Youdao, Inc. American Depositary Shares (DAO)

9.2800

+0.2300 (2.54%)

NYSE · Last Trade: Feb 16th, 5:02 PM EST

Detailed Quote

| Previous Close | 9.050 |

|---|---|

| Open | 9.040 |

| Bid | 9.000 |

| Ask | 12.09 |

| Day's Range | 8.860 - 9.550 |

| 52 Week Range | 6.300 - 12.96 |

| Volume | 209,235 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 119,156 |

Chart

About Youdao, Inc. American Depositary Shares (DAO)

Youdao Inc is a leading technology-driven education company based in China, specializing in providing a range of innovative learning products and services. The company primarily focuses on language learning and educational tools, combining advanced artificial intelligence and big data analytics to enhance the learning experience for students of all ages. With a diverse portfolio that includes mobile applications, online courses, and smart devices, Youdao aims to empower learners by making education more accessible and interactive. The company's commitment to quality education is reflected in its emphasis on developing personalized learning solutions that cater to the unique needs of each user. Read More

News & Press Releases

On February 11, 2026, NetEase, Inc. (NASDAQ: NTES) released its full-year 2025 earnings report, marking a pivotal moment in the company’s transition from a domestic giant to a truly global gaming powerhouse. Following a tumultuous few years defined by shifting regulatory landscapes and the high-profile severance (and subsequent reconciliation) with Blizzard Entertainment, NetEase’s latest numbers [...]

Via Finterra · February 11, 2026

NetEase (NTES) stock dropped after reporting Q3 results. Revenue missed estimates at $3.98B, but EPS beat at $2.09.

Via Benzinga · November 20, 2025

NetEase (NASDAQ: NTES) stock drops after reporting Q2 results, revenue exceeds estimates. Gaming segment drives growth, $0.5700 dividend declared.

Via Benzinga · August 14, 2025

Chinese gaming company NetEase (NTES) reported a 7.4% increase in quarterly revenue to $3.97 billion, beating analyst estimates. NetEase holds $18.9B in cash and declared a dividend of $0.6750 per ADS.

Via Benzinga · May 15, 2025

Via Benzinga · April 4, 2025

Youdao turns to parent NetEase and expansion of its marketing services outside of China to revive its stalling growth.

Via Benzinga · February 25, 2025

Shares of Youdao Inc (NYSE: DAO) fell slightly after Q4 results, with net revenues of RMB 1.3B, down 9.5% YoY. AI platform improved profitability.

Via Benzinga · February 24, 2025

NetEase Q4 revenue decline, EPS beat; Youdao, Inc. revenue decline; Cloud Music revenue down; Innovative businesses revenue down; dividend increase

Via Benzinga · February 20, 2025

Via Benzinga · February 11, 2025

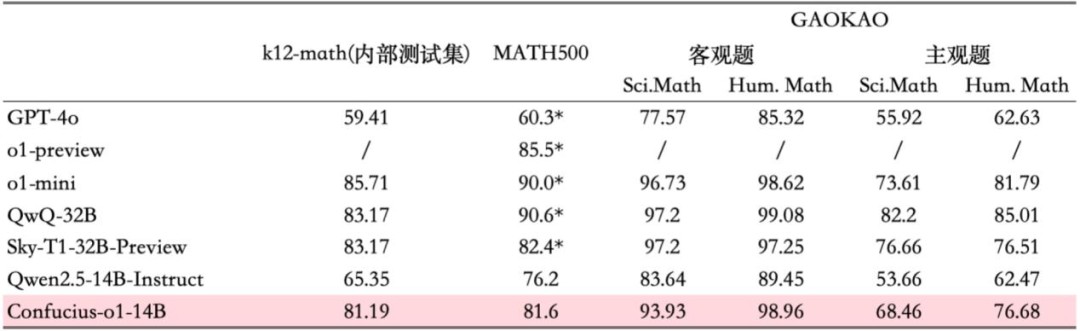

In 2025, the AI industry has witnessed a surge in the development of large-scale inference models, following OpenAI’s release of o1. Various inference models have been emerging, with their high-level reasoning capabilities significantly enhanced and their application value increasingly recognized by the industry.

Via Get News · January 22, 2025

Via Benzinga · November 25, 2024

NetEase reported a 3.9% revenue decline in Q3 2024, beating analyst estimates. Strong performance in gaming and new releases.

Via Benzinga · November 14, 2024

Via Benzinga · October 8, 2024

Via Benzinga · October 3, 2024

Via Benzinga · October 3, 2024

Via Benzinga · October 3, 2024

Via Benzinga · October 2, 2024

DAO stock results show that Youdao beat analyst estimates for earnings per share but missed on revenue for the second quarter of 2024.

Via InvestorPlace · August 22, 2024

NetEase reported Q2 2024 revenue of $3.51B, missing analyst estimate of $3.70B. Adjusted EPADS of $1.66 beat estimate of $1.65. Games revenue up 6.7% with gross margin of 70%. Youdao revenue up 9.5% with gross margin of 48.2%. Cloud Music revenue up 4.7% with gross margin of 32.1%. Dividend of $0.4350 per ADS approved. CEO William Ding excited for global gaming expansion. NTES shares down 4.9% premarket.

Via Benzinga · August 22, 2024