Although Lowe's (currently trading at $244.30 per share) has gained 10.5% over the last six months, it has trailed the S&P 500’s 24.4% return during that period. This might have investors contemplating their next move.

Is now the time to buy Lowe's, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is Lowe's Not Exciting?

We're cautious about Lowe's. Here are three reasons there are better opportunities than LOW and a stock we'd rather own.

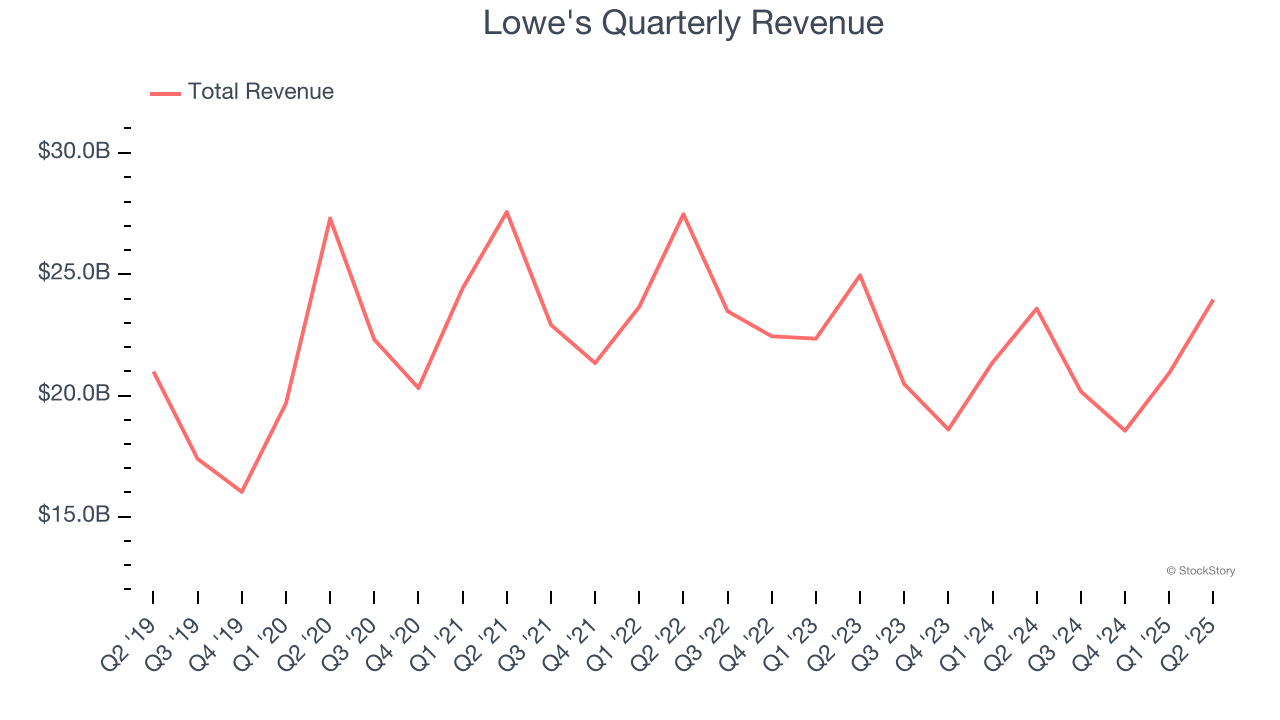

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Lowe’s sales grew at a sluggish 2.6% compounded annual growth rate over the last six years. This was below our standards.

2. Stores Are Closing, a Headwind for Revenue

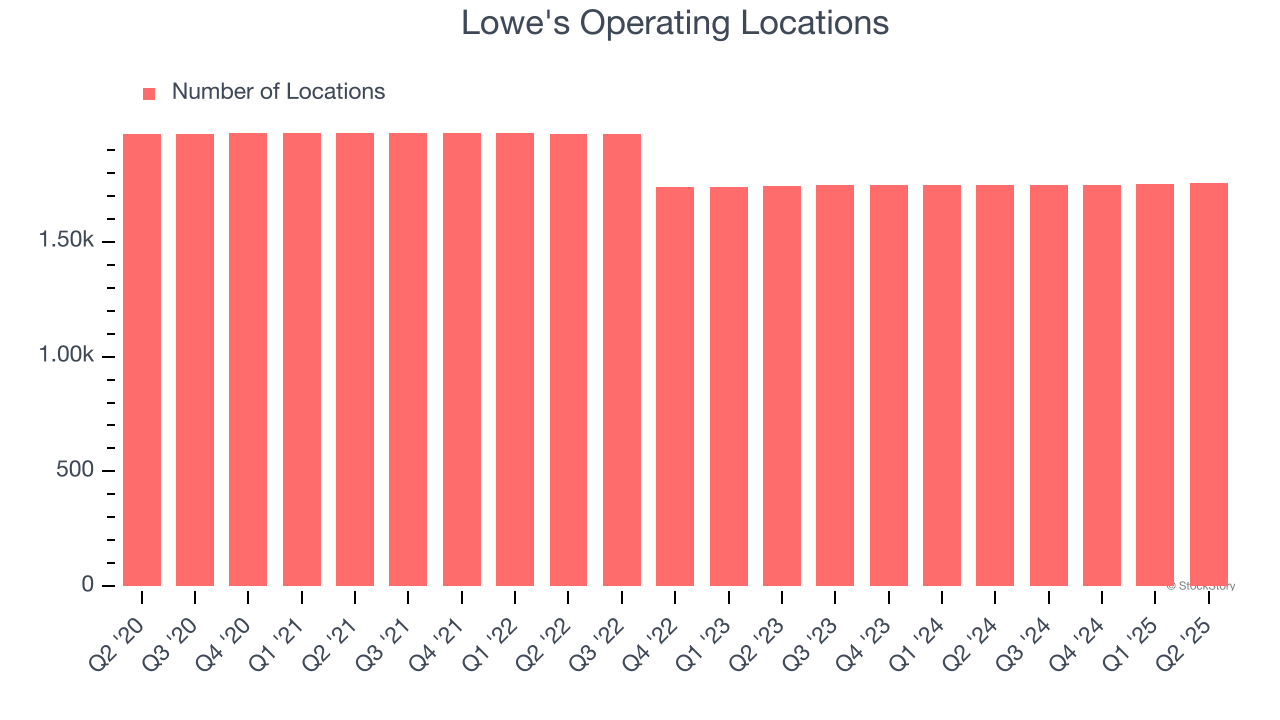

A retailer’s store count often determines how much revenue it can generate.

Lowe's listed 1,753 locations in the latest quarter and has generally closed its stores over the last two years, averaging 1.2% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

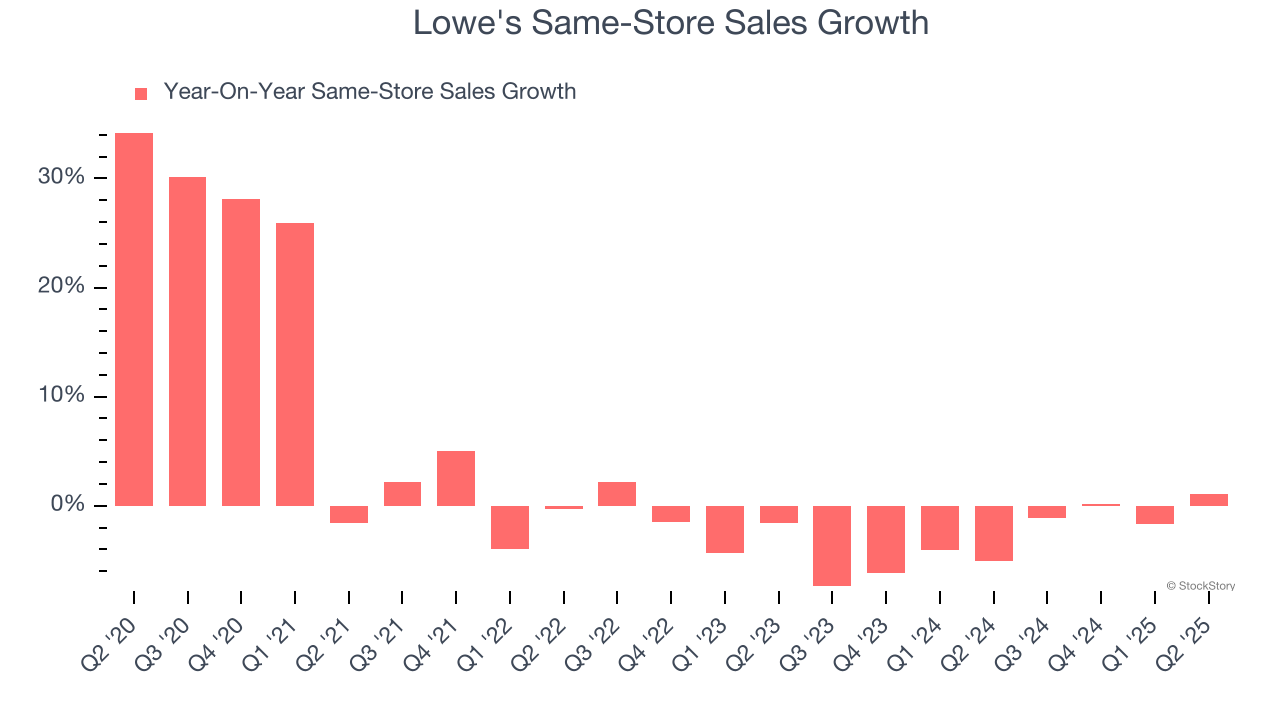

3. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Lowe’s demand has been shrinking over the last two years as its same-store sales have averaged 3% annual declines.

Final Judgment

Lowe's isn’t a terrible business, but it doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 19× forward P/E (or $244.30 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward the Amazon and PayPal of Latin America.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.