Since December 2024, Bentley has been in a holding pattern, floating around $48.27.

Given the underwhelming price action, is now a good time to buy BSY? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does BSY Stock Spark Debate?

Founded by brothers Keith and Barry Bentley, Bentley Systems (NASDAQ:BSY) offers a software-as-a-service platform that addresses the lifecycle of infrastructure projects such as road networks, tunnel systems, and wastewater facilities.

Two Positive Attributes:

1. Strong Retention Supports Growth and Profitability

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

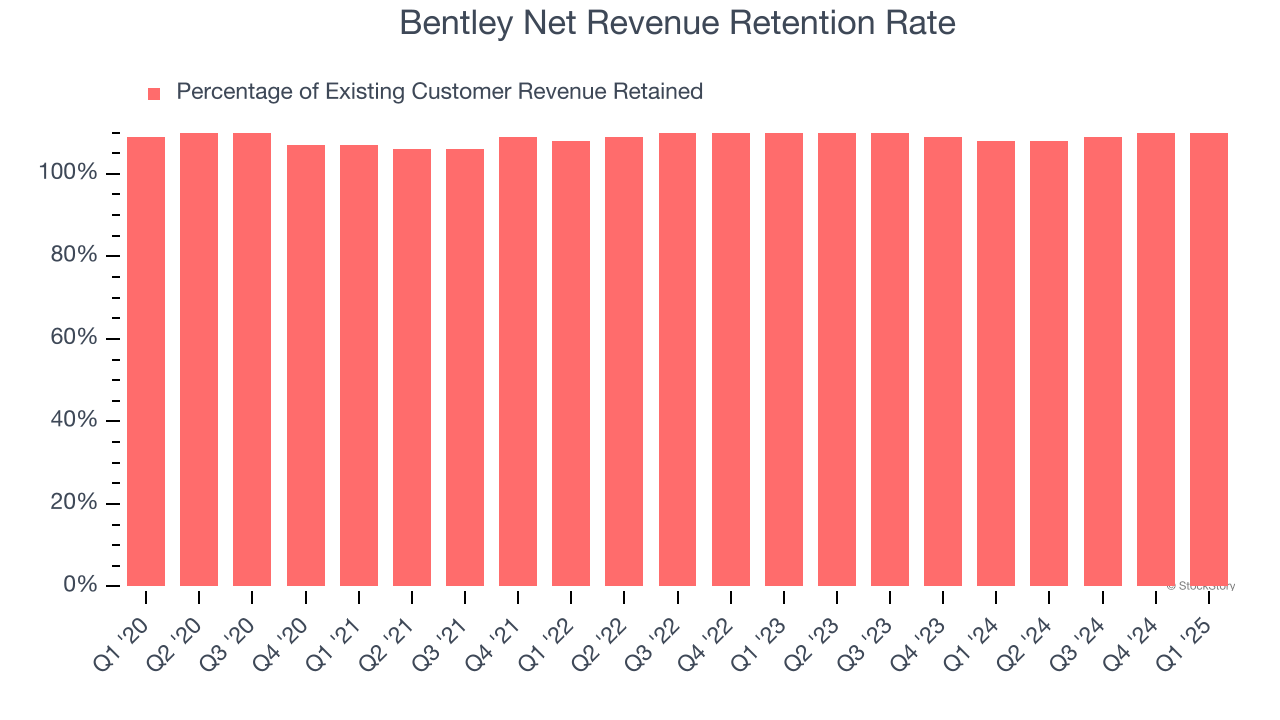

Bentley’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 109% in Q1. This means Bentley would’ve grown its revenue by 9.3% even if it didn’t win any new customers over the last 12 months.

Bentley has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Bentley is extremely efficient at acquiring new customers, and its CAC payback period checked in at 11.9 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Bentley more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

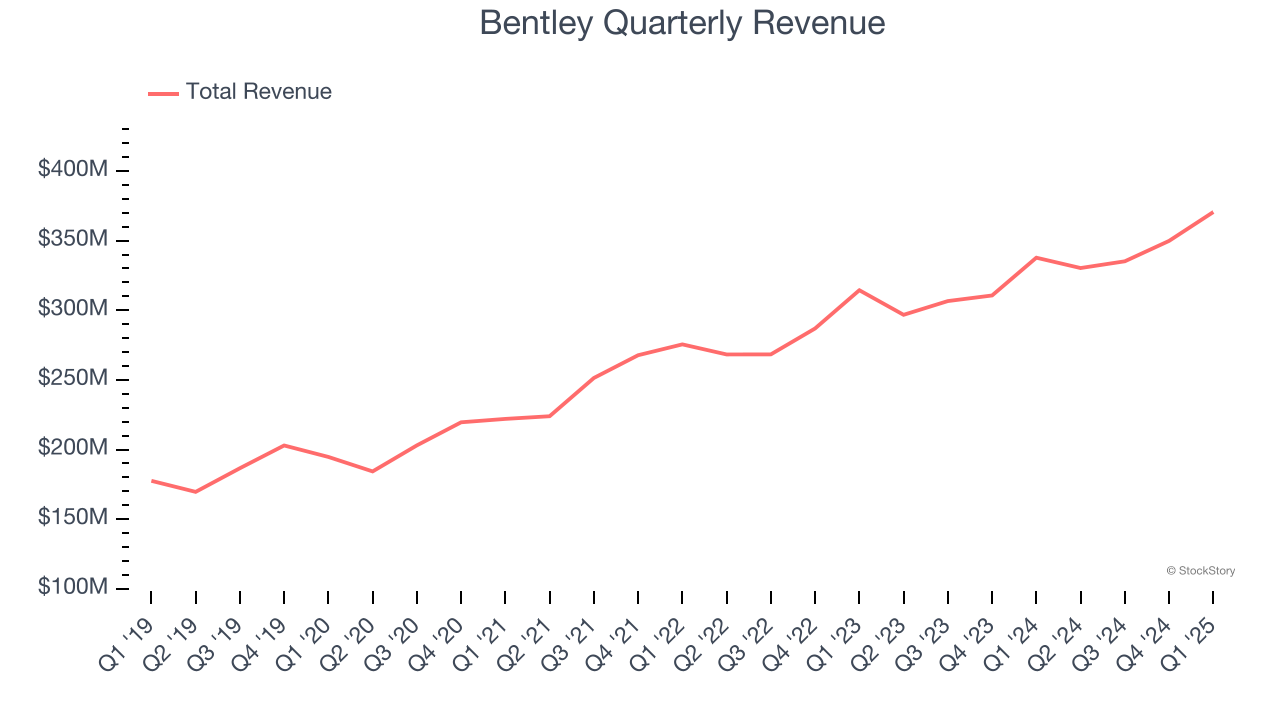

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Bentley grew its sales at a 10.8% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Bentley.

Final Judgment

Bentley’s positive characteristics outweigh the negatives, but at $48.27 per share (or 10.6× forward price-to-sales), is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.