INVESCO Ltd (IVZ)

26.52

+0.50 (1.92%)

NYSE · Last Trade: Feb 16th, 3:03 PM EST

EverTrust Group Inc today announced the official launch of its military-grade AI investment engine, the ETG Smart Quantitative Trading System (Engine Trading Generation Quantitative System), alongside the rollout of a global expansion strategy. The ETG system aims to make professional investment services accessible to a broader audience, marking a shift in wealth management from the traditional advisor-driven model to a transparent, data-driven approach that empowers users to take control.

Via GlobePRwire · January 8, 2026

A shutdown of the U.S. federal government, when Congress fails to pass spending legislation and many agencies cease non-essential operations, poses a material risk to the economy. But when viewed through the lens of market history and global asset flows, the evidence suggests that such shutdowns are often absorbed by the markets and, in several ways, may present tactical opportunities for globally diversified investors.

Via AB Newswire · November 21, 2025

Toronto – Amid growing volatility in global financial markets, INVESCO VERTEX CAPITAL LTD. is advancing steadily with a technology-driven investment model, positioning itself as a frontrunner in international finance. The company leverages artificial intelligence, quantitative trading, and blockchain technology to deliver comprehensive, innovative, and efficient wealth management solutions to clients worldwide, spanning traditional securities, digital assets, and cryptocurrency markets. Since its establishment in 2015, INVESCO VERTEX CAPITAL LTD. has expanded its presence into major financial hubs across North America, Europe, and Asia. In addition to providing intelligent investment analysis, the firm integrates multi-asset, multi-market strategies to ensure clients achieve stable returns in today’s complex and rapidly evolving economic environment.

Via Binary News Network · September 23, 2025

Toronto, September 2025 – As global financial markets grow increasingly volatile, investors are facing a complex and ever-changing economic environment, information overload, and slow responses from traditional investment models. Against this backdrop, INVESCO VERTEX CAPITAL LTD. has been establishing itself as a leader in international financial investing through technological innovation, global expansion, and diversified investment solutions.

Via Binary News Network · September 22, 2025

Invesco Vertex Capital Ltd. is a leading international financial investment firm committed to leveraging innovative technology platforms and data analytics to help global investors grow their assets and manage wealth. Founded in Canada, the company provides a wide range of financial services worldwide, including digital assets, quantitative trading, traditional securities, and asset management. With flexible, forward-looking investment strategies, Invesco Vertex Capital Ltd. has a deep understanding of market trends and delivers tailored solutions for its clients.

Via Binary News Network · September 19, 2025

Originally acquired in 2021 with partner Invesco Real Estate, the 710 residences are part of a larger Section 8 portfolio comprising nearly 2,000 residences across 48 buildings

By Fairstead · Via GlobeNewswire · July 30, 2025

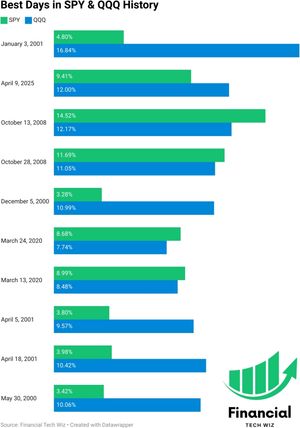

Chicago, IL - April 30, 2025 - Financial Tech Wiz, a leading provider of trading education, released new data confirming that Wednesday, April 9, 2025, marked the third-biggest single-day percentage gain in history for the Invesco QQQ Trust (Nasdaq-100 ETF). QQQ surged about 12%, while the SPDR S&P 500 ETF (SPY) climbed 9.41%, after the U.S. administration announced a 90-day suspension of proposed import tariffs, instantly easing macro-fear that had gripped markets through late March.

Via AB Newswire · April 30, 2025

Seasoned technology expert Karthi Gopalaswamy joins the 2025 Global Recognition Awards judging panel, bringing two decades of enterprise architecture experience across major corporations. His unique combination of technical expertise and leadership skills enables comprehensive evaluation of innovative solutions against practical business implementation considerations.

Via Press Release Distribution Service · March 24, 2025

Major Pension Fund Pulls $35 Billion from State Street Over ESG Concerns

Earlier this week, the People’s Pension moved $35 billion in assets to Amundi and Invesco following an increase in ESG concerns. The People’s Pension is one of the biggest pension funds in the UK, provided by People’s Partnership. The pension’s assets were previously managed by global financial services firm State Street, which is currently managing only $6.2 billion of investments.

Via Investor Brand Network · March 6, 2025

The MoneyShow/TradersEXPO Las Vegas: Unlock the Full Spectrum of Investing Opportunities

The highly anticipated MoneyShow/TradersEXPO Las Vegas will take place from Feb. 17-19, 2025, at the luxurious Paris Las Vegas resort. This premier event will bring together investors, traders, financial analysts, portfolio managers, finance experts, and best-selling authors for three days of unparalleled learning, insightful discussions and meaningful collaborations.

Via Investor Brand Network · January 23, 2025

According to the SEC’s order, from 2020 to 2022, Invesco told clients and stated in marketing materials that between 70 and 94 percent of its parent company’s

Via Equities.com · November 8, 2024

AVANTA Residential is pleased to announce the successful closing of a $10.6 million preferred equity investment for the development of Ridgeline Vista Townhomes, marking the company's first preferred equity investment. This significant investment underscores AVANTA's commitment to expanding its geographic footprint in the build-to-rent (BTR) sector with this project in Brighton, Colorado.

By AVANTA · Via Business Wire · October 24, 2024

U.S. equity markets have surged in 2024 as a handful of large-cap tech stocks have lifted the S&P 500 by more than 23% as investor excitement over

Via Equities.com · October 22, 2024

A growing number of ETFs have niche themes ranging from religious focuses to the mandate to copy particular investors, among many others.

Via MarketBeat · October 11, 2024

So far, 2024 has been a very difficult year for solar power investors. The S&P MAC Global Solar Energy Index has declined by more than 18% year-to-date

Via Equities.com · October 2, 2024

ON Semiconductor has had a rough 2024 when it comes to sales and its stock price. However, its made improvements that set it up for success when demand returns.

Via MarketBeat · September 23, 2024

The Invesco Global Listed Private Equity ETF is a way to indirectly access private equity investments without specialized credentials.

Via MarketBeat · September 11, 2024

Semtech is a mid-cap semiconductor firm that has seen rapid growth in its share price this year. What's the long term potential of this company?

Via MarketBeat · September 9, 2024

Toronto, Ontario--(Newsfile Corp. - September 5, 2024) - Pat Chiefalo, SVP, Head of ETFs & Indexed Strategies, Canada, Invesco,...

Via Newsfile · September 5, 2024

Synopsys beat estimates on adjusted earnings per share and revenue. Answers to questions in the earnings call also gave positive signals.

Via MarketBeat · August 23, 2024

CryptoNewsBreaks – Upstream Looks at First Week of Spot Ethereum ETF Trading

Upstream, a MERJ Exchange stock market and global trading app, is reporting on the first week of trading for spot Ethereum exchange-traded funds (“ETFs”). According to the article, spot Ethereum ETFs began trading on July 23, 2024; the ETFs were offered by entities such as BlackRock, Fidelity, 21Shares, Bitwise, Franklin Templeton, VanEck and Invesco Galaxy, which also offer spot Bitcoin ETFs. Spot Ethereum ETFs started strong with more than $1 billion in trade volume on the first day, representing 23% of the volume seen by Bitcoin ETFs on their launch.

Via Investor Brand Network · August 5, 2024

CryptoNewsBreaks – Upstream Looks at First Week of Spot Ethereum ETF Trading

Upstream, a MERJ Exchange stock market and global trading app, is reporting on the first week of trading for spot Ethereum exchange-traded funds (“ETFs”). According to the article, spot Ethereum ETFs began trading on July 23, 2024; the ETFs were offered by entities such as BlackRock, Fidelity, 21Shares, Bitwise, Franklin Templeton, VanEck and Invesco Galaxy, which also offer spot Bitcoin ETFs. Spot Ethereum ETFs started strong with more than $1 billion in trade volume on the first day, representing 23% of the volume seen by Bitcoin ETFs on their launch.

Via CryptoCurrencyWire · August 5, 2024

As investors rotate out of tech stocks, here are three names to consider if you’re looking to sift through the tech wreck for some attractive deals.

Via MarketBeat · July 29, 2024

AVANTA Residential (the “Company’), a private real estate firm focused exclusively on the Build-To-Rent (BTR) industry, announced a new preferred equity investment program designed to meet the capital needs of today’s BTR sponsors, investors, and borrowers.

By AVANTA · Via Business Wire · July 25, 2024

Golden Triangle Ventures’ ‘Destino Ranch’ Set To Unlock Significant Shareholder Value

The leisure and recreational industry seems poised for a stellar recovery after bearing the brunt of the COVID-19 outbreak, which caused sector revenue to decline substantially.

Via AB Newswire · June 19, 2024