Articles from Citi

Today, Citi Wealth released The Short and Long: Q1 Macro Investment View, a new, quarterly report designed to offer global, data-driven guidance to help investors navigate increasingly complex markets with confidence and clarity.

By Citi · Via Business Wire · January 7, 2026

Citi Global Wealth at Work and Hildebrandt Consulting today released the 2026 Citi Hildebrandt Client Advisory. The Client Advisory covers the broad landscape for the legal industry, including how law firms are responding to market challenges and opportunities for growth in the year ahead.

By Citi · Via Business Wire · December 11, 2025

Citi announced today that it will begin the process of transitioning the role of Chief Financial Officer from Mark Mason to Gonzalo Luchetti.

By Citi · Via Business Wire · November 20, 2025

Citi has earned the #1 ranking in the J.D. Power 2025 U.S. Mortgage Origination Satisfaction Study, a prestigious achievement that highlights our unwavering commitment to providing an exceptional client experience throughout every stage of the mortgage process.

By Citi · Via Business Wire · November 12, 2025

Citi today announced the expansion of Citi Token Services (CTS) with the integration of Euro transactions and an extended footprint to Dublin, Ireland. This development broadens the platform’s reach across multiple currencies and markets aiming to enhance 24/7, real-time, cross-border liquidity and payment capabilities for corporate and institutional clients globally. The solution is currently live in key financial hubs including the US, UK, Singapore, and Hong Kong, with plans for further market expansion.1

By Citi · Via Business Wire · November 7, 2025

Today, Citi and Coinbase announced their intention to collaborate on digital asset payment capabilities for Citi’s institutional clients and explore additional global clients in the future, further solidifying both companies’ market leadership in payment solutions. The initial phase of their collaboration focuses on fiat pay-ins/pay-outs, supporting Coinbase's on/off-ramps1—the bridge between traditional fiat and digital asset ecosystems—along with payments orchestration. Additional details on specific initiatives, including the exploration of creating alternative fiat to onchain stablecoin payout methods, will be shared in the coming months.2 This collaboration aims to make these transitions smoother and accessible 24/7 for Citi’s clients.

By Citi · Via Business Wire · October 27, 2025

Citi today announced that its Board of Directors has elected Jane Fraser, Citi’s Chief Executive Officer, as Chair of the Board. John Dugan, who served as Chair of Citi’s Board since 2019, will become Lead Independent Director.

By Citi · Via Business Wire · October 22, 2025

American Airlines, Citi and Mastercard today unveiled the Citi® / AAdvantage® Globe™ Mastercard®—a new entry in the travel credit card market that reimagines what mid-tier means with access to premium benefits. Designed to maximize the travel journey, the Citi® / AAdvantage® Globe™ Mastercard® offers four Admirals Club® Globe™ passes, each valid for 24 hours; more opportunities to earn AAdvantage® miles and Loyalty Points toward status, including a first-of-its-kind Flight Streak™ bonus; and over $750 in valuable travel and lifestyle benefits—all for an annual fee of $3501.

By Citi · Via Business Wire · October 19, 2025

Citi Issuer Services, acting through Citibank, N.A., has been appointed by POMDOCTOR LIMITED (POM), a Chinese online medical services platform, as Depositary Bank for its American Depositary Receipt (ADR) program.

By Citi · Via Business Wire · October 17, 2025

Today, Citi announced its plans for an industry-first integration of Citi® Token Services, a blockchain-based platform, with its 24/7 USD Clearing solution to create a 24/7, multibank cross-border instant payments capability for Citi’s institutional clients in the UK and US. This pioneering move expands Citi’s growing real-time, 24/7 network and empowers corporate and financial institution clients to initiate payment transactions and manage liquidity near instantaneously across Citi and non-Citi accounts globally.

By Citi · Via Business Wire · September 29, 2025

Today, Citi and Dandelion, a Euronet Worldwide, Inc. (NASDAQ: EEFT) company, announced a collaboration to enhance cross-border payments, powered by the integration of Citi’s cross-border payments solution WorldLink® Payment Services and Dandelion’s expansive digital wallet network. The collaboration empowers Citi’s institutional clients to deliver near-instant, full-value payments into digital wallets across the globe, with near 24/7 availability. The capability will initially extend to the Philippines, Indonesia, Bangladesh and Colombia, with plans for further expansion.

By Citi · Via Business Wire · September 25, 2025

Citi Issuer Services, acting through Citibank, N.A., has been appointed by BRBI BR Partners S.A. (“BRBI”) as depositary bank for its sponsored Level 2 American Depositary Receipt (“ADR”) program.

By Citi · Via Business Wire · September 24, 2025

Citi Investor Services has enabled Financial Information eXchange (FIX) API connectivity between its proprietary Advanced Citi ETF System (ACES) platform with Bloomberg’s BSKT service to further automate the ETF creation and redemption process for authorized participants (APs). This builds on an existing integration between Citi ACES and BSKT, which is Bloomberg’s ETF creation and redemption solution for the primary market.

By Citi · Via Business Wire · September 9, 2025

Citi Wealth today announced the selection of BlackRock to create a new portfolio offering for its clients – Citi Portfolio Solutions powered by BlackRock. This offering will combine the strategic investment advisory and planning capabilities of the leading global bank with the investment management and technology strengths of one of the world’s preeminent asset managers.

By Citi · Via Business Wire · September 4, 2025

Today, Citi announced the Citi Strata Elite℠ Card—a new premium credit card offering 12x points on Hotels, Car Rentals, and Attractions booked on the Citi Travel® platform; 6x points on Air Travel booked on Citi Travel; 6x points at Restaurants, every Friday & Saturday from 6 p.m. to 6 a.m. ET; and more travel, dining and entertainment benefits. Plus, with the Citi Strata Elite Card, cardmembers can unlock nearly $1,500 in value each year—with valuable lifestyle benefits cardmembers will want to use and even more perks for those who fly with American Airlines.

By Citi · Via Business Wire · July 28, 2025

Citi Issuer Services, acting through Citibank, N.A., has been appointed by Youlife Group Inc. (Youlife) as depositary bank for its American Depositary Receipt (ADR) program.

By Citi · Via Business Wire · July 24, 2025

Today Citi reported fourth quarter and full-year 2024 results, which can be found on its website at https://www.citigroup.com/global/investors. A Quarterly Financial Data Supplement with additional financial, statistical and business-related information, as well as business and segment trends, is also available.

By Citi · Via Business Wire · January 15, 2025

Today, Citi Wealth released its full-year Wealth Outlook for 2025 – Growth Amid Discord: Strategies for a “Rule-Breaking” Expansion. The report offers detailed perspectives on the global economic, market and geopolitical landscape ahead.

By Citi · Via Business Wire · December 11, 2024

Citi Wealth and Hildebrandt Consulting today released their 2025 Citi Hildebrandt Client Advisory. The Advisory covers the broad landscape for the legal industry, including ways law firms are responding to market challenges and where they see the greatest opportunities for growth in the year ahead.

By Citi · Via Business Wire · December 5, 2024

Citi has launched Citi Digital Bill (CDB), a new integrated digital bill discounting solution, making centuries old practices future ready. CDB significantly reduces complexity by eliminating the need for physical documents and couriers and the movement of paper across multiple parties in different geographies. For sellers, CDB provides a faster, more transparent way to manage receivables, reducing the time for monetizing receivables from a week to less than an hour.

By Citi · Via Business Wire · October 27, 2024

Today Citi reported third quarter 2024 results, which can be found on its website at https://www.citigroup.com/global/investors. A Quarterly Financial Data Supplement with additional financial, statistical and business-related information, as well as business and segment trends, is also available.

By Citi · Via Business Wire · October 15, 2024

Citi Issuer Services, acting through Citibank, N.A., has been appointed as depositary bank by NIP Group Inc. (“NIP”) for its American Depositary Receipt (“ADR”) program. NIP is a leading Chinese esports organization with an expansive global footprint that spans Asia, Europe, and South America.

By Citi · Via Business Wire · August 1, 2024

Winning a new mandate from asset manager Nuveen, Citi Securities Services’ ETF Services business has onboarded 23 new ETFs with approximately US$9 billion in assets in North America. The book is comprised of both transparent and non-transparent ETFs.

By Citi · Via Business Wire · June 28, 2024

Today, Citi (NYSE: C) and Emirates NBD, a leading banking group in the MENAT (Middle East, North Africa and Türkiye) region, announced a collaboration to launch Citi’s first-of-its-kind 24/7 USD Clearing service in the Middle East. This makes Emirates NBD the first bank to use Citi’s 24/7 USD Clearing service to make cross-border USD payments available to their corporate and retail clients 24 hours a day, 7 days a week, 365 days a year, end to end across their branch network.

By Citi · Via Business Wire · June 12, 2024

Citi Issuer Services, acting through Citibank, N.A., has been appointed as depositary bank by Super Hi International Holding Ltd. (“HDL”), a Hong Kong-listed leading Chinese cuisine restaurant brand operating the Haidilao hot pot restaurant chain in its international markets outside of Mainland China, Hong Kong, Macau, and Taiwan, for the initial public offering (the “IPO”) of HDL’s American Depositary Shares (“ADSs” or “ADRs”), representing its ordinary shares listed in Hong Kong.

By Citi · Via Business Wire · May 30, 2024

Today, Citi announced the Citi Strata Premier℠ Card – an enhancement of the existing Citi Premier® Card – now offering increased benefits and more opportunities to earn ThankYou® Points with the same $95 annual fee1, and Mastercard as the payments network. The newly redesigned card provides cardmembers with the opportunity of making travel more rewarding and adds travel protections for peace of mind.

By Citi · Via Business Wire · May 13, 2024

Citi has made a strategic minority investment in Cicada Technologies Inc.

By Citi · Via Business Wire · May 8, 2024

Today, Citi has announced that it has successfully completed a proof of concept on tokenization of private funds along with Wellington Management and WisdomTree.

By Citi · Via Business Wire · February 14, 2024

Citi Securities Services announces the launch of Financial Information eXchange (FIX) API connectivity on ACES1 – the bank’s online, global ETF portal that fully automates the entire ETF process.

By Citi · Via Business Wire · February 7, 2024

For consumers looking to score a deal, Citi introduces Citi Shop℠, a free shopping desktop browser extension for eligible U.S. Citi(R) credit cardmembers. Once downloaded, Citi Shop automatically searches behind the scenes for offers and available coupons at over 5,000 online merchants. This is the latest example of how Citi continues to provide additional value to its cardmembers by saving them time and money.

By Citi · Via Business Wire · January 23, 2024

Citi and LuminArx Capital today announced the launch of Cinergy, a strategic financing vehicle in the rapidly growing private lending market.

By Citi · Via Business Wire · January 18, 2024

Citi today announced that it will donate over $6.6 million in support of education-focused non-profit organizations as part of its 2023 e for education campaign.

By Citi · Via Business Wire · January 8, 2024

Citi has led a strategic investment round in Supra. Far Out Ventures and H20 Capital also participated in the financing round.

By Citi · Via Business Wire · December 11, 2023

Citi Treasury and Trade Solutions (TTS), within Citi’s Services organization, has made an investment in Icon Solutions, a leading fintech provider of payments technology and consultancy services. In addition to the investment, Citi plans to expand its use of the Icon Payments Framework (IPF) to enhance its micro-services orchestration architecture. This investment and relationship with Icon Solutions demonstrates Citi’s strategy of working with fintechs to strengthen its technology and payments capabilities.

By Citi · Via Business Wire · December 6, 2023

The Law Firm Group of Citi Global Wealth at Work and Hildebrandt Consulting today released their 2024 Citi Hildebrandt Client Advisory, which establishes the broad landscape for the law firm industry, how firms are responding to industry and market challenges and their potential opportunities for growth in the year ahead.

By Citi · Via Business Wire · December 6, 2023

Citi has been named Best Digital Bank 2023 by Global Finance Magazine. This marks 22 consecutive years of recognition as a global banking leader by the publication. Global Finance also named Citi Best Corporate/Institutional Digital Bank Globally, as well as best in several regional categories.

By Citi · Via Business Wire · November 30, 2023

Citi’s Issuer Services, acting through Citibank, N.A., has been appointed by Will Semiconductor Co., Ltd. Shanghai (“Will Semiconductor”) to act as the Depositary Bank for its Global Depositary Receipt (“GDR”) Program.

By Citi · Via Business Wire · November 13, 2023

On June 30, 2023 (the “Cessation Date”), ICE Benchmark Administration (“IBA”) ceased publication of all ICE Swap Rate settings based on USD LIBOR. This cessation followed the announcement by the UK Financial Conduct Authority on March 5, 2021, that all USD LIBOR settings would either cease or no longer be representative after the Cessation Date. The USD LIBOR ICE Swap Rate is also referred to as a constant maturity swap (or “CMS”) rate, and in this press release is referred to as the “USD LIBOR CMS Rate”.

By Citi · Via Business Wire · September 27, 2023

Inflation and ongoing market volatility remain the primary concerns of business leaders of mid-sized corporates and organizations surveyed by Citi Commercial Bank (CCB) in its first ‘Global Industry Insights Report’ released today.

By Citi · Via Business Wire · September 21, 2023

Citi today announced significant changes to its organizational model that will fully align its management structure with its business strategy and simplify the bank. The new, flatter structure elevates the leaders of Citi’s five businesses and eliminates management layers, which will speed up decision making, drive increased accountability and strengthen the focus on clients. Simplifying the organization will also advance the execution of Citi’s Transformation, the firm’s top priority.

By Citi · Via Business Wire · September 13, 2023

Citi today announced the acquisition of its Bridge built by Citi® platform (“Bridge”) by Foro Holdings, Inc. (“Foro”), a Charlotte-based commercial lending services provider. As part of the transaction, Citi contributed Bridge to Foro and joined Foro’s investors, including TTV Capital (TTV), US Bank and Correlation Ventures in an additional capital investment in Foro to support the continued growth of the business.

By Citi · Via Business Wire · September 11, 2023

Citi, a global leader in foreign exchange (FX) markets, has made a strategic investment in Rextie, Peru’s leading fintech for FX services.

By Citi · Via Business Wire · August 24, 2023

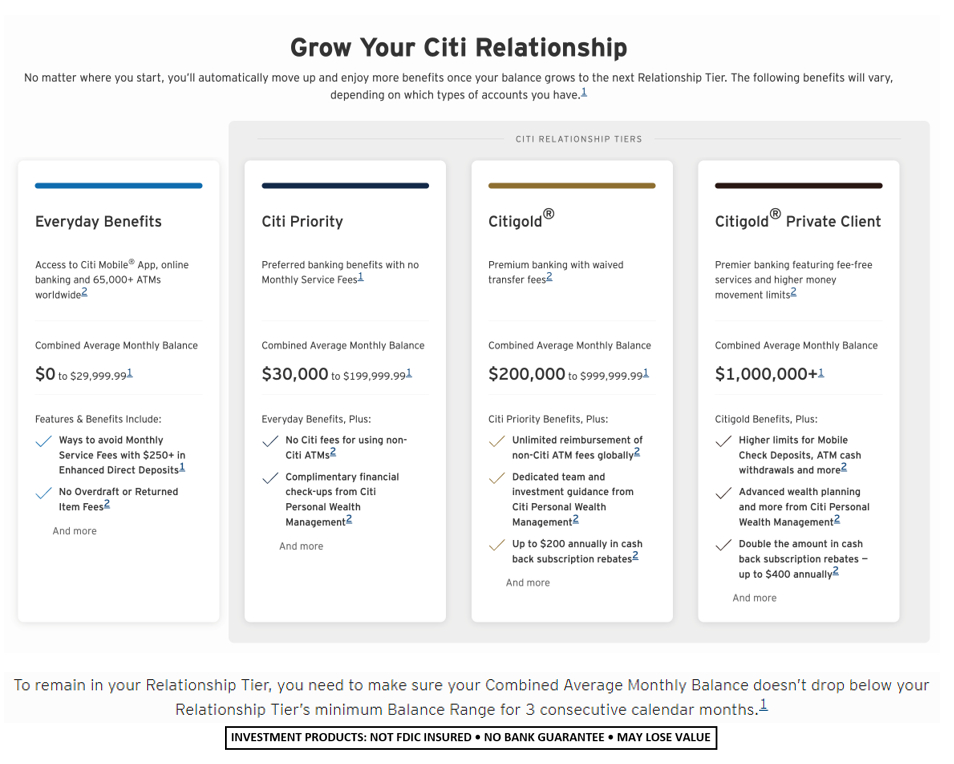

Citi’s U.S. Retail Bank introduces simplified banking, a more straightforward way of banking. By retiring account packages and introducing Relationship Tiers, Citi is streamlining its benefits and services and enhancing the customer experience. New customers can benefit from these changes immediately and Citi will begin converting existing customers to simplified banking in 2024.

By Citi · Via Business Wire · August 23, 2023

Citi’s Issuer Services, acting through Citibank, N.A., has been appointed by Zhejiang Yongtai Technology Co., Ltd. (“Yongtai”) – a leading manufacturer of fluorine-containing fine chemicals in the industry – to act as the Depositary Bank for its Global Depositary Receipt (“GDR”) Program.

By Citi · Via Business Wire · July 19, 2023

Citi’s Issuer Services, acting through Citibank, N.A., has been appointed by Zhejiang Huayou Cobalt Co., Ltd. (“Huayou”) to act as the Depositary Bank for its Global Depositary Receipt (“GDR”) Program.

By Citi · Via Business Wire · July 11, 2023

Citi has announced the launch of a new platform, CitiDirect® Commercial Banking, specifically to address the needs of Citi Commercial Bank (CCB) clients. This is part of Citi’s significant strategic investment plan to meet the growing global needs of these clients by delivering a single-entry point digital platform.

By Citi · Via Business Wire · July 10, 2023

Further to its announcement that it has completed the Federal Reserve’s 2023 Comprehensive Capital Analysis and Review (“CCAR”) stress test process, Citi today disclosed its Dodd-Frank Act Stress test results, which can be found on the company’s website at https://www.citigroup.com/global/investors/events-and-presentations. Citi also announced that it has initiated dialogue with the Federal Reserve to understand differences in Non-Interest Income (Non-Interest Revenue per Citi’s Financial Reporting presentation) over the nine-quarter stress period between the Federal Reserve’s CCAR results and Citi’s Dodd-Frank Act Stress Test results.

By Citi · Via Business Wire · July 3, 2023

Citi announced today that it has completed the Federal Reserve’s 2023 Comprehensive Capital Analysis and Review (“CCAR”) stress test process. The Firm’s indicative Stress Capital Buffer (“SCB”) requirement is 4.3%, up from the current 4.0%, and the Firm’s preliminary Standardized Common Equity Tier 1 (CET1) capital ratio regulatory requirement is 12.3%, up from the current 12.0%, effective October 1, 2023.

By Citi · Via Business Wire · June 30, 2023

Citi Treasury and Trade Solutions (TTS) and Pismo, the next-gen banking and payments software company, jointly announced their relationship in which Citi will use Pismo’s technology platform to help strengthen Citi’s corporate demand deposit accounts (DDA), to clients worldwide.

By Citi · Via Business Wire · June 15, 2023

Citi’s Issuer Services, acting through Citibank, N.A., has been appointed by Kunshan Dongwei Technology Co., Ltd. (“Dongwei”), a global leading electroplating equipment manufacturer mainly engaged in the research and development, design, production and sales of high-end precision electroplating equipment and its supporting equipment, to act as Depositary Bank for its Global Depositary Receipt (“GDR”) Program.

By Citi · Via Business Wire · June 14, 2023

Citi Global Wealth Investments today released its Mid-Year Wealth Outlook 2023 report - Opportunities on the Horizon: Investing Through a Slowing Economy. This biannual report sets out Citi Global Wealth’s outlook on how investors should approach developments in the global economy, markets and geopolitics.

By Citi · Via Business Wire · June 8, 2023

Depósito Central de Valores and Citi Securities Services jointly announced today that Citi has been appointed as custodian of international securities for Depósito Central de Valores (DCV), the central securities depositary (CSD) for Chilean securities. The transition of the assets successfully went live on May 26th, broadening the existing relationship between Citi and DCV.

By Citi · Via Business Wire · June 7, 2023

Mark Mason, Chief Financial Officer of Citi, will present at Morgan Stanley’s US Financials, Payments & CRE Conference on Wednesday, June 14. The presentation is expected to begin at approximately 2:30 p.m. (Eastern). A live webcast will be available at http://www.citigroup.com/citi/investor. A replay and transcript of the webcast will be available shortly after the event.

By Citi · Via Business Wire · June 2, 2023

Citi Treasury and Trade Solutions (TTS) has won top honors in two transaction banking categories at the fifth annual Digital CX Awards 2023, hosted by The Digital Banker -- dedicated to recognizing pioneering innovation in Digital Customer Experience (CX) across the financial services ecosystem. Citi placed first in the World’s Best Transaction Bank for Digital CX and Outstanding Digital CX – Bank Cards categories.

By Citi · Via Business Wire · May 31, 2023

As a leader in U.S. payments, Citi Retail Services, one of North America's largest and most experienced retail payments and credit solution providers, is expanding its embedded payments strategy with its suite of Citi Pay® products. Designed with customers and merchants in mind, the new family of products will deliver a digital-first, consumer finance journey in partner checkout processes.

By Citi · Via Business Wire · May 10, 2023

Citibank, N.A. said today it has raised its base lending rate to 8.25% from 8.00%, effective tomorrow, Thursday, May 4, 2023.

By Citi · Via Business Wire · May 3, 2023

Citi’s Treasury and Trade Solutions (TTS) has expanded its relationship with Treasury Intelligence Solutions (TIS), a global leader in cloud-native cashflow, liquidity, and payment solutions. Joint clients may now, through Citi, gain access to TIS' innovative cash forecasting and working capital platform, enhancing Citi's end-to-end solutions suite across its market-leading global banking network.

By Citi · Via Business Wire · May 1, 2023

Citi was recognized as the number one affordable housing lender in the United States for 2022 according to Affordable Housing Finance magazine's annual ranking, marking the 13th consecutive year that Citi has earned the distinction.

By Citi · Via Business Wire · April 24, 2023

Citi’s Issuer Services, acting through Citibank, N.A., has been appointed by Zhejiang Supcon Technology Co., Ltd. (“Supcon”) and Yangzhou Yangjie Electronic Technology Co., Ltd. (“Yangjie”) to act as the Depositary Bank for their Global Depositary Receipt (“GDR”) Programs. Citi’s Issuer Services acts as the Depositary Bank for 17 out of 18 China Connect GDR Programs (including 5 Shanghai-London Stock Connect Programs and 12 China-Swiss Stock Connect Programs).

By Citi · Via Business Wire · April 18, 2023

Citi® has announced the launch of a new sustainable time deposit solution designed to assist U.S. institutional clients when investing excess cash while supporting their sustainability goals. Citi’s new Sustainable Time Deposit (TD) will deliver competitive yields and supports projects identified under Citi's green and social bond frameworks, expanding the program launched in Europe, the Middle East and Asia last year.

By Citi · Via Business Wire · April 5, 2023

Citibank, N.A. said today it has raised its base lending rate to 8.00% from 7.75%, effective tomorrow, Thursday, March 23, 2023.

By Citi · Via Business Wire · March 22, 2023

Citi’s Issuer Services, acting through Citibank, N.A., has been appointed by Fangda Carbon New Material Co., Ltd. (“Fangda”), a leading company engaged in the research, development, production and sales of carbon materials, to act as the Depositary Bank for its Global Depositary Receipt (“GDR”) Program.

By Citi · Via Business Wire · March 20, 2023

On March 5, 2021, the UK Financial Conduct Authority (the “FCA”) announced that all USD LIBOR settings will either cease publication or no longer be representative after June 30, 2023 (the "Cessation Date").

By Citi · Via Business Wire · February 27, 2023

Citi’s Issuer Services, acting through Citibank, N.A., has been appointed by Zhejiang HangKe Technology Incorporated Company (“Hangke”) to act as the Depositary Bank for its Global Depositary Receipt (“GDR”) Program.

By Citi · Via Business Wire · February 27, 2023

Mark Mason, Chief Financial Officer of Citi, will present at the 2023 RBC Capital Markets Financial Institutions Conference on Wednesday, March 8. The presentation is expected to begin at approximately 3:20 p.m. (Eastern). A live webcast will be available at http://www.citigroup.com/citi/investor. A replay and transcript of the webcast will be available shortly after the event.

By Citi · Via Business Wire · February 21, 2023

Anand Selvakesari, Citi’s Chief Executive Officer of Personal Banking & Wealth Management, will present at the Bank of America 2023 Financial Services Conference on Thursday, February 16. The presentation is expected to begin at approximately 9:40 a.m. (Eastern). A live webcast will be available at http://www.citigroup.com/citi/investor. A replay and transcript of the webcast will be available shortly after the event.

By Citi · Via Business Wire · February 1, 2023

Citi’s Issuer Services, acting through Citibank, N.A., has been appointed by Jiangsu Eastern Shenghong Co., Ltd. (“Shenghong”) - to act as the Depositary Bank for its Global Depositary Receipt (“GDR”) Program. This is the ninth China-Swiss Stock Connect Program listed on the SIX Swiss Exchange, and the eighth China-Swiss Stock Connect Program for which Citi’s Issuer Services acts as the Depositary Bank.

By Citi · Via Business Wire · January 9, 2023

Citibank, N.A. said today it has raised its base lending rate to 7.50% from 7.00%, effective tomorrow, Thursday, December 15, 2022.

By Citi · Via Business Wire · December 14, 2022

Citi Law Firm Group and Hildebrandt Consulting today released their 2023 Citi Hildebrandt Client Advisory, which establishes the broad landscape for the law firm industry, how firms are responding to industry, economic and market challenges, and their potential opportunities for growth in the year ahead. While 2022 proved to be a challenging year for law firms, especially off the back of an unusually strong 2021, we view a comparison to 2019 as more accurate, the law firm industry has performed very well and proven resilient.

By Citi · Via Business Wire · December 7, 2022

Citi’s Issuer Services, acting through Citibank, N.A., has been appointed by Sunwoda Electronic Co., Ltd. (“Sunwoda”) and Hangzhou GreatStar Industrial Co., Ltd. (“GreatStar”) to act as the Depositary Bank for their Global Depositary Receipt (“GDR”) programs. These are the seventh and eighth China-Swiss Stock Connect programs listed on the SIX Swiss Exchange.

By Citi · Via Business Wire · November 17, 2022

Today, Citi and AT&T announced the AT&T Points Plus Card from Citi, a new no annual fee* card that rewards wireless customers with statement credits and Citi ThankYou Points on purchases. Building on the long-standing relationship between the two companies, the new card delivers on a shared commitment to drive loyalty and customer engagement by providing an ideal option for AT&T wireless customers looking for rewards on everyday purchases.

By Citi · Via Business Wire · November 14, 2022

Citi® Virtual Accounts continues its strong growth with institutional clients including corporations, financial institutions, ecommerce and insurance companies. This growth comes as multinational companies across industries continue to use Citi’s solutions to help improve operational efficiency, reduce costs, accelerate time to market and ramp up their digitization initiatives. In 2022, account balances grew by 82%, accompanied by 33% growth in adoption.

By Citi · Via Business Wire · November 10, 2022

Citi today announced the release of three Global Perspectives & Solutions (Citi GPS) reports that highlight a range of challenges and opportunities related to the climate crisis. The new research, which underscore the importance of increased private and public sector engagement to address complex global issues, will be discussed at the 2022 United Nations Climate Change Conference (COP27) in Sharm El Sheikh, Egypt.

By Citi · Via Business Wire · November 8, 2022

Citi has been named World's Best Digital Bank by Global Finance magazine for the 21st consecutive year. The bank was also recognized as Best Corporate/Institutional Digital Bank and received multiple regional and subcategory awards in addition to 135 country awards from Global Finance.

By Citi · Via Business Wire · October 25, 2022

Spring by Citi®, Citi’s digital payments service enabling ecommerce and B2B funds flows launched in the U.S. in 2020, has now been fully integrated with Citi® Present and Pay, Citi’s electronic bill presentment platform. The combined solution offers comprehensive digital payment acceptance and electronic bill presentment in one integrated platform.

By Citi · Via Business Wire · October 24, 2022