The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how XPO (NYSE:XPO) and the rest of the ground transportation stocks fared in Q1.

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 16 ground transportation stocks we track reported a slower Q1. As a group, revenues missed analysts’ consensus estimates by 2.2%.

In light of this news, share prices of the companies have held steady as they are up 4.1% on average since the latest earnings results.

XPO (NYSE:XPO)

Owning a mobile game simulating freight operations for the Tour de France, XPO (NYSE:XPO) is a transportation company specializing in expedited shipping services.

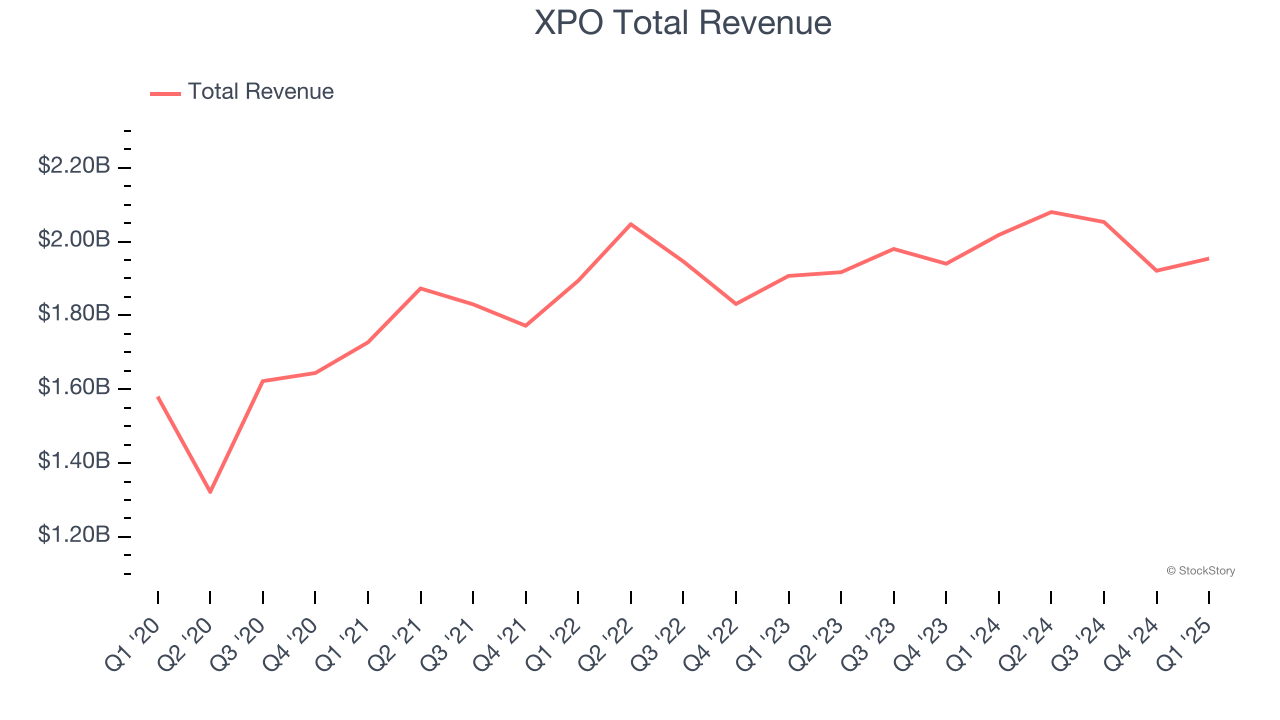

XPO reported revenues of $1.95 billion, down 3.2% year on year. This print fell short of analysts’ expectations by 0.9%, but it was still a strong quarter for the company with a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ EPS estimates.

Mario Harik, chief executive officer of XPO, said, “We carried our momentum into 2025 and delivered first quarter financial results that outperformed the industry. Companywide, we reported adjusted EBITDA of $278 million and adjusted diluted EPS of $0.73, while operating more efficiently.

The stock is up 15.8% since reporting and currently trades at $112.89.

Is now the time to buy XPO? Access our full analysis of the earnings results here, it’s free.

Best Q1: Schneider (NYSE:SNDR)

Employing thousands of drivers across the country to make deliveries, Schneider (NYSE:SNDR) makes full truckload and intermodal deliveries regionally and across borders.

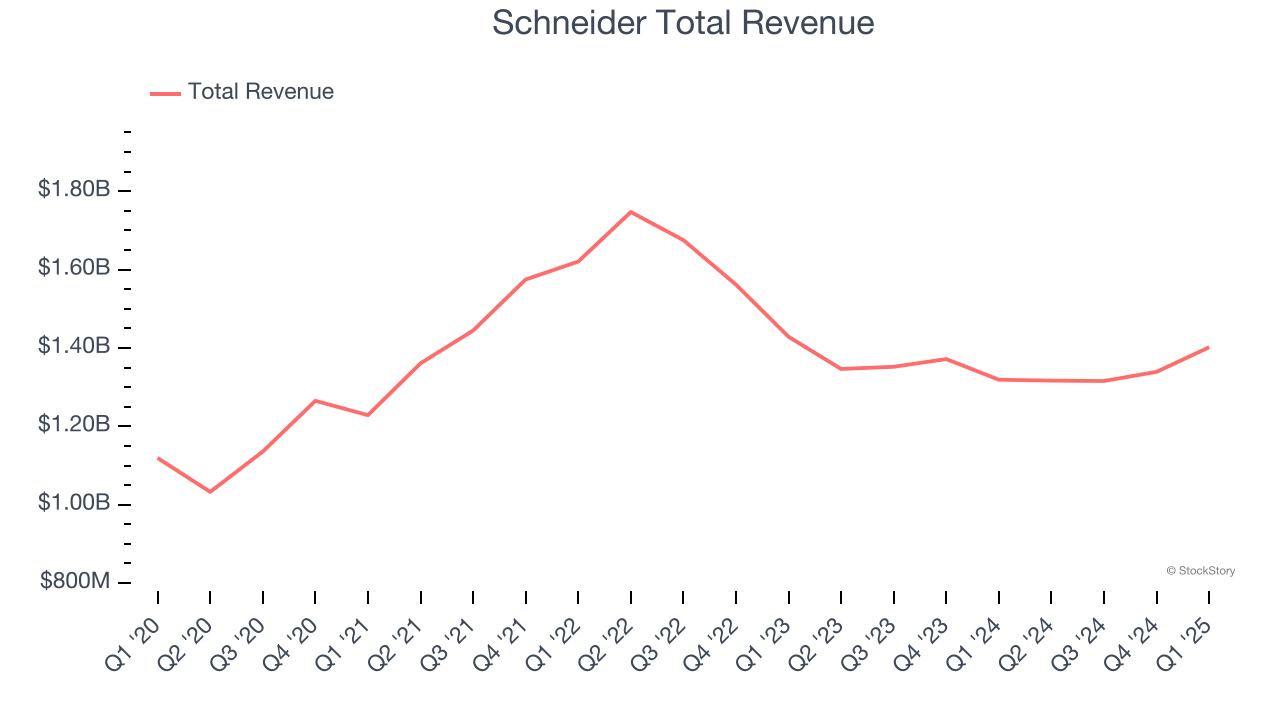

Schneider reported revenues of $1.40 billion, up 6.3% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 13.6% since reporting. It currently trades at $24.41.

Is now the time to buy Schneider? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Werner (NASDAQ:WERN)

Conducting business in over a 100 countries, Werner (NASDAQ:WERN) offers full-truckload, less-than-truckload, and intermodal delivery services.

Werner reported revenues of $712.1 million, down 7.4% year on year, falling short of analysts’ expectations by 3.4%. It was a disappointing quarter as it posted a miss of analysts’ Logistics revenue estimates.

As expected, the stock is down 4.9% since the results and currently trades at $26.30.

Read our full analysis of Werner’s results here.

RXO (NYSE:RXO)

With access to millions of trucks, RXO (NYSE:RXO) offers full-truckload, less-than-truckload, and last-mile deliveries.

RXO reported revenues of $1.43 billion, up 57% year on year. This result came in 3.5% below analysts' expectations. It was a slower quarter as it also recorded a significant miss of analysts’ EPS and EBITDA estimates.

RXO scored the fastest revenue growth among its peers. The stock is up 10.7% since reporting and currently trades at $15.20.

Read our full, actionable report on RXO here, it’s free.

Knight-Swift Transportation (NYSE:KNX)

Covering 1.6 billion loaded miles in 2023 alone, Knight-Swift Transportation (NYSE:KNX) offers less-than-truckload and full truckload delivery services.

Knight-Swift Transportation reported revenues of $1.82 billion, flat year on year. This number topped analysts’ expectations by 1.6%. Zooming out, it was a satisfactory quarter as it also produced an impressive beat of analysts’ EPS estimates but EPS guidance for next quarter missing analysts’ expectations.

The stock is up 11.2% since reporting and currently trades at $44.04.

Read our full, actionable report on Knight-Swift Transportation here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.