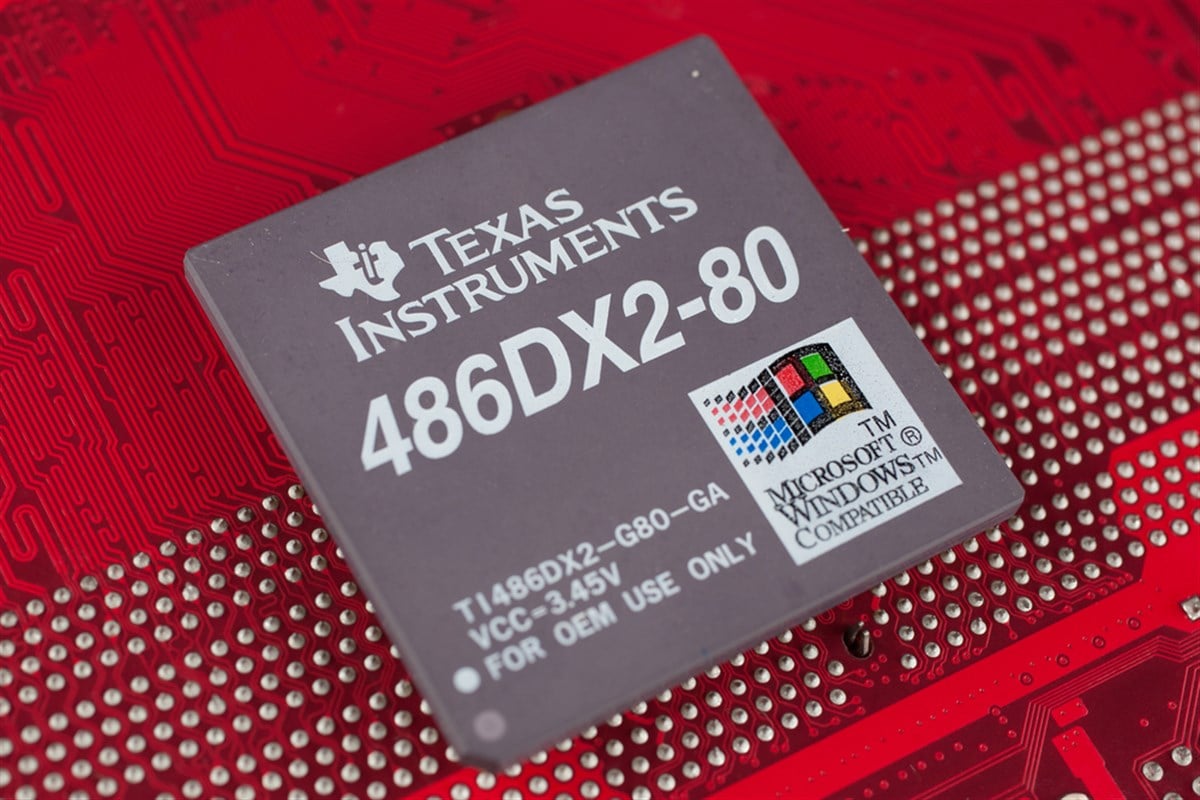

Texas Instruments (TXN)

225.69

-0.47 (-0.21%)

NASDAQ · Last Trade: Feb 18th, 1:19 AM EST

EQNX::TICKER_START (NASDAQ:VWAV),(NASDAQ:ARBE),(NASDAQ:TXN),(NASDAQ:NXPI),(NASDAQ:ADI) EQNX::TICKER_END

Via FinancialNewsMedia · February 6, 2026

Chip stocks aren't the place most think of when it comes to investment income, but these three stocks provide dividends and exposure to this exciting industry.

Via MarketBeat · October 8, 2024

Check out this list of 10 U.S. companies that recently increased their dividends, providing more income to their shareholders.

Via MarketBeat · October 1, 2024

Intel has announced that it is exploring options to sell off a big part of its business. If it happens, can it turn the firm around?

Via MarketBeat · September 9, 2024

Texas Instruments Inc. (NASDAQ: TXN) Climbs to New 52-Week High

Shares of Texas Instruments Incorporated (NASDAQ: TXN) traded at a new 52-week high today and are currently trading at $187.13. So far today, approximately 720.6k shares have been exchanged, as compared to an average 30-day volume of 4.45M shares.

Via Investor Brand Network · July 25, 2023

Texas Instruments Inc. (NASDAQ: TXN) Making Surprising Moves in Friday Session

Texas Instruments Incorporated (NASDAQ: TXN) has caught the attention of the investment community today with its bullish price action. The company’s shares are currently up 3.12% on the day to $174.91.

Via Investor Brand Network · May 26, 2023

Cirrus Logic Inc. (NASDAQ: CRUS) is a semiconductor developer focused on audio and haptic technology. Haptics are the touch response feedback you receive.

Via MarketBeat · August 12, 2024

Arm Holdings plc (NASDAQ: ARM) stock plummeted on its fiscal Q1 2025 earnings results as investors were treated to a nasty dose of reality

Via MarketBeat · August 5, 2024

NXP Semiconductors is well-positioned in the industrial and commercial markets. Analysts forecast a pivot back to growth later this year.

Via MarketBeat · April 30, 2024

Investors continue to look for clarity as tech earnings sent stocks higher to end the week, even as investors hope for rate cuts fade as inflation rises

Via MarketBeat · April 27, 2024

Texas Instruments struggled in Q1, but details indicate a trough in the cycle and a return to growth ahead. Analysts are raising their price targets.

Via MarketBeat · April 24, 2024

Nvidia's success reverberates far beyond its corporate borders, with several other stocks finding themselves in the slipstream of Nvidia's meteoric rise

Via MarketBeat · February 26, 2024

AI-driven demand catapults semiconductor stocks, propelled by Taiwan Semiconductor's stellar earnings, robust AI-related revenue, and upbeat forecast

Via MarketBeat · January 26, 2024

The Market Beat Dividend Screener is a highly useful resource that helps you sift through the enormous dividend pile to find stocks that best fit your style.

Via MarketBeat · January 17, 2024

The S&P 500 closed below its 200-day moving average, signaling a potential shift in market sentiment. Downside trade in leading techs added to the decline.

Via MarketBeat · October 26, 2023

Texas Instruments gapped down as the chipmaker's weak revenue forecast sent the tech sector lower. TI said all customer sectors except automotive were down.

Via MarketBeat · October 26, 2023

All the major indexes moved lower on Friday, making it a near certainty that stocks would post their worst week in a month; the bears are firmly in control

Via MarketBeat · October 21, 2023

Texas Instruments is a stock for buy-and-hold investors; management is entrenched and foresightful, and the stock pays to own it.

Via MarketBeat · October 18, 2023

Chip stocks have been beaten up over the past few months and present an opportunity for investors ahead of the Q3 reporting season.

Via MarketBeat · September 26, 2023

China's economic slowdown is impacting chip stocks Monolithic Power Systems, Texas Instruments, and Qualcomm, which didn't participate much in the AI boom.

Via MarketBeat · August 21, 2023

Now is a good time to find stocks that are likely to perform well no matter which direction inflation heads; here are three stocks to consider

Via MarketBeat · August 9, 2023

Sometimes dividend cuts are a smart moves that eventually lead to improved financial health. Here are three recent examples of companies that lowered dividends.

Via MarketBeat · June 2, 2023

NXP Semiconductors is positioned to weather the cyclical downturn in consumer-oriented chips due to diversification and auto markets.

Via MarketBeat · May 3, 2023

onsemi is on track to outperform the semiconductor industry in 2023, and the stock is heading up to a new all-time high because of it.

Via MarketBeat · May 1, 2023

KLA Corporation is set up to outperform the semiconductor industry, driven by the shift to next-gen technology and demand from China.

Via MarketBeat · April 27, 2023