In a sliding market, Dutch Bros has defied the odds, trading up to $72.33 per share. Its 34% gain since December 2024 has outpaced the S&P 500’s 1.8% drop. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy BROS? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does Dutch Bros Spark Debate?

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Two Positive Attributes:

1. New Restaurants Opening at Breakneck Speed

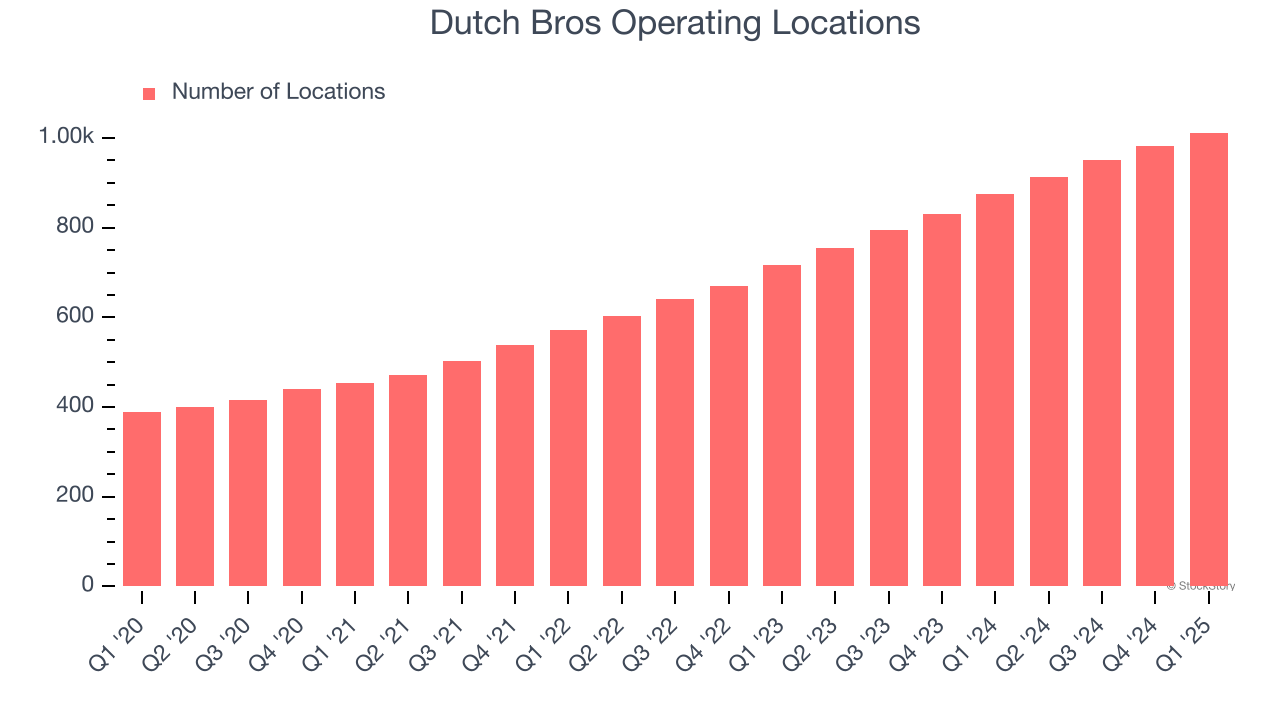

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Dutch Bros operated 1,012 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 21.2% annual growth, much faster than the broader restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

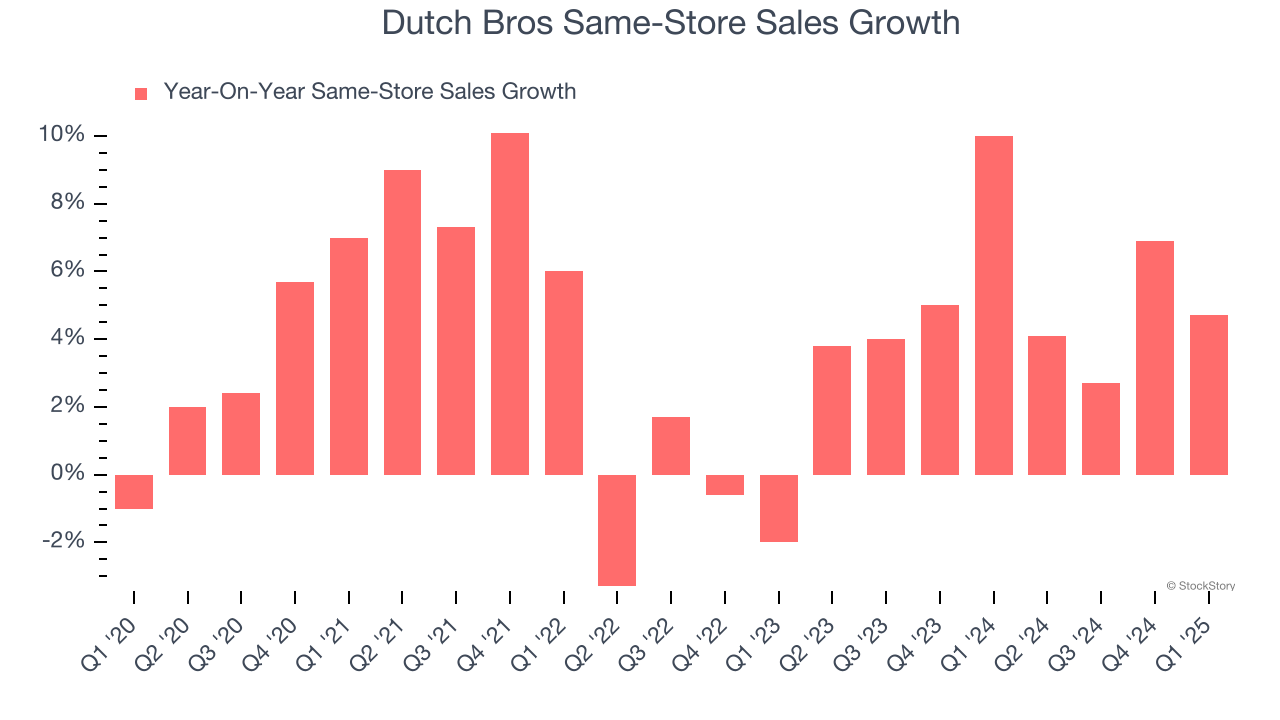

2. Surging Same-Store Sales Show Increasing Demand

Same-store sales show the change in sales at restaurants open for at least a year. This is a key performance indicator because it measures organic growth.

Dutch Bros has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 5.2%.

One Reason to be Careful:

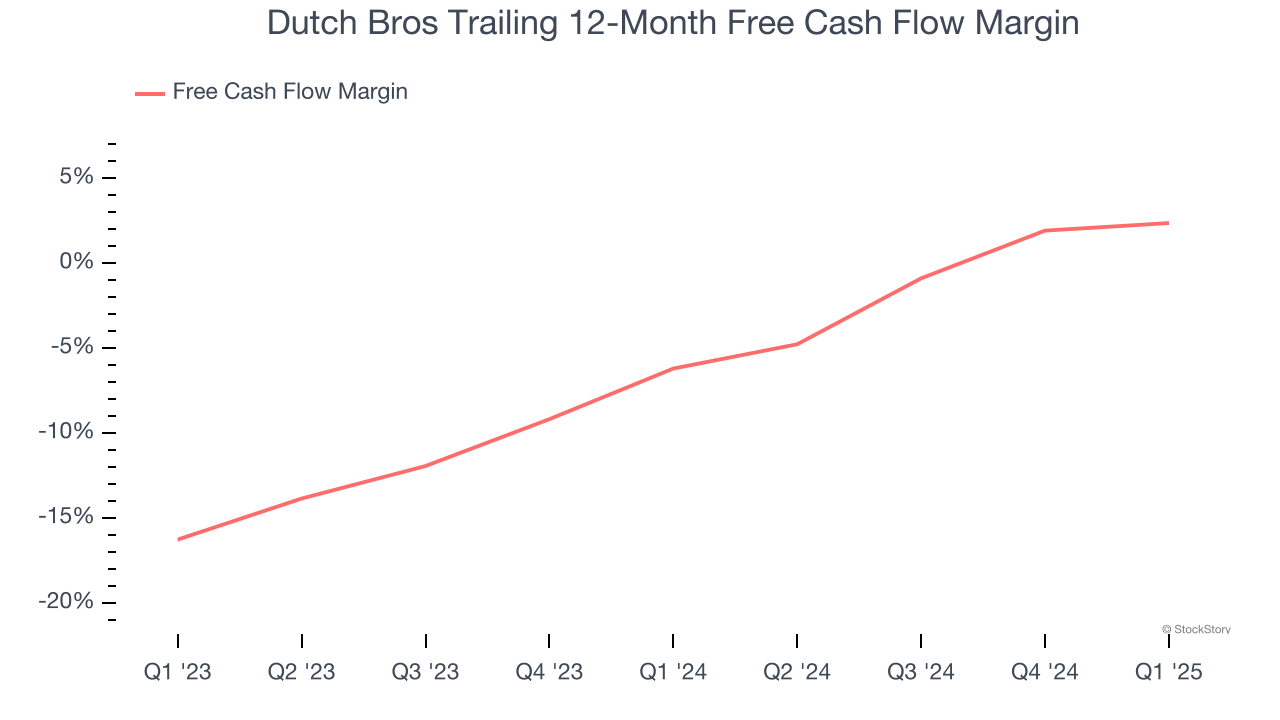

Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the last two years, Dutch Bros’s capital-intensive business model and large investments in new physical locations have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.3%, meaning it lit $1.34 of cash on fire for every $100 in revenue.

Final Judgment

Dutch Bros has huge potential even though it has some open questions, and with its shares topping the market in recent months, the stock trades at 112.3× forward P/E (or $72.33 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Dutch Bros

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.