Articles from LandBridge Company LLC

LandBridge Company LLC (NYSE: LB, NYSE Texas: LB) ("LandBridge") today announced that it will release its financial results for the fourth quarter and the fiscal year ended December 31, 2025 after market close on Wednesday, February 25, 2026.

By LandBridge Company LLC · Via Business Wire · January 22, 2026

LandBridge Company LLC (NYSE: LB) (“LandBridge”) today announced that it will hold an Investor Day on March 19, 2026 at 1:00 pm ET in New York City, NY. The meeting will feature presentations by Chief Executive Officer Jason Long and other members of the LandBridge leadership team. Those interested in attending the event in person may contact ir@landbridgeco.com.

By LandBridge Company LLC · Via Business Wire · January 22, 2026

LandBridge Company LLC (NYSE: LB; NYSE Texas: LB) (“LandBridge” or the “Company”) today announced that it has entered into development agreements (Option to Lease Agreements) with subsidiaries of Samsung C&T Renewables, LLC (“SCTR”) providing the option to lease acreage for two potential Battery Energy Storage System ("BESS") projects in Pecos and Loving counties, Texas with an aggregate capacity of 350 MW. The agreements grant SCTR exclusive rights at each site location to deploy and develop a BESS facility designed to enhance grid stability, support renewable energy integration, and deliver clean power to the local grid. The projects, which could achieve commercial operation as soon as year-end 2028, represent the first BESS projects on LandBridge’s acreage and underscore the Company’s commitment to leveraging its premium land assets for innovative projects across conventional and renewable energy development.

By LandBridge Company LLC · Via Business Wire · December 11, 2025

LandBridge Company LLC (NYSE: LB; NYSE Texas: LB) (“LandBridge”) announced today that DBR Land Holdings LLC, a subsidiary of LandBridge, has priced its offering of $500 million aggregate principal amount of 6.250% senior notes due 2030 at par (the “Notes”). The offering is expected to close on November 25, 2025, subject to customary closing conditions.

By LandBridge Company LLC · Via Business Wire · November 19, 2025

LandBridge Company LLC (NYSE: LB; NYSE Texas: LB) (“LandBridge”) announced today that DBR Land Holdings LLC, a subsidiary of LandBridge, intends to offer $500 million in aggregate principal amount of senior notes (the “Notes”) in a private placement to eligible purchasers, subject to market conditions.

By LandBridge Company LLC · Via Business Wire · November 19, 2025

LandBridge Company LLC (NYSE: LB) (“LandBridge” or the "Company") today announced the pricing of an underwritten public offering of 2,500,000 Class A shares representing limited liability company interests (“Class A shares”), at a price to the public of $71.00 per share, by LandBridge Holdings LLC (the “Selling Shareholder”). LandBridge will not sell any Class A shares in the offering and will not receive any proceeds therefrom. The Selling Shareholder granted the underwriter a 30-day option to purchase up to an additional 375,000 Class A shares to cover sales by the underwriter in the initial offering of the Class A shares or in the open market.

By LandBridge Company LLC · Via Business Wire · November 17, 2025

LandBridge Company LLC (NYSE: LB) (“LandBridge” or the “Company”) today announced the commencement of an underwritten public offering of 2,500,000 Class A shares representing limited liability company interests (“Class A shares”) by LandBridge Holdings LLC (the “Selling Shareholder”). LandBridge will not sell any Class A shares in the offering and will not receive any proceeds therefrom. The Selling Shareholder expects to grant the underwriter a 30-day option to purchase up to an additional 375,000 Class A shares to cover sales by the underwriter in the initial offering of the Class A shares or in the open market.

By LandBridge Company LLC · Via Business Wire · November 17, 2025

LandBridge Company LLC (NYSE: LB) (the “Company,” or “LandBridge”) today announced its financial and operating results for the third quarter ended September 30, 2025.

By LandBridge Company LLC · Via Business Wire · November 12, 2025

LandBridge Company LLC (NYSE: LB) ("LandBridge") today announced that it will release its financial results for the third quarter of 2025 after market close on Wednesday, November 12, 2025. LandBridge will host a webcast and conference call to discuss its results on Thursday, November 13, 2025, at 9:30 a.m. Central Time / 10:30 a.m. Eastern Time.

By LandBridge Company LLC · Via Business Wire · October 15, 2025

LandBridge Company LLC (NYSE: LB) (“LandBridge”) today announced it has finalized the sale of a solar project to a leading, publicly-traded energy infrastructure developer. In connection with the transaction, LandBridge received an upfront cash payment and the right to receive contingent future cash payments based on the achievement of certain developmental milestones. The solar project is a 3,000-acre photovoltaic solar energy generation project in Reeves County, Texas with a proposed generation capacity of up to 250 MW.

By LandBridge Company LLC · Via Business Wire · October 9, 2025

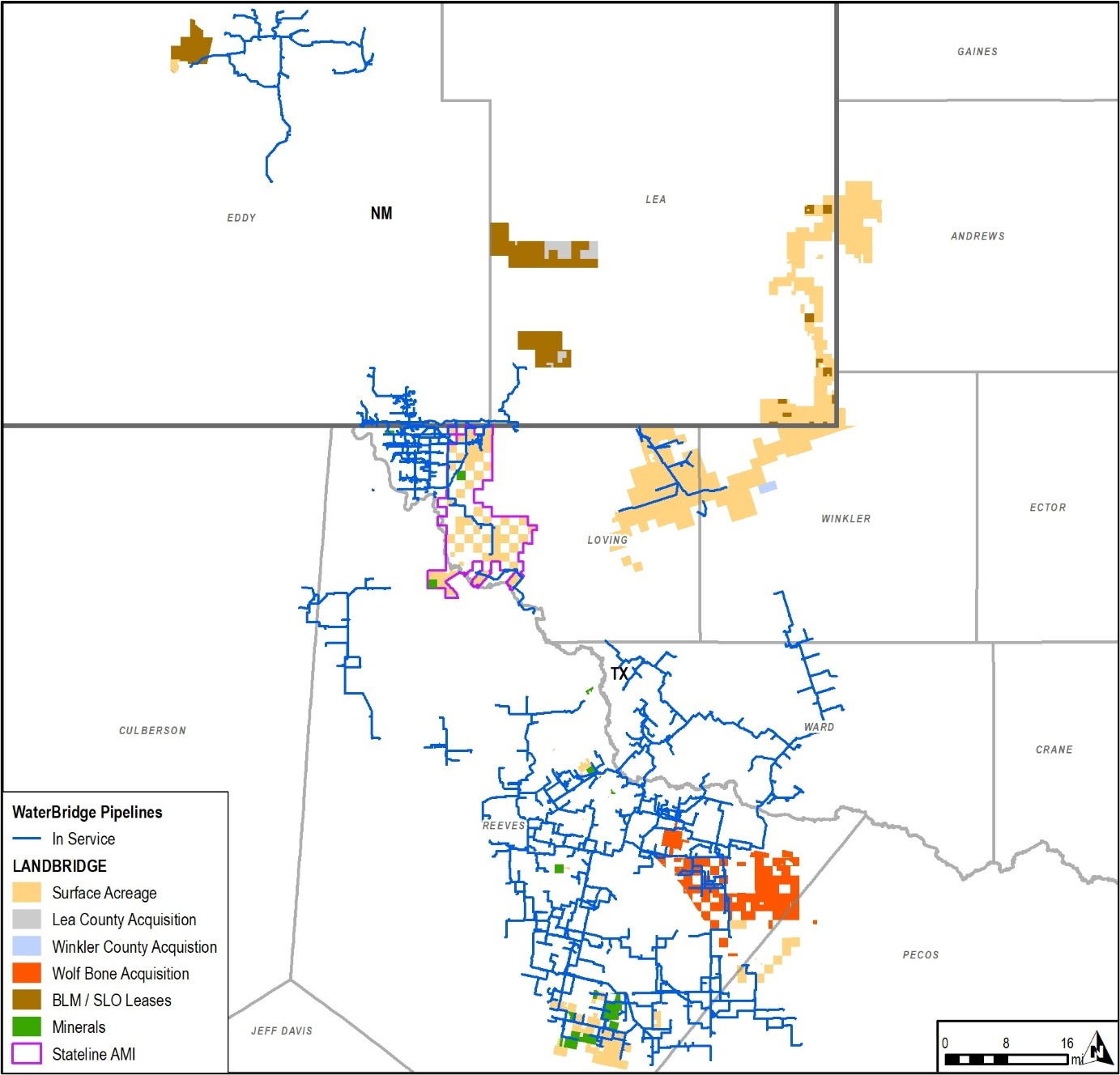

LandBridge Company LLC (NYSE: LB) (“LandBridge”) today announced that it has entered into an agreement to acquire approximately 37,500 total acres, across Loving, Reeves, Winkler and Ward counties, Texas, from 1918 Ranch & Royalty, LLC (the “Acquisition”), with closing anticipated to occur in the fourth quarter of 2025, subject to customary closing conditions. The acreage to be acquired consists of approximately 22,000 fee surface acres, approximately 3,500 surface acres held pursuant to a long-term management agreement and approximately 12,000 leasehold surface acres.

By LandBridge Company LLC · Via Business Wire · October 7, 2025

LandBridge Company LLC (NYSE: LB) (“LandBridge”) announced that it has entered into a strategic agreement with NRG Energy, Inc. (“NRG”) with respect to a potential data center site in Reeves County, Texas, in the Delaware Basin.

By LandBridge Company LLC · Via Business Wire · September 23, 2025

LandBridge Company LLC (NYSE: LB) (“LandBridge”) today announced the dual listing of its Class A shares representing limited liability company interests in the Company on NYSE Texas, Inc. (“NYSE Texas”), the newly-launched, fully electronic equities exchange headquartered in Dallas, Texas. LandBridge will maintain its primary listing on the New York Stock Exchange and continue to trade under the same ticker symbol, “LB,” on NYSE Texas, effective August 15, 2025.

By LandBridge Company LLC · Via Business Wire · August 14, 2025

LandBridge Company LLC (NYSE: LB) (the “Company,” “LandBridge”) today announced its financial and operating results for the second quarter ended June 30, 2025.

By LandBridge Company LLC · Via Business Wire · August 6, 2025

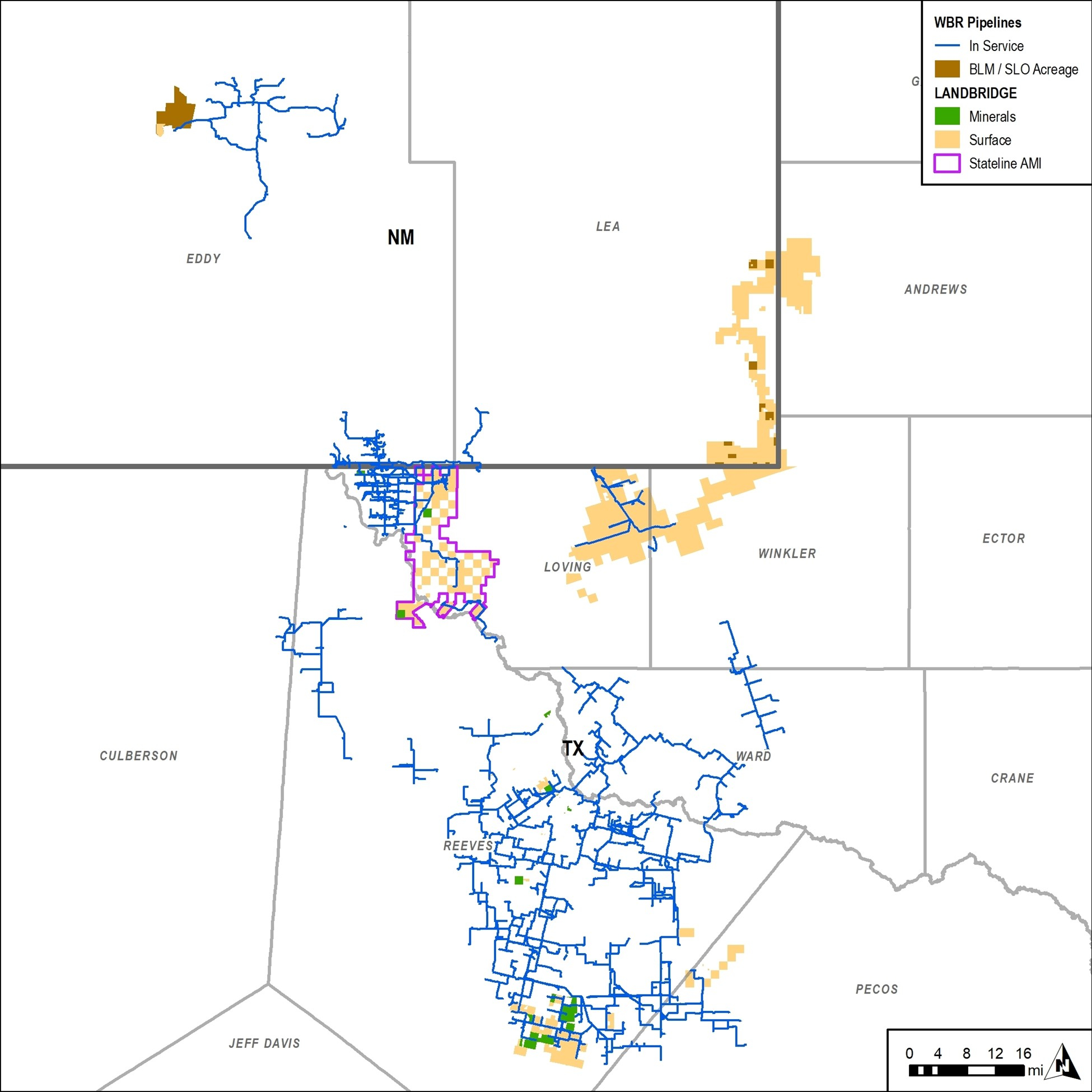

LandBridge Company LLC (NYSE: LB) (“LandBridge”) today announced it has executed a 10-year surface use and pore space reservation agreement with Devon Energy Corp. (NYSE: DVN) (“Devon”) to support Devon’s operations in the core of the New Mexico Delaware Basin. Under the agreement, LandBridge will provide Devon with 300,000 barrels per day (bpd) of pore space capacity on its East Stateline Ranch and Speed Ranch surface acreage. The pore space reservation will commence in the second quarter of 2027 and includes an obligation for Devon to deliver at least 175,000 bpd of produced water via a minimum volume commitment.

By LandBridge Company LLC · Via Business Wire · August 6, 2025

LandBridge Company LLC (NYSE: LB) ("LandBridge") today announced that it will release its financial results for the second quarter of 2025 after market close on Wednesday, August 6, 2025. LandBridge will host a webcast and conference call to discuss its results on Thursday, August 7, 2025, at 8:00 a.m. Central Time / 9:00 a.m. Eastern Time.

By LandBridge Company LLC · Via Business Wire · July 8, 2025

LandBridge Company LLC (NYSE: LB) (the “Company,” “LandBridge”) today announced its financial and operating results for the first quarter ended March 31, 2025.

By LandBridge Company LLC · Via Business Wire · May 7, 2025

LandBridge Company LLC (NYSE: LB) ("LandBridge") today announced that it will release its financial results for the first quarter of 2025 after market close on Wednesday, May 7, 2025. LandBridge will host a webcast and conference call to discuss its results on Thursday, May 8, 2025, at 8:00 a.m. Central Time / 9:00 a.m. Eastern Time.

By LandBridge Company LLC · Via Business Wire · April 9, 2025

LandBridge Company LLC (NYSE: LB) (the “Company,” “LandBridge”) today announced its financial and operating results for the fourth quarter and fiscal year ended December 31, 2024.

By LandBridge Company LLC · Via Business Wire · March 5, 2025

LandBridge Company LLC (NYSE: LB) today announced that its Board of Directors declared a quarterly cash dividend of $0.10 per Class A share. The dividend will be paid on March 20, 2025 to shareholders of record as of March 6, 2025.

By LandBridge Company LLC · Via Business Wire · February 21, 2025

LandBridge Company LLC ("LandBridge") today announced that it will release its financial results for the fourth quarter and the fiscal year ended December 31, 2024 after market close on Wednesday, March 5, 2025. LandBridge will host a webcast and conference call to discuss its results on Thursday, March 6, 2025, at 8:00 a.m. Central Time / 9:00 a.m. Eastern Time.

By LandBridge Company LLC · Via Business Wire · January 31, 2025

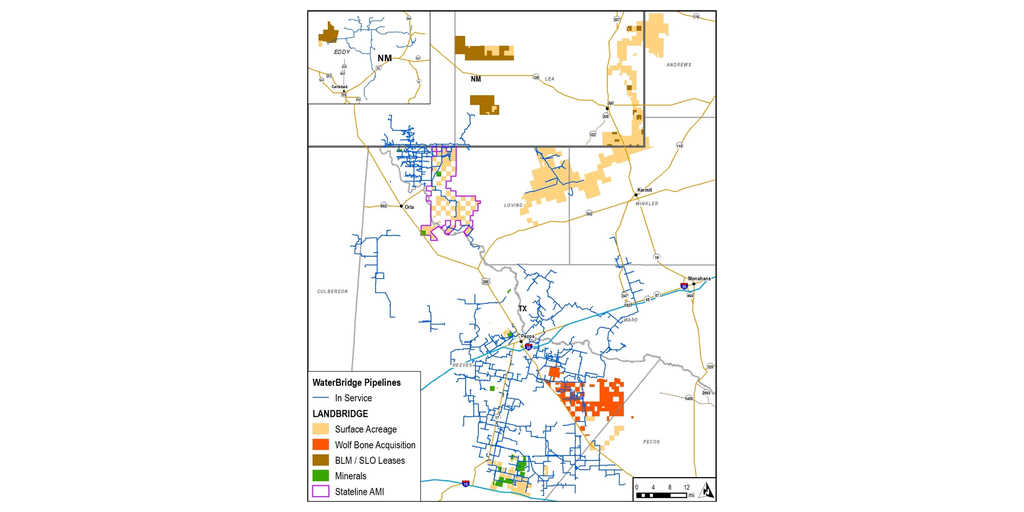

LandBridge Company LLC (NYSE: LB) (“LandBridge,” “we” or “our”) today announced it has closed its previously announced acquisition of approximately 46,000 largely contiguous surface acres, known as the Wolf Bone Ranch, in the Delaware Basin from a subsidiary of VTX Energy Partners, LLC, a Vitol investment (“VTX Energy”).

By LandBridge Company LLC · Via Business Wire · December 20, 2024

LandBridge Company LLC (NYSE: LB) (“LandBridge”) today announced it has closed its previously-announced acquisition of approximately 5,800 largely contiguous surface acres in Lea County, New Mexico, expanding LandBridge’s holdings into a new area of the Delaware Basin.

By LandBridge Company LLC · Via Business Wire · November 22, 2024

LandBridge Company LLC (NYSE: LB) (“LandBridge”) today announced it has entered into a purchase and sale agreement (the “Agreement”) to acquire approximately 46,000 largely contiguous surface acres in the Southern Delaware Basin known as the Wolf Bone Ranch for total consideration of $245 million in cash from a subsidiary of VTX Energy Partners, LLC, a Vitol investment (the “Acquisition”), subject to customary purchase price adjustments and closing conditions.

By LandBridge Company LLC · Via Business Wire · November 19, 2024

LandBridge Company LLC (NYSE: LB) (the “Company,” “LandBridge”) today announced its financial and operating results for the third quarter of 2024.

By LandBridge Company LLC · Via Business Wire · November 6, 2024

LandBridge Company LLC ("LandBridge") today announced that it will release its financial results for the third quarter 2024 after market close on Wednesday, November 6, 2024. LandBridge will host a webcast and conference call to discuss its results on Thursday, November 7, 2024, at 8:00 a.m. Central Time / 9:00 a.m. Eastern Time.

By LandBridge Company LLC · Via Business Wire · October 9, 2024

LandBridge Company LLC (NYSE: LB) (the “Company,” “LandBridge” or “LB”) today announced its financial and operating results for the second quarter of 2024.

By LandBridge Company LLC · Via Business Wire · August 7, 2024

LandBridge Company LLC ("LandBridge") today announced that it will release its financial results for the second quarter 2024 after market close on Wednesday, August 7, 2024. LandBridge will host a webcast and conference call to discuss its results on Thursday, August 8, 2024, at 8:00 a.m. Central Time / 9:00 a.m. Eastern Time.

By LandBridge Company LLC · Via Business Wire · July 26, 2024

LandBridge Company LLC (“LandBridge”) closed its initial public offering of 14,500,000 Class A shares representing limited liability company interests (“Class A shares”) at a price to the public of $17.00 per Class A share. In addition, the underwriters have exercised in full their 30-day option to purchase an additional 2,175,000 Class A shares at the public offering price, less underwriting discounts and commissions. The Class A shares began trading on the New York Stock Exchange (“NYSE”) under the ticker symbol “LB” on June 28, 2024. In addition to the Class A shares sold in the offering, LandBridge sold 750,000 Class A shares at a price of $17.00 per Class A share in a concurrent private placement to an accredited investor (the “concurrent private placement”). The sale of the Class A shares in the concurrent private placement are exempt from registration under the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof and Regulation D promulgated thereunder.

By LandBridge Company LLC · Via Business Wire · July 1, 2024

LandBridge Company LLC (“LandBridge”) today priced its initial public offering of 14,500,000 Class A shares representing limited liability company interests (“Class A shares”) at a price to the public of $17.00 per Class A share. In addition, LandBridge granted the underwriters a 30-day option to purchase up to an additional 2,175,000 Class A shares at the public offering price, less underwriting discounts and commissions. The Class A shares are expected to begin trading on the New York Stock Exchange (“NYSE”) under the ticker symbol “LB” on June 28, 2024. The offering is expected to close on July 1, 2024, subject to the satisfaction of customary closing conditions. In addition to the Class A shares sold in the offering, LandBridge agreed to sell 750,000 Class A shares at a price of $17.00 per Class A share in a concurrent private placement to an accredited investor (the “concurrent private placement”). The sale of the Class A shares in the concurrent private placement will be exempt from the registration requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof and Regulation D promulgated thereunder.

By LandBridge Company LLC · Via Business Wire · June 27, 2024