Blue Bird’s stock price has taken a beating over the past six months, shedding 27.2% of its value and falling to $33.05 per share. This might have investors contemplating their next move.

Following the drawdown, is now the time to buy BLBD? Find out in our full research report, it’s free.

Why Are We Positive On BLBD?

With around a century of experience, Blue Bird (NASDAQ:BLBD) is a manufacturer of school buses and complementary parts.

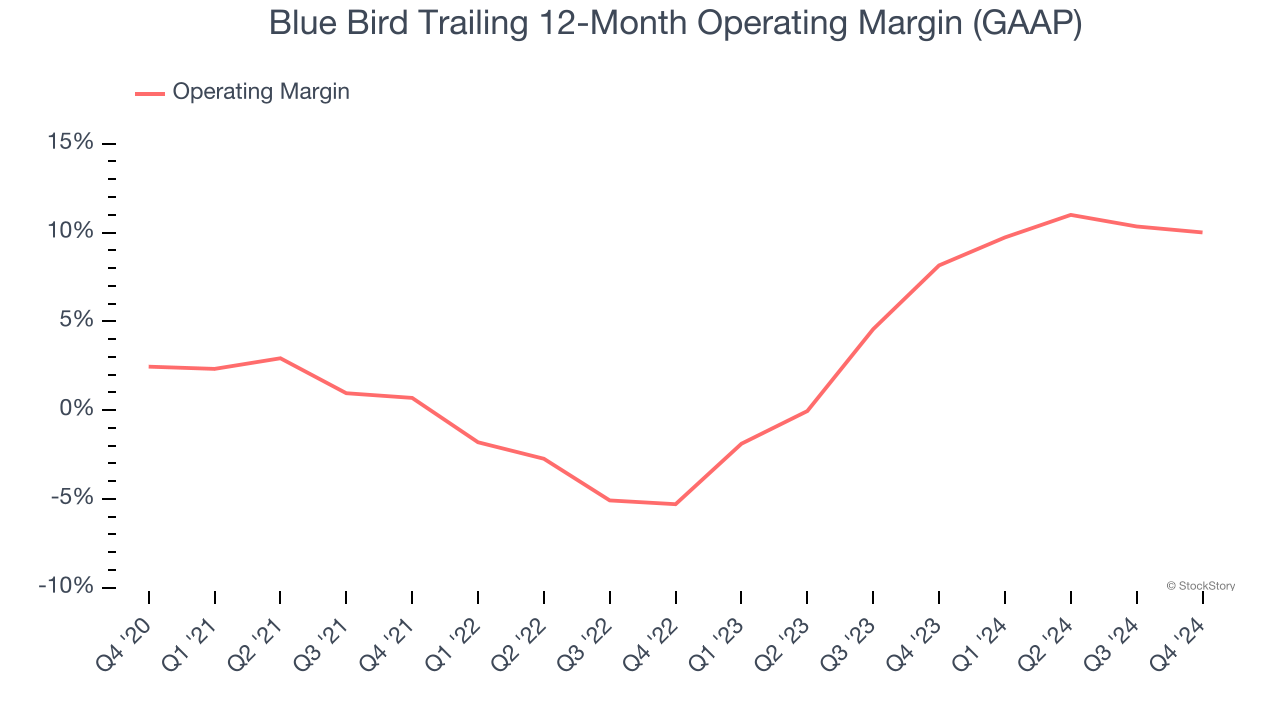

1. Operating Margin Rising, Profits Up

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Blue Bird’s operating margin rose by 7.6 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 10%.

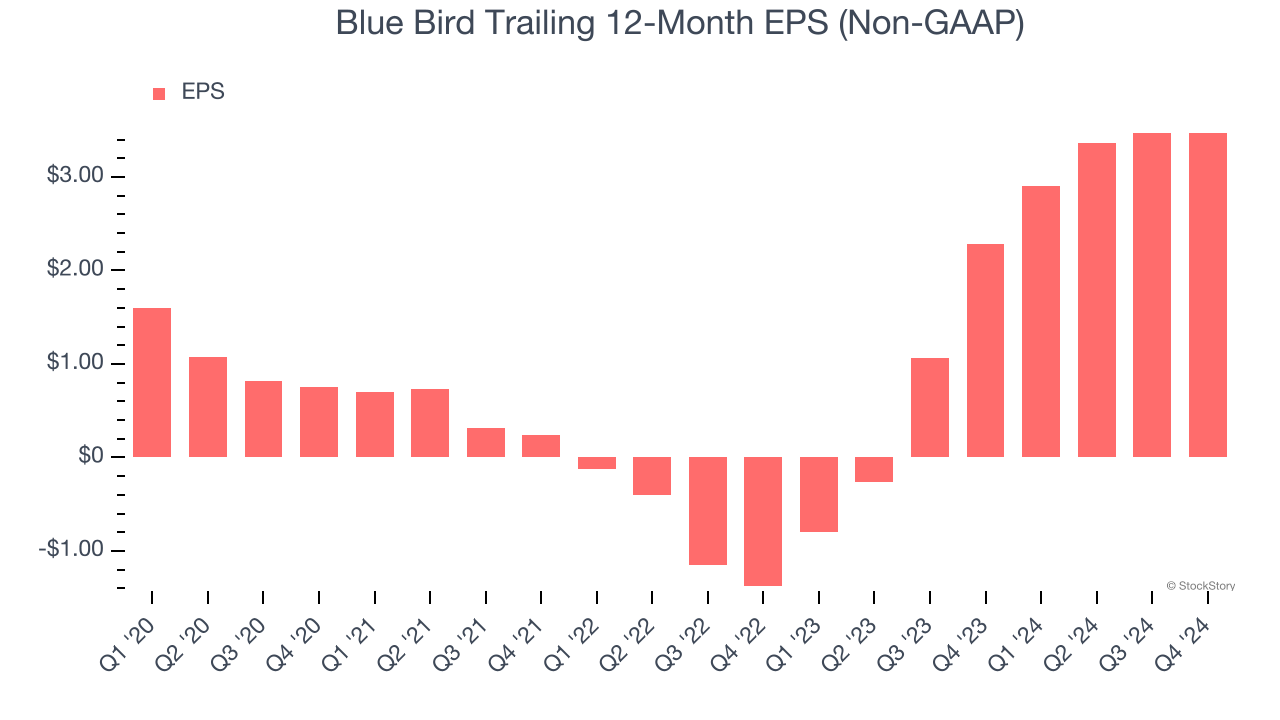

2. EPS Increasing Steadily

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Blue Bird’s EPS grew at a solid 11.5% compounded annual growth rate over the last five years, higher than its 5.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

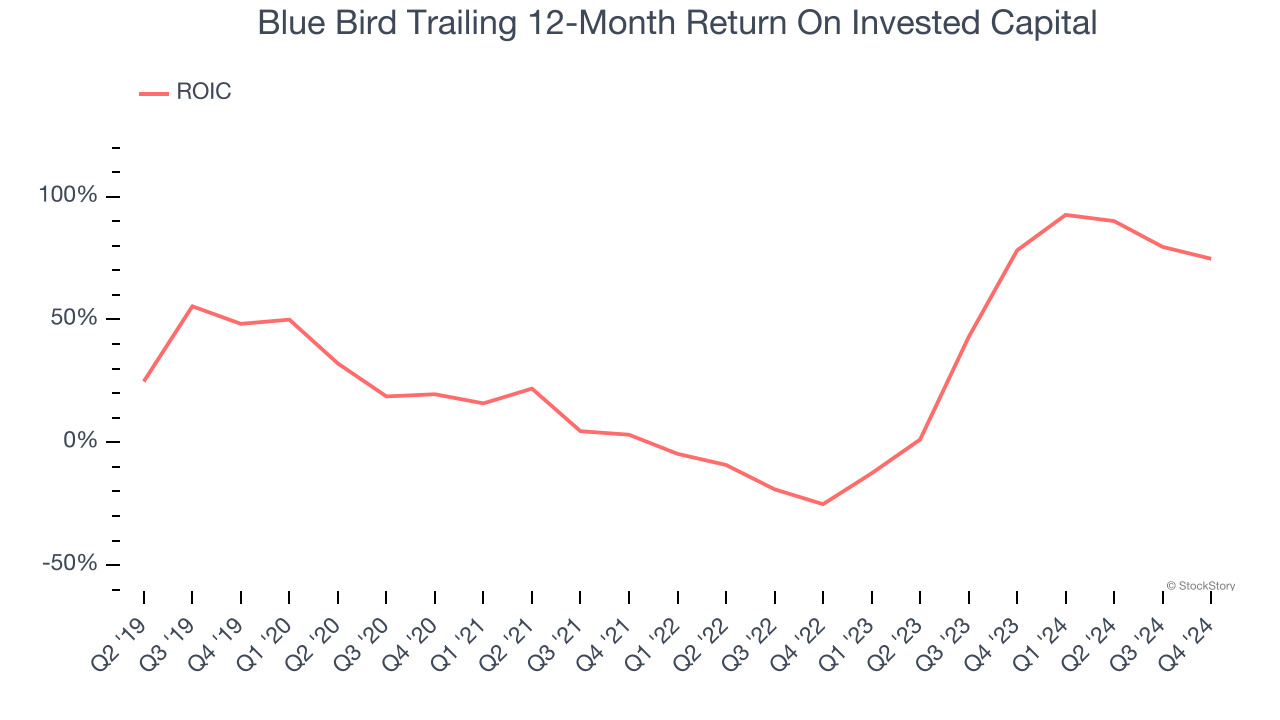

3. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Blue Bird’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

These are just a few reasons why Blue Bird ranks highly on our list. With the recent decline, the stock trades at 8.2× forward price-to-earnings (or $33.05 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Blue Bird

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.