Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Carter's (NYSE:CRI) and the best and worst performers in the apparel and accessories industry.

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 16 apparel and accessories stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.7% since the latest earnings results.

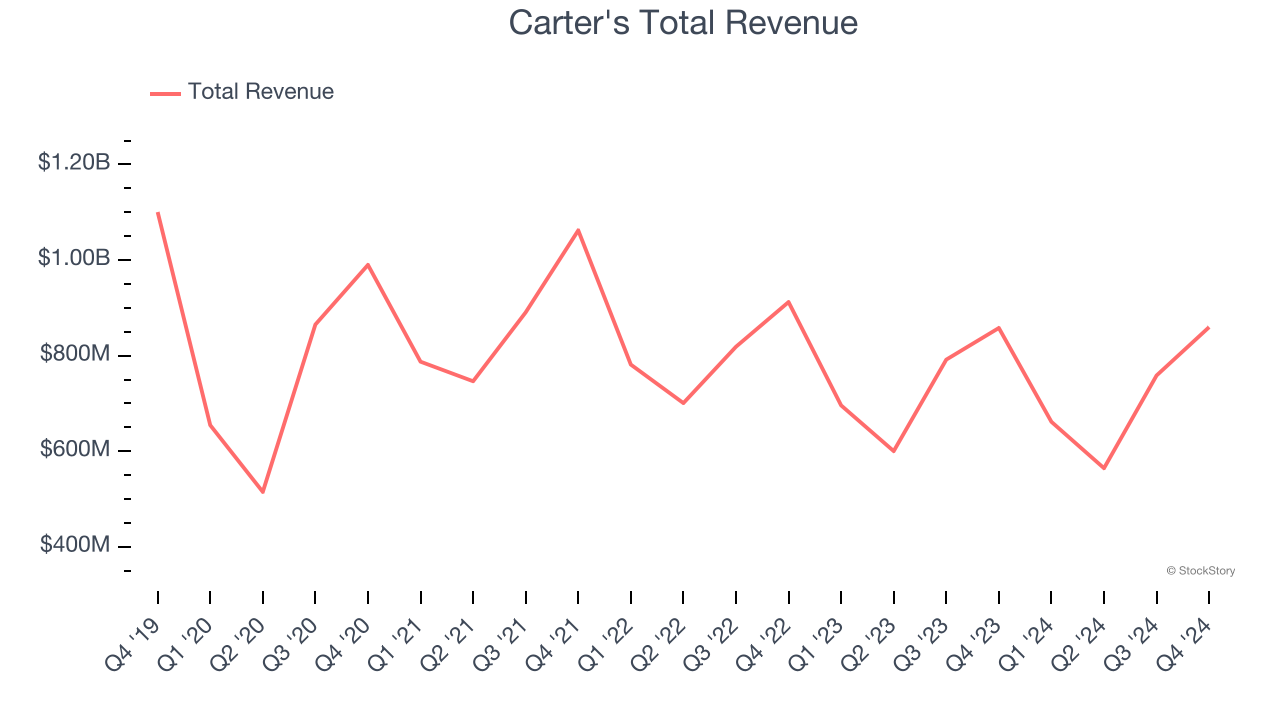

Carter's (NYSE:CRI)

Rumored to sell more than 10 products for every child born in the United States, Carter's (NYSE:CRI) is an American designer and marketer of children's apparel.

Carter's reported revenues of $859.7 million, flat year on year. This print exceeded analysts’ expectations by 3%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ same-store sales estimates but full-year EPS guidance missing analysts’ expectations significantly.

“Our product, pricing and promotional strategies in the fourth quarter drove a continued trend improvement in traffic, conversion and comparable sales in our U.S. Retail businesses,” said Richard F. Westenberger, Interim Chief Executive Officer, Senior Executive Vice President, Chief Financial Officer & Chief Operating Officer.

The stock is down 30% since reporting and currently trades at $36.48.

Is now the time to buy Carter's? Access our full analysis of the earnings results here, it’s free.

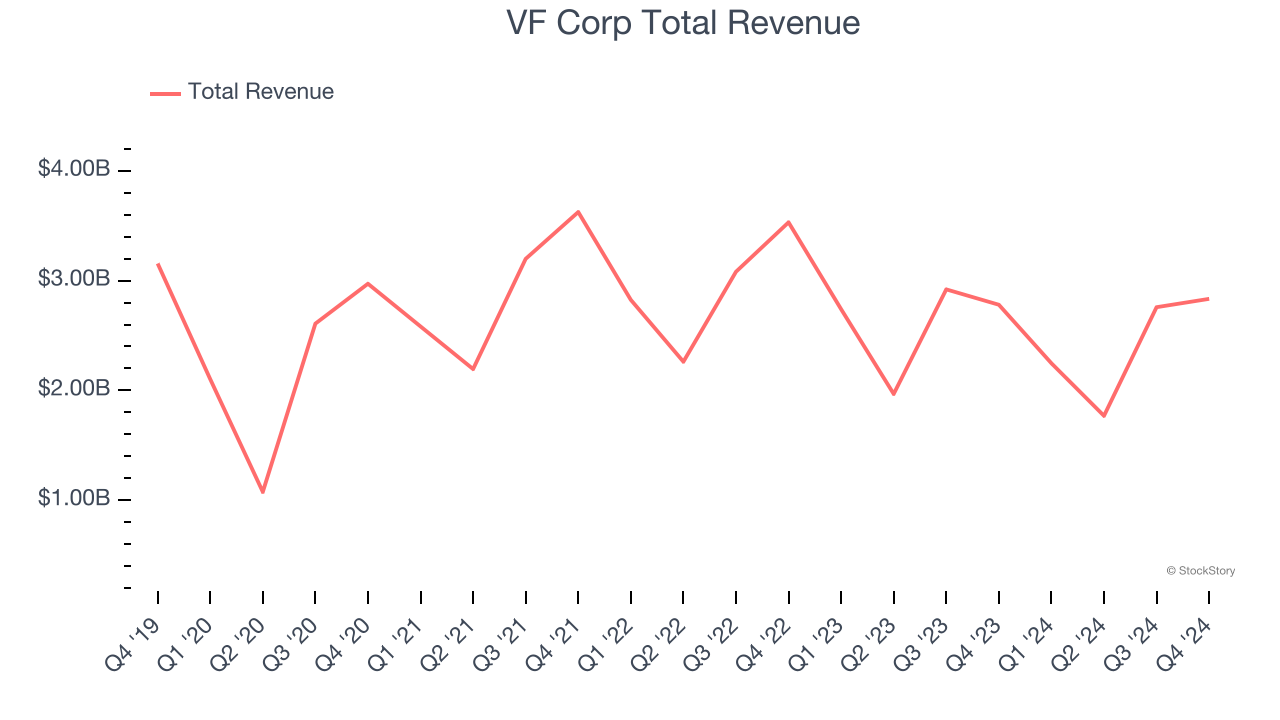

Best Q4: VF Corp (NYSE:VFC)

Owner of The North Face, Vans, and Supreme, VF Corp (NYSE:VFC) is a clothing conglomerate specializing in branded lifestyle apparel, footwear, and accessories.

VF Corp reported revenues of $2.83 billion, up 1.9% year on year, outperforming analysts’ expectations by 1.2%. The business had a stunning quarter with a solid beat of analysts’ constant currency revenue and EPS estimates.

The stock is down 56.3% since reporting. It currently trades at $11.62.

Is now the time to buy VF Corp? Access our full analysis of the earnings results here, it’s free.

Guess (NYSE:GES)

Flexing the iconic upside-down triangle logo with a question mark, Guess (NYSE:GES) is a global fashion brand known for its trendy clothing, accessories, and denim wear.

Guess reported revenues of $932.3 million, up 4.6% year on year, exceeding analysts’ expectations by 2.9%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 1% since the results and currently trades at $9.98.

Read our full analysis of Guess’s results here.

Under Armour (NYSE:UAA)

Founded in 1996 by a former University of Maryland football player, Under Armour (NYSE:UAA) is an apparel brand specializing in sportswear designed to improve athletic performance.

Under Armour reported revenues of $1.40 billion, down 5.7% year on year. This print beat analysts’ expectations by 4.5%. It was an exceptional quarter as it also logged an impressive beat of analysts’ constant currency revenue estimates and a solid beat of analysts’ EPS estimates.

Under Armour had the slowest revenue growth among its peers. The stock is down 33.1% since reporting and currently trades at $5.51.

Read our full, actionable report on Under Armour here, it’s free.

Levi's (NYSE:LEVI)

Credited for inventing the first pair of blue jeans in 1873, Levi's (NYSE:LEVI) is an apparel company renowned for its iconic denim products and classic American style.

Levi's reported revenues of $1.53 billion, down 2% year on year. This number lagged analysts' expectations by 0.8%. Zooming out, it was actually a strong quarter as it logged a solid beat of analysts’ constant currency revenue estimates and an impressive beat of analysts’ EPS estimates.

The stock is up 10.2% since reporting and currently trades at $14.86.

Read our full, actionable report on Levi's here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.