Enova has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 19.8% to $110.40 per share while the index has gained 23.2%.

Is ENVA a buy right now? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On Enova?

Pioneering online lending since 2004 with a massive database of over 65 terabytes of customer behavior data, Enova International (NYSE:ENVA) provides online financial services including installment loans and lines of credit to non-prime consumers and small businesses in the United States and Brazil.

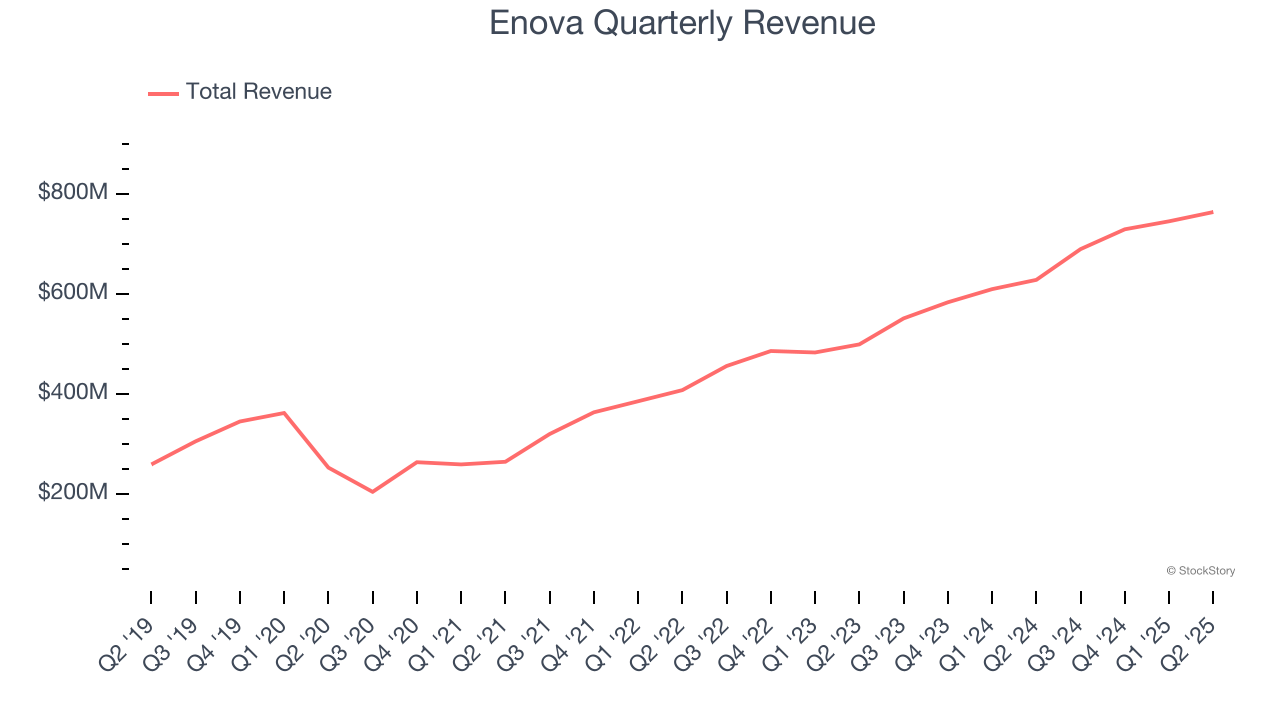

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Thankfully, Enova’s 18.3% annualized revenue growth over the last five years was excellent. Its growth surpassed the average financials company and shows its offerings resonate with customers.

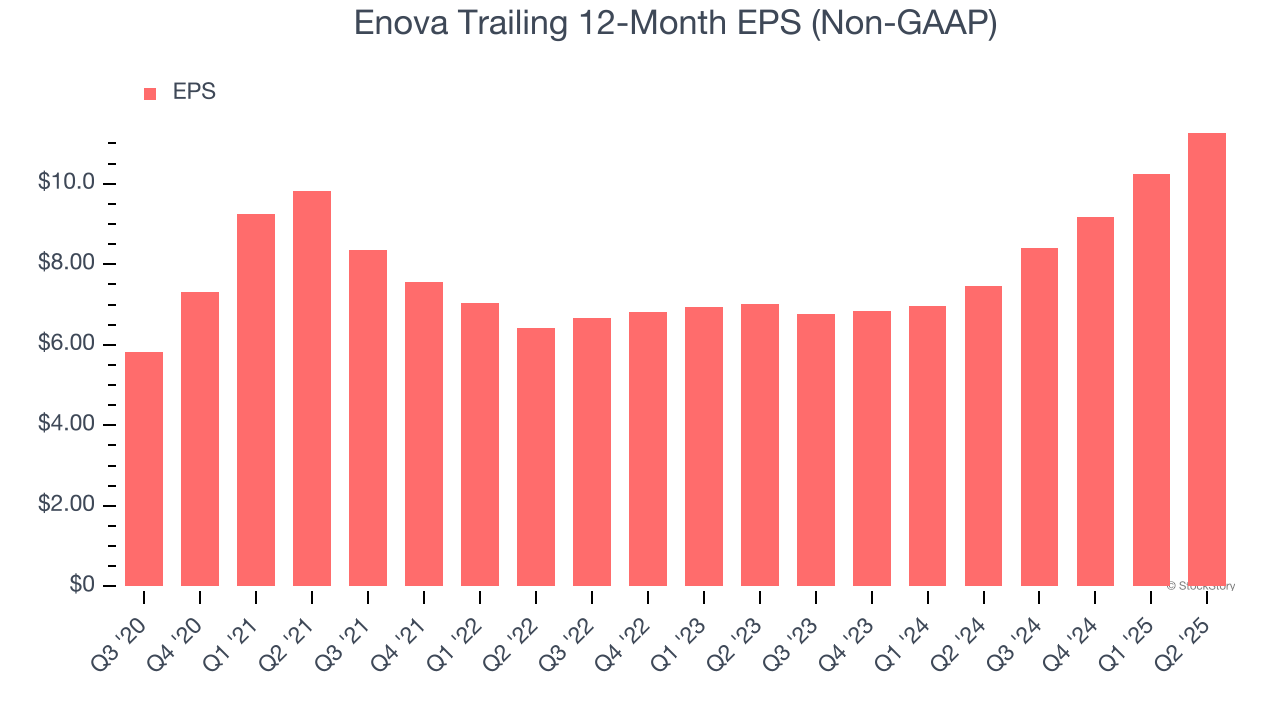

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Enova’s EPS grew at an astounding 25.3% compounded annual growth rate over the last five years, higher than its 18.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

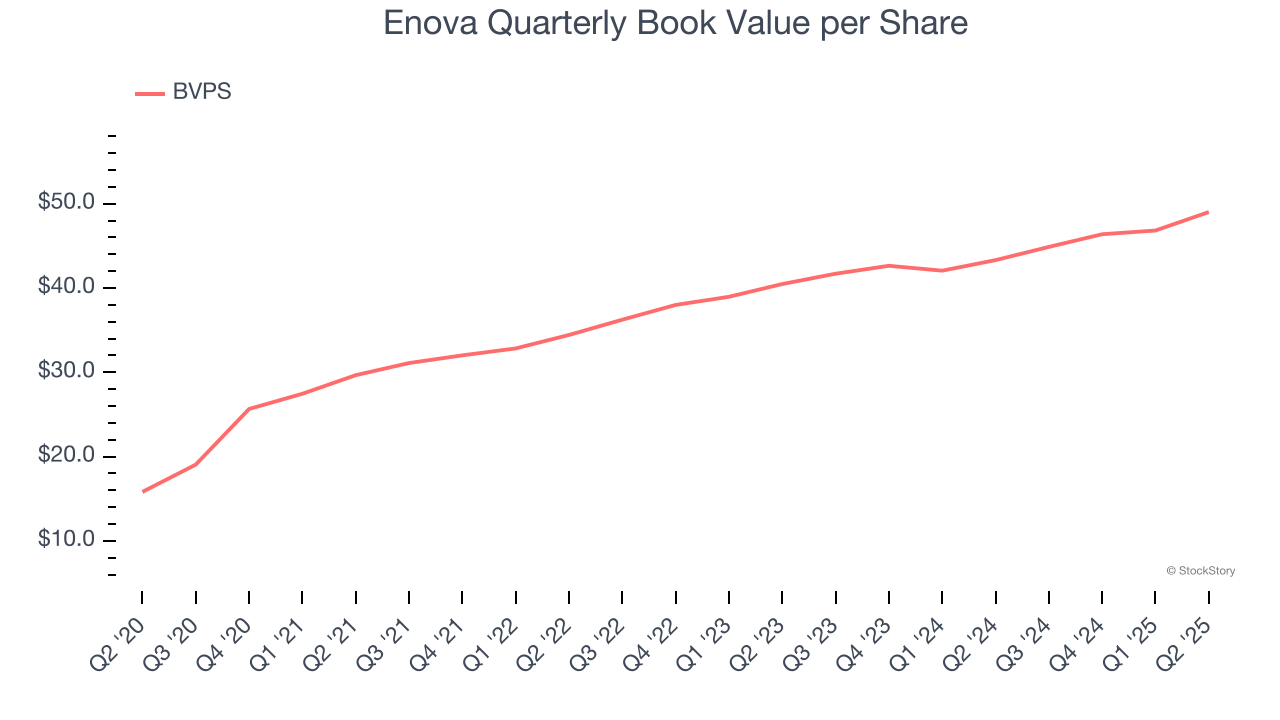

3. Steady Increase in BVPS Highlights Solid Asset Growth

Book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities.

Enova’s BVPS increased by 25.4% annually over the last five years, and although its annualized growth has recently decelerated to 10% over the last two years (from $40.47 to $49.01 per share), we still think its performance was solid.

Final Judgment

These are just a few reasons why Enova ranks near the top of our list, but at $110.40 per share (or 8.5× forward P/E), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Enova

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.