Medical device company ResMed (NYSE:RMD) announced better-than-expected revenue in Q4 CY2024, with sales up 10.3% year on year to $1.28 billion. Its non-GAAP profit of $2.43 per share was 5.2% above analysts’ consensus estimates.

Is now the time to buy ResMed? Find out by accessing our full research report, it’s free.

ResMed (RMD) Q4 CY2024 Highlights:

- Revenue: $1.28 billion vs analyst estimates of $1.27 billion (10.3% year-on-year growth, 1% beat)

- Adjusted EPS: $2.43 vs analyst estimates of $2.31 (5.2% beat)

- Adjusted EBITDA: $482.4 million vs analyst estimates of $462.8 million (37.6% margin, 4.2% beat)

- Operating Margin: 32.5%, up from 23.7% in the same quarter last year

- Free Cash Flow Margin: 22.5%, up from 21.5% in the same quarter last year

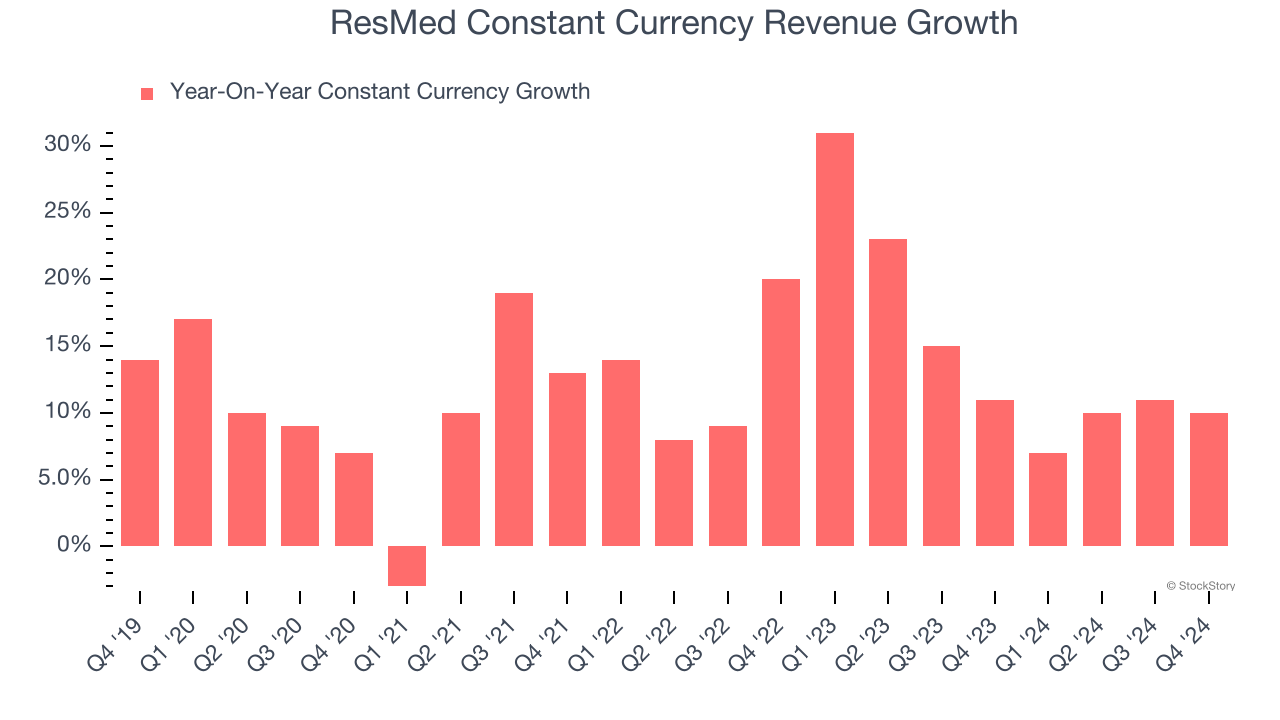

- Constant Currency Revenue rose 10% year on year (11% in the same quarter last year)

- Market Capitalization: $37.84 billion

“Our second quarter fiscal year 2025 top-line growth, margin expansion, and double-digit EPS growth were the result of increased demand for our sleep health and breathing health products and digital health solutions that people love, as well as our laser-focus on operational excellence,” said ResMed’s Chairman and CEO, Mick Farrell.

Company Overview

Founded in 1989 in Australia, ResMed (NYSE:RMD) is a medical device company specializing in products for chronic health conditions like sleep apnea, asthma, neuromuscular disorders, and others.

Patient Monitoring

Patient monitoring companies within the healthcare equipment industry offer devices and technologies that track chronic conditions and support real-time health management, such as continuous glucose monitors (CGMs) and sleep apnea machines. These businesses benefit from recurring revenue from consumables and software subscriptions tied to device sales (razor, razor blade model). The rising prevalence of chronic diseases like diabetes and respiratory disorders due to an aging population as well as growing adoption of digitization are good for the industry. However, these companies face challenges from high R&D costs and reliance on regulatory approvals. Looking ahead, the sector is positioned for growth due to tailwinds like the rising burden of chronic diseases from an aging population, the shift toward value-based care, and increased adoption of digital health solutions. Innovations in AI and machine learning are expected to enhance device accuracy and functionality, improving patient outcomes and driving demand. However, there are headwinds such as pricing pressures as healthcare costs are a key focus, especially in the US. An evolving regulatory landscape and competition from more tech-forward new entrants could present additional challenges.

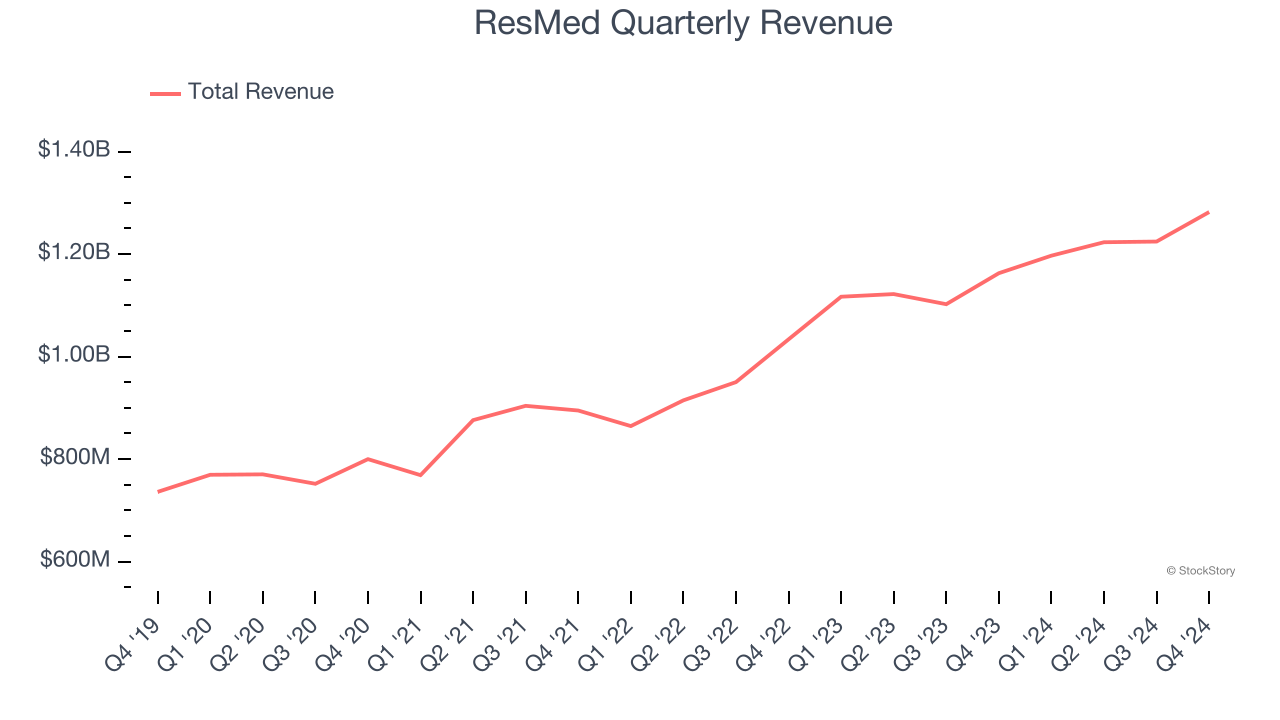

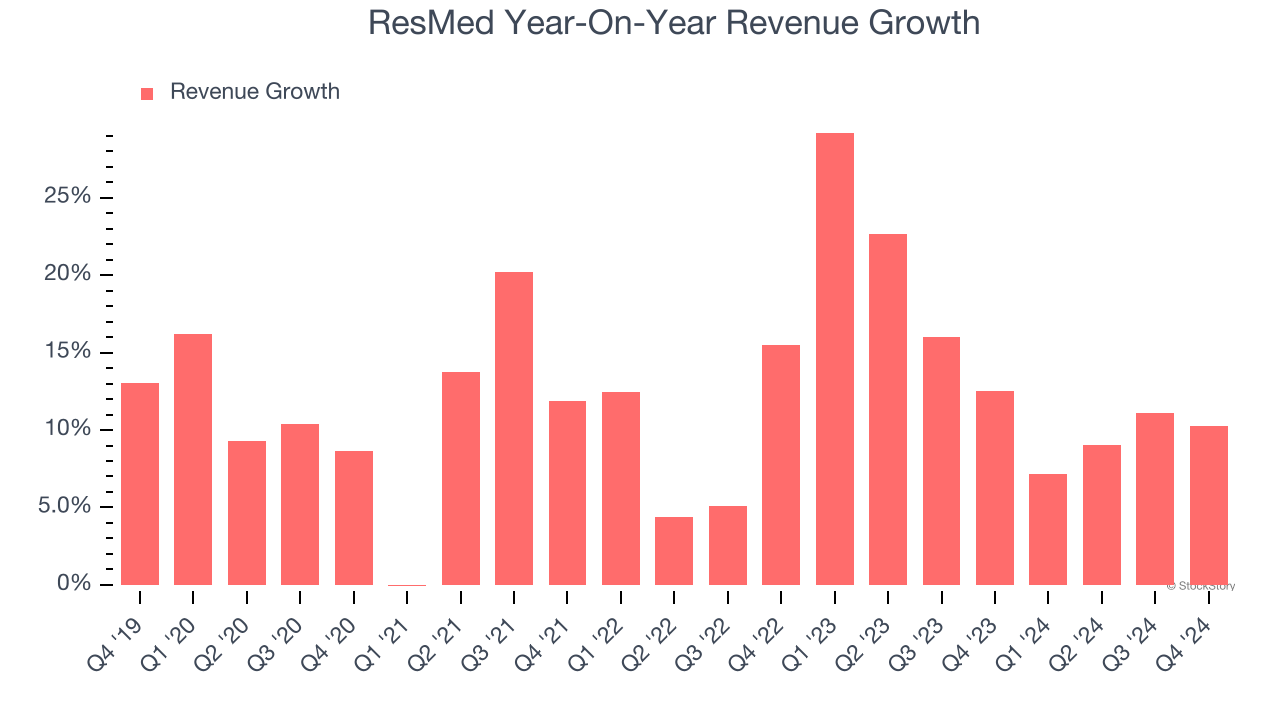

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, ResMed’s 12.1% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. ResMed’s annualized revenue growth of 14.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 14.8% year-on-year growth. Because this number aligns with its normal revenue growth, we can see ResMed’s foreign exchange rates have been steady.

This quarter, ResMed reported year-on-year revenue growth of 10.3%, and its $1.28 billion of revenue exceeded Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 7.3% over the next 12 months, a deceleration versus the last two years. Still, this projection is above the sector average and implies the market is factoring in some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

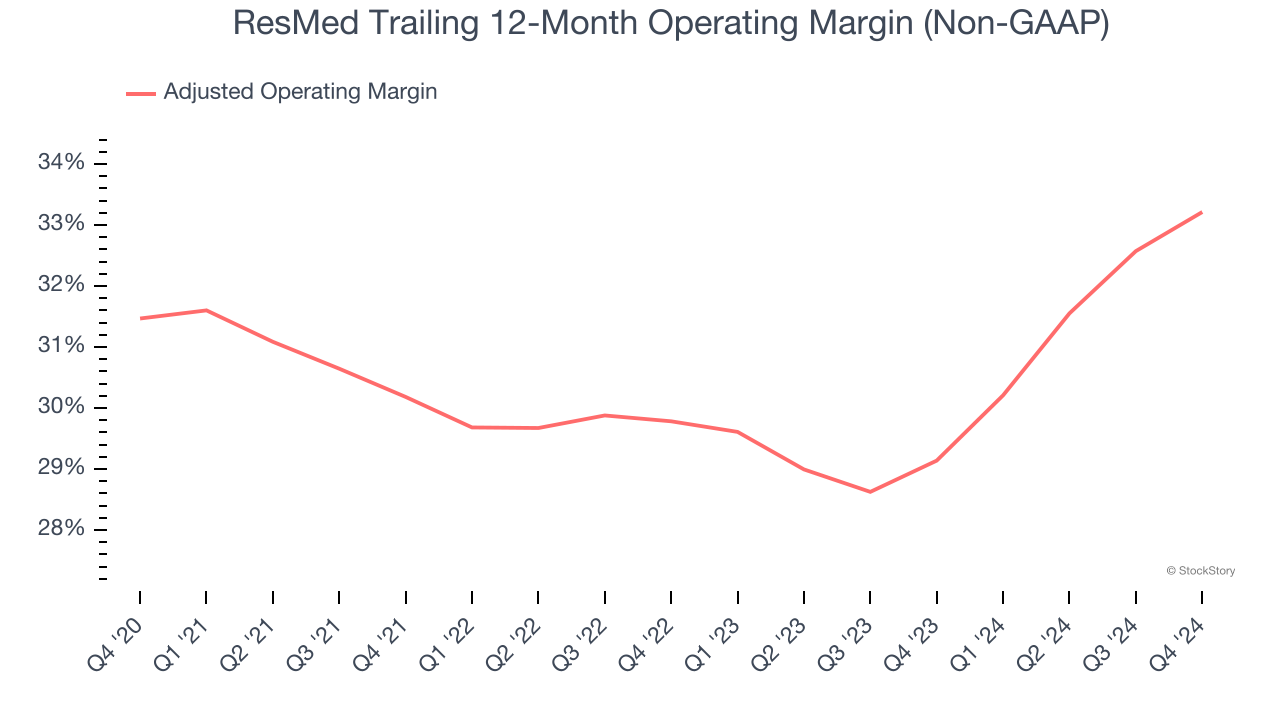

Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

ResMed has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 30.8%.

Analyzing the trend in its profitability, ResMed’s adjusted operating margin rose by 1.7 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 3.4 percentage points on a two-year basis. These data points are very encouraging and shows momentum is on its side.

In Q4, ResMed generated an adjusted operating profit margin of 34%, up 2.6 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

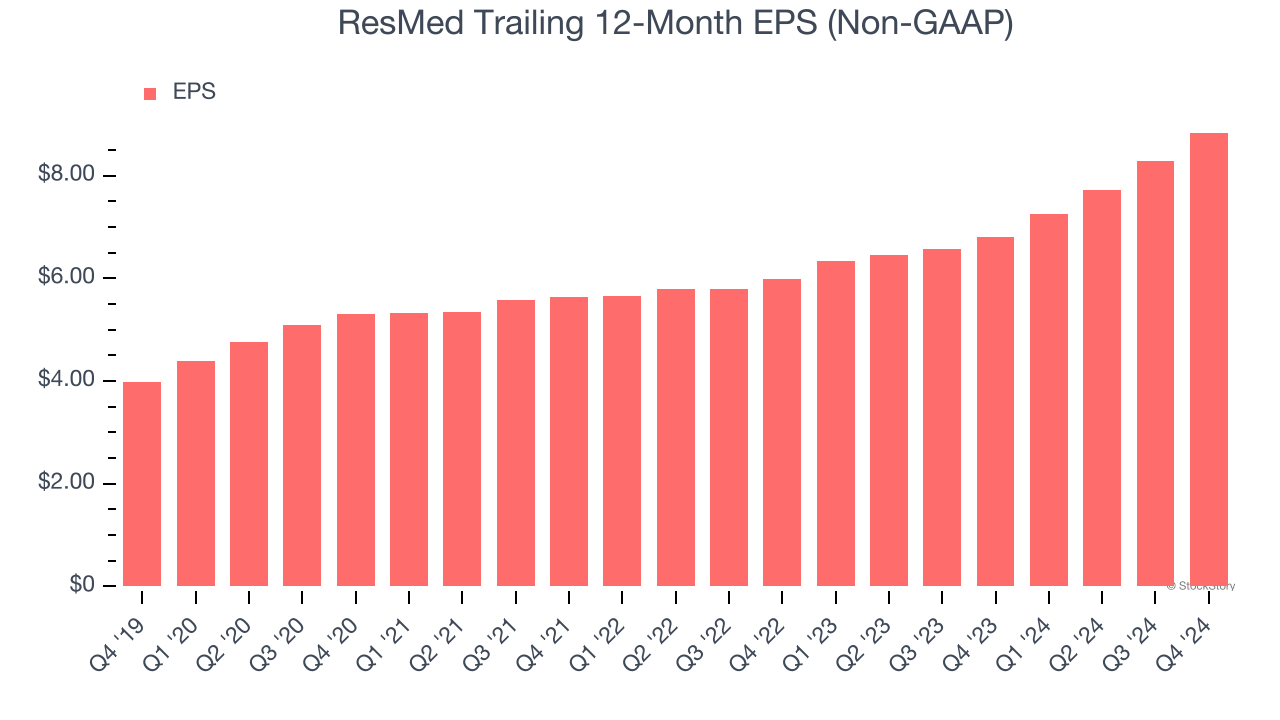

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

ResMed’s EPS grew at an astounding 17.3% compounded annual growth rate over the last five years, higher than its 12.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into ResMed’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, ResMed’s adjusted operating margin expanded by 1.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, ResMed reported EPS at $2.43, up from $1.88 in the same quarter last year. This print beat analysts’ estimates by 5.2%. Over the next 12 months, Wall Street expects ResMed’s full-year EPS of $8.84 to grow 11%.

Key Takeaways from ResMed’s Q4 Results

It was good to see ResMed narrowly top analysts’ constant currency revenue expectations this quarter. On the other hand, its EPS was in line. Overall, this quarter was mixed.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.