As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the leisure facilities industry, including United Parks & Resorts (NYSE:PRKS) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 11 leisure facilities stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 1.4% below.

While some leisure facilities stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.2% since the latest earnings results.

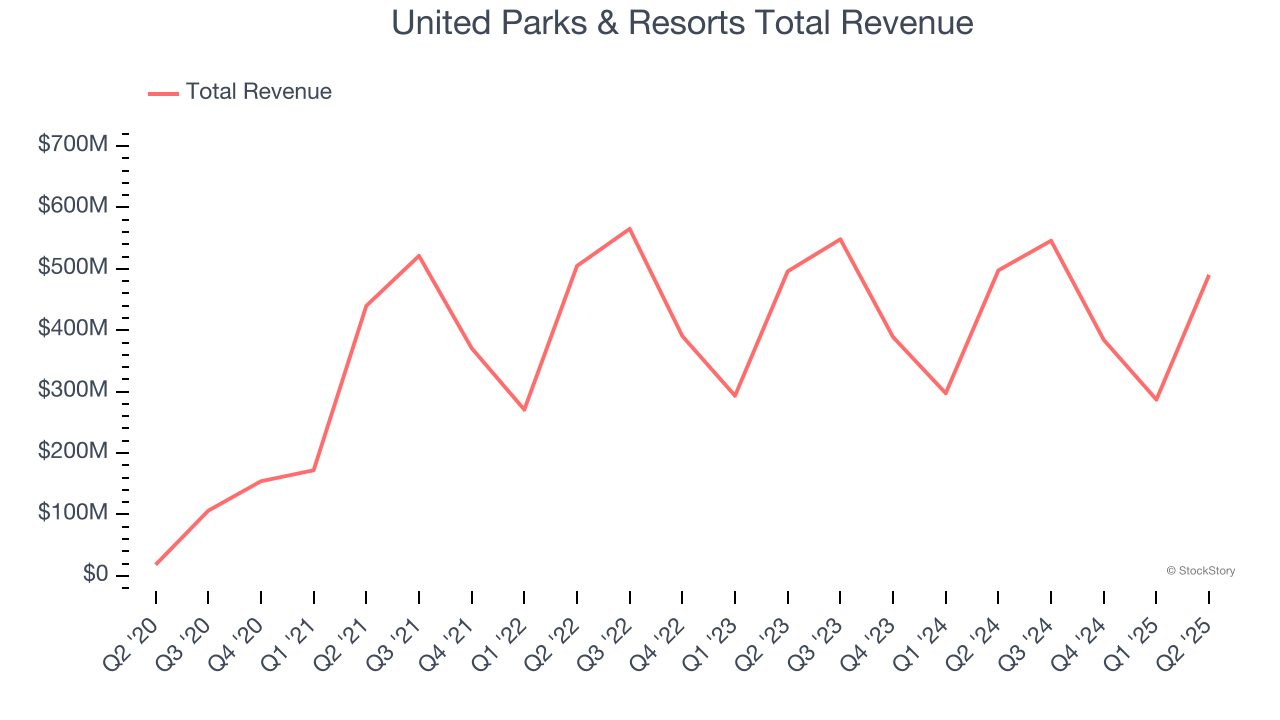

United Parks & Resorts (NYSE:PRKS)

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE:PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

United Parks & Resorts reported revenues of $490.2 million, down 1.5% year on year. This print fell short of analysts’ expectations by 2.1%. Overall, it was a softer quarter for the company with a significant miss of analysts’ EPS estimates and a miss of analysts’ adjusted operating income estimates.

Interestingly, the stock is up 10.7% since reporting and currently trades at $51.14.

Is now the time to buy United Parks & Resorts? Access our full analysis of the earnings results here, it’s free for active Edge members.

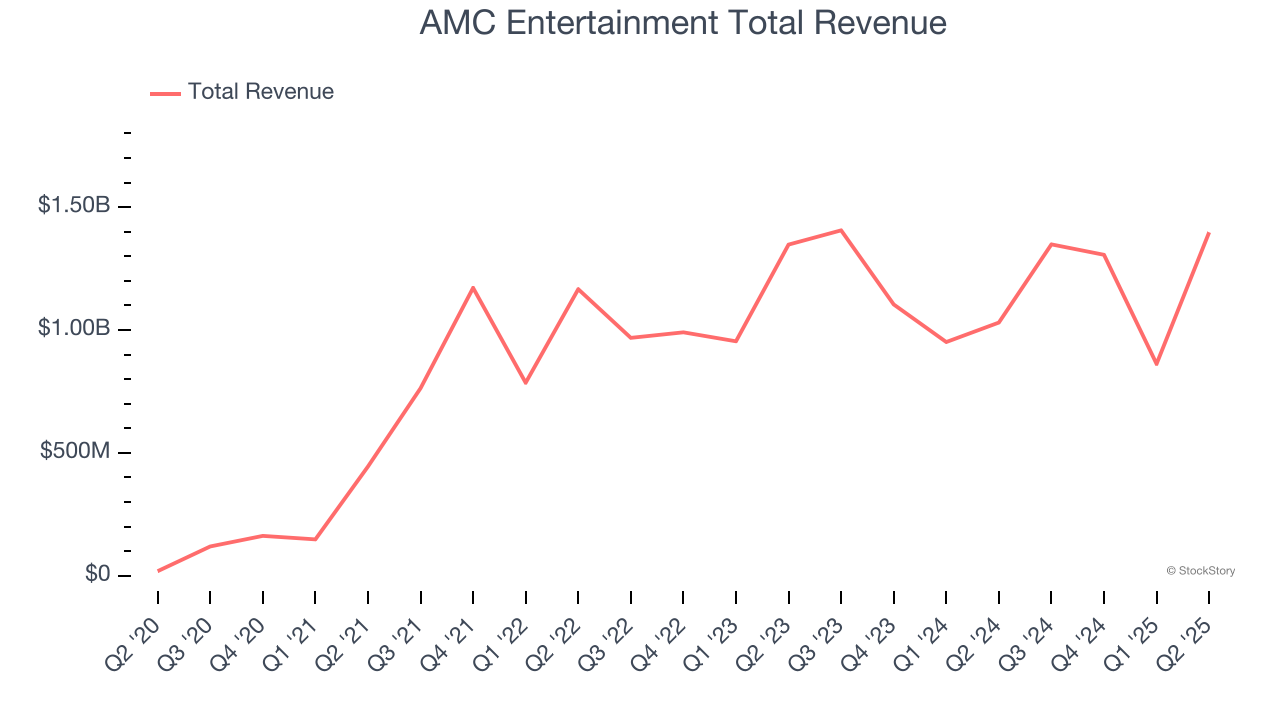

Best Q2: AMC Entertainment (NYSE:AMC)

With a profile that was raised due to meme stock mania beginning in 2021, AMC Entertainment (NYSE:AMC) operates movie theaters primarily in the US and Europe.

AMC Entertainment reported revenues of $1.40 billion, up 35.6% year on year, outperforming analysts’ expectations by 3.1%. The business had a stunning quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

AMC Entertainment scored the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 7.5% since reporting. It currently trades at $2.72.

Is now the time to buy AMC Entertainment? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Dave & Buster's (NASDAQ:PLAY)

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ:PLAY) operates a chain of arcades providing immersive entertainment experiences.

Dave & Buster's reported revenues of $557.4 million, flat year on year, falling short of analysts’ expectations by 0.9%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 29.4% since the results and currently trades at $17.08.

Read our full analysis of Dave & Buster’s results here.

Vail Resorts (NYSE:MTN)

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE:MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

Vail Resorts reported revenues of $271.3 million, up 2.2% year on year. This result lagged analysts' expectations by 0.5%. Overall, it was a slower quarter as it also logged a significant miss of analysts’ EPS estimates and .

The stock is up 3.3% since reporting and currently trades at $153.

Read our full, actionable report on Vail Resorts here, it’s free for active Edge members.

Sphere Entertainment (NYSE:SPHR)

Famous for its viral Las Vegas Sphere venue, Sphere Entertainment (NYSE:SPHR) hosts live entertainment events and distributes content across various media platforms.

Sphere Entertainment reported revenues of $282.7 million, up 3.4% year on year. This print came in 7.4% below analysts' expectations. It was a slower quarter as it also recorded a significant miss of analysts’ revenue estimates and a significant miss of analysts’ EBITDA estimates.

Sphere Entertainment had the weakest performance against analyst estimates among its peers. The stock is up 67.8% since reporting and currently trades at $67.60.

Read our full, actionable report on Sphere Entertainment here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.