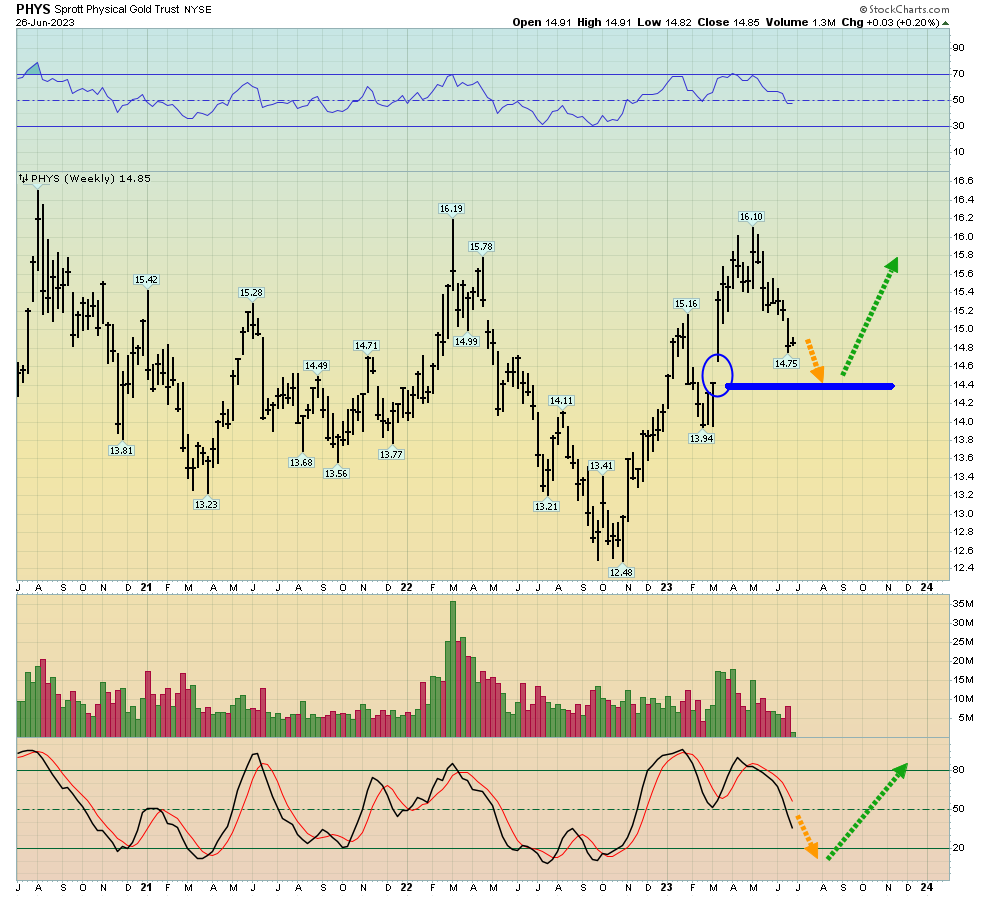

Via Talk Markets · June 27, 2023

My favorite indicator is the GDX/GLD ratio. This is a simple relative strength ratio that compares the price action in big-cap mining stocks to the price of gold. It’s important, because the price action in these stocks tends to lead gold prices.

Via Talk Markets · April 9, 2023

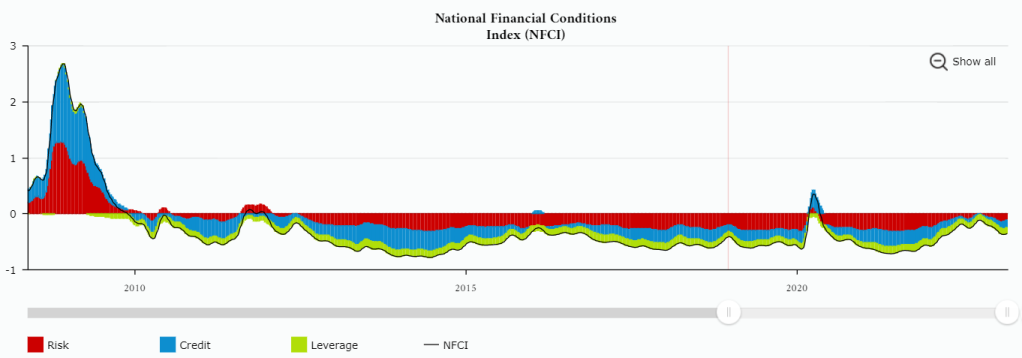

As I continue to see blame heaped on the Fed for this latest episode of financial instability, I have surprisingly adopted a more sympathetic view of the Fed’s work.

Via Talk Markets · March 22, 2023

Yet another analyst offers a bullish case for gold, is it ever going to be enough?

Via Talk Markets · November 2, 2022

Two ways of looking at gold and gold miners in an inflationary environment.

Via Talk Markets · October 6, 2022

It’s not an enviable position to be in. As for which option Fed will choose, world-renowned author Robert Kiyosaki has an idea.

Via Talk Markets · June 28, 2022

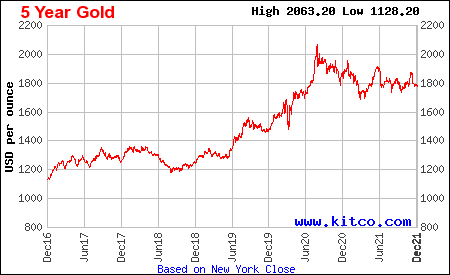

Through the past year gold has struggled somewhat as it continues to digest the strong gains of the last two years. Many wonder, has gold lost its golden touch? But remember, gold was $1,200 as recently as late 2018. It’s now almost 50% higher.

Via Talk Markets · December 26, 2021

It has been a frustrating year for gold bulls. Every attempt of gold to move higher was short-lived, the spring rally was the strongest one of the year but was capped.

Via Talk Markets · November 23, 2021

It has been difficult to trade the metals market over the past year. The fundamentals have been indicating that gold and silver should be shooting up, yet the markets have been going up and down a great deal.

Via Talk Markets · October 22, 2021

It has been difficult to trade the market based on fundamentals since the pandemic struck. We appear to have several new black swans on the horizon to further muddy the application of fundamentals.

Via Talk Markets · October 14, 2021