What a fantastic six months it’s been for Roblox. Shares of the company have skyrocketed 55.3%, setting a new 52-week high of $91.51. This run-up might have investors contemplating their next move.

Following the strength, is RBLX a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does RBLX Stock Spark Debate?

Best known for its wide assortment of user-generated content, Roblox (NYSE:RBLX) is an online gaming platform and game creation system.

Two Positive Attributes:

1. Daily Active Users Skyrocket, Fueling Growth Opportunities

As a video gaming company, Roblox generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

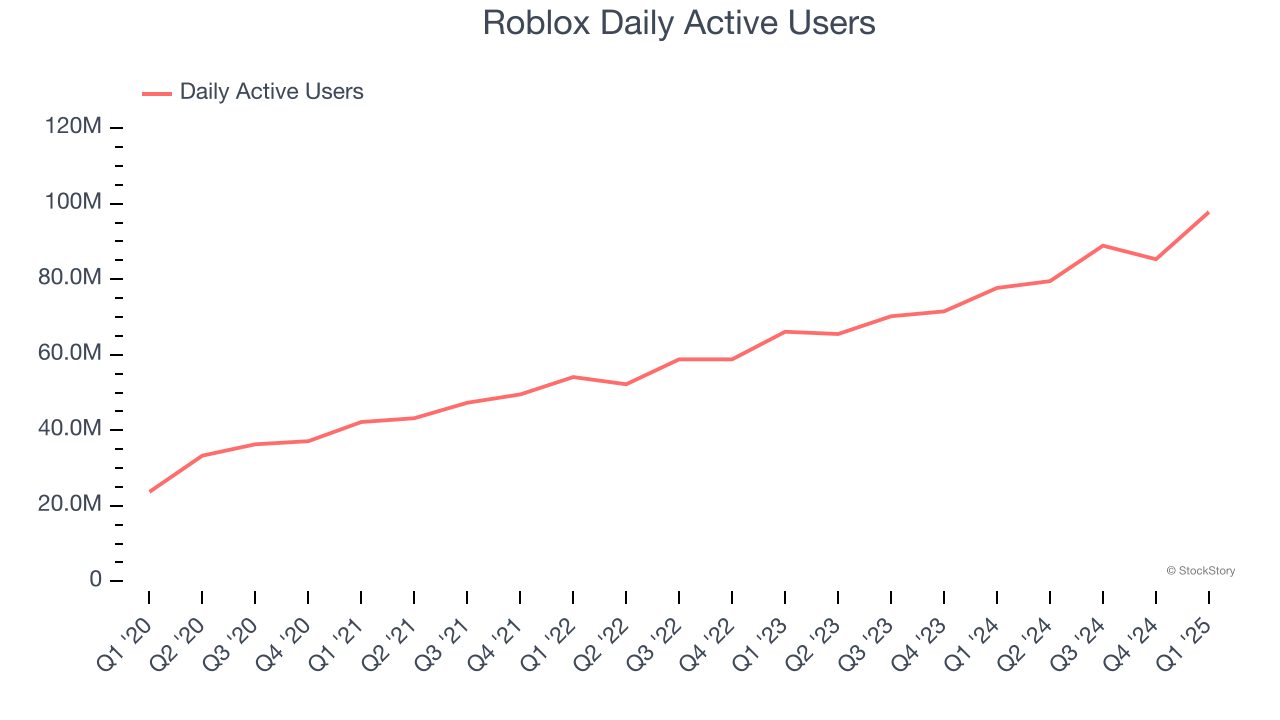

Over the last two years, Roblox’s daily active users, a key performance metric for the company, increased by 22.1% annually to 97.8 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

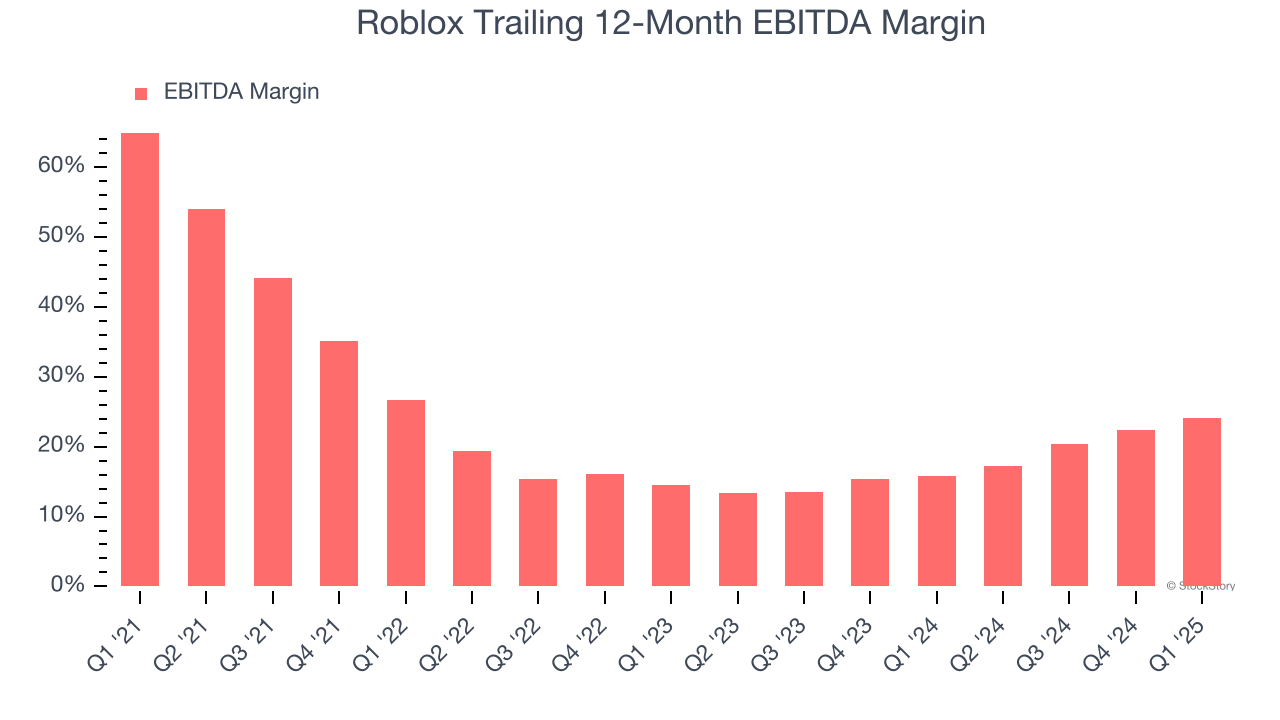

2. EBITDA Margin Reveals a Well-Run Organization

EBITDA is a good way of judging operating profitability for consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a more standardized view of the business’s profit potential.

Roblox has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 20.5%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

One Reason to be Careful:

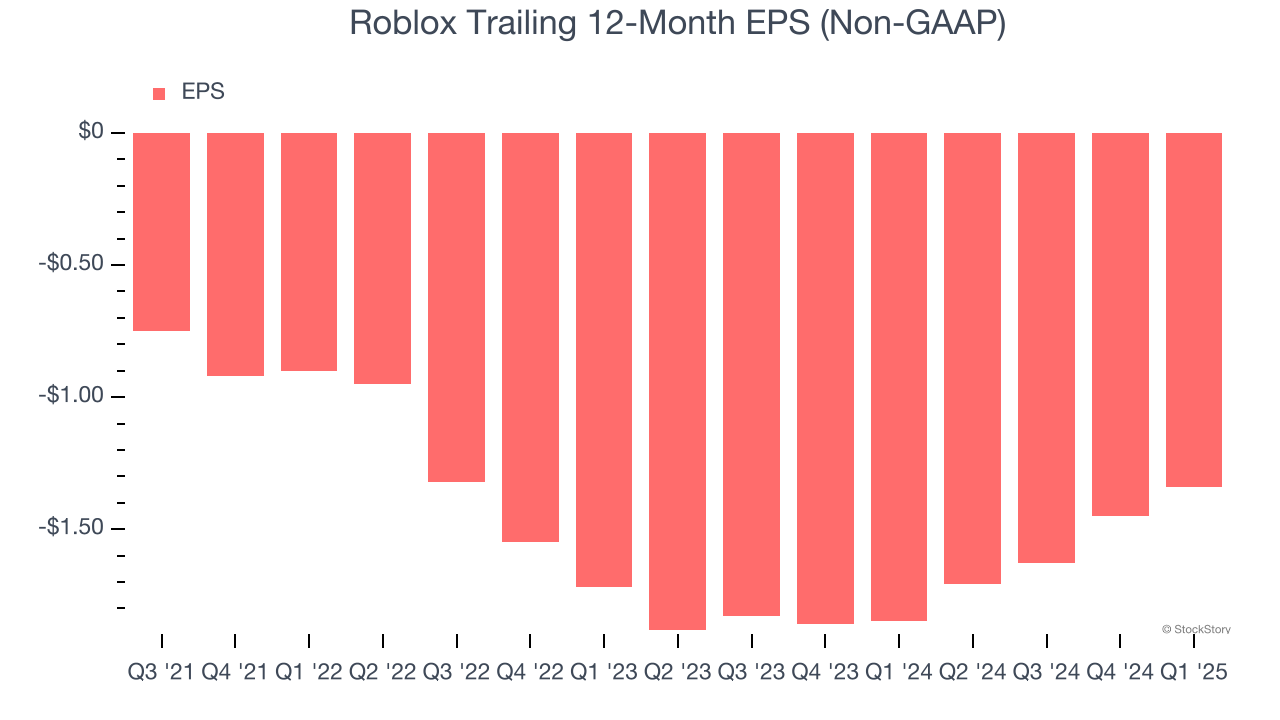

EPS Trending Down

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Roblox’s earnings losses deepened over the last three years as its EPS dropped 14.2% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

Final Judgment

Roblox has huge potential even though it has some open questions, and after the recent surge, the stock trades at 53.8× forward EV/EBITDA (or $91.51 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Roblox

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.