Footwear, apparel, and accessories retailer Genesco (NYSE:GCO) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 3.6% year on year to $474 million. Its non-GAAP loss of $2.05 per share was 3.8% above analysts’ consensus estimates.

Is now the time to buy Genesco? Find out by accessing our full research report, it’s free.

Genesco (GCO) Q1 CY2025 Highlights:

- Revenue: $474 million vs analyst estimates of $463.8 million (3.6% year-on-year growth, 2.2% beat)

- Adjusted EPS: -$2.05 vs analyst estimates of -$2.13 (3.8% beat)

- Management reiterated its full-year Adjusted EPS guidance of $1.50 at the midpoint

- Operating Margin: -5.9%, up from -7% in the same quarter last year

- Locations: 1,256 at quarter end, down from 1,321 in the same quarter last year

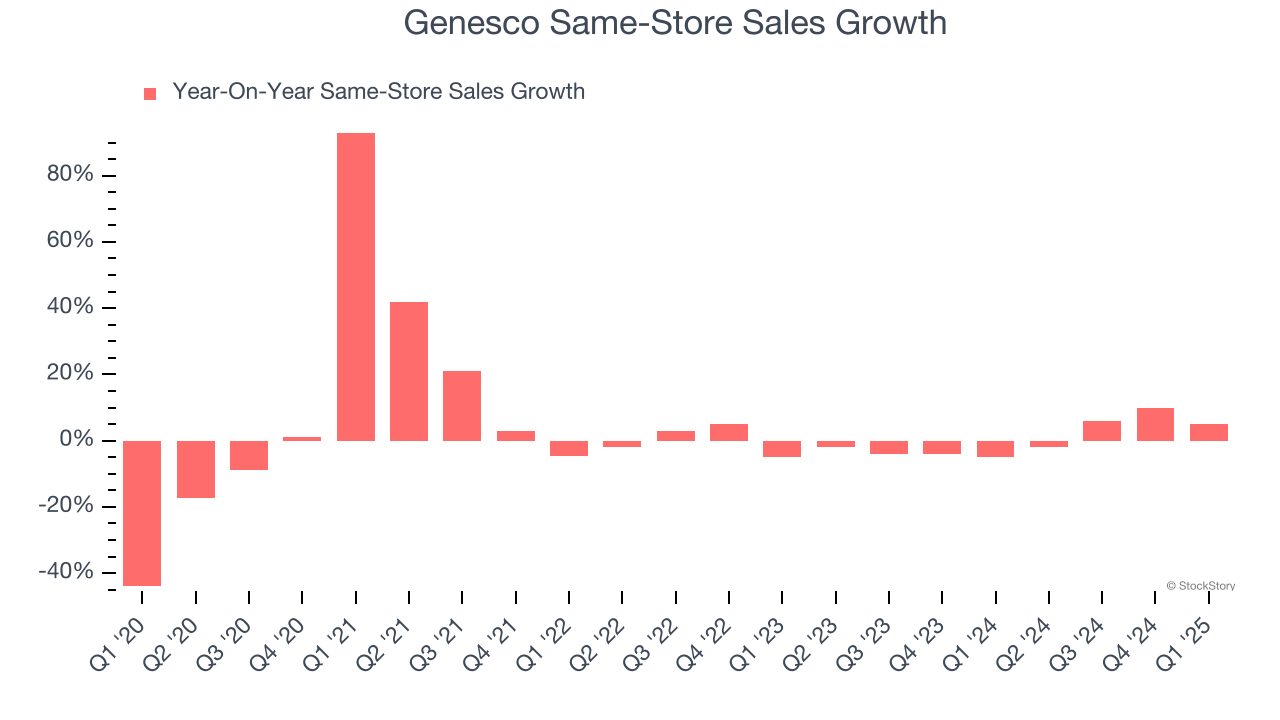

- Same-Store Sales rose 5% year on year (-5% in the same quarter last year)

- Market Capitalization: $240.9 million

Mimi E. Vaughn, Genesco’s Board Chair, President and Chief Executive Officer, said, “Following the significant momentum in last year’s back half, we are pleased with our start to fiscal 2026 with both sales and profitability coming in above our expectations. Our first quarter performance was highlighted by our third consecutive quarter of positive comparable sales increases, with results once again driven by Journeys, as our strategic plan to accelerate growth and increase market share continues to gain traction. At the same time, the work we’ve done realigning our cost structure including our ongoing store optimization initiatives, helped drive a nice year-over-year improvement in operating income.”

Company Overview

Spanning a broad range of styles, brands, and prices, Genesco (NYSE:GCO) sells footwear, apparel, and accessories through multiple brands and banners.

Sales Growth

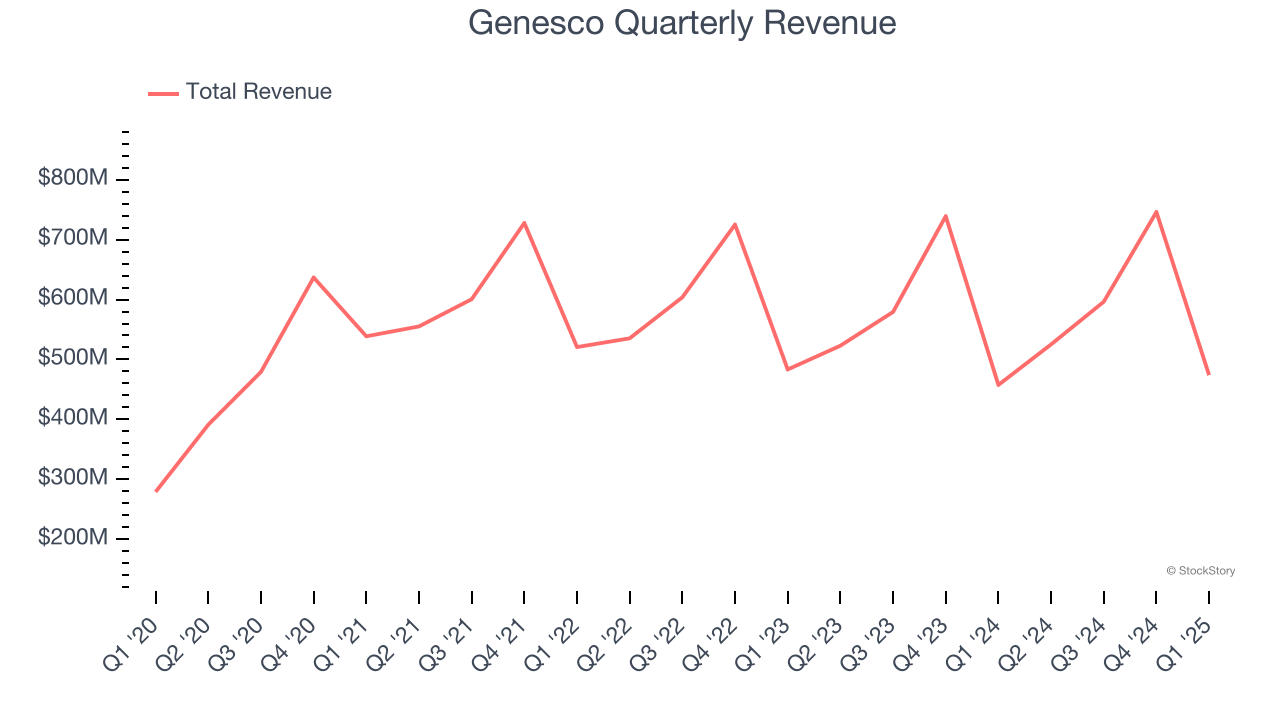

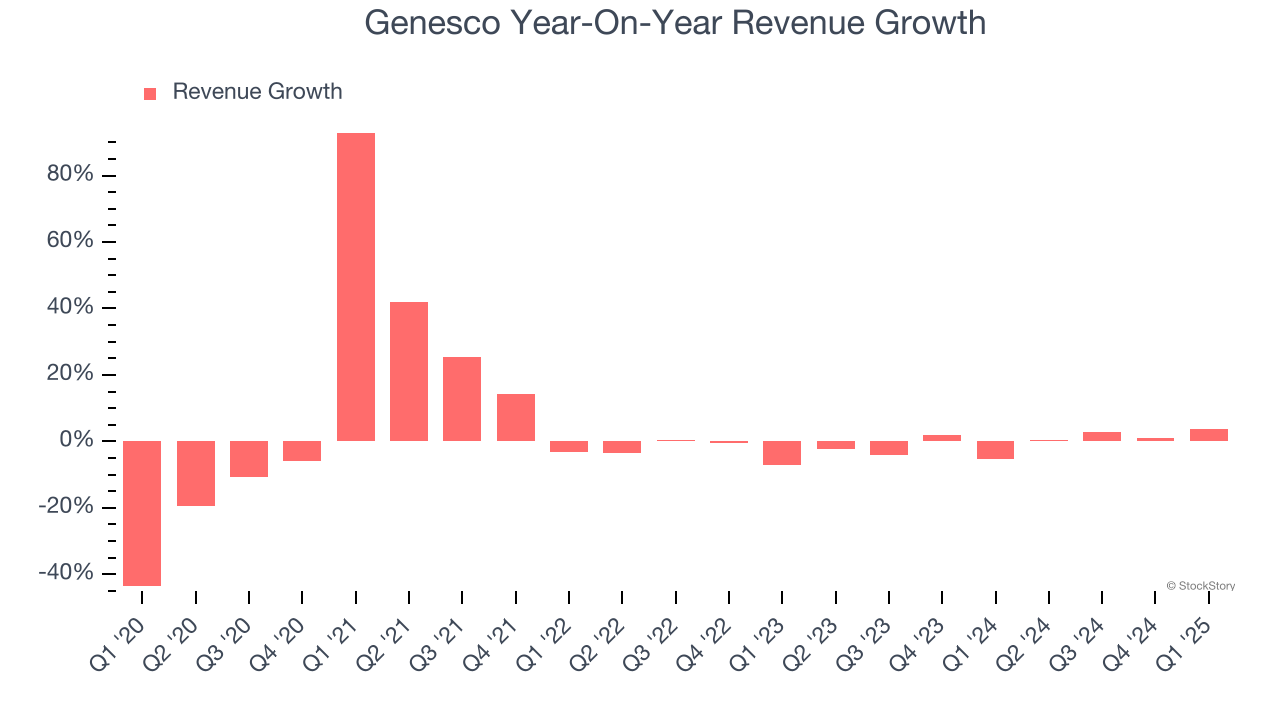

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Genesco’s sales grew at a sluggish 3.4% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Genesco’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Genesco’s same-store sales were flat. This number doesn’t surprise us as it’s in line with its revenue growth.

This quarter, Genesco reported modest year-on-year revenue growth of 3.6% but beat Wall Street’s estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

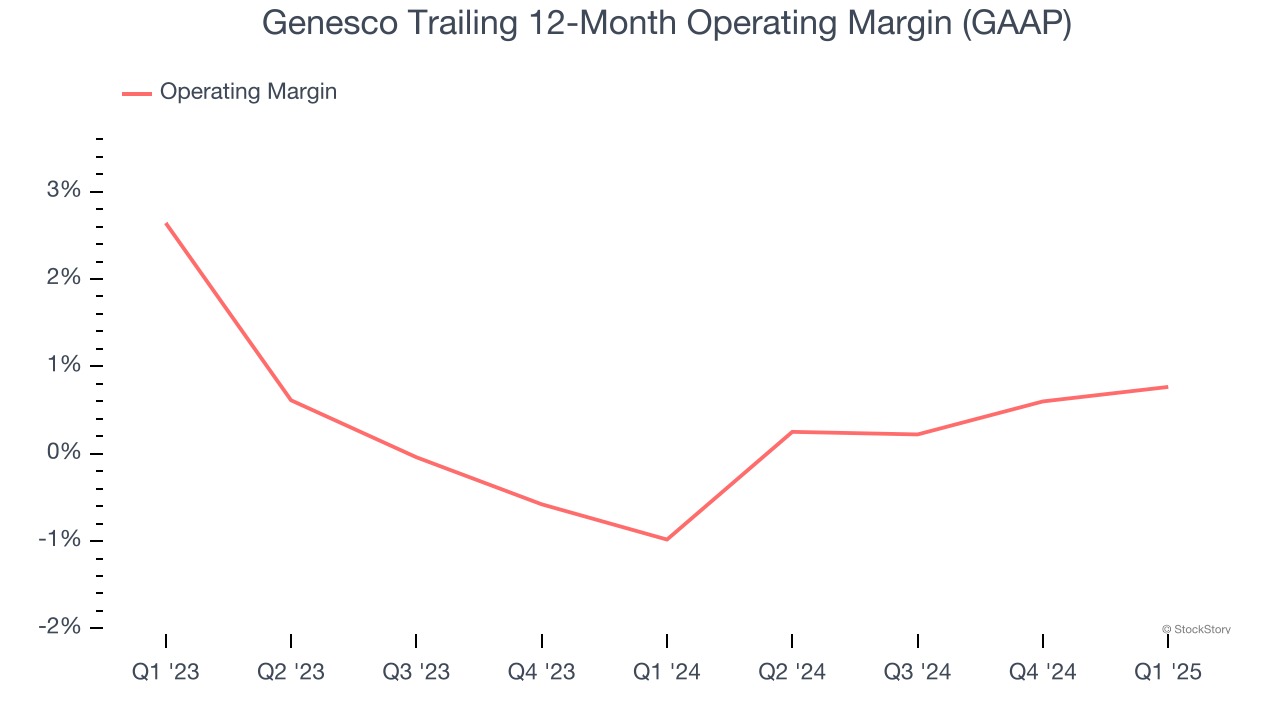

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Genesco’s operating margin has been trending up over the last 12 months, leading to break even profits over the last two years. However, its large expense base and inefficient cost structure mean it still sports inadequate profitability for a consumer discretionary business.

Genesco’s operating margin was negative 5.9% this quarter. The company's consistent lack of profits raise a flag.

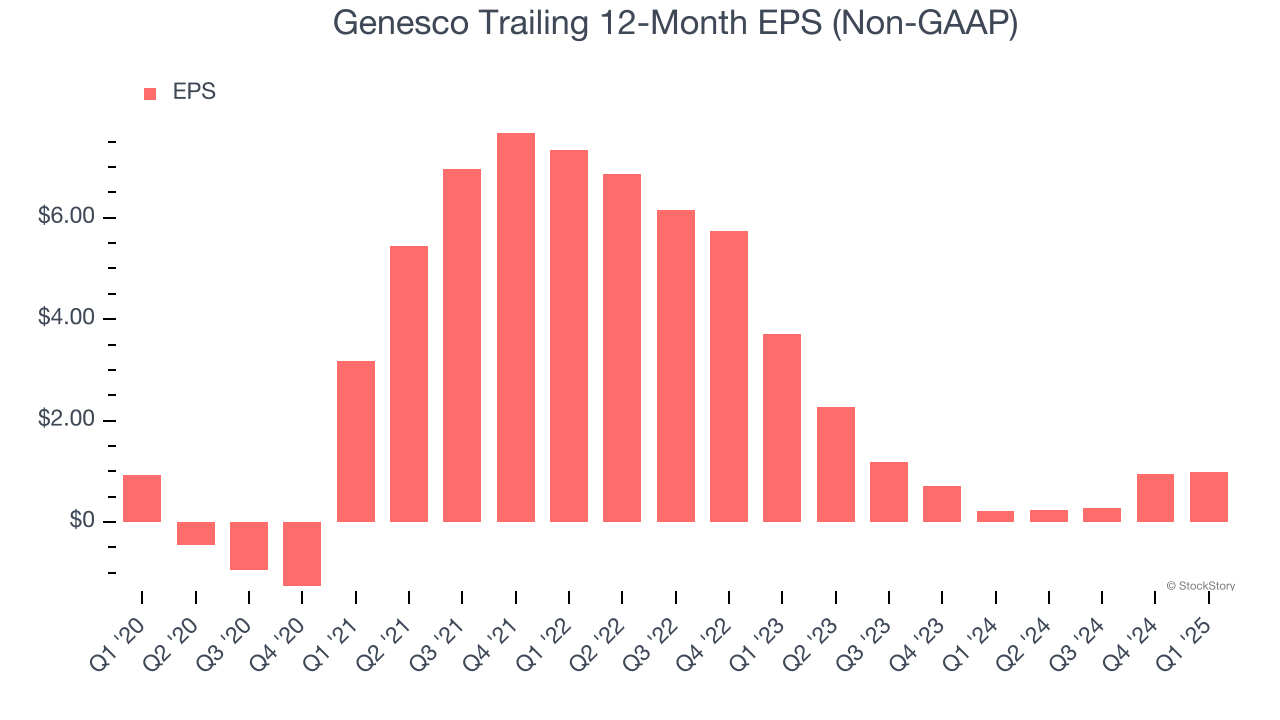

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Genesco’s EPS grew at a weak 1.5% compounded annual growth rate over the last five years, lower than its 3.4% annualized revenue growth. We can see the difference stemmed from higher interest expenses or taxes as the company actually grew its operating margin and repurchased its shares during this time.

In Q1, Genesco reported EPS at negative $2.05, up from negative $2.10 in the same quarter last year. This print beat analysts’ estimates by 3.8%. Over the next 12 months, Wall Street expects Genesco’s full-year EPS of $0.99 to grow 53%.

Key Takeaways from Genesco’s Q1 Results

It was encouraging to see Genesco’s full-year EPS guidance beat analysts’ expectations. We were also happy its revenue and EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $22.55 immediately after reporting.

Genesco put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.