Looking back on maintenance and repair distributors stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Distribution Solutions (NASDAQ:DSGR) and its peers.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

The 9 maintenance and repair distributors stocks we track reported a satisfactory Q1. As a group, revenues were in line with analysts’ consensus estimates.

Thankfully, share prices of the companies have been resilient as they are up 6.8% on average since the latest earnings results.

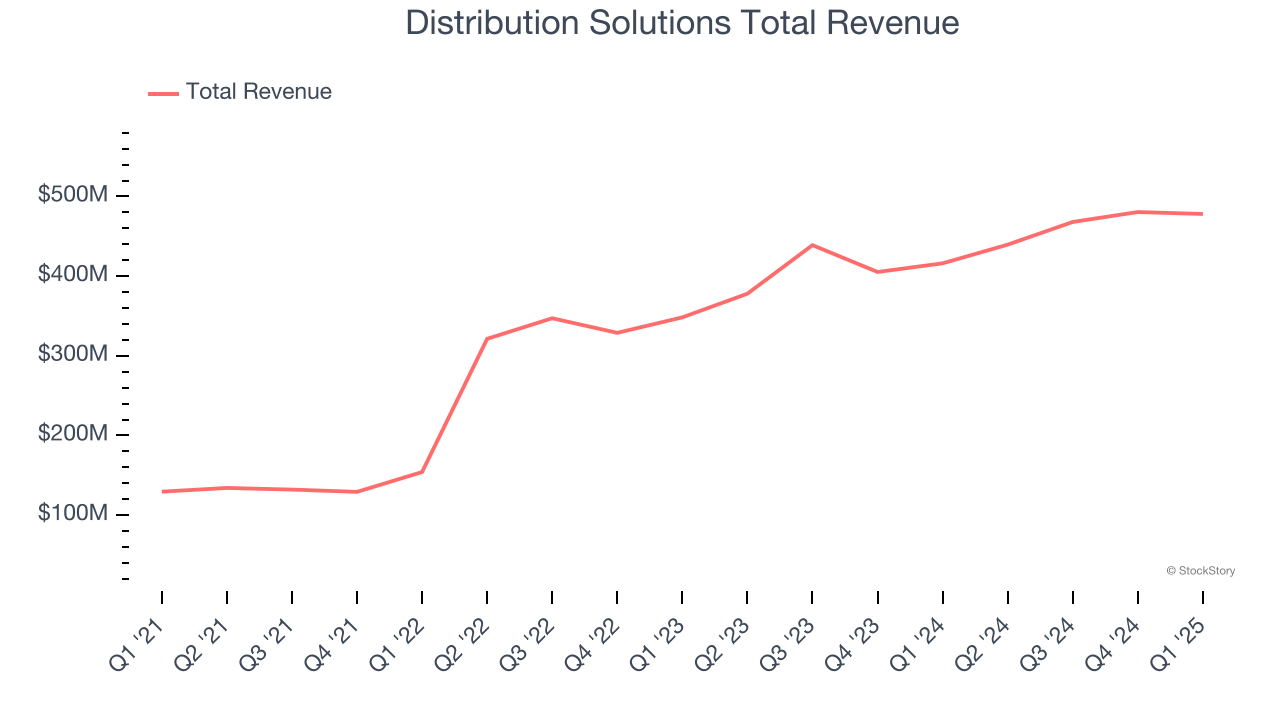

Weakest Q1: Distribution Solutions (NASDAQ:DSGR)

Founded in 1952, Distribution Solutions (NASDAQ:DSGR) provides supply chain solutions and distributes industrial, safety, and maintenance products to various industries.

Distribution Solutions reported revenues of $478 million, up 14.9% year on year. This print fell short of analysts’ expectations by 3.8%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EBITDA and EPS estimates.

Bryan King, CEO and Chairman, said, "Our financial results met expectations for the quarter, despite macro uncertainties that affected all U.S. companies. We are pleased with first quarter sales of $478 million, up 14.9%, comprising inorganic revenue of $51 million and an increase in organic average daily sales of 4.3%. On a constant currency basis our organic ADS was up 4.7%, which includes a full quarter of contribution from Source Atlantic. First quarter's Adjusted EBITDA grew to $42.8 million, up 18.6% and expanded to 9.0% as a percent of sales compared to 8.7% in the year-ago period.

Interestingly, the stock is up 6.8% since reporting and currently trades at $27.83.

Is now the time to buy Distribution Solutions? Access our full analysis of the earnings results here, it’s free.

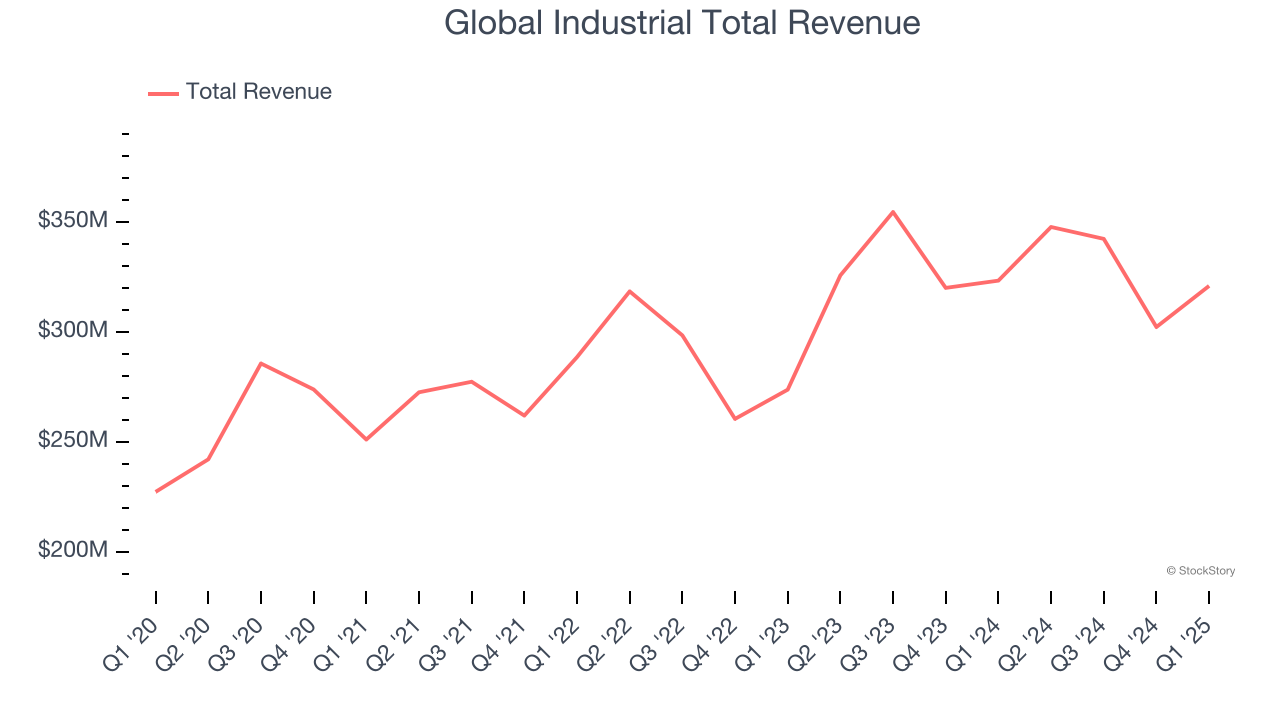

Best Q1: Global Industrial (NYSE:GIC)

Formerly known as Systemax, Global Industrial (NYSE:GIC) distributes industrial and commercial products to businesses and institutions.

Global Industrial reported revenues of $321 million, flat year on year, outperforming analysts’ expectations by 4.6%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Global Industrial delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 22.4% since reporting. It currently trades at $27.11.

Is now the time to buy Global Industrial? Access our full analysis of the earnings results here, it’s free.

WESCO (NYSE:WCC)

Based in Pittsburgh, WESCO (NYSE:WCC) provides electrical, industrial, and communications products and augments them with services such as supply chain management.

WESCO reported revenues of $5.34 billion, flat year on year, exceeding analysts’ expectations by 1.8%. Still, it was a slower quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a miss of analysts’ EPS estimates.

Interestingly, the stock is up 6.5% since the results and currently trades at $173.18.

Read our full analysis of WESCO’s results here.

Fastenal (NASDAQ:FAST)

Founded in 1967, Fastenal (NASDAQ:FAST) provides industrial and construction supplies, including fasteners, tools, safety products, and many other product categories to businesses globally.

Fastenal reported revenues of $1.96 billion, up 3.4% year on year. This number was in line with analysts’ expectations. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ sales volume estimates and EPS in line with analysts’ estimates.

The stock is up 6.9% since reporting and currently trades at $40.50.

Read our full, actionable report on Fastenal here, it’s free.

W.W. Grainger (NYSE:GWW)

Founded as a supplier of motors, W.W. Grainger (NYSE:GWW) provides maintenance, repair, and operating (MRO) supplies and services to businesses and institutions.

W.W. Grainger reported revenues of $4.31 billion, up 1.7% year on year. This result met analysts’ expectations. Aside from that, it was a satisfactory quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates but full-year revenue guidance slightly missing analysts’ expectations.

The stock is up 9.9% since reporting and currently trades at $1,124.

Read our full, actionable report on W.W. Grainger here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.