Caterpillar (CAT)

775.00

+0.00 (0.00%)

NYSE · Last Trade: Feb 12th, 9:37 AM EST

Detailed Quote

| Previous Close | 775.00 |

|---|---|

| Open | - |

| Bid | 771.00 |

| Ask | 771.29 |

| Day's Range | N/A - N/A |

| 52 Week Range | 267.30 - 775.54 |

| Volume | 40,551 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 6.040 (0.78%) |

| 1 Month Average Volume | 2,889,445 |

Chart

About Caterpillar (CAT)

Caterpillar is a leading manufacturer of construction and mining equipment, diesel and natural gas engines, and industrial gas turbines. The company serves a diverse range of industries, offering products designed for various applications such as construction, agriculture, mining, and energy production. With a strong emphasis on innovation and sustainability, Caterpillar develops advanced machinery and technology solutions aimed at increasing productivity and efficiency for its customers. Additionally, the company provides extensive support services, including parts and maintenance, ensuring that clients can rely on their equipment for optimal performance over time. Read More

News & Press Releases

Caterpillar’s turbine business continues to ride AI-related growth.

Via Stocktwits · February 11, 2026

The Dow Jones Industrial Average (DJIA) surrendered its hard-won psychological high ground on Wednesday, February 11, 2026, sliding back below the 50,000-point milestone. The blue-chip index fell 188 points, or 0.38%, to close at 49,999.24, ending a brief tenure above the historic mark and signaling a

Via MarketMinute · February 11, 2026

As the first quarter of 2026 gets underway, the American economic landscape is being fundamentally reshaped by the "One Big Beautiful Bill Act" (OBBBA). Signed into law by President Trump following a heated legislative battle in late 2025, the sweeping fiscal package has begun to filter through the pockets of

Via MarketMinute · February 11, 2026

In a striking display of market divergence, the Dow Jones Industrial Average surged to its third consecutive record high on Tuesday, February 10, 2026, momentarily piercing the 50,609 mark intraday. This milestone marks a significant psychological and technical breakthrough for the "blue-chip" index, which has found a second wind

Via MarketMinute · February 11, 2026

The Dow Jones Industrial Average has reached a summit once thought to be years away, officially crossing the 50,000-point threshold in a historic trading session on February 6, 2026. This milestone represents more than just a psychological victory for Wall Street; it serves as a definitive signal that the

Via MarketMinute · February 11, 2026

As of February 11, 2026, the industrial landscape is witnessing a significant shift in the perceived value of heavy equipment manufacturing, and at the center of this movement is Wabtec Corporation (NYSE: WAB). Formally known as Westinghouse Air Brake Technologies Corporation, Wabtec has transformed from a traditional component manufacturer into a high-tech cornerstone of global [...]

Via Finterra · February 11, 2026

Though Caterpillar has outperformed relative to the broader market over the past year, Wall Street analysts maintain a cautiously optimistic outlook on the stock’s prospects.

Via Barchart.com · February 10, 2026

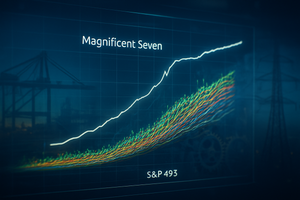

As of February 10, 2026, the long-standing "two-speed" economy that defined the post-pandemic era has finally reached a historic turning point. For years, a handful of mega-cap technology titans—the "Magnificent Seven"—carried the weight of the entire U.S. stock market on their shoulders, while the remaining 493 companies

Via MarketMinute · February 10, 2026

On February 9, 2026, the Dow Jones Industrial Average (DJIA) carved its name into the history books, closing at a record high of 50,219.00. This historic milestone marks a monumental achievement for the blue-chip index, which has navigated a turbulent start to the year characterized by massive sector

Via MarketMinute · February 10, 2026

Via Benzinga · February 10, 2026

Wall Street's iconic index eclipsed 50,000 for the first time on Feb. 6 -- and an even bigger milestone may not be too far off.

Via The Motley Fool · February 10, 2026

Peter Tuchman flags a widening split between the S&P 500 and Dow as mega-cap tech spending tests investor patience.

Via Stocktwits · February 10, 2026

Lifting and material handling equipment company Terex (NYSE:TEX)

will be reporting results this Wednesday before market open. Here’s what to expect.

Via StockStory · February 9, 2026

The Dow Jones Industrial Average (DJIA) achieved a monumental milestone on Friday, February 6, 2026, closing above the 50,000 mark for the first time in history. The index finished the week at 50,115.67, gaining over 1,200 points in a single session to cap off a historic

Via MarketMinute · February 9, 2026

The U.S. industrial sector has finally signaled a definitive end to its prolonged period of stagnation, with the Institute for Supply Management (ISM) reporting that the Manufacturing PMI surged to 52.6% in January 2026. This reading marks the first significant expansion for the sector in over a year,

Via MarketMinute · February 9, 2026

The long-standing dominance of the "Magnificent Seven" has finally met its match. In a week that market historians may look back on as the definitive end of the "two-speed" market, the S&P 493—the cohort of stocks in the benchmark index excluding the seven largest tech titans—has staged

Via MarketMinute · February 9, 2026

The Dow Jones Industrial Average (DJIA) struggled to maintain its footing above the historic 50,000-point milestone on Monday, as a wave of selling in the software sector dampened the euphoria from Friday’s record-breaking session. After closing above the psychological barrier for the first time in history just three

Via MarketMinute · February 9, 2026

Caterpillar broke out of its chrysalis during 2025, transforming into a high-flying butterfly.

Via Barchart.com · February 9, 2026

Could Dow 60,000 be around the corner?

Via The Motley Fool · February 9, 2026

Caterpillar Inc. delivered an impressive performance in the fourth quarter of 2025, posting record revenues on higher volumes across segments. The industrial giant also returned to positive earnings growth. How should investors approach the stock?

Via Talk Markets · February 7, 2026

In a stunning reversal of a year-long industrial malaise, the U.S. manufacturing sector roared back to life this week as the Institute for Supply Management (ISM) released its latest Purchasing Managers' Index (PMI) data. The report, made public on February 6, 2026, showed the manufacturing PMI climbing to a

Via MarketMinute · February 6, 2026

In a historic display of market resilience and technological optimism, the Dow Jones Industrial Average closed above the 50,000-point milestone for the first time in history on Friday, February 6, 2026. The blue-chip index surged by a staggering 1,200 points during the session, ending the day at 50,

Via MarketMinute · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

As of February 6, 2026, the dominant narrative on Wall Street has shifted from the virtual to the tangible. After years of dominance by Silicon Valley’s software giants, a powerful "Great Rotation" is underway, with institutional capital aggressively migrating toward the backbone of the physical economy. Investors are increasingly

Via MarketMinute · February 6, 2026

The enterprise software sector is currently weathering its most severe valuation crisis in over two decades, as investors aggressively reappraise the future of software-as-a-service (SaaS) in an era dominated by autonomous AI. As of February 6, 2026, the industry’s average forward price-to-earnings (P/E) ratio has plummeted to roughly

Via MarketMinute · February 6, 2026