Articles from Rubric Capital Management LP

Rubric Capital Management LP (“Rubric”), an investment advisor whose managed funds and accounts collectively own approximately 9.0% of the outstanding shares of common stock of Xperi Inc. (NYSE: XPER) (“Xperi” or the “Company”), today issued the following open letter to Xperi’s stockholders regarding the preliminary results of the Company’s 2024 Annual Meeting of Stockholders (the “Annual Meeting”).

By Rubric Capital Management LP · Via Business Wire · May 28, 2024

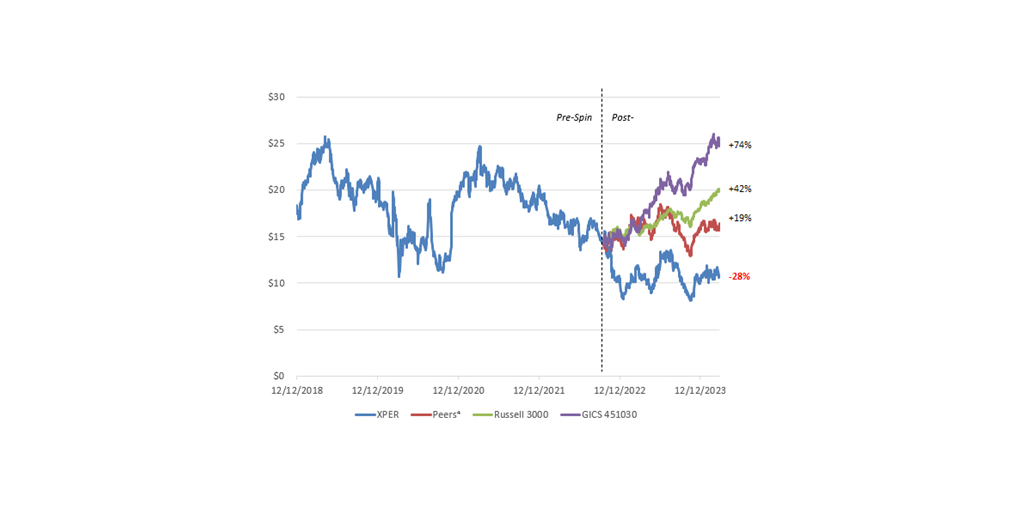

Rubric Capital Management LP (“Rubric”), an investment advisor whose managed funds and accounts collectively own approximately 9.0% of the outstanding shares of common stock of Xperi Inc. (NYSE: XPER) (“Xperi” or the “Company”), today sent a letter to Xperi stockholders urging them to reject the status quo of value destruction under the current Board of Directors by replacing incumbent directors David Habiger and Darcy Antonellis with Rubric’s nominees, Thomas A. Lacey and Deborah S. Conrad, at Xperi’s Annual Meeting of Stockholders, which is scheduled to be held on May 24, 2024.

By Rubric Capital Management LP · Via Business Wire · May 16, 2024

Rubric Capital Management LP (“Rubric”), an investment advisor whose managed funds and accounts collectively own approximately 9.0% of the outstanding shares of common stock of Xperi Inc. (NYSE: XPER) (“Xperi” or the “Company”), today sent a letter to Xperi stockholders urging them to replace David Habiger and Darcy Antonellis as members of the Company’s Board of Directors with Rubric’s nominees, Thomas A. Lacey and Deborah S. Conrad, at Xperi’s Annual Meeting of Stockholders, which is scheduled to be held on May 24, 2024.

By Rubric Capital Management LP · Via Business Wire · May 8, 2024

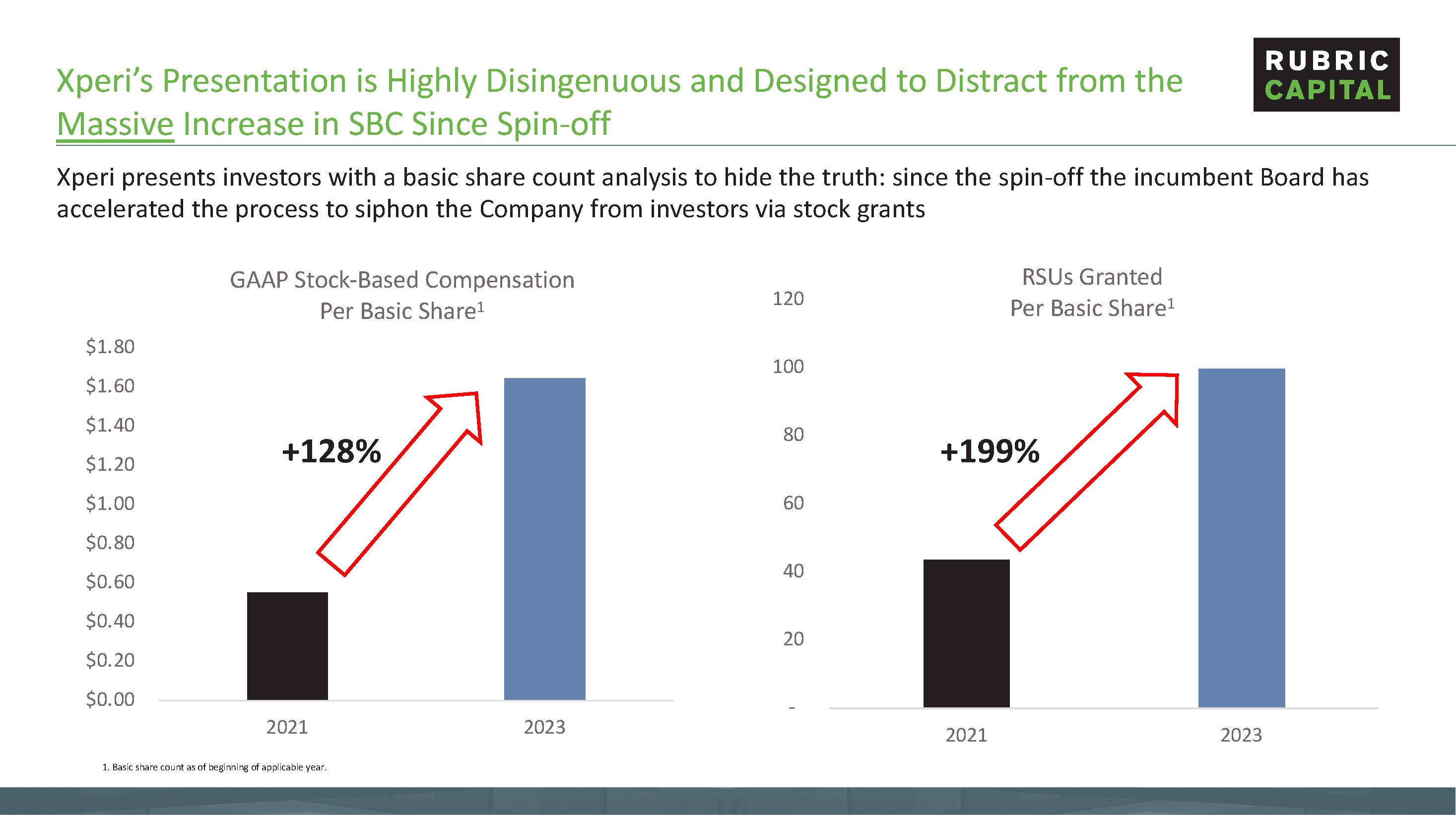

Rubric Capital Management LP (“Rubric”), an investment advisor whose managed funds and accounts collectively own approximately 9.0% of the outstanding shares of common stock of Xperi Inc. (NYSE: XPER) (“Xperi” or the “Company”), today issued the following statement in response to Xperi’s recently updated investor presentation in connection with its 2024 Annual Meeting of Stockholders.

By Rubric Capital Management LP · Via Business Wire · May 3, 2024

Rubric Capital Management LP (“Rubric”), an investment advisor whose managed funds and accounts collectively own approximately 9.0% of the outstanding shares of common stock of Xperi Inc. (NYSE: XPER) (“Xperi” or the “Company”), today issued an open letter to Xperi’s stockholders in response to an investor presentation released by the Company in connection with its 2024 Annual Meeting of Stockholders.

By Rubric Capital Management LP · Via Business Wire · May 1, 2024

Rubric Capital Management LP (“Rubric”), an investment advisor whose managed funds and accounts collectively own approximately 9.0% of the outstanding shares of common stock of Xperi Inc. (NYSE: XPER) (“Xperi” or the “Company”), today released a presentation highlighting the urgent need for change to Xperi’s Board of Directors (the “Board”) and outlining a clear action plan to restore and rebuild stockholder value that Rubric’s director nominees – Thomas A. Lacey and Deborah S. Conrad – are best suited to execute.

By Rubric Capital Management LP · Via Business Wire · April 29, 2024

Rubric Capital Management LP (“Rubric”), an investment advisor whose managed funds and accounts collectively own approximately 9.0% of the outstanding shares of common stock of Xperi Inc. (NYSE: XPER) (“Xperi” or the “Company”), today filed its definitive proxy statement with the Securities and Exchange Commission in connection with its nomination of Thomas A. Lacey and Deborah S. Conrad for election to Xperi’s Board of Directors (the “Board”) at the Company’s 2024 Annual Meeting of Stockholders, which is scheduled to be held on May 24, 2024.

By Rubric Capital Management LP · Via Business Wire · April 17, 2024

Rubric Capital Management LP (“Rubric”), an investment adviser whose managed funds and accounts collectively own approximately 8.5% of the common stock of Chimerix, Inc. (“Chimerix” or the “Company”) (NASDAQ: CMRX), today sent a letter to Chimerix’s Board of Directors (the “Board”).

By Rubric Capital Management LP · Via Business Wire · November 10, 2022

Rubric Capital Management LP (“Rubric”), an investment advisor whose funds and accounts collectively own approximately 14% of the outstanding equity of Mereo BioPharma Group plc (NASDAQ: MREO) (“Mereo” or the “Company”), today issued the following statement in response to the Company’s updated operating plan:

By Rubric Capital Management LP · Via Business Wire · October 18, 2022

Rubric Capital Management LP (“Rubric”), an investment advisor whose funds and accounts collectively own approximately 14% of the outstanding equity of Mereo BioPharma Group plc (NASDAQ: MREO) (“Mereo” or the “Company”), today issued an open letter to Mereo’s shareholders. In its letter, Rubric details Mereo’s entrenching tactics in a desperate attempt to once more thwart Rubric’s effort to call a general meeting of shareholders.

By Rubric Capital Management LP · Via Business Wire · October 3, 2022

Rubric Capital Management LP (“Rubric”), an investment advisor whose funds and accounts collectively own approximately 14% of the outstanding equity of Mereo BioPharma Group plc (NASDAQ: MREO) (“Mereo” or the “Company”), today issued an open letter to Mereo’s shareholders. In its letter, Rubric highlighted Mereo’s poor corporate governance and performance, and addressed the Company’s many misleading public statements regarding Rubric’s attempts to constructively engage with the Board and maximize shareholder value.

By Rubric Capital Management LP · Via Business Wire · September 14, 2022

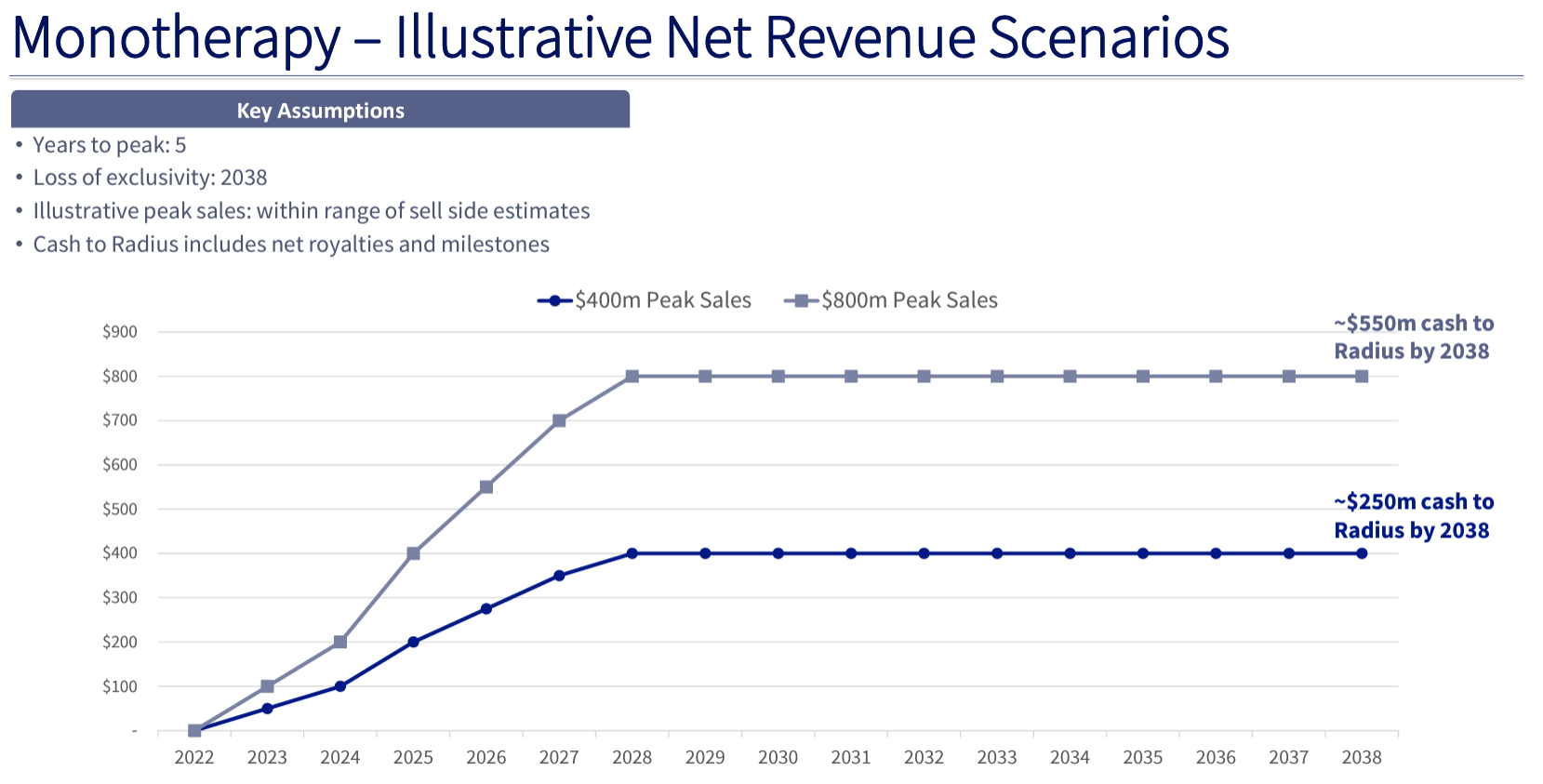

Rubric Capital Management LP (“Rubric”), an investment advisor whose funds and accounts collectively own approximately 14.62% of the common stock of Radius Health, Inc. (“Radius” or the “Company”) (NASDAQ: RDUS), today sent a letter to Radius’ Board of Directors (the “Board”).

By Rubric Capital Management LP · Via Business Wire · June 16, 2022