Since April 2020, the S&P 500 has delivered a total return of 85%. But one standout stock has more than doubled the market - over the past five years, Sanmina has surged 191% to $76.72 per share. Its momentum hasn’t stopped as it’s also gained 12.5% in the last six months, beating the S&P by 21.4%.

Is there a buying opportunity in Sanmina, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why there are better opportunities than SANM and a stock we'd rather own.

Why Do We Think Sanmina Will Underperform?

Founded in 1980, Sanmina (NASDAQ:SANM) is an electronics manufacturing services company offering end-to-end solutions for various industries.

1. Long-Term Revenue Growth Flatter Than a Pancake

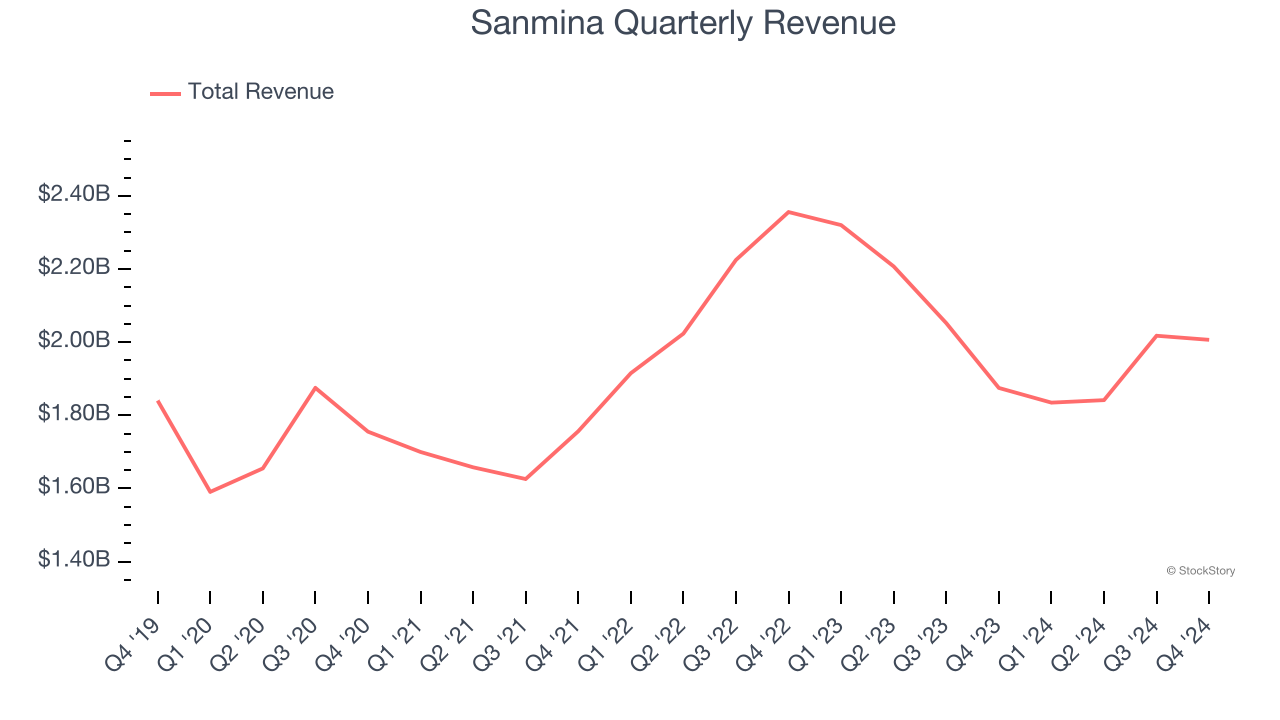

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Sanmina struggled to consistently increase demand as its $7.7 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

2. Low Gross Margin Reveals Weak Structural Profitability

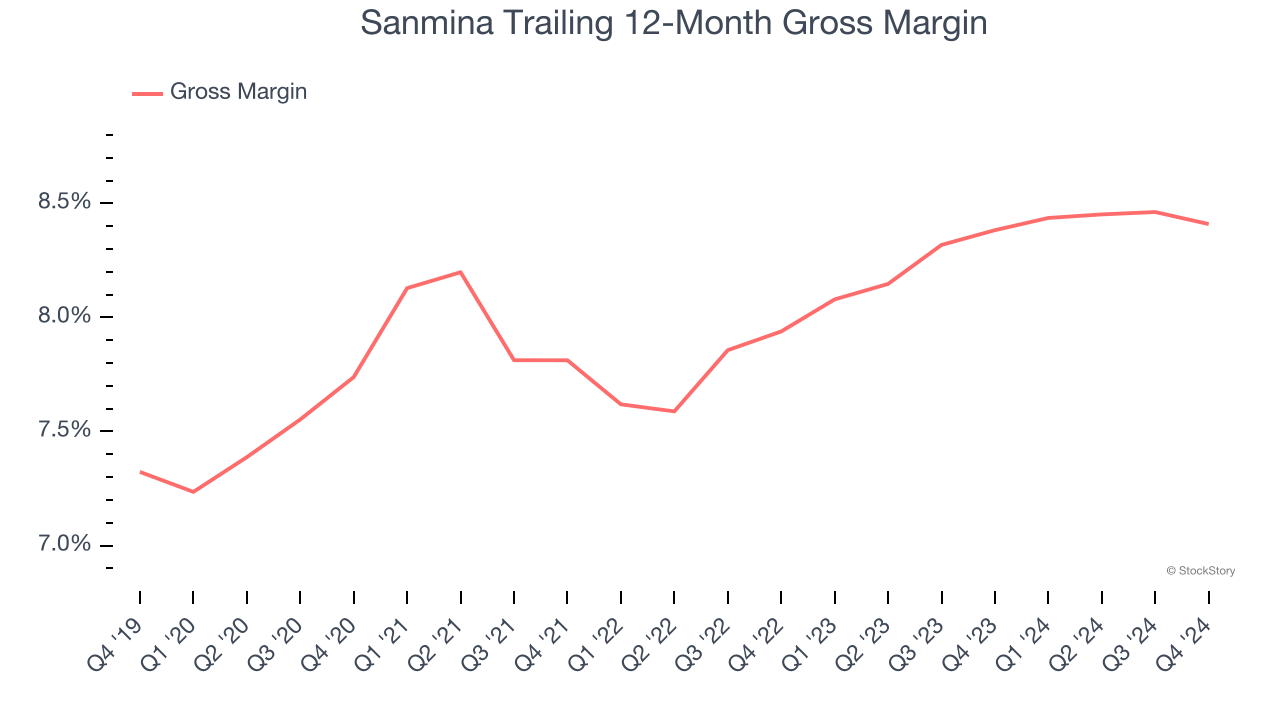

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

Sanmina has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 8.1% gross margin over the last five years. That means Sanmina paid its suppliers a lot of money ($91.93 for every $100 in revenue) to run its business.

3. EPS Took a Dip Over the Last Two Years

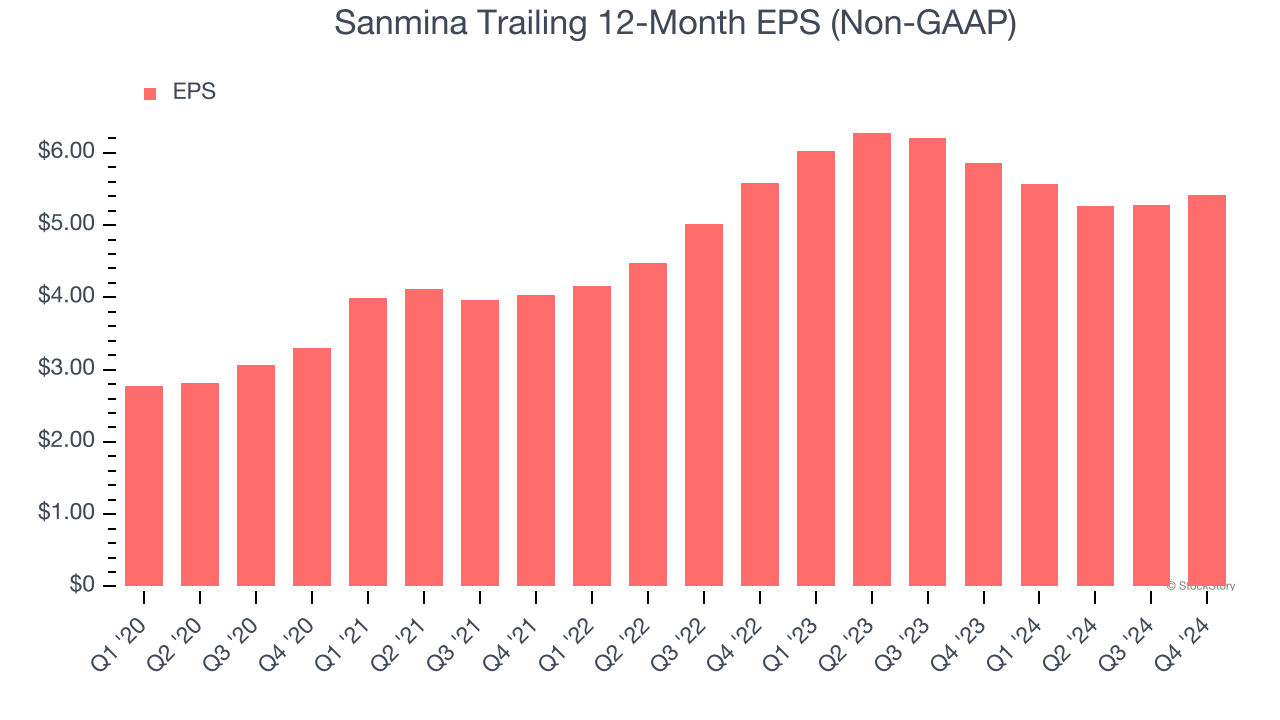

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Sanmina, its EPS and revenue declined by 1.4% and 4.9% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Sanmina’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Sanmina, we’ll be cheering from the sidelines. With its shares outperforming the market lately, the stock trades at 11.9× forward price-to-earnings (or $76.72 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are superior stocks to buy right now. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Sanmina

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.