State Street SPDR S&P Metals & Mining ETF (XME)

117.83

+1.15 (0.99%)

NYSE · Last Trade: Feb 15th, 5:51 PM EST

Detailed Quote

| Previous Close | 116.68 |

|---|---|

| Open | 115.23 |

| Day's Range | 113.41 - 118.50 |

| 52 Week Range | 45.89 - 135.68 |

| Volume | 2,688,573 |

| Market Cap | 35.17M |

| Dividend & Yield | 0.5160 (0.44%) |

| 1 Month Average Volume | 3,632,312 |

Chart

News & Press Releases

An SEC filing from Feb. 11 revealed that CEO Lourenco Goncalves had sold 3 million shares of Cleveland-Cliffs for about $12.42 each.

Via Stocktwits · February 13, 2026

The venture will be structured with Americas Gold and Silver holding a 51% stake and US Antimony holding a 49% stake, with the latter acting as the managing member.

Via Stocktwits · February 10, 2026

Cleveland-Cliffs reported revenue of $4.3 billion, flat year-on-year, but significantly below analyst consensus of $4.6 billion, according to data from Fiscal.ai.

Via Stocktwits · February 9, 2026

Barrick posted a substantial earnings increase in the fourth quarter but expects gold and copper production for 2026 to be slightly lower than 2025 levels.

Via Stocktwits · February 5, 2026

Perpetua Resources Speaking With Glencore, Trafigura To Bolster US Antimony Refining Amid China Export Ban: Reportstocktwits.com

Via Stocktwits · September 26, 2025

Watch CRML, MP Stocks Closely: Trump Says Greenland’s ‘Two Dog Sleds’ Not Enough To Hold Off China, Russia Threatstocktwits.com

Via Stocktwits · January 12, 2026

The pilot plant will support the company’s Tanbreez rare-earth and critical metals initiative by providing infrastructure for its Arctic mining operations.

Via Stocktwits · January 7, 2026

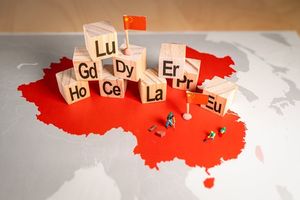

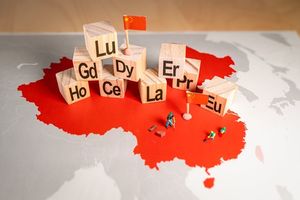

Report exposes how China manipulates global mineral prices for economic and geopolitical gain, posing a national security threat to the US.

Via Benzinga · November 14, 2025

China has lifted its ban on exporting gallium, germanium, and antimony to the US after a amazing meeting between Trump and Xi.

Via Benzinga · November 10, 2025

Canada's 2025 budget allocates billions to boost mining sector and establish sovereign fund for critical minerals.

Via Benzinga · November 6, 2025

Canada announces $6.4B critical mineral projects to challenge China's dominance in supply chain, invoking Defence Production Act.

Via Benzinga · November 3, 2025

Private equity investors are investing $1B in critical minerals via Appian-IFC fund. This boosts supply chain security and local development.

Via Benzinga · October 22, 2025

Trump and Albanese signed a partnership to secure critical mineral supply chains and strengthen defense cooperation.

Via Benzinga · October 21, 2025

US seeks Australia's help in critical metal problem with China. Australia offers plentiful resources but wants investment and tech transfer.

Via Benzinga · October 20, 2025

US cancels $500M cobalt tender after multiple extensions. DLA's first stockpile acquisition since 1990 faces challenges.

Via Benzinga · October 17, 2025

Global materials and mining revenues fell in 2024, but AI, defense demand, and productivity gains signal a rebound.

Via Benzinga · October 8, 2025

Trump admin in talks to take stake in Critical Metals Corp, aiming to secure rare earth deposit in Greenland.

Via Benzinga · October 6, 2025

US offers investment in Australian critical minerals companies to secure alternative supply chains and reduce reliance on China.

Via Benzinga · October 3, 2025

Commercial Metals, CMC, will buy Concrete Pipe & Precast LLC for $675 million in cash, expanding into the U.S. precast concrete sector.

Via Benzinga · September 18, 2025

US to launch $5 billion fund for critical minerals, in partnership with Orion Resource Partners and other investors. Aimed at reducing reliance on Chinese supply chains and securing long-term resources.

Via Benzinga · September 17, 2025

Global nuclear leaders meet in London to discuss tripling capacity by 2050. Uranium shortage threatens to derail nuclear energy renaissance.

Via Benzinga · September 5, 2025

US govt updating critical minerals list to 54 minerals, adding 6 new ones. Trump aims to reduce dependence on foreign adversaries and spur innovation.

Via Benzinga · August 26, 2025

Peabody Energy cancels $3.8B deal to buy coal assets from Anglo American due to mine fire. Focus shifts to Centurion Mine for growth.

Via Benzinga · August 19, 2025

Elliott Management places new bets against the market in the second quarter, while taking a new long position in Hewlett Packard Enterprise.

Via Benzinga · August 14, 2025

The DOE will provide nearly $1 billion in funding to strengthen domestic supply chains for critical minerals, following Trump's executive order.

Via Benzinga · August 14, 2025