Articles from Fidelity Investments

New research from Fidelity Investments® reveals women are setting their sights on future financial wellness and adopting frugal money habits to help them get there. According to the 2025 Women & Money Study, nearly half of women (42%) cut down their spending on non-essential activities over the past year, with more than 3-in-4 women attributing this to economic uncertainties. In the year ahead, women are committed to saving more (47%) and reducing or paying off their debt (35%), and the majority are confident in their ability to do so.

By Fidelity Investments · Via Business Wire · October 29, 2025

Fidelity Investments® today announced the upcoming liquidation of five exchange-traded funds (ETFs): Fidelity Digital Health ETF (FDHT), Fidelity Sustainable Core Plus Bond ETF (FSBD), Fidelity Sustainable Low Duration Bond ETF (FSLD), Fidelity Sustainable U.S. Equity ETF (FSST), and Fidelity Women's Leadership ETF (FDWM).

By Fidelity Investments · Via Business Wire · October 16, 2025

Addressing current and future needs of the most advanced traders, Fidelity Investments® today announced the launch of Fidelity Trader+TM, an integrated ecosystem that delivers real-time insights, dynamic visual analytics, and powerful trading tools across web, desktop and mobile.

By Fidelity Investments · Via Business Wire · September 25, 2025

Fidelity Investments, in its 16th annual Plan Sponsor Attitudes Study released today, found that plan advisors continue to deliver meaningful value to sponsors and participants navigating today’s dynamic investment landscape.

By Fidelity Investments · Via Business Wire · September 15, 2025

According to Fidelity Investments®’ latest Q2 2025 retirement analysis, average 401(k), 403(b), and IRA balances reached new record highs in Q2. Driven by consistent savings and positive stock market performance - and despite the market volatility experienced at the start of the quarter - the average 401(k) balance increased by 8% from a year prior, while the average 403(b) balance increased 9% and the IRA balance increased 5% since Q2 2024.

By Fidelity Investments · Via Business Wire · September 4, 2025

Recent bouts of market volatility aren’t dimming investor confidence, as nearly two-thirds of self-directed traders expect their portfolios to perform the same or better in the coming months, according to Fidelity Investments’ inaugural State of the American Investor study. That said, as investors gain more experience, they also develop a more pessimistic outlook and lower risk tolerance, likely after trading through a longer history of market fluctuations.

By Fidelity Investments · Via Business Wire · August 19, 2025

As families navigate an evolving economic landscape, Fidelity Investments’® 2025 College Savings & Student Debt Study reveals high school students are redefining what success looks like after graduation, by prioritizing affordability, career readiness, and long-term financial security. More than half of high school students say living through recent times of economic uncertainty shaped how they view the role of higher education, which may be driving a surge of interest in non-traditional paths and a sharper focus on return on investment when it comes to pursuing post-high school education.

By Fidelity Investments · Via Business Wire · August 14, 2025

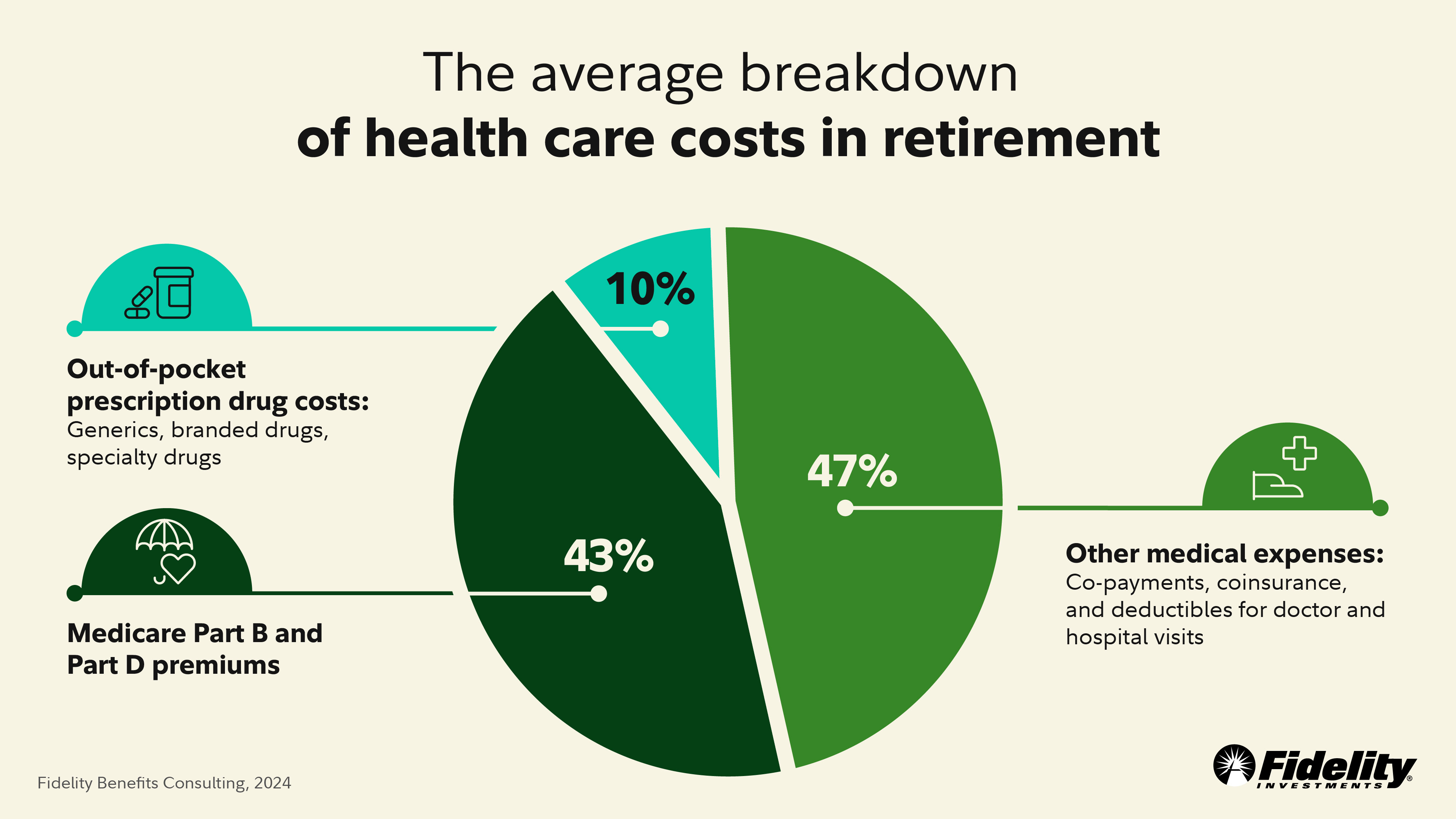

Fidelity Investments® today shared its 24th annual Retiree Health Care Cost Estimate, revealing that a 65-year-old retiring in 2025 can expect to spend an average of $172,500 in health care and medical expenses throughout retirement1. This represents a more than 4% increase over 2024 and continues the general upward trajectory of projected health-related expenses since Fidelity’s inaugural $80,000 estimate in 2002.

By Fidelity Investments · Via Business Wire · July 30, 2025

Fidelity Investments® today announced the launch of Fidelity Managed Futures ETF (FFUT), a liquid alternative strategy that aims to capitalize on market trends through disciplined, systematic long-short investing. FFUT is listed on The Nasdaq Stock Market LLC and available today commission-free for individual investors and financial advisors through Fidelity’s online brokerage platforms.

By Fidelity Investments · Via Business Wire · June 5, 2025

According to Fidelity Investments®’ latest Q1 2025 retirement analysis, average 401(k), 403(b), and IRA balances ended the quarter slightly lower, primarily as a result of market swings. Encouragingly, both employer and employee savings rates stayed consistently high, with the total 403(b) savings rate holding steady at 11.8% while the total 401(k) savings rate increased to a record 14.3%.

By Fidelity Investments · Via Business Wire · June 4, 2025

Fidelity Investments® today announced the launch of two fixed income ETFs: Fidelity Municipal Bond Opportunities ETF (FMUB) and Fidelity Systematic Municipal Bond Index ETF (FMUN). According to Fidelity’s Portfolio Construction Insights, the number of portfolios that utilize fixed income ETFs increased by 6% in the past year and more than two-thirds of portfolios analyzed had a fixed income allocation[i], reinforcing investor demand in the fixed income ETF market. The ETFs are listed on Nasdaq and are available commission-free for individual investors and financial advisors through Fidelity’s online brokerage platforms today.

By Fidelity Investments · Via Business Wire · April 7, 2025

More Americans than ever are expected to reach retirement age in 2025, and according to the latest Fidelity Investments® State of Retirement Planning study, many are understandably experiencing a reality check. In fact, while two-thirds (67%) of Americans in their planning years express confidence around their retirement prospects, that level is down seven percentage points from last year, with confidence down due to the lingering impact of inflation and the cost-of-living. Similarly, although more than 70% of recent retirees say retirement is going as planned, many have been caught off guard around rising costs, particularly health care expenses.

By Fidelity Investments · Via Business Wire · March 11, 2025

According to Fidelity Investments®’ latest Q4 2024 retirement analysis, retirement savers experienced a year of positive growth in 2024. While average balances across the board dipped slightly from Q3, the end-of-year 401(k) balance ranks as the second-highest average on record and an 11% increase from the start of 2024. Additionally, both long-term Gen X1 401(k) savers and Gen X IRA savers experienced positive gains over the course of the year in both average balance and contributions.

By Fidelity Investments · Via Business Wire · February 27, 2025

Fidelity Investments® today announced the expansion of its model portfolio lineup for wealth management firms with the launch of two new all-ETF model portfolio suites. According to Fidelity’s Portfolio Construction Insights, advisors continue to increase their ETF allocations with 53% of advisors’ portfolios leveraging the vehicle as of Q4 2024, up from 44% in 2023. In fact, the number of investments in unique ETFs within Fidelity Custom Model Portfolios more than doubled1 between 2022 and 2024, further signaling amplified interest from advisors.

By Fidelity Investments · Via Business Wire · February 20, 2025

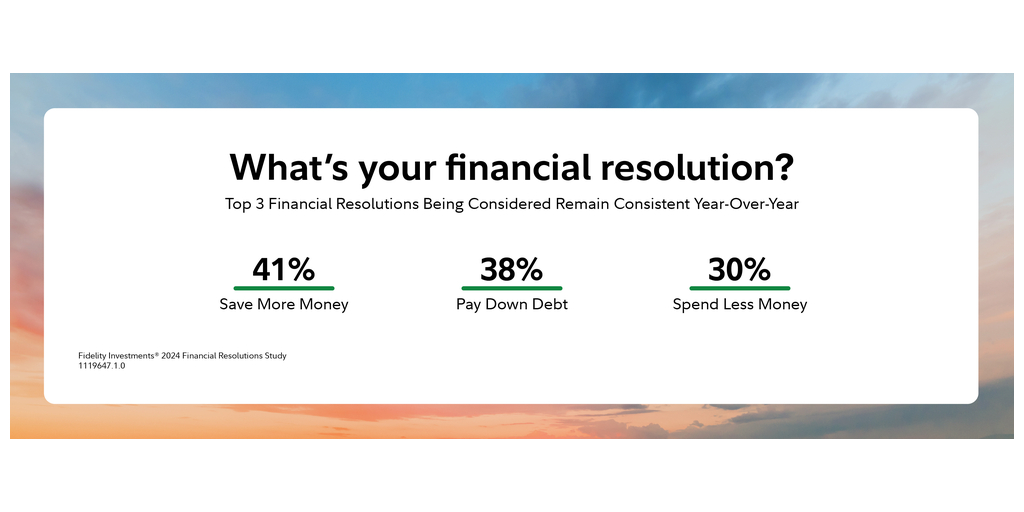

According to Fidelity Investments®, 2025 New Year’s Financial Resolutions study, Americans are looking ahead to a year of ‘living practically.’ At the end of a year where Americans have continued to feel the impact of inflation and the high cost-of-living, the majority of Americans are entering 2025 sensibly, with nearly two-thirds (65%) considering a financial resolution for the year ahead.

By Fidelity Investments · Via Business Wire · December 12, 2024

According to the Fidelity Investments®’ latest Q3 2024 retirement analysis, retirement savers experienced another quarter of growth thanks to continuing strong contribution levels and positive market conditions, with 401(k) and 403(b) account balances reaching the highest average on record. Additionally, Gen X-ers1 continue to make positive strides with retirement savings, with increases in both IRA contributions and the number of IRA accounts receiving contributions.

By Fidelity Investments · Via Business Wire · December 5, 2024

According to the Fidelity Investments® State of Wealth Mobility study, which examines how Americans are faring on building their wealth, respondents across income and asset levels agree people need to improve their comfort level about discussing family finances. More than half (56%) say their parents never discussed money with them, yet the majority (81%) would have benefited from financial education at an earlier age. Encouragingly, most Americans today are changing course, with 4-out-of-5 saying it’s important to talk to the young people in their lives about the subject—and two-thirds are actively engaging in those conversations.

By Fidelity Investments · Via Business Wire · November 19, 2024

Fidelity Investments® today announced the launch of five actively managed equity ETFs: Fidelity® Enhanced U.S. All-Cap Equity ETF (FEAC), Fidelity® Enhanced Emerging Markets ETF (FEMR), Fidelity® Fundamental Developed International ETF (FFDI), Fidelity® Fundamental Global ex-U.S. ETF (FFGX), and Fidelity® Fundamental Emerging Markets ETF (FFEM). The Enhanced and Fundamental ETFs are listed on NYSE and Cboe, respectively, and are available commission-free for individual investors and financial advisors through Fidelity’s online brokerage platforms today. The five new ETFs build upon Fidelity’s Enhanced ETF suite which launched in November 2023 and its Fundamental ETF suite which launched in February 2024.

By Fidelity Investments · Via Business Wire · November 21, 2024

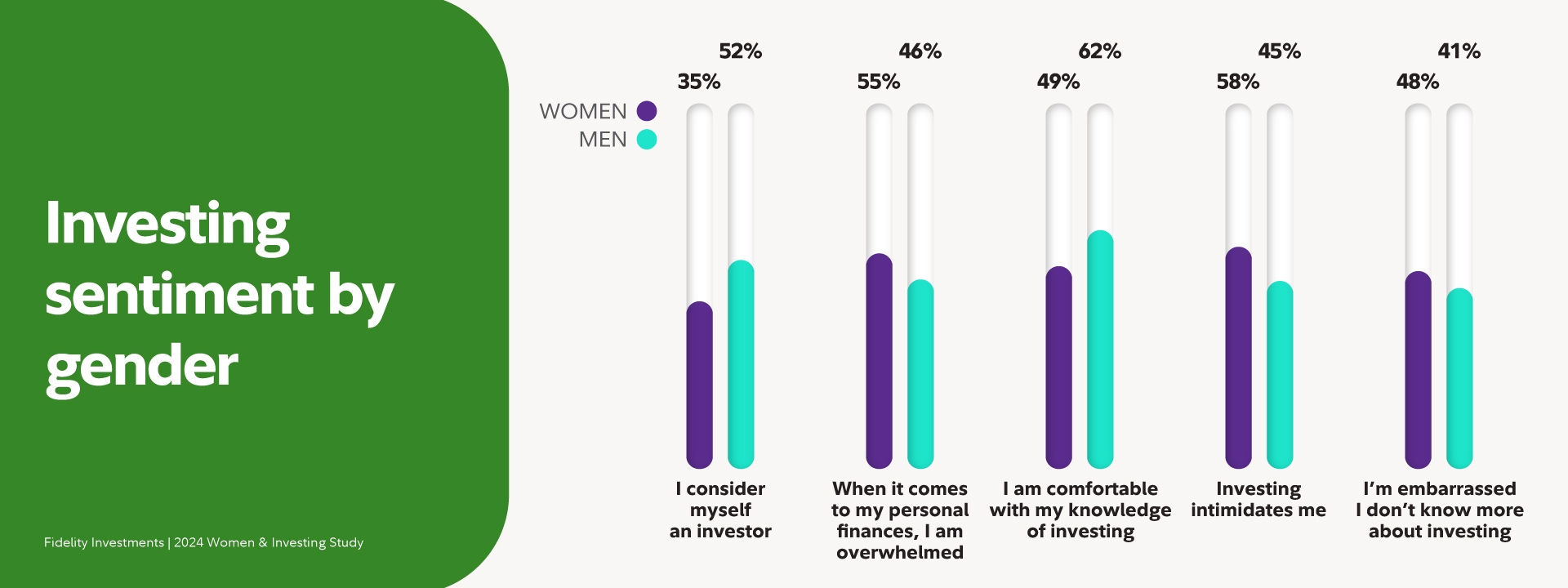

More women are taking control of their finances and investing than ever before, according to new research from Fidelity Investments®. Fidelity’s 2024 Women & Investing Study finds 7-in-10 women own investments in the stock market, an 18% increase compared to 2023. While younger generations continue to invest in higher numbers, the percentage of Gen X and Boomer women who invest in the stock market jumped the most year-over-year, increasing 18% and 23% respectively. This trend also holds true among Fidelity customers – the number of women retail customers has grown more than 20% over the past two years.1

By Fidelity Investments · Via Business Wire · October 3, 2024

According to the Fidelity Investments®’ latest Q2 2024 retirement analysis, retirement savers experienced the third quarter in a row of growth – a continuation of the strong contribution levels and positive market conditions that have driven average account balances to record-high levels. Gen X1, in particular, made strong gains with their retirement savings, with current IRA contributions the highest observed in the last five years.

By Fidelity Investments · Via Business Wire · August 28, 2024

Fidelity Investments® announced today the findings from its 15th annual Plan Sponsor Attitudes Study, highlighting how evolving advisor expertise is meeting sponsors’ expanding needs and, in turn, driving positive plan results and record satisfaction amongst plan sponsors.

By Fidelity Investments · Via Business Wire · August 19, 2024

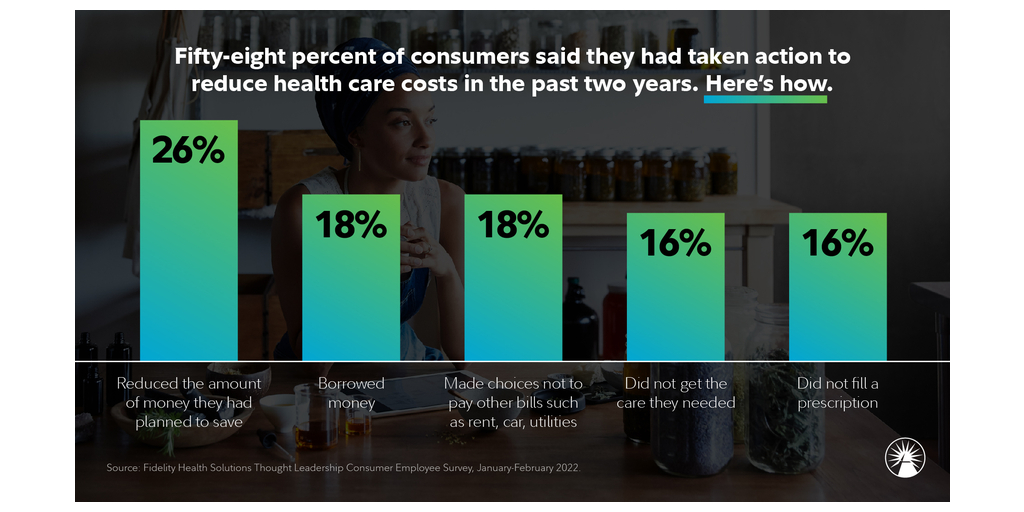

Fidelity Investments® today shared its 23rd annual Retiree Health Care Cost Estimate, revealing that a 65-year-old retiring this year can expect to spend an average of $165,000 in health care and medical expenses throughout retirement2. Fidelity’s 2024 estimate is up nearly 5% over 2023 and has more than doubled from its inaugural estimate in 2002.

By Fidelity Investments · Via Business Wire · August 8, 2024

Furthering its commitment to serving wealth management firms of all sizes, Fidelity Investments today announced two new technology offerings developed specifically for smaller and mid-sized registered investment advisors (RIAs) looking to establish and grow their business. The all-in-one technology stack and the advisory bundle featuring FMAX Essentials, a new, streamlined managed account platform, each aim to reduce two common technology barriers for smaller firms: resources and cost.

By Fidelity Investments · Via Business Wire · August 5, 2024

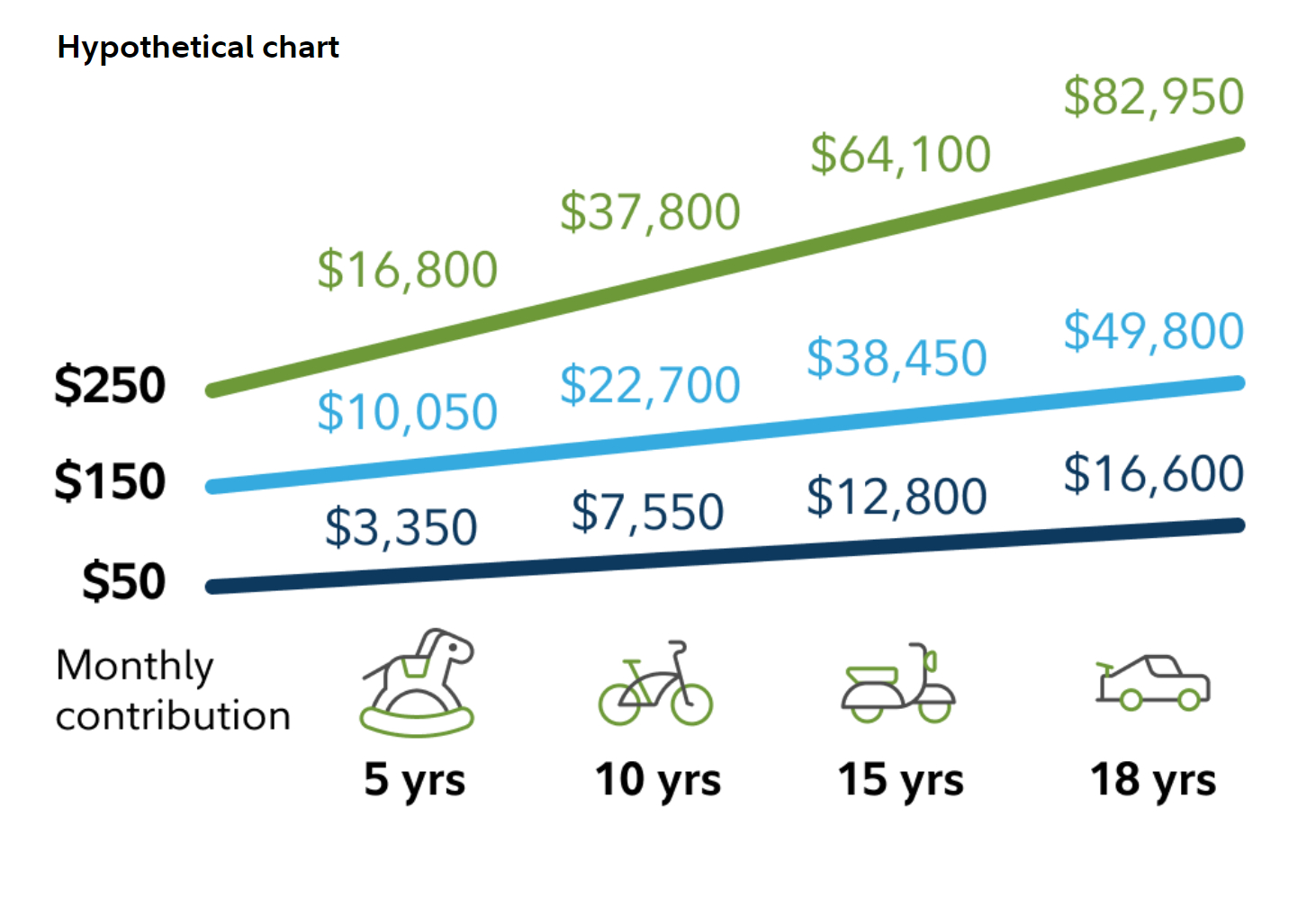

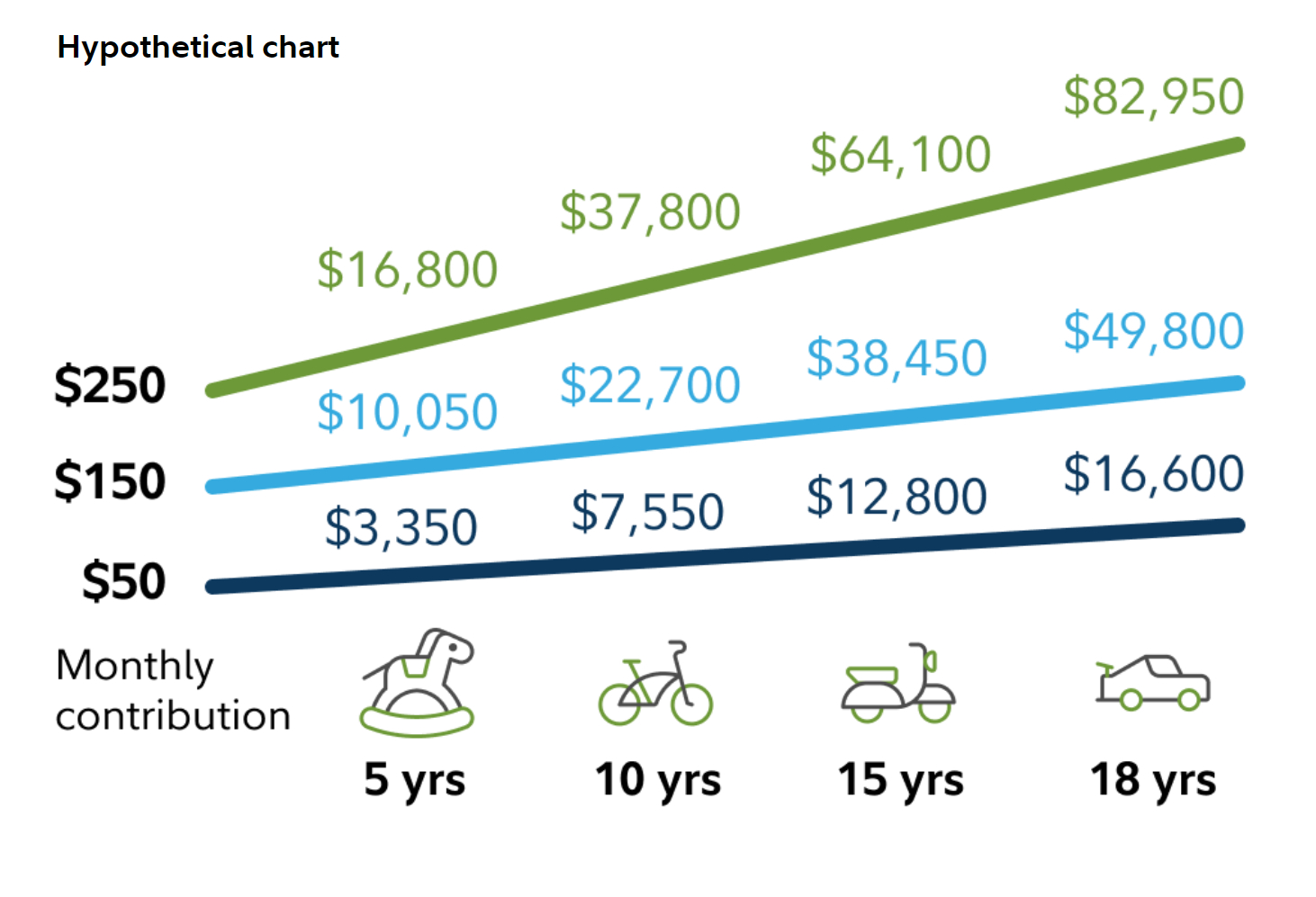

American families say they’re committed to saving for college despite rising costs and the impact of inflation as data from Fidelity Investments® 2024 College Savings Indicator Study reveals saving for college is a priority now more than ever. Nearly 3-in-4 parents (74%) have started saving in 2024 compared to 58% in 2007, when the study was first conducted, and the majority (77%) agree the value of a college education is worth the cost. Even so, 30% aren’t sure what college will cost by the time their child enrolls and more than half (55%) use “their own best guess” to estimate costs.

By Fidelity Investments · Via Business Wire · August 1, 2024

Amid the rising cost of college and inflation, Massachusetts families say saving for college is a priority now more than ever, according to data from Fidelity Investments® and MEFA’s (Massachusetts Educational Financing Authority) 2024 College Savings Indicator Study. Nearly 8-in-10 Massachusetts parents have started saving in 2024 compared to 70% in 2018, and the majority (89%) agree the value of a college education is worth the cost. Even so, 32% aren’t sure what college will cost by the time their child enrolls and 41% use “their own best guess” to estimate costs.

By Fidelity Investments · Via Business Wire · August 1, 2024

Fidelity Investments and Envestnet (NYSE: ENV) today announced the expansion of their 20+ year relationship to deliver a comprehensive wealth and advisory solution that builds on the success of Fidelity Managed Account Xchange® (FMAX), Fidelity’s wealth management platform, and the firms’ long-standing collaboration that has grown to more than $500 billion across managed accountsi.

By Fidelity Investments · Via Business Wire · June 13, 2024

According to the latest retirement data from Fidelity Investments®’ Q1 2024 retirement analysis, record-high contribution levels coupled with positive market conditions pushed average account balances to their highest levels since the fourth quarter of 2021. Long-term savers observed the greatest improvement, which is good news, especially for the more than 4.9 million workers that have been in their 401(k) plan for five years or more.

By Fidelity Investments · Via Business Wire · May 23, 2024

Saifr®, a compliance solutions provider that uses artificial intelligence (AI) to help financial services firms mitigate regulatory risks, today announced expanded AI capabilities that help firms develop compliant, marketing-optimized content more efficiently.

By Fidelity Investments · Via Business Wire · May 7, 2024

Saifr®, a compliance solutions provider that uses artificial intelligence (AI) to help financial services firms mitigate regulatory risks, won Most Innovative AI in Regulatory Compliance Initiative in A-Team Group’s Innovation Awards 2024.

By Fidelity Investments · Via Business Wire · April 30, 2024

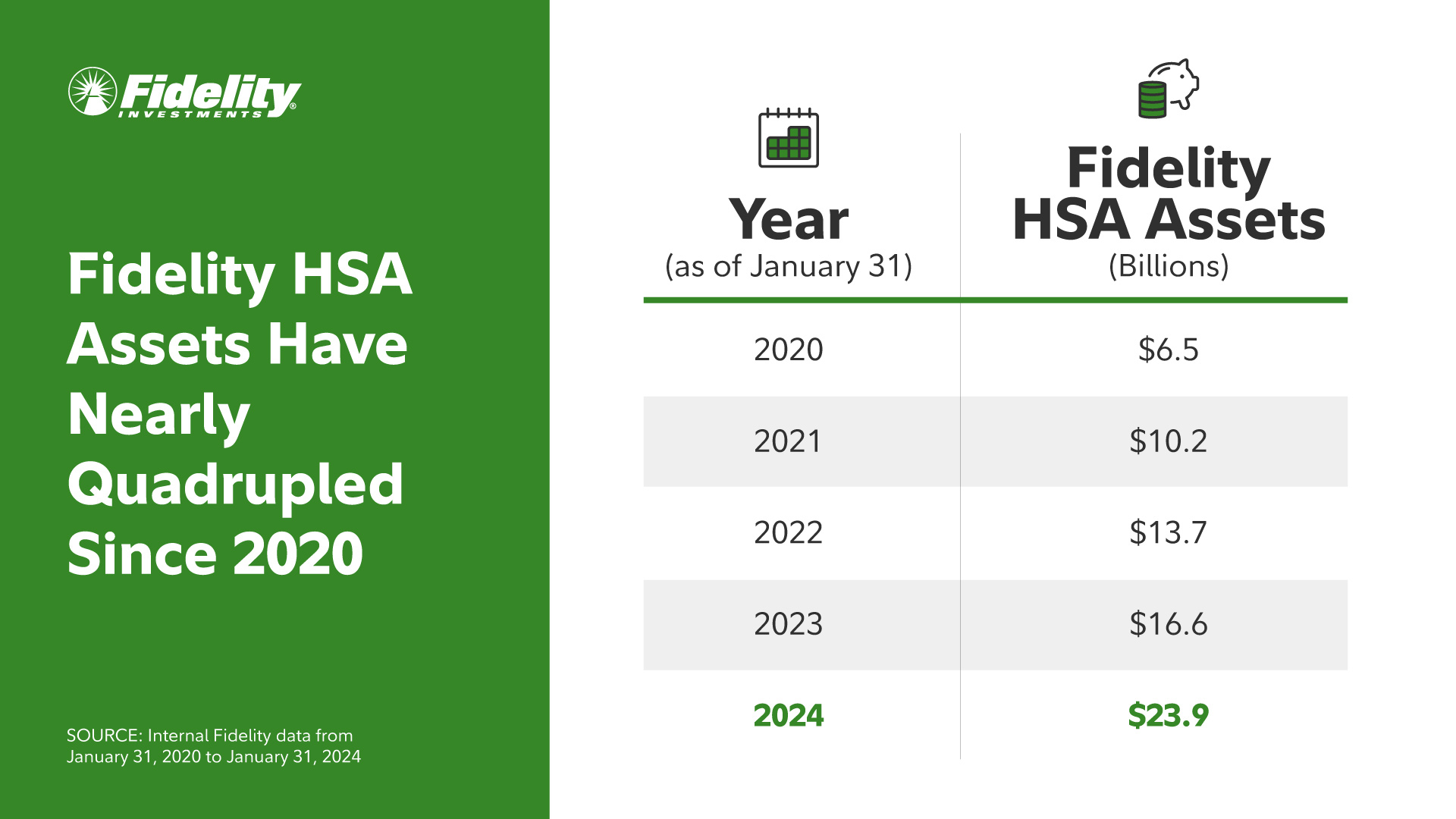

Fidelity Investments® today reported substantial growth in the number of Americans taking advantage of health savings accounts (HSAs), with a 19% increase in funded HSAs year-over-year. This comes as total Fidelity HSA assets increased 44% to a record-high $24 billion, making Fidelity the second-largest HSA provider in the country1. In addition to offering the Fidelity HSA, Fidelity Health® helps nearly 2,000 employers and millions of Americans navigate the health landscape through innovative offerings that aim to bring clarity to the ever-changing, complex health care system.

By Fidelity Investments · Via Business Wire · April 23, 2024

Fidelity Investments® today announced the launch of three actively managed liquid alternatives (alts) ETFs: Fidelity Dynamic Buffered Equity ETF (FBUF), Fidelity Hedged Equity ETF (FHEQ), and Fidelity Yield Enhanced Equity ETF (FYEE). The options-based ETFs are listed on CBOE and available commission-free for individual investors and financial advisors through Fidelity’s online brokerage platforms today, adding to Fidelity’s $14 billion alts lineup.

By Fidelity Investments · Via Business Wire · April 11, 2024

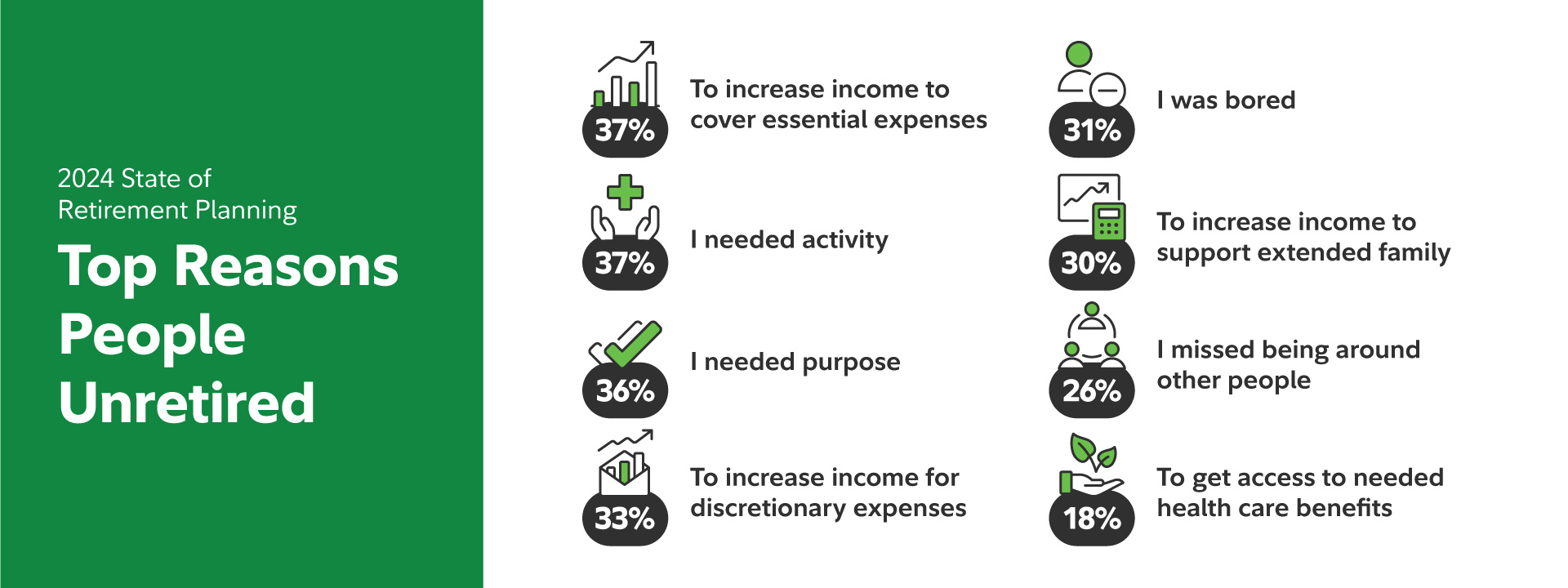

Several years since the pandemic began, its societal and economic impact is still felt throughout the country, as many Americans now opt for a non-traditional approach to retirement. According to the latest Fidelity Investments® State of Retirement Planning study, which examines how people are viewing and planning for retirement, 2-in-3 (66%) respondents say the pandemic made them more intentional about focusing on their personal passions and dreams in retirement, with Millennials leading the charge at 73%.

By Fidelity Investments · Via Business Wire · March 12, 2024

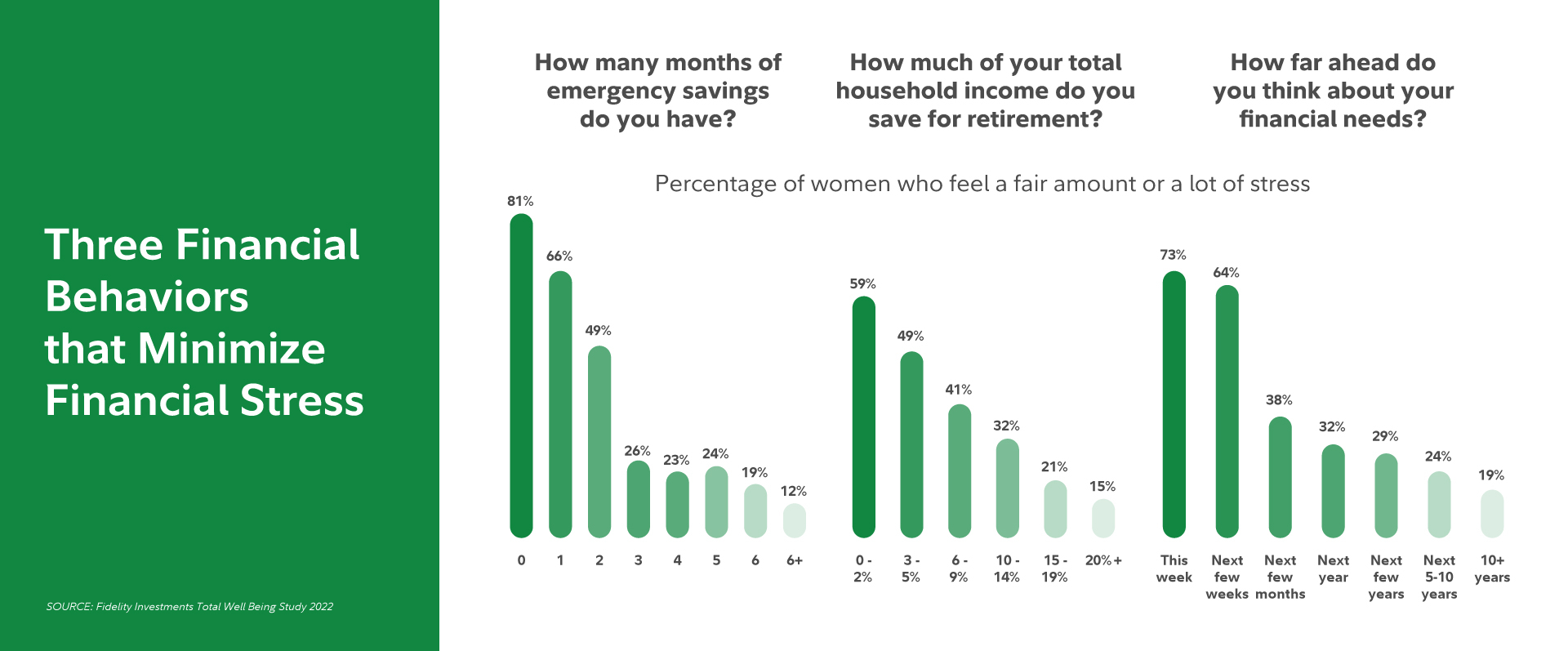

With financial stress a reality for more than 9-in-10 women, new research from Fidelity Investments® reveals the financial steps women can take to de-stress and increase their financial confidence. Fidelity’s 2024 Women’s History Month Study, released annually at the start of Women’s History Month, finds stress levels remain consistently high among women no matter their total household income. Taking financial action, however, makes the biggest difference in decreasing stress, with women who made financial moves in the past 6 months indicating less stress than women who haven’t. Fidelity’s research also identifies three financial behaviors to help women of all ages and income levels reduce financial stress: saving for emergencies, saving for retirement and thinking ahead.

By Fidelity Investments · Via Business Wire · March 1, 2024

According to the latest retirement data from Fidelity Investments®, even with other ongoing financial struggles, retirement savers ended the year on a positive note with improved market conditions and consistent contributions helping boost average account balances to their highest level in nearly two years. Additionally, more than a third (37%) of workers increased their retirement savings contribution rate in 2023.

By Fidelity Investments · Via Business Wire · February 27, 2024

Saifr®, a compliance solutions provider created by Fidelity Investments®, today announced the acquisition of capabilities from Giant Oak. Saifr will acquire GOST, an artificial intelligence platform for adverse media screening and monitoring that serves financial institutions. Terms of the acquisition were not disclosed.

By Fidelity Investments · Via Business Wire · February 20, 2024

Fidelity Investments® today announced the upcoming launch of two new active ETFs and updates to three existing equity ETFs, available commission-free for individual investors and financial advisors through Fidelity’s online brokerage platforms on February 26, 2024.

By Fidelity Investments · Via Business Wire · February 12, 2024

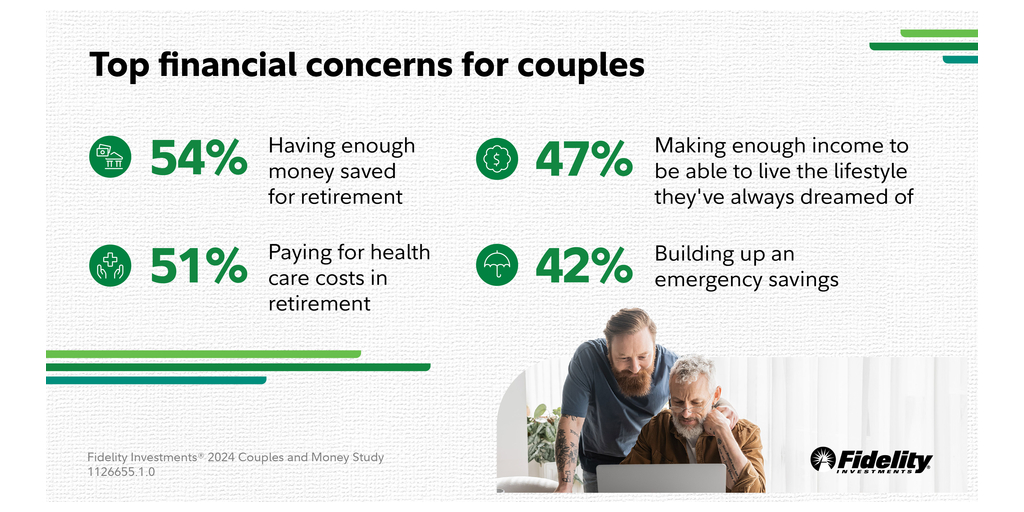

The spotlight on love and relationships becomes very bright every February as Americans celebrate their commitment to one another and yet, Fidelity Investments® 2024 Couples and Money study reveals couples may not be as aligned as they think, with 45% of partners admitting they argue about money at least occasionally. While more than 1-in-4 couples identify money as their greatest relationship challenge, the good news is more than half of respondents feel very good or excellent about their financial health and 27% of boomers say building a financial plan together is their love language.

By Fidelity Investments · Via Business Wire · February 1, 2024

Fidelity Investments®, the nation’s retirement leader1, announces the broad availability of Guaranteed Income Direct, a new solution allowing employees to convert all or a portion of their retirement savings – from a 401(k), 403(b) or 457(b) – into an immediate income annuity to provide consistent, pension-like payments2 throughout retirement.

By Fidelity Investments · Via Business Wire · January 25, 2024

Saifr®, a compliance solutions provider that uses artificial intelligence (AI) to detect and help correct regulatory compliance and brand risks in financial services marketing content, will be featured in an episode of Advancements with Ted Danson, focusing on how AI can improve compliance processes.

By Fidelity Investments · Via Business Wire · January 16, 2024

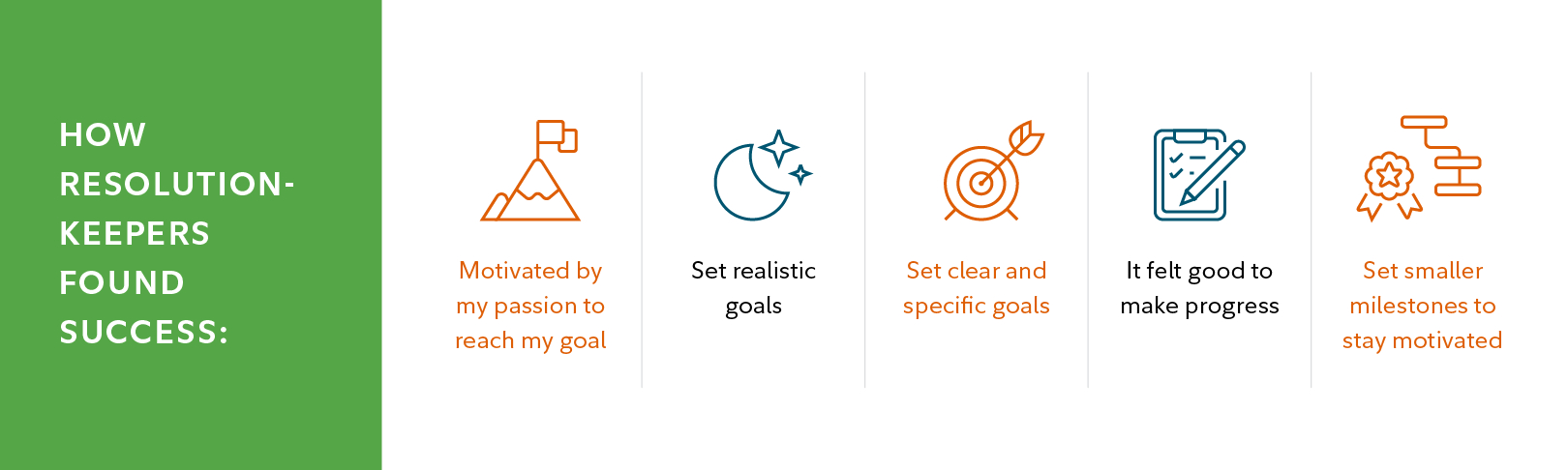

According to Fidelity Investments®’ 2024 New Year’s Financial Resolutions study, Americans are poised for a resolution revolution – improving their financial lives by conquering their financial goals and gearing up for a year of ‘new chapters’ and ‘living practically.’ The study, which has been conducted for the past 15 years, shows two-thirds of Americans are considering a financial resolution for the year ahead, perhaps motivated by their current situation and concerns about the future.

By Fidelity Investments · Via Business Wire · December 7, 2023

Saifr®, a compliance solutions provider that uses artificial intelligence (AI) to help detect and correct regulatory compliance and brand risks in financial services marketing content, has been named to the 2024 RegTech 100 list of the world’s most innovative RegTech companies.

By Fidelity Investments · Via Business Wire · December 6, 2023

According to the latest data from Fidelity Investments®’ Q3 2023 retirement analysis, account balances have decreased slightly since last quarter, while withdrawals and loans are inching up, showing the impact economic events such as inflation and market volatility can have on Americans‘ wallets—and ultimately their retirement savings. Encouragingly, retirement savings behaviors remain strong and many employers are coming together to find ways to tackle the problem of unexpected expenses, which can derail budgets, short-term financial goals, and even saving for retirement.

By Fidelity Investments · Via Business Wire · November 20, 2023

Saifr®, a regulatory technology (RegTech) business that helps financial services professionals mitigate brand, regulatory, and reputational risk in public communications, won a RegTech Insight award for Best AI Solution for Regulatory Compliance.

By Fidelity Investments · Via Business Wire · November 17, 2023

Fidelity Investments® today announced the launch of six new active equity ETFs, which will be available commission-free for individual investors and financial advisors through Fidelity’s online brokerage platforms on November 20, 2023. The new suite includes:

By Fidelity Investments · Via Business Wire · November 13, 2023

Saifr®, an AI-focused regulatory technology (RegTech) business that assists financial services clients in the review and approval of public communications to help mitigate brand, regulatory, and reputational risk, will be an exhibitor, sponsor, and speaker at RegTech Summit New York on November 16, 2023.

By Fidelity Investments · Via Business Wire · November 1, 2023

Saifr®, a regulatory technology (RegTech) business that helps financial services professionals mitigate brand, regulatory, and reputational risk in public communications, will be an exhibitor, sponsor, and speaker at The Summit for Asset Management (TSAM) New York on October 31, 2023.

By Fidelity Investments · Via Business Wire · October 18, 2023

New research from Fidelity Investments® shows that about 1 in 6 advisors[i] have proactively switched firms in the past five years, with independent business models as the top destination. In fact, 94% of advisors are happy with their decision to move, with 85% noting an increased control over their future. Despite this popularity, only half of advisors consider themselves knowledgeable about firm types (54%) and independent models (49%), and only 25% know the various intermediaries (e.g., 3rd party recruiters, consultants, clearing or custody providers) that can help with finding a firm. Advisors may prefer independence and the benefits associated, but the lack of knowledge and fear of the unknown may be preventing them from taking that leap.

By Fidelity Investments · Via Business Wire · October 17, 2023

With annual enrollment season in full swing, many Americans are facing the pressure of selecting health benefits for themselves and their families. Encouragingly, 8-in-10 Americans rank health benefits among their top priorities for workplace benefits, according to a new Fidelity Health℠ study. Of concern, however, is the more than half (56%) who admit the thought of annual enrollment makes them feel “overwhelmed” or “discouraged” and, according to the clinicians that care for them1, creating a care plan that makes the best use of the benefits selected can often be challenging.

By Fidelity Investments · Via Business Wire · October 16, 2023

How urgent is the emergency savings crisis in America? According to recent research by Fidelity Investments®, a lack of emergency savings has become a major source of stress for Americans, with 8-in-10 Fidelity participants saying inflation and the cost-of-living are causing them stress, and half saying it is causing them to be distracted at work.i Small wonder, then, that emergency savings ranks as the number one savings goal among participants after retirement.ii While Americans have struggled to maintain emergency savings for years, economic and world events like inflation, market volatility, and the pandemic have exacerbated the issue. Today, the majority of U.S. adults (57%) say they are currently unable to afford a $1,000 emergency expense.

By Fidelity Investments · Via Business Wire · October 12, 2023

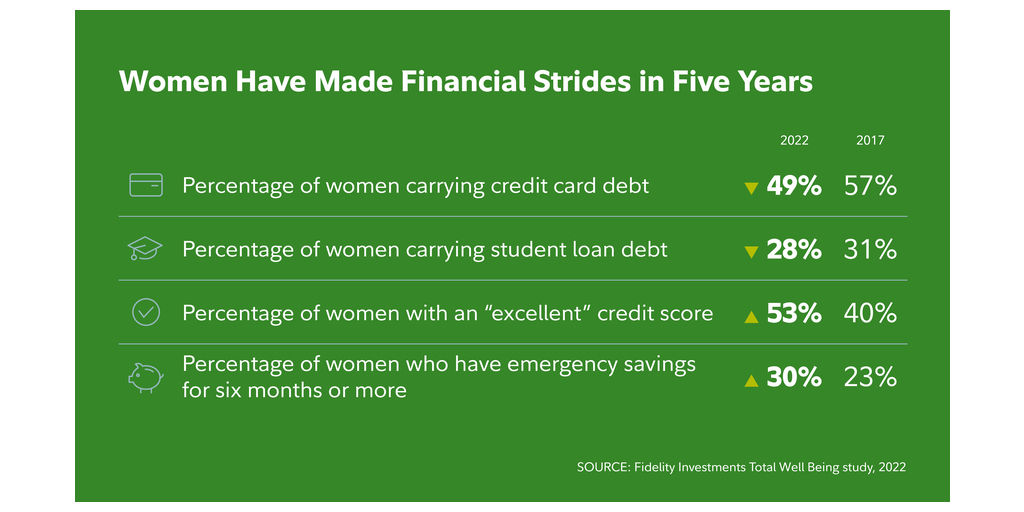

Coming on the heels of a summer where women across the country showcased their buying power, new research from Fidelity Investments® reveals women are leaning into their financial strengths and making smart money moves to gain ground with their finances. Fidelity added 48% more new women customers in 2023 compared to 2019. Younger women lead the way, as the firm added a formidable 99% more new Gen Z women customers and 48% more new Millennial women in the same period.1

By Fidelity Investments · Via Business Wire · October 9, 2023

Saifr®, an AI-focused regulatory technology (RegTech) business that assists financial services clients in the review and approval of public communications to help mitigate brand, regulatory, and reputational risk, will be a speaker, exhibitor, and sponsor at the National Society of Compliance Professionals (NSCP) National Conference in Dallas, TX on October 16-18, 2023.

By Fidelity Investments · Via Business Wire · October 3, 2023

Saifr®, a regulatory technology (RegTech) business that helps financial services professionals mitigate brand, regulatory, and reputational risk in public communications, will be a panel participant at RegTech Summit in London on October 5, 2023.

By Fidelity Investments · Via Business Wire · September 19, 2023

The majority of teens (75%) age 13-17 say investing is important to them, but fewer than 1 in 4 (23%) have actually started, according to Fidelity’s 2023 Teens & Money Study. The report reveals more than half (51%) of teens feel eager or well-informed when it comes to financial topics like saving, spending, or investing. Despite that enthusiasm, nearly a third (31%) of teens who haven't started investing but plan to in the future believe they're too young to start.

By Fidelity Investments · Via Business Wire · September 6, 2023

Saifr®, an AI-focused regulatory technology (RegTech) business that assists financial services clients in the review and approval of public communications to help mitigate brand, regulatory, and reputational risk, will be both a gold-level sponsor and a panelist at FinTech Global’s Global RegTech Summit USA 2023 in New York City on September 28th.

By Fidelity Investments · Via Business Wire · September 5, 2023

Fidelity Investments® announced today findings from its Plan Sponsor Attitudes Study, which characterizes 2023 as a year of opportunity for the retirement plan industry. Most notably, rising plan complexities – ranging from investment menu changes to evolving plan designs – are creating avenues for greater advisor impact.

By Fidelity Investments · Via Business Wire · August 28, 2023

Some good news for retirement savers: for the third straight quarter, Fidelity Investments’ Q2 2023 retirement analysis reveals retirement account balances increased, owing in large part to steady employer and employee contributions and positive market conditions. As one of the country’s leading workplace benefits providers1 and America’s No. 1 IRA provider2, the company’s quarterly analysis of savings behaviors and account balances for more than 45 million IRA, 401(k), and 403(b) retirement accounts reported an increase in 401(k) balances by double digits over Q2 2022—including a 66% increase among Gen Z workers. Young investors3 also saw a 34.4% year-over-year increase in IRA accounts.

By Fidelity Investments · Via Business Wire · August 17, 2023

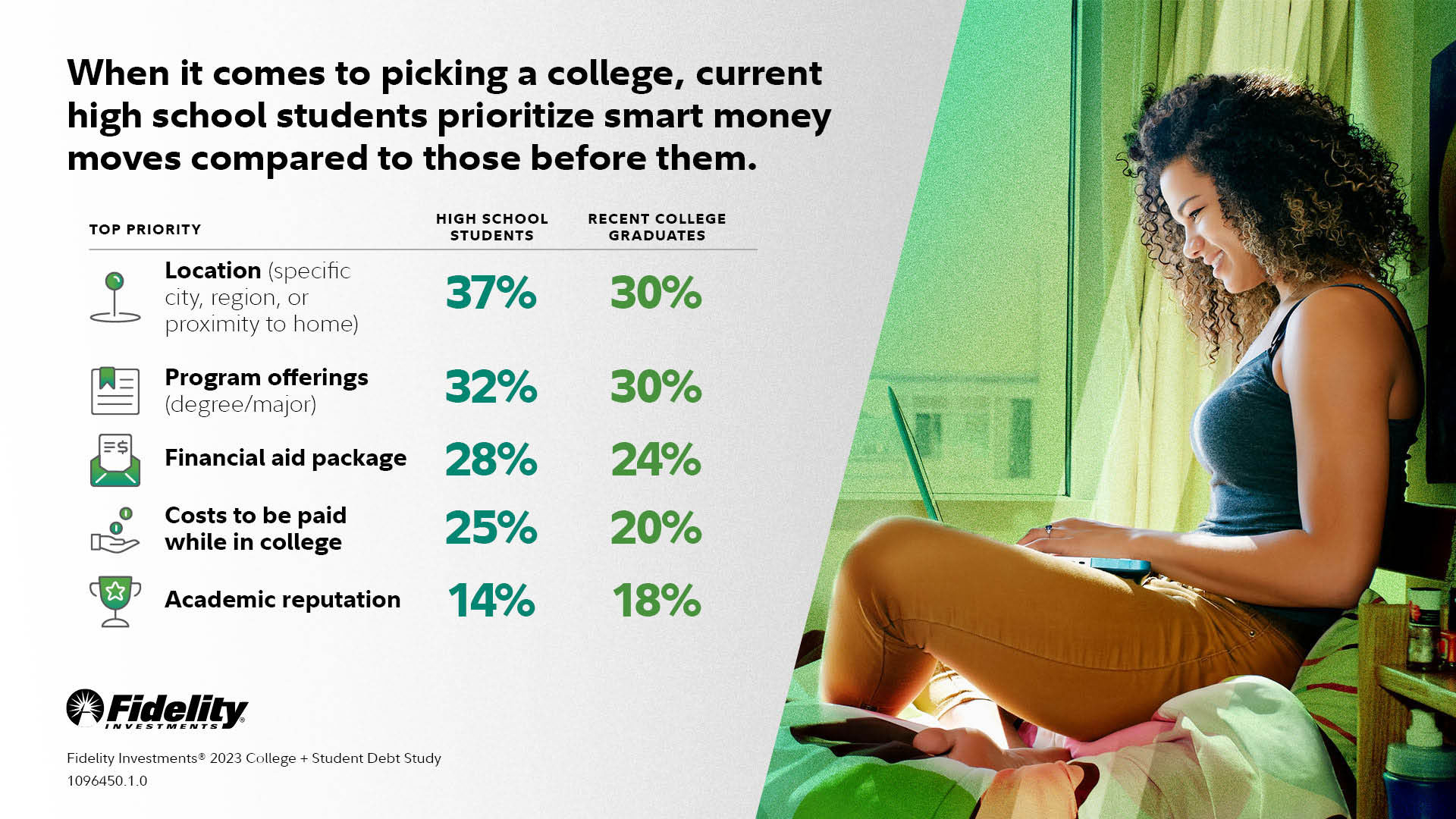

New data from Fidelity Investments’® 2023 College Savings and Student Debt Study reveals the next wave of college students are breaking the mold when it comes to their college choices and are prioritizing the path leading to maximum career impact and the brightest financial future. The study, which analyzes the attitudes, behaviors, and expectations about higher education amongst current high school students and recent college graduates, found 7-in-10 recent college graduates claim they would reconsider what they studied in college to secure a better return on their investment.

By Fidelity Investments · Via Business Wire · August 7, 2023

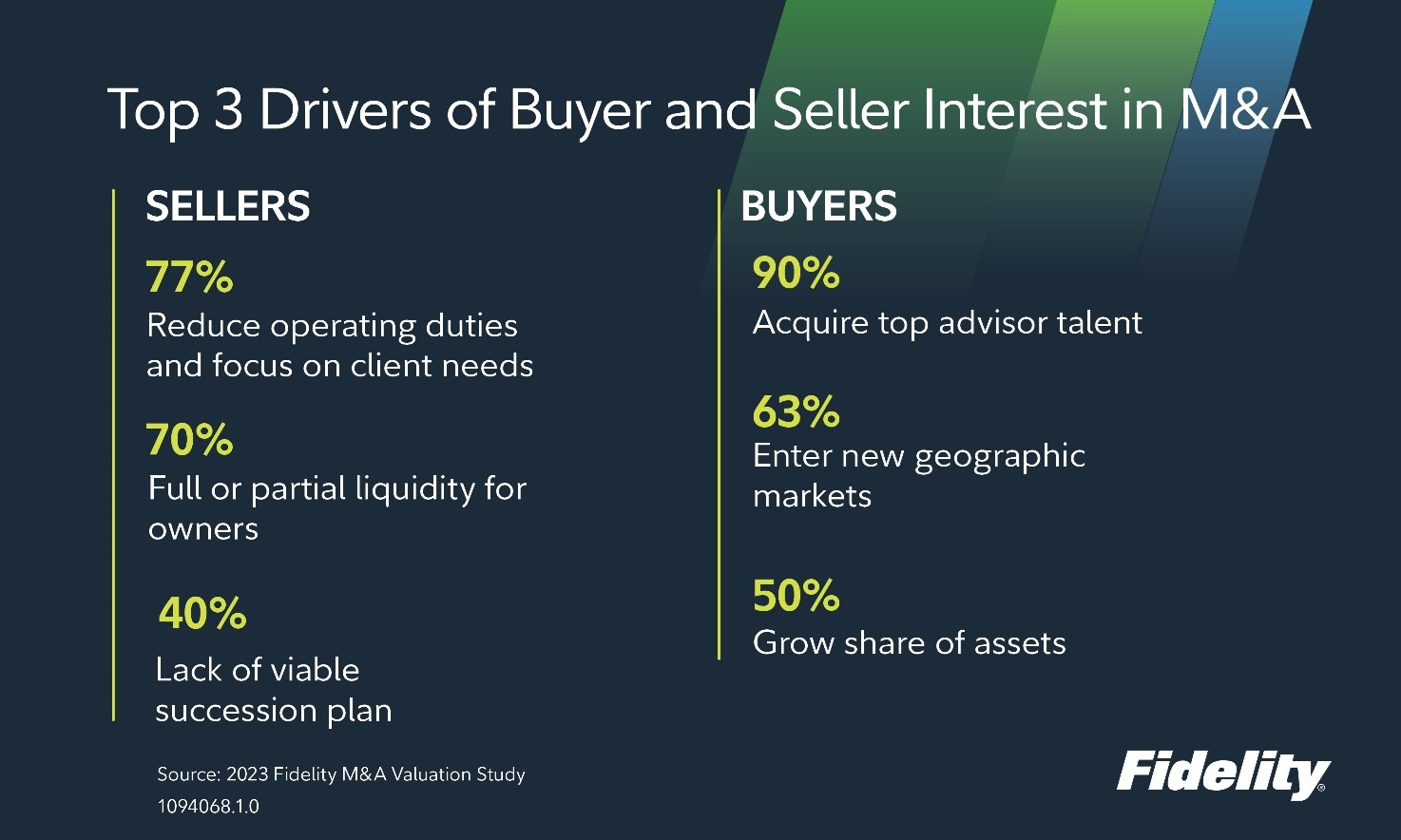

Fidelity Investments® 2023 M&A Valuation & Deal Structure Survey revealed a 237% increase in registered investment advisor (RIA) M&A deals, with 492 reported transactions, up from 146 for the 2017- 2019 study period. The survey, which examines trends and buyer perceptions related to RIA M&A transactions, also uncovered that buyers reported larger deals vs. the previous study period, with the median AUM of acquired firms increasing from $250M to $400M.

By Fidelity Investments · Via Business Wire · June 27, 2023

Saifr®, an AI-focused regulatory technology (RegTech) and financial technology (FinTech) business that assists financial services clients in the review and approval of public communications to help mitigate brand, regulatory, and reputational risk, today announced it has been selected as one of the 100 most innovative AI FinTech companies in the financial industry by FinTech Global.

By Fidelity Investments · Via Business Wire · June 21, 2023

Fidelity Investments® today shared its 22nd annual Retiree Health Care Cost Estimate, revealing that a 65-year-old retiring this year can expect to spend an average of $157,500 in health care and medical expenses throughout retirement1. Fidelity’s 2023 estimate remains the same as last year1, due to expected limits to retiree out of pocket costs for prescription drugs starting in 2025. This is the first time in nearly a decade that the anticipated health care costs for retirees have stayed flat year-over-year. The estimate assumes retirees are enrolled in traditional Medicare, which between Medicare Part A and Part B covers expenses such as hospital stays, doctor visits and services, physical therapy, lab tests and more, and in Medicare Part D, which covers prescription drugs.

By Fidelity Investments · Via Business Wire · June 21, 2023

Fidelity Investments® announced the launch of six new disruptive ETFs. Fidelity® Disruptive Automation ETF (FBOT), Fidelity® Disruptive Communications ETF (FDCF), Fidelity® Disruptive Finance ETF (FDFF), Fidelity® Disruptive Medicine ETF (FMED), and Fidelity® Disruptive Technology ETF (FDTX) are trading on Nasdaq and available immediately commission-free for individual investors and financial advisors through Fidelity’s online brokerage platforms. Fidelity® Disruptors ETF (FDIF), a fund of funds which will invest in a combination of these five Fidelity ETFs, will be available on June 20, 2023.

By Fidelity Investments · Via Business Wire · June 12, 2023

According to Fidelity Investments’ recent Retirement Savings Assessment, the challenging economic environment, pandemic and market volatility of the last several years has left many Americans households saving less and investing more conservatively. However, with U.S. employers adding one million1 jobs to the economy in the first quarter of 2023, Americans appear to be refocusing on investing in their future, according to Fidelity’s latest retirement trends analysis.

By Fidelity Investments · Via Business Wire · May 25, 2023

Fidelity Investments® announced the launch of Fidelity Multi-Strategy Credit Fund, expanding its alternative investments (alts) product lineup which now includes 35 funds and $9.8B in assets under management as of March 31, 2023. As a closed-end interval fund, Fidelity Multi-Strategy Credit Fund will not provide for daily redemptions but will conduct quarterly repurchase offers between 5% and 25% of the fund's outstanding shares at net asset value. The fund will be available on May 25, 2023, for financial advisors on https://institutional.fidelity.com/app/item/RD_9902264.html.

By Fidelity Investments · Via Business Wire · May 22, 2023

Employers of all sizes view well-being as a key part of their workforce strategy, more so now than in the past, according to the 14th Annual Employer-Sponsored Health & Well-Being Survey, fielded by Fidelity Investments and Business Group on Health.

By Fidelity Investments · Via Business Wire · May 17, 2023

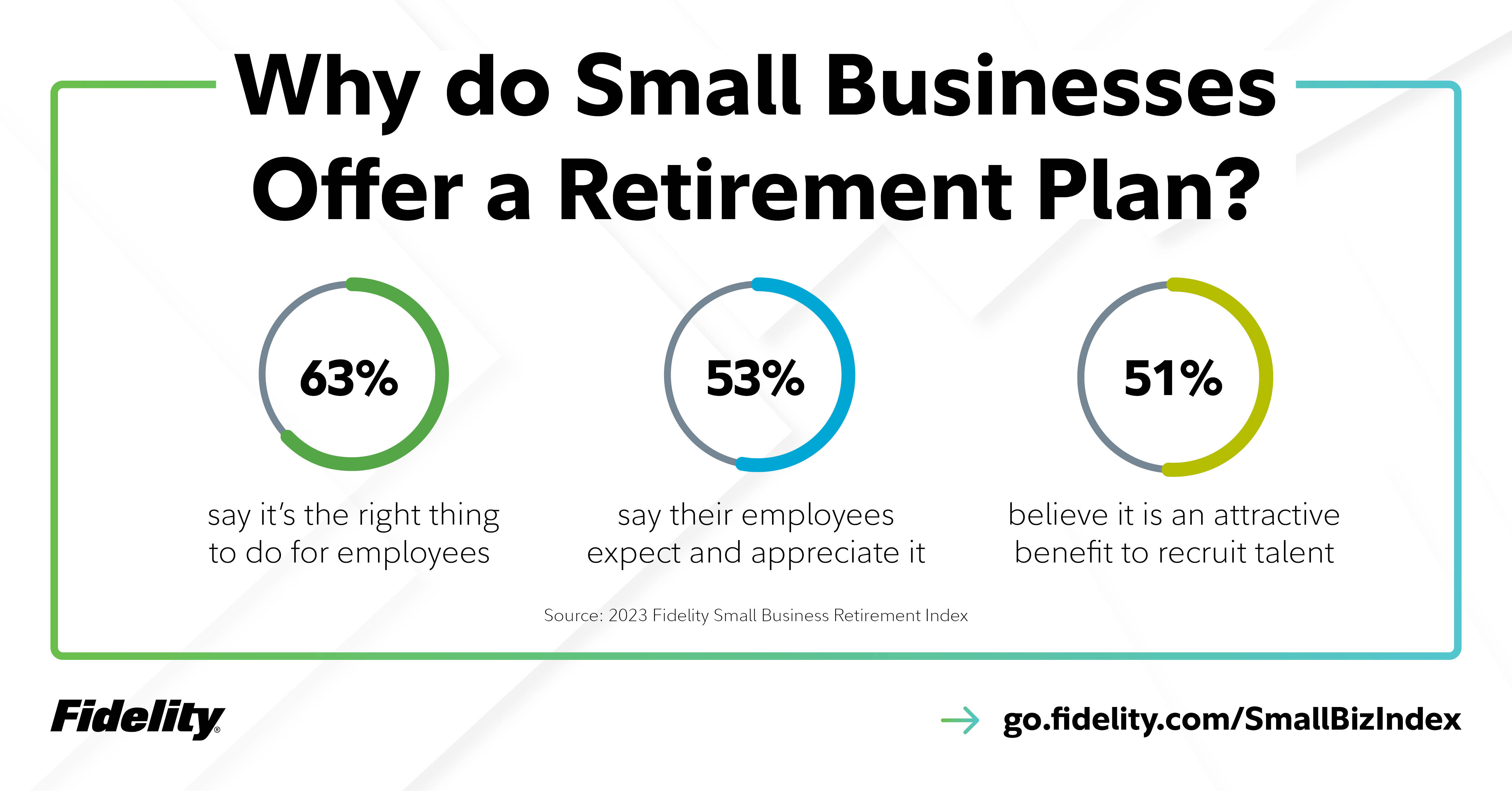

Faced with high inflation and market volatility, small business owners today are tasked with recruiting top talent in a tight labor market where employees are expecting more from their employers than ever before. According to Fidelity Investment’s 2023 Small Business Retirement Index, there is an opportunity for small employers to offer competitive retirement benefits with only one-third (34%) of small employers currently offering retirement savings to employees today.

By Fidelity Investments · Via Business Wire · May 11, 2023

As the next step in its ongoing effort to provide relevant financial education, Fidelity Investments® today announces two new digital experiences designed to help the next generation of investors grow their financial know-how and build healthier money habits:

By Fidelity Investments · Via Business Wire · April 27, 2023

Fidelity Investments® today reported significant growth in its health business, including a 27% increase in funded health savings accounts (HSAs) to 2.8 million, and more than $16 billion in total HSA assets, up from nearly $14 billion last year. This represents just one aspect of the Fidelity Health business, which works to help more than 1,600 employers and millions of Americans with health decisions so they can navigate the journey with ease. From HSAs to reimbursement accounts (like FSAs), health and welfare administrative services, voluntary benefits, and Medicare, Fidelity Health aims to drive confidence among plan sponsors and consumers.

By Fidelity Investments · Via Business Wire · April 12, 2023

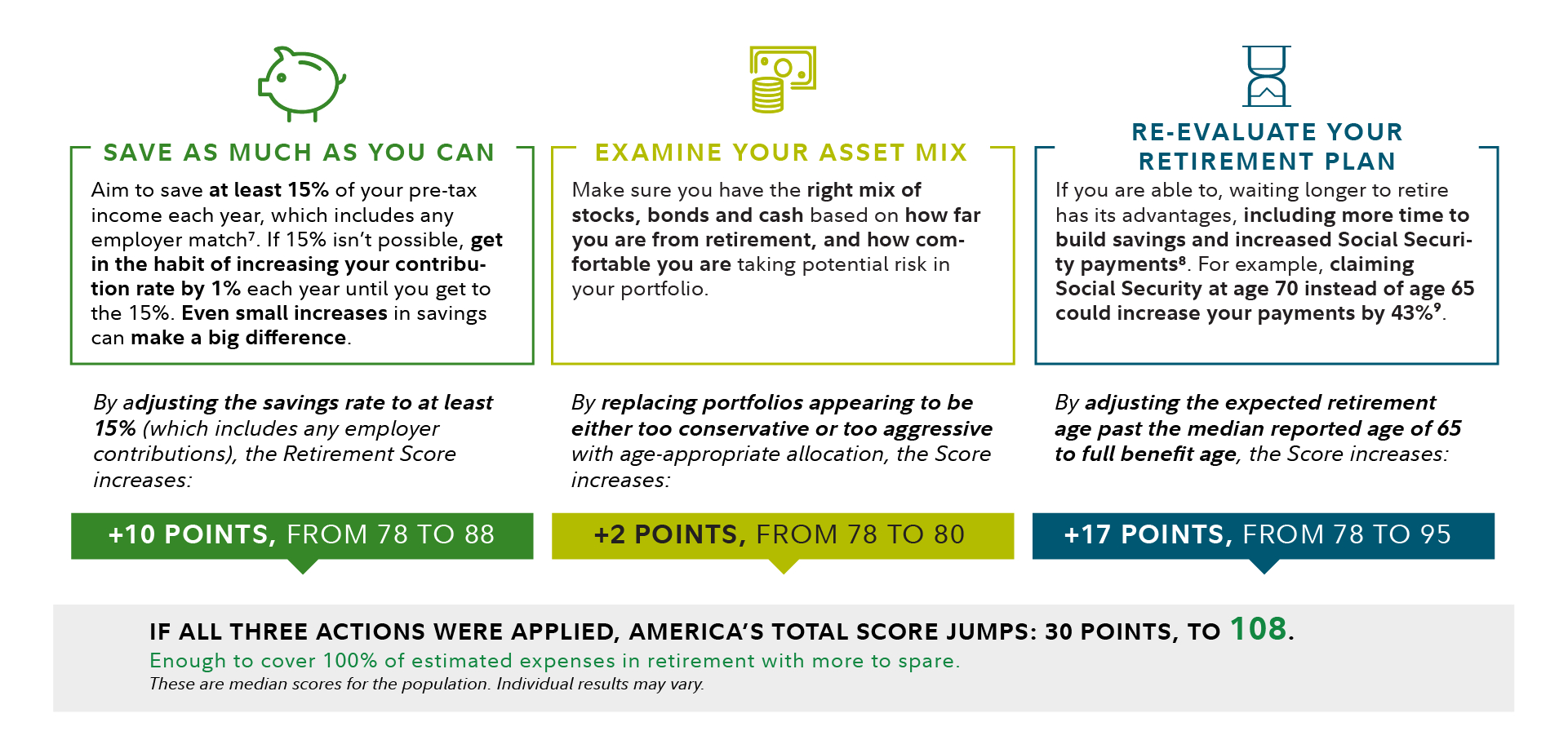

Fidelity Investments® today released its latest Retirement Savings Assessment, revealing a decline in retirement readiness as American savers continue to navigate market volatility and disruption. America’s Retirement Score1 has moved back into the yellow to 78, a five-point decline from an all-time high of 83 reported in 2020, with American savers estimated to have only 78% of the income needed to cover expenses during retirement. In the midst of continuing uncertainty, Fidelity reveals actions that can be taken to help people improve their financial wellness.

By Fidelity Investments · Via Business Wire · March 21, 2023

In recognition of Women’s History Month, Fidelity Investments® today released new research showing women are taking action with their finances despite external stressors. According to the research, “stress” (46%) is the no. 1 word women use to describe their emotions surrounding money, far more than men (34%), whose top term is “hopeful” (42%). Encouragingly, many women are tackling stress head on by taking control of their finances — nearly 90% of women say they have made money moves recently or are planning to within the next six months. That trend is evident among Fidelity customers, with the number of retail accounts opened annually by women growing 65% between 2019 and 2022 compared to a 60% growth in retail accounts opened annually by men.

By Fidelity Investments · Via Business Wire · March 1, 2023

Times are challenging everywhere: according to recent Fidelity Investments® research, nearly three in four (74%)1 workers around the world identify the impact of the cost of living and rising inflation as the No. 1 cause of stress in their lives. Yet at the same time, nearly everyone (95%)2 identifies being financially comfortable in retirement as a long-term goal. Fortunately, at least in America, despite these concerns around economic uncertainty, retirement savers have their eye on the prize and are continuing to invest in their future, according to Fidelity’s latest retirement trends analysis.

By Fidelity Investments · Via Business Wire · February 23, 2023

Contrary to industry stereotypes, young investors can be attractive clients for wealth management firms. New research from Fidelity Investments® shows that 63% of Gen YZiii investors believe working with an advisor is key to achieving financial success and 60% feel a heightened need to engage a financial advisor this year due to economic uncertainty. With 57% of existing client assets expected to pass to the next generation by 2045, this presents a significant growth opportunity for financial advisors – and potential looming business vulnerability for those who do not prioritize engaging with this group, as firms with a younger client base are growing nearly 10 times faster than their peersiv.

By Fidelity Investments · Via Business Wire · January 24, 2023

As part of its long-standing commitment to financial education and inclusion, Fidelity Investments today announced a $250 million commitment that will provide access to education and support for up to 50,000 Black, Latinx, and historically underserved students through the launch of its Invest in My Education (ME)SM program. The social impact initiative is the latest step in Fidelity’s ongoing commitment to historically underserved communities. In tandem, the firm is continuing to take deliberate steps to strengthen its commitment to diversity and inclusion at every level within its own organization and maintaining its focus on delivering relevant products and services to its increasingly diverse customers.

By Fidelity Investments · Via Business Wire · January 17, 2023

Fidelity Investments® today announced it is furthering its commitment to the private market with the acquisition of Shoobx®, a leading provider of automated equity management operations and financing software for private companies at all growth stages, up to and including an initial public offering (IPO). Financial terms of the acquisition are not being disclosed.

By Fidelity Investments · Via Business Wire · January 10, 2023

Fidelity Investments® today announced the expansion of its rapidly growing alternative investments (alts) product lineup with the launch of the Fidelity Private Credit Fund, a business development company (BDC). The new BDC is available today for individual investors* and distributed through financial advisors and intermediaries in most states**, and we continue to look for opportunities to expand our offering.

By Fidelity Investments · Via Business Wire · January 9, 2023

As the country prepares to ring in the new year, Americans are feeling less-than-optimistic when it comes to the year ahead, according to Fidelity Investments®’ 2023 New Year’s Financial Resolutions Study. In a dramatic shift from last year’s results, more than a third of respondents say they’re in a worse financial situation than last year, likely due to inflation concerns, and only 65% believe they’ll be better off in the coming year (vs. 72% in the last study). The good news? About half say they’re ready to “live sensibly” or “plan ahead,” which means making practical resolutions and staying focused on balancing short-term and long-term financial goals. And, the next generation1 continues to serve as a beacon of hope, with more than three-quarters expressing confidence they will be better off financially in 2023.

By Fidelity Investments · Via Business Wire · December 8, 2022