Let’s dig into the relative performance of Alphabet (NASDAQ:GOOGL) and its peers as we unravel the now-completed Q4 consumer internet earnings season.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 50 consumer internet stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 21.4% since the latest earnings results.

Alphabet (NASDAQ:GOOGL)

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ:GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

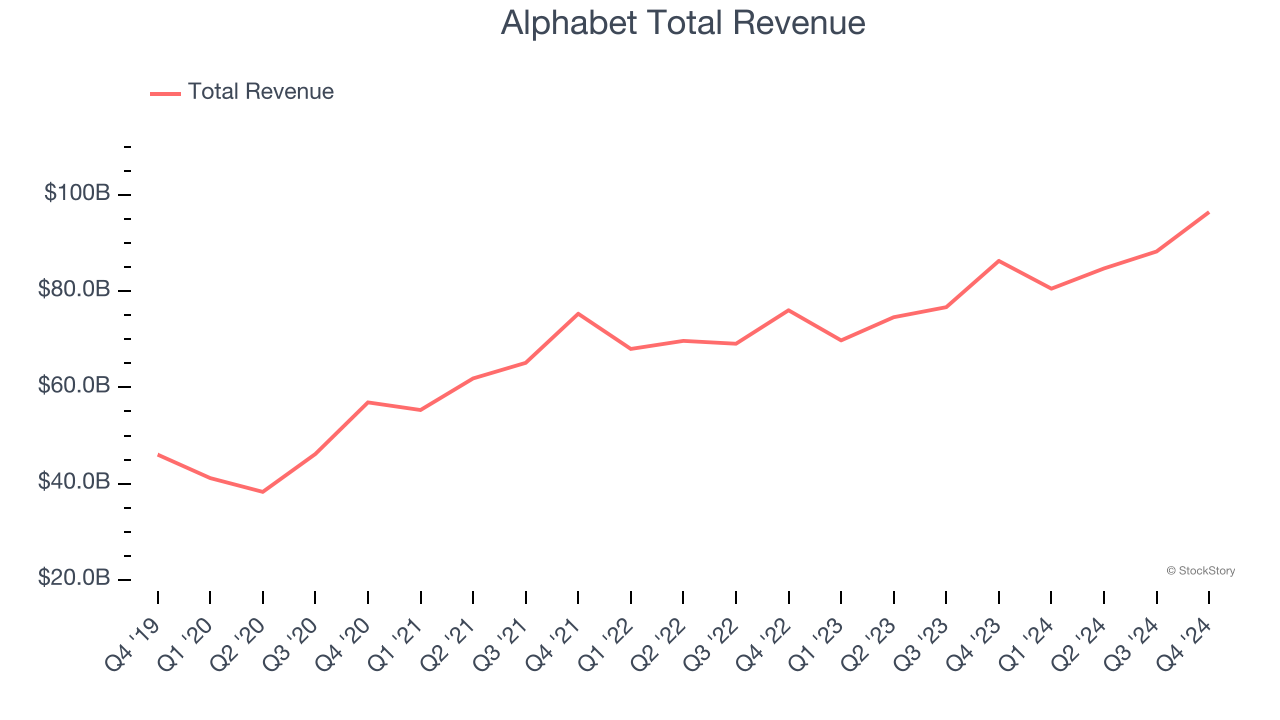

Alphabet reported revenues of $96.47 billion, up 11.8% year on year. It was encouraging to see Alphabet beat analysts’ operating income expectations this quarter. On the other hand, its total revenue was in line and its all-important Google Cloud revenue missed, spooking some investors with high expectations.

The stock is down 25% since reporting and currently trades at $154.64.

Is now the time to buy Alphabet? Access our full analysis of the earnings results here, it’s free.

Best Q4: Carvana (NYSE:CVNA)

Known for its glass tower car vending machines, Carvana (NYSE:CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

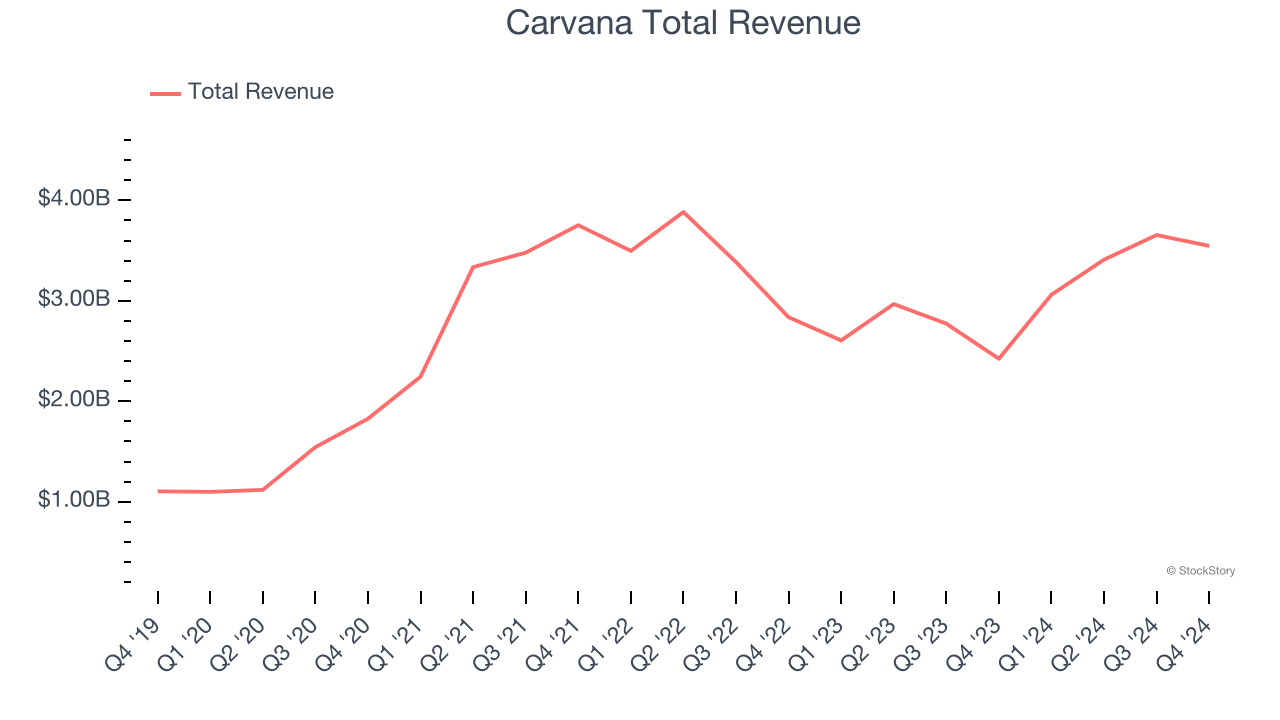

Carvana reported revenues of $3.55 billion, up 46.3% year on year, outperforming analysts’ expectations by 6.2%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

The stock is down 26% since reporting. It currently trades at $208.53.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $20.37 million, down 34.5% year on year, falling short of analysts’ expectations by 18.7%. It was a disappointing quarter as it posted a decline in its users.

Skillz delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 110,000 monthly active users, down 19.7% year on year. As expected, the stock is down 18.6% since the results and currently trades at $4.15.

Read our full analysis of Skillz’s results here.

Chewy (NYSE:CHWY)

Founded by Ryan Cohen, who later became known for his involvement in GameStop, Chewy (NYSE:CHWY) is an online retailer specializing in pet food, supplies, and healthcare services.

Chewy reported revenues of $3.25 billion, up 14.9% year on year. This number surpassed analysts’ expectations by 1.5%. Overall, it was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates.

The stock is down 4.3% since reporting and currently trades at $32.07.

Read our full, actionable report on Chewy here, it’s free.

Reddit (NYSE:RDDT)

Founded in 2005 by two University of Virginia roommates, Reddit (NYSE:RDDT) facilitates user-generated content across niche communities (called subreddits) that discuss anything from stocks to dating and memes.

Reddit reported revenues of $427.7 million, up 71.3% year on year. This print topped analysts’ expectations by 4.6%. Aside from that, it was a satisfactory quarter as it also recorded EBITDA guidance for next quarter exceeding analysts’ expectations.

The company reported 48 million daily active users, up 31.9% year on year. The stock is down 50.8% since reporting and currently trades at $106.56.

Read our full, actionable report on Reddit here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.