Latin American e-commerce and fintech company MercadoLibre (NASDAQ:MELI) announced better-than-expected revenue in Q4 CY2024, with sales up 37.4% year on year to $6.06 billion. Its GAAP profit of $12.61 per share was 66.8% above analysts’ consensus estimates.

Is now the time to buy MercadoLibre? Find out by accessing our full research report, it’s free.

MercadoLibre (MELI) Q4 CY2024 Highlights:

- Revenue: $6.06 billion vs analyst estimates of $5.89 billion (37.4% year-on-year growth, 2.8% beat)

- EPS (GAAP): $12.61 vs analyst estimates of $7.56 (66.8% beat)

- Adjusted EBITDA: $972 million vs analyst estimates of $757.5 million (16% margin, 28.3% beat)

- Operating Margin: 13.5%, up from 7.6% in the same quarter last year

- Free Cash Flow Margin: 43.2%, up from 25.9% in the previous quarter

- Unique Active Users: 67 million, up 12.6 million year on year

- Market Capitalization: $105.2 billion

Company Overview

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

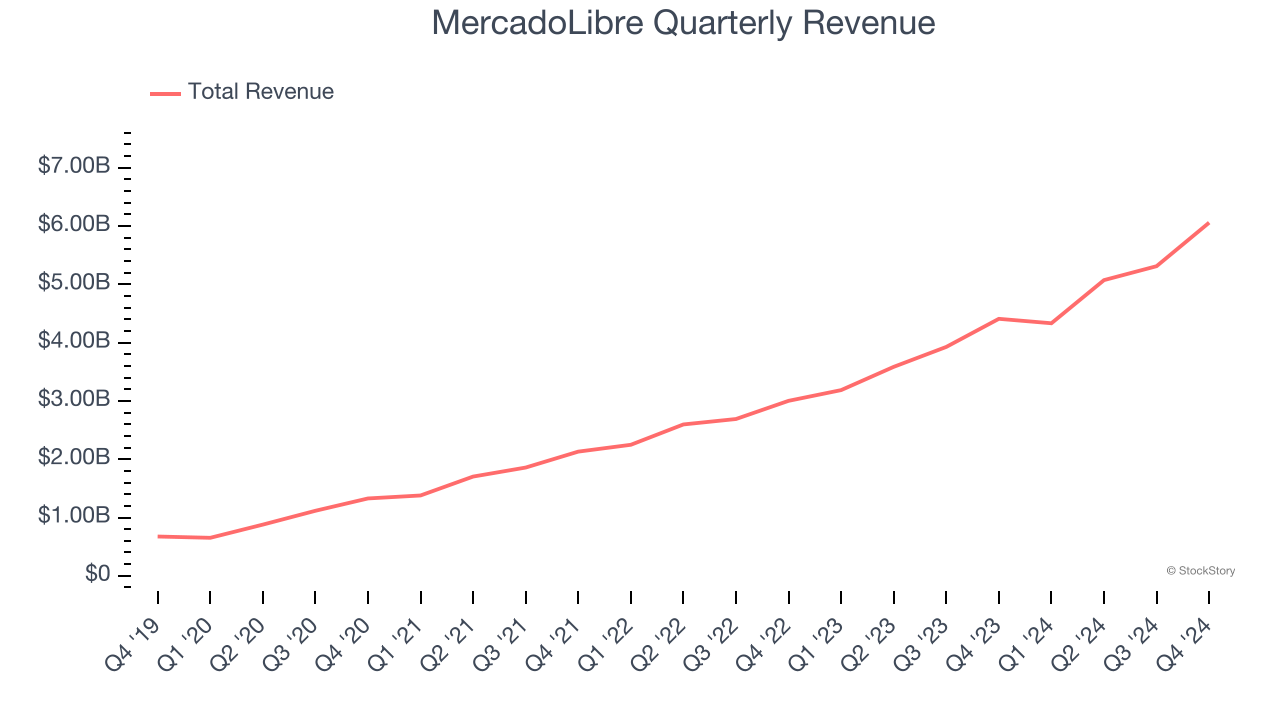

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Thankfully, MercadoLibre’s 43.2% annualized revenue growth over the last three years was incredible. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, MercadoLibre reported wonderful year-on-year revenue growth of 37.4%, and its $6.06 billion of revenue exceeded Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to grow 21.4% over the next 12 months, a deceleration versus the last three years. We still think its growth trajectory is attractive given its scale and implies the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Unique Active Users

User Growth

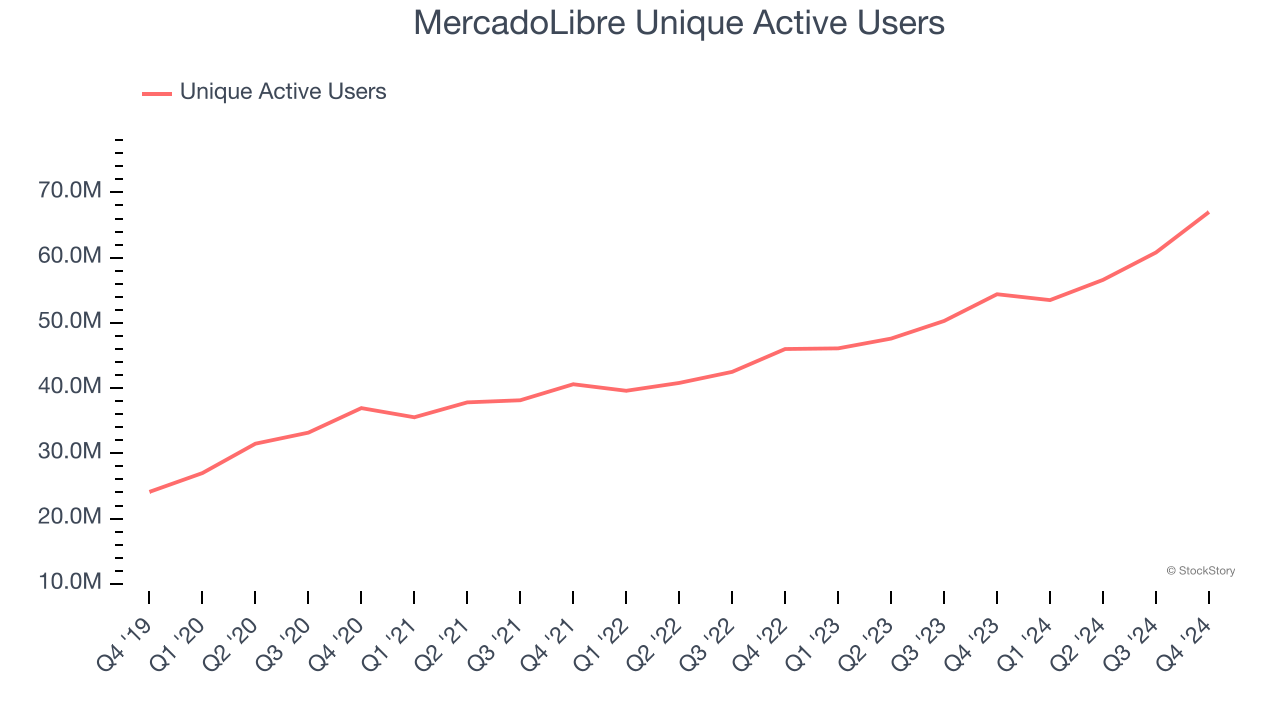

As an online marketplace, MercadoLibre generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, MercadoLibre’s unique active users, a key performance metric for the company, increased by 18.6% annually to 67 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q4, MercadoLibre added 12.6 million unique active users, leading to 23.2% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

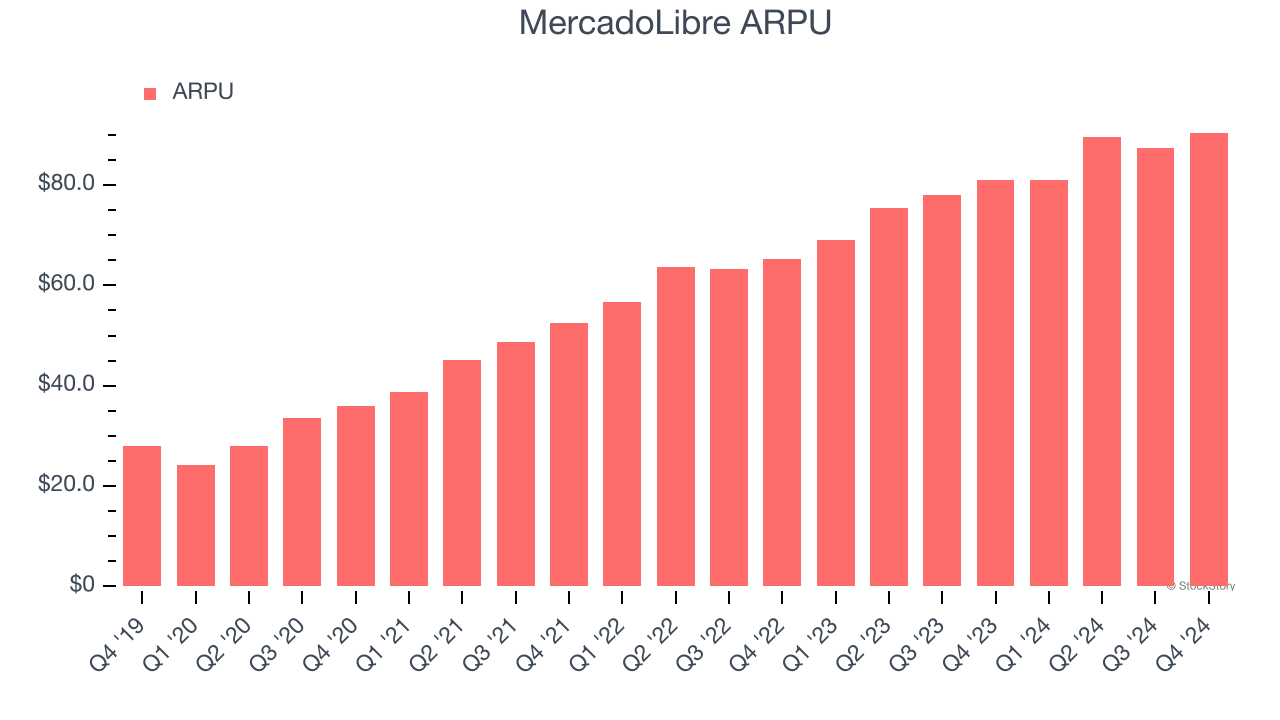

Average revenue per user (ARPU) is a critical metric to track for online marketplace businesses like MercadoLibre because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and MercadoLibre’s take rate, or "cut", on each order.

MercadoLibre’s ARPU growth has been exceptional over the last two years, averaging 18.4%. Its ability to increase monetization while growing its unique active users at an impressive rate reflects the strength of its platform, as its users are spending significantly more than last year.

This quarter, MercadoLibre’s ARPU clocked in at $90.43. It grew by 11.6% year on year, slower than its user growth.

Key Takeaways from MercadoLibre’s Q4 Results

We were impressed by how significantly MercadoLibre blew past analysts’ EPS and EBITDA expectations this quarter. We were also glad its revenue and number of unique active users outperformed Wall Street’s estimates. Drivers of the company's performance included better-than-anticipated TPV (total payment volume) growth, healthy adoption of its credit card offering, and fixed cost leverage from its logistics division. Zooming out, we think this was a solid quarter. The stock traded up 12.3% to $2,380 immediately after reporting.

MercadoLibre put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.