The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Dynex Capital (NYSE:DX) and the rest of the thrifts & mortgage finance stocks fared in Q1.

Thrifts & Mortgage Finance institutions operate by accepting deposits and extending loans primarily for residential mortgages, earning revenue through interest rate spreads (difference between lending rates and borrowing costs) and origination fees. The industry benefits from demographic tailwinds as millennials enter prime homebuying age, technological advancements streamlining the loan approval process, and potential interest rate stabilization improving affordability. However, significant headwinds include net interest margin compression during rate volatility, increased competition from fintech disruptors offering digital-first experiences, mounting regulatory compliance costs, and potential housing market corrections that could impact loan portfolios and default rates.

The 22 thrifts & mortgage finance stocks we track reported a slower Q1. As a group, revenues missed analysts’ consensus estimates by 18.5%.

In light of this news, share prices of the companies have held steady as they are up 1.7% on average since the latest earnings results.

Dynex Capital (NYSE:DX)

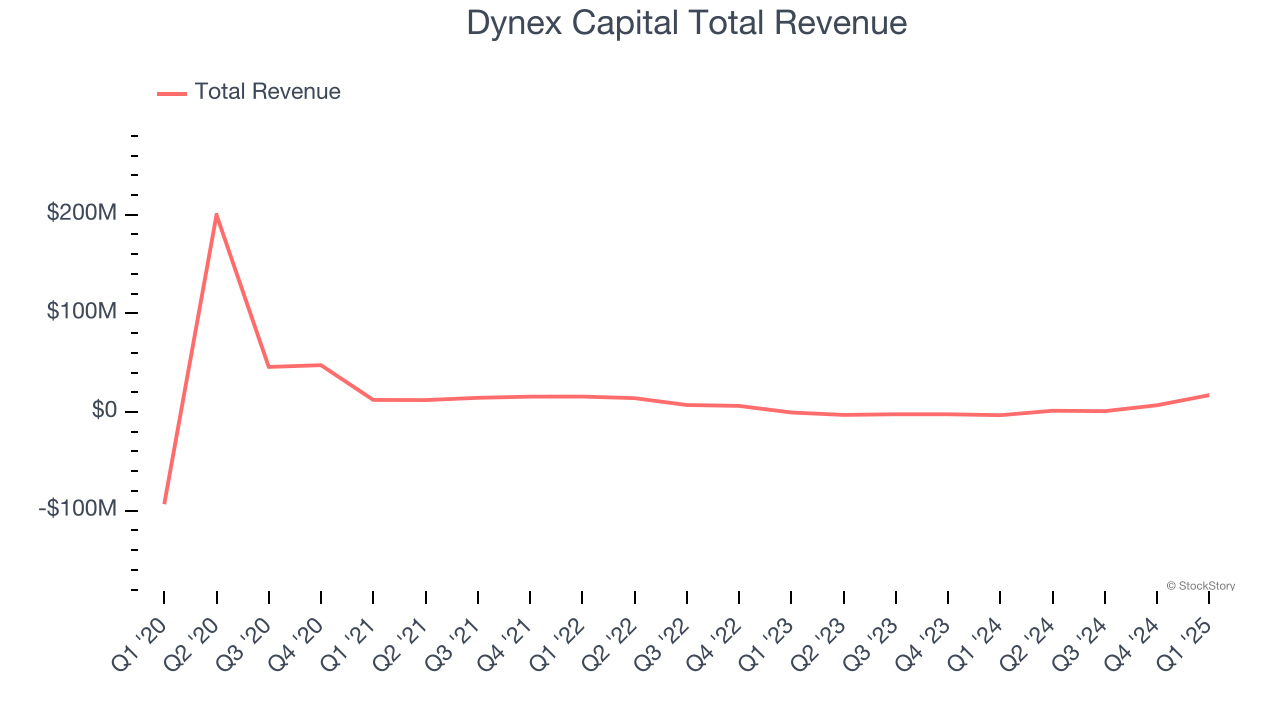

Operating in the financial markets since 1988 with a focus on capital preservation during economic turbulence, Dynex Capital (NYSE:DX) is a mortgage real estate investment trust that invests primarily in government-backed residential mortgage securities to generate income for shareholders.

Dynex Capital reported revenues of $17.13 million, up 637% year on year. This print fell short of analysts’ expectations by 22.4%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EPS estimates.

"Over the past several quarters, we have deliberately positioned ourselves for a more dynamic macroeconomic environment. We’ve taken decisive steps to build resilience, including raising capital at attractive terms, preserving liquidity, and adding flexibility across our portfolio," said Byron L. Boston, Chairman and Co-CEO.

Dynex Capital scored the fastest revenue growth of the whole group. Still, the market seems discontent with the results. The stock is down 5.8% since reporting and currently trades at $12.34.

Read our full report on Dynex Capital here, it’s free.

Best Q1: Northwest Bancshares (NASDAQ:NWBI)

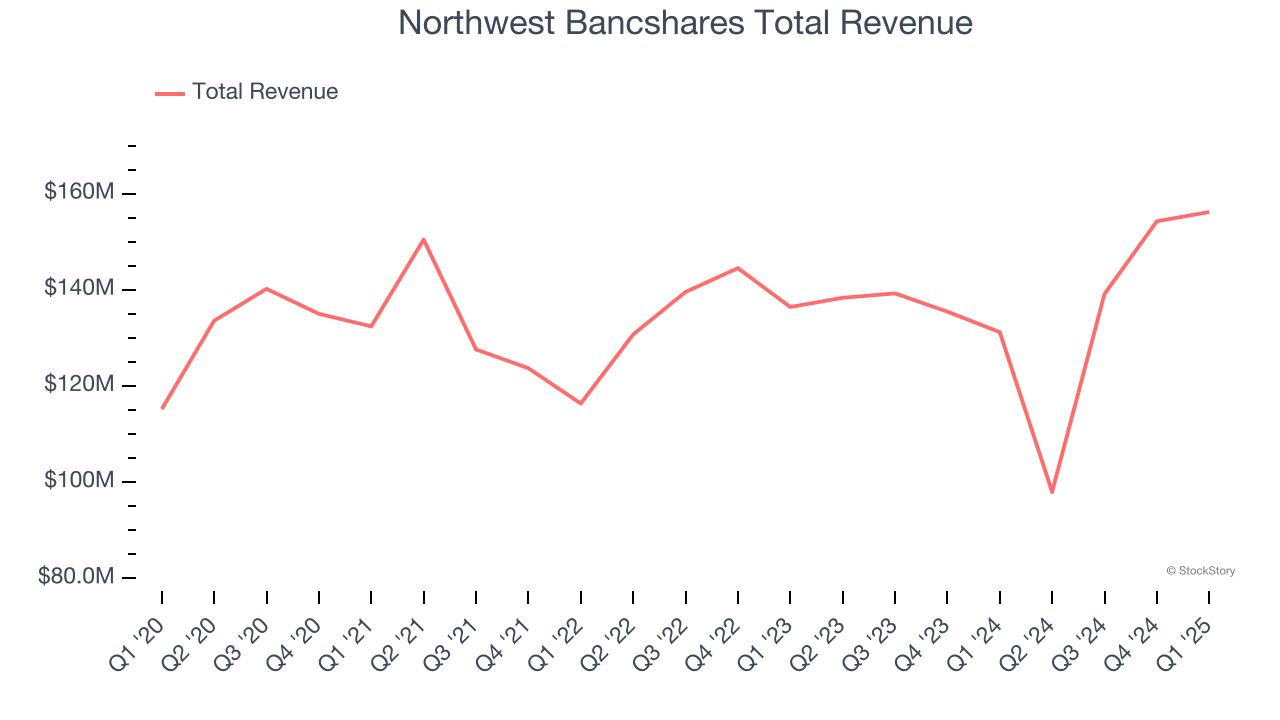

Founded in 1896 and operating across Pennsylvania, New York, Ohio, and Indiana, Northwest Bancshares (NASDAQ:NWBI) is a bank holding company that operates Northwest Bank, providing personal and business banking, investment management, and trust services.

Northwest Bancshares reported revenues of $156.2 million, up 19% year on year, outperforming analysts’ expectations by 9.9%. The business had a stunning quarter with a solid beat of analysts’ EPS and net interest income estimates.

The market seems happy with the results as the stock is up 5.8% since reporting. It currently trades at $12.50.

Is now the time to buy Northwest Bancshares? Access our full analysis of the earnings results here, it’s free.

Franklin BSP Realty Trust (NYSE:FBRT)

Operating as a specialized real estate investment trust (REIT) with roots dating back to 2012, Franklin BSP Realty Trust (NYSE:FBRT) originates and manages a diversified portfolio of commercial real estate debt investments secured by properties in the United States and abroad.

Franklin BSP Realty Trust reported revenues of $52.01 million, up 1.8% year on year, falling short of analysts’ expectations by 6%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 1.9% since the results and currently trades at $11.31.

Read our full analysis of Franklin BSP Realty Trust’s results here.

Ladder Capital (NYSE:LADR)

Founded during the 2008 financial crisis when traditional lenders retreated from commercial real estate, Ladder Capital (NYSE:LADR) is a real estate investment trust that originates commercial real estate loans, owns commercial properties, and invests in real estate securities.

Ladder Capital reported revenues of $51.28 million, down 18.9% year on year. This number lagged analysts' expectations by 7.1%. It was a disappointing quarter as it also logged a significant miss of analysts’ tangible book value per share and EPS estimates.

The stock is flat since reporting and currently trades at $10.76.

Read our full, actionable report on Ladder Capital here, it’s free.

Flagstar Financial (NYSE:FLG)

Tracing its roots back to 1859 and rebranded from New York Community Bancorp in 2024, Flagstar Financial (NYSE:FLG) is a bank holding company that offers commercial and consumer banking services, with specialties in multi-family lending, mortgage originations, and warehouse lending.

Flagstar Financial reported revenues of $490 million, down 22.6% year on year. This print came in 4% below analysts' expectations. It was a slower quarter as it also recorded a significant miss of analysts’ net interest income estimates.

The stock is up 2.5% since reporting and currently trades at $11.55.

Read our full, actionable report on Flagstar Financial here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.