Celsius has been on fire lately. In the past six months alone, the company’s stock price has rocketed 66.7%, reaching $61.80 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy CELH? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free for active Edge members.

Why Is CELH a Good Business?

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ:CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

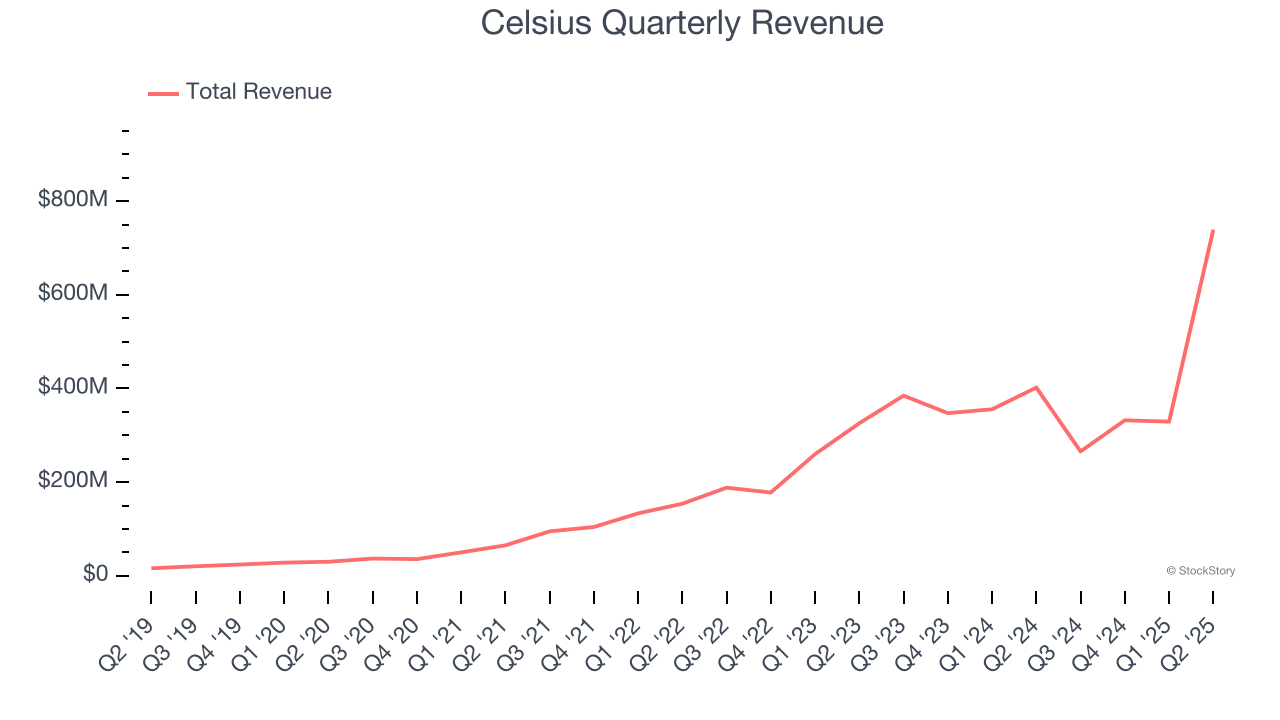

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Celsius’s sales grew at an incredible 50.7% compounded annual growth rate over the last three years. Its growth surpassed the average consumer staples company and shows its offerings resonate with customers.

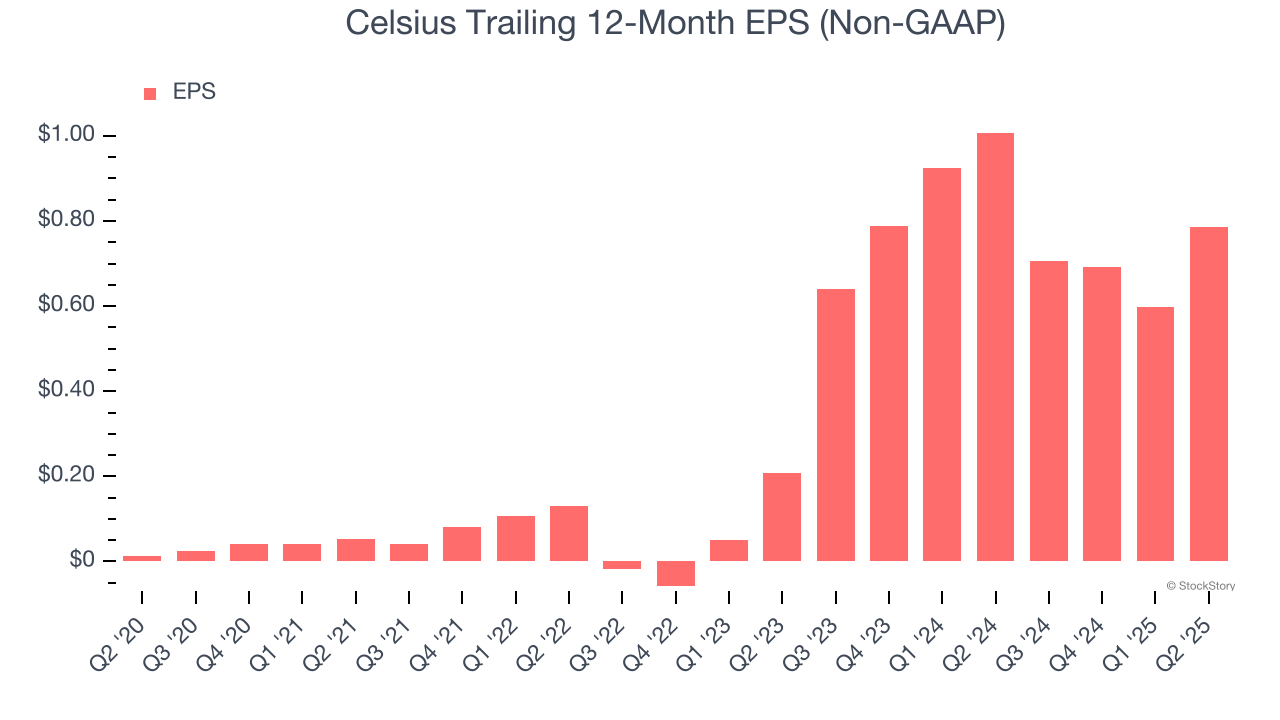

2. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Celsius’s EPS grew at an astounding 82.2% compounded annual growth rate over the last three years, higher than its 50.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

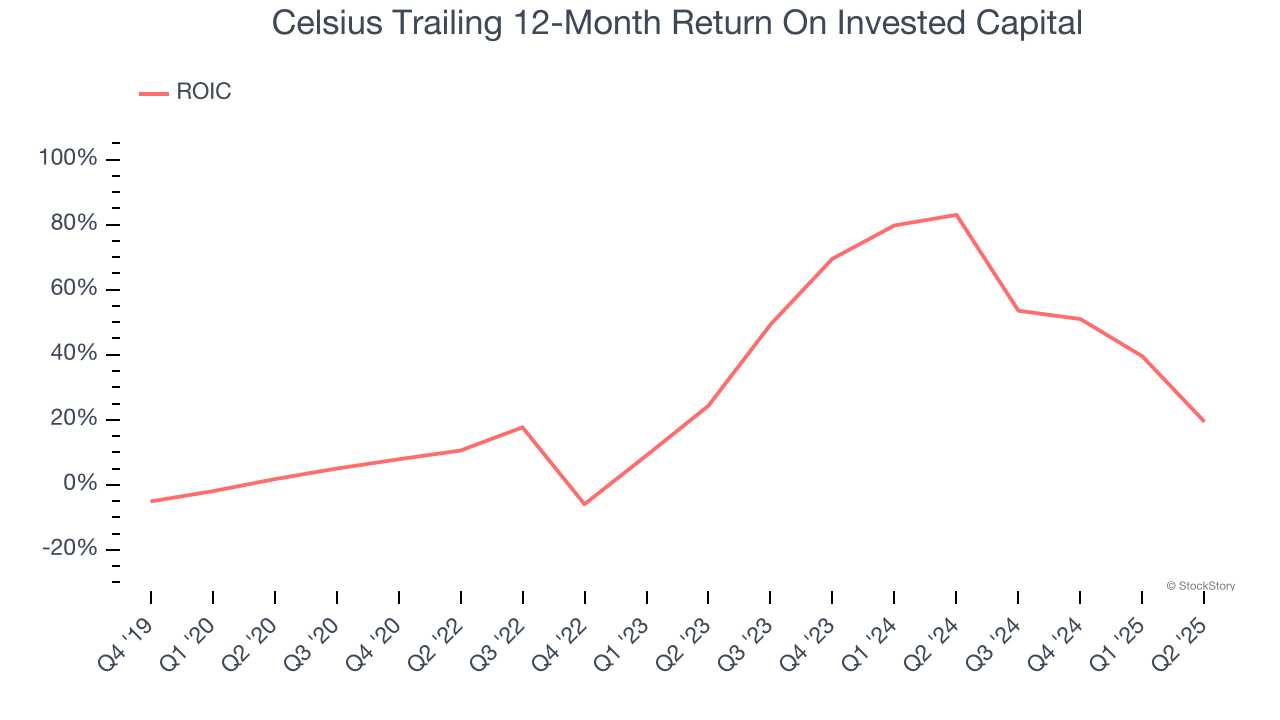

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Celsius’s five-year average ROIC was 34.3%, placing it among the best consumer staples companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons why Celsius is one of the best consumer staples companies out there, and with the recent rally, the stock trades at 48.6× forward P/E (or $61.80 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.