Financial Institutions, Inc. - Common Stock (FISI)

26.46

+0.00 (0.00%)

NASDAQ · Last Trade: Jul 29th, 8:27 AM EDT

Detailed Quote

| Previous Close | 26.46 |

|---|---|

| Open | - |

| Bid | 25.55 |

| Ask | 42.33 |

| Day's Range | N/A - N/A |

| 52 Week Range | 20.97 - 29.79 |

| Volume | 0 |

| Market Cap | 406.84M |

| PE Ratio (TTM) | -12.91 |

| EPS (TTM) | -2.0 |

| Dividend & Yield | 1.240 (4.69%) |

| 1 Month Average Volume | 153,506 |

Chart

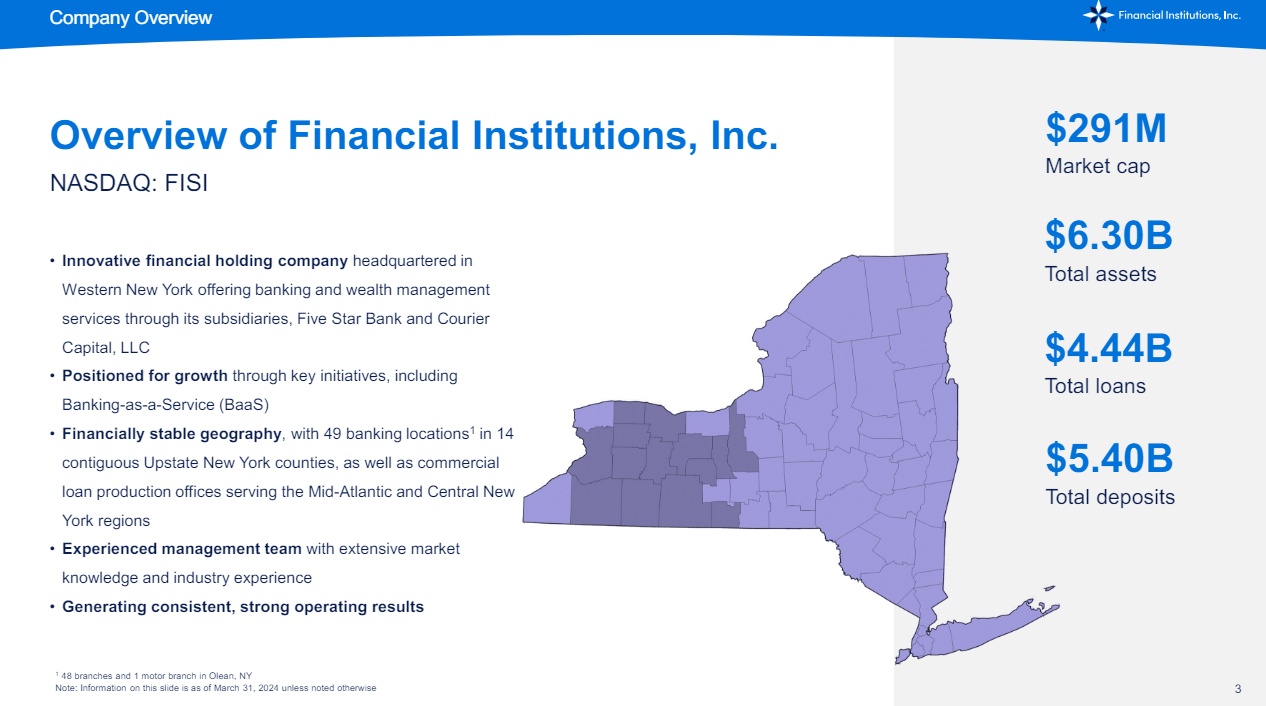

About Financial Institutions, Inc. - Common Stock (FISI)

Financial Institut is a company that focuses on providing a wide range of financial services aimed at enhancing the financial well-being of its clients. The company operates primarily in the banking sector, offering various products including savings accounts, loans, and investment services. With a commitment to leveraging technology and innovative solutions, Financial Institut aims to deliver tailored financial products and exceptional customer service to individuals and businesses alike. Their operations include comprehensive financial planning, wealth management, and investment advisory services, making them a key player in helping clients achieve their financial goals. Read More

News & Press Releases

Financial Institutions Inc (FISI) reports mixed Q2 2025 results with EPS beating estimates but revenue missing. Shares remain flat post-earnings amid modest monthly gains.

Via Chartmill · July 24, 2025

Via Benzinga · April 25, 2025

Via Benzinga · January 16, 2025

FISI stock results show that Financial Institutions missed analyst estimates for earnings per share and missed on revenue for the second quarter of 2024.

Via InvestorPlace · July 25, 2024

Via Benzinga · July 12, 2024

The bank’s earnings-per-share plummeted 86% year-over-year from the check-kiting scheme it suffered, but that should be a one-time incident.

Via Talk Markets · June 20, 2024

FISI stock results show that Financial Institutions missed analyst estimates for earnings per share but beat on revenue for the first quarter of 2024.

Via InvestorPlace · April 25, 2024

Via Benzinga · February 21, 2024

Via Benzinga · February 15, 2024

Via Benzinga · February 9, 2024

By the close of today, February 23, 2024, Primis Finl (NASDAQ:FRST) will issue a dividend payout of $0.10 per share, resulting in an annualized dividend yield of 3.17%. This payout is exclusively for shareholders who held the stock before the ex-dividend date on February 08, 2024.

Via Benzinga · February 23, 2024

Via Benzinga · February 21, 2024

Via Benzinga · February 12, 2024

Via Benzinga · February 9, 2024

A "realignment" should hopefully bring better results for the company in 2024.

Via The Motley Fool · January 26, 2024

Via Benzinga · January 10, 2024

Shares of Intel Corporation (NASDAQ: INTC) fell sharply during Friday’s session. Intel reported upbeat results for its fourth quarter, but issued a weak forecast for the first quarter.

Via Benzinga · January 26, 2024

Via Benzinga · December 7, 2023

Companies Reporting Before The Bell • Nokia (NYSE:NOK) is projected to report quarterly earnings at $0.15 per share on revenue of $7.05 billion.

Via Benzinga · January 25, 2024