Bearings manufacturer RBC Bearings (NYSE:RBC) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 5.5% year on year to $394.4 million. The company expects next quarter’s revenue to be around $439 million, coming in 0.7% above analysts’ estimates. Its non-GAAP profit of $2.34 per share was 6.3% above analysts’ consensus estimates.

Is now the time to buy RBC Bearings? Find out by accessing our full research report, it’s free.

RBC Bearings (RBC) Q4 CY2024 Highlights:

- Revenue: $394.4 million vs analyst estimates of $393.9 million (5.5% year-on-year growth, in line)

- Adjusted EPS: $2.34 vs analyst estimates of $2.20 (6.3% beat)

- Adjusted EBITDA: $122.6 million vs analyst estimates of $118.5 million (31.1% margin, 3.5% beat)

- Revenue Guidance for Q1 CY2025 is $439 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 21.7%, up from 20.1% in the same quarter last year

- Free Cash Flow Margin: 18.7%, similar to the same quarter last year

- Market Capitalization: $10.06 billion

“RBC delivered another quarter of strong operational performance with A&D segment sales up 10.7% year over year and Industrial segment sales up 2.7%,” said Dr. Michael J. Hartnett, Chairman and Chief Executive Officer.

Company Overview

With a Guinness World Record for engineering the largest spherical plain bearing, RBC Bearings (NYSE:RBC) is a manufacturer of bearings and related components for the aerospace & defense, industrial, and transportation industries.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

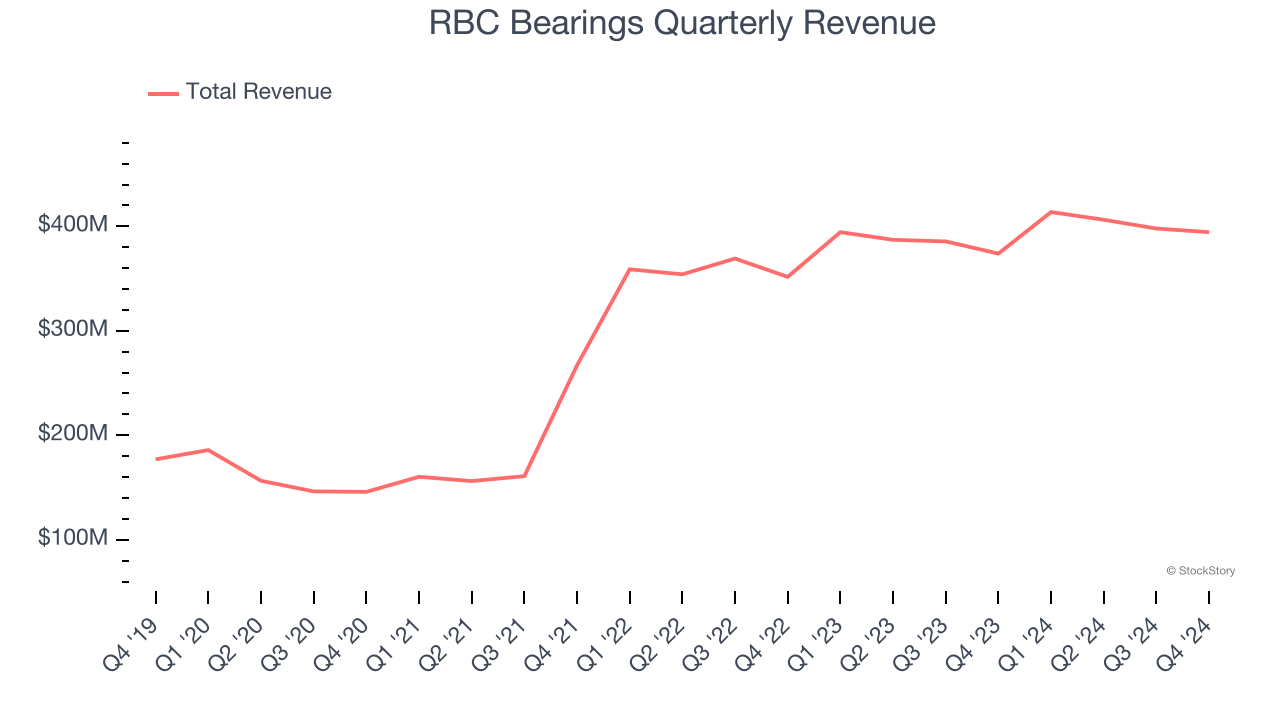

Sales Growth

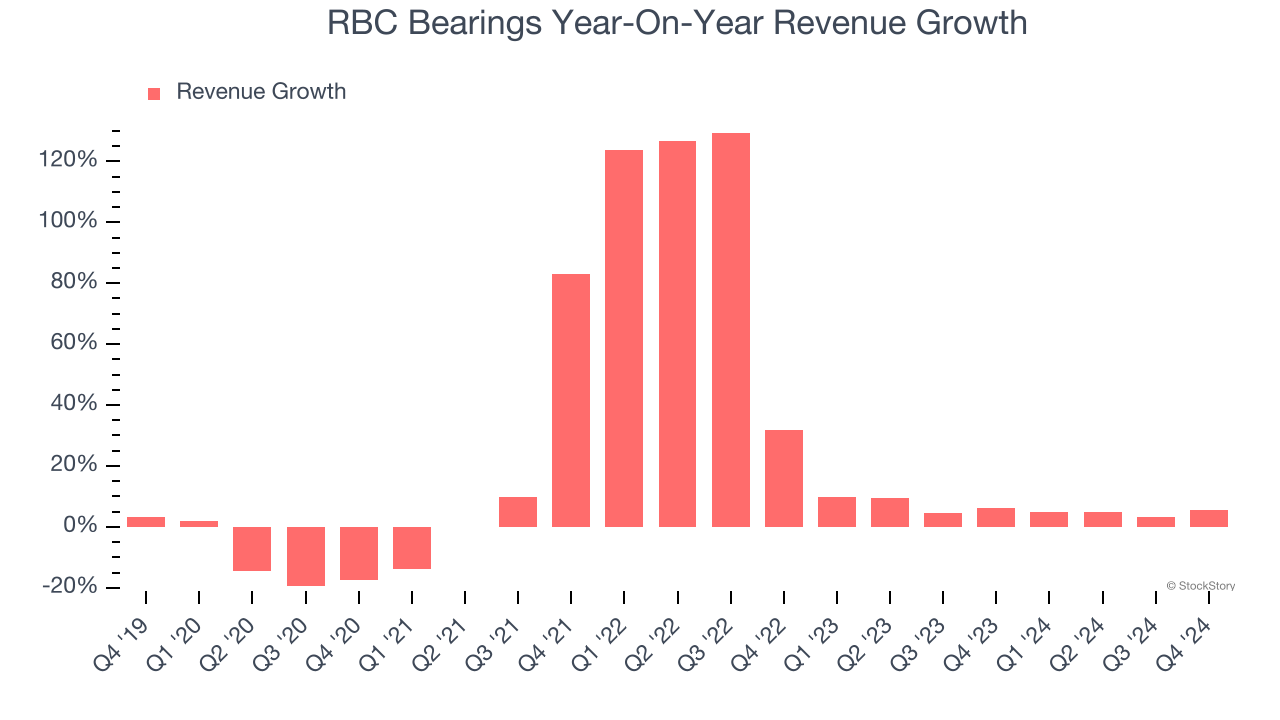

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, RBC Bearings grew its sales at an incredible 17.4% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. RBC Bearings’s recent history shows its demand slowed significantly as its annualized revenue growth of 6% over the last two years is well below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Diversified Industrials and Aerospace and Defense, which are 36.3% and 63.7% of revenue. Over the last two years, RBC Bearings’s Diversified Industrials revenue (general industrial equipment) averaged 4.8% year-on-year declines. On the other hand, its Aerospace and Defense revenue (aircraft equipment, radar, missiles) averaged 28.8% growth.

This quarter, RBC Bearings grew its revenue by 5.5% year on year, and its $394.4 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 6.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.7% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not accelerate its top-line performance yet. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

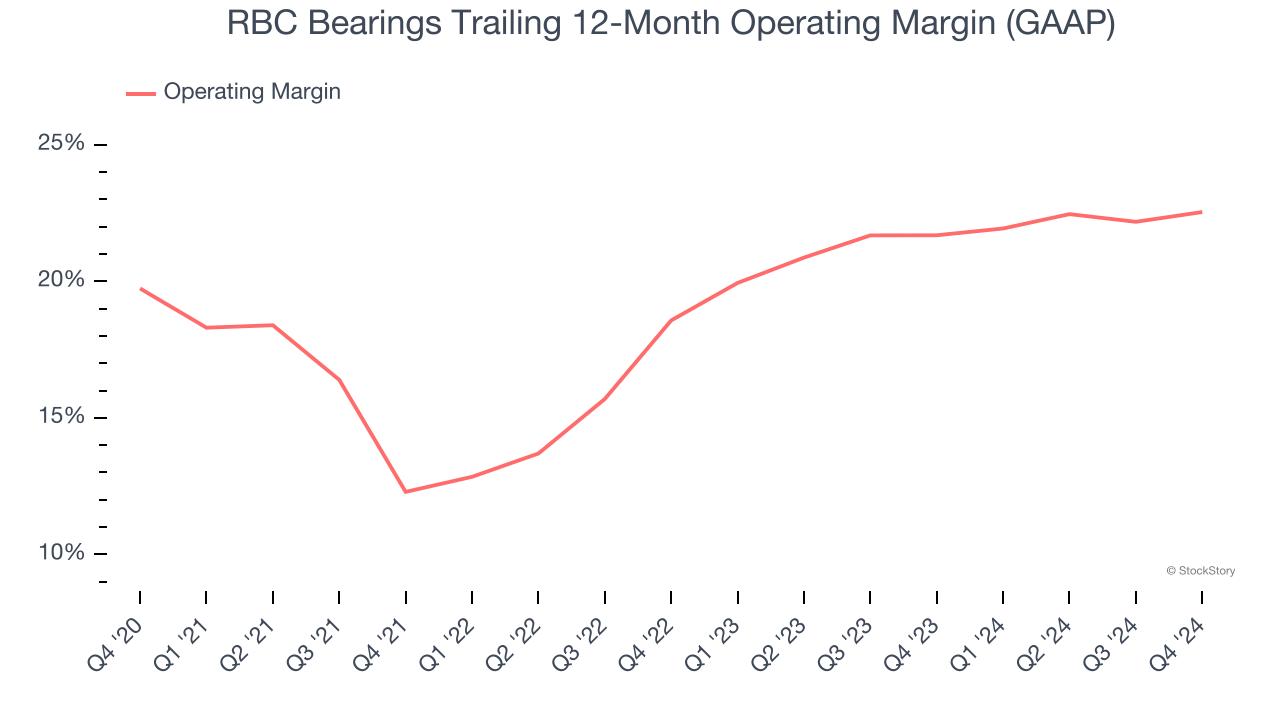

Operating Margin

RBC Bearings has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 19.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, RBC Bearings’s operating margin rose by 2.8 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, RBC Bearings generated an operating profit margin of 21.7%, up 1.6 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

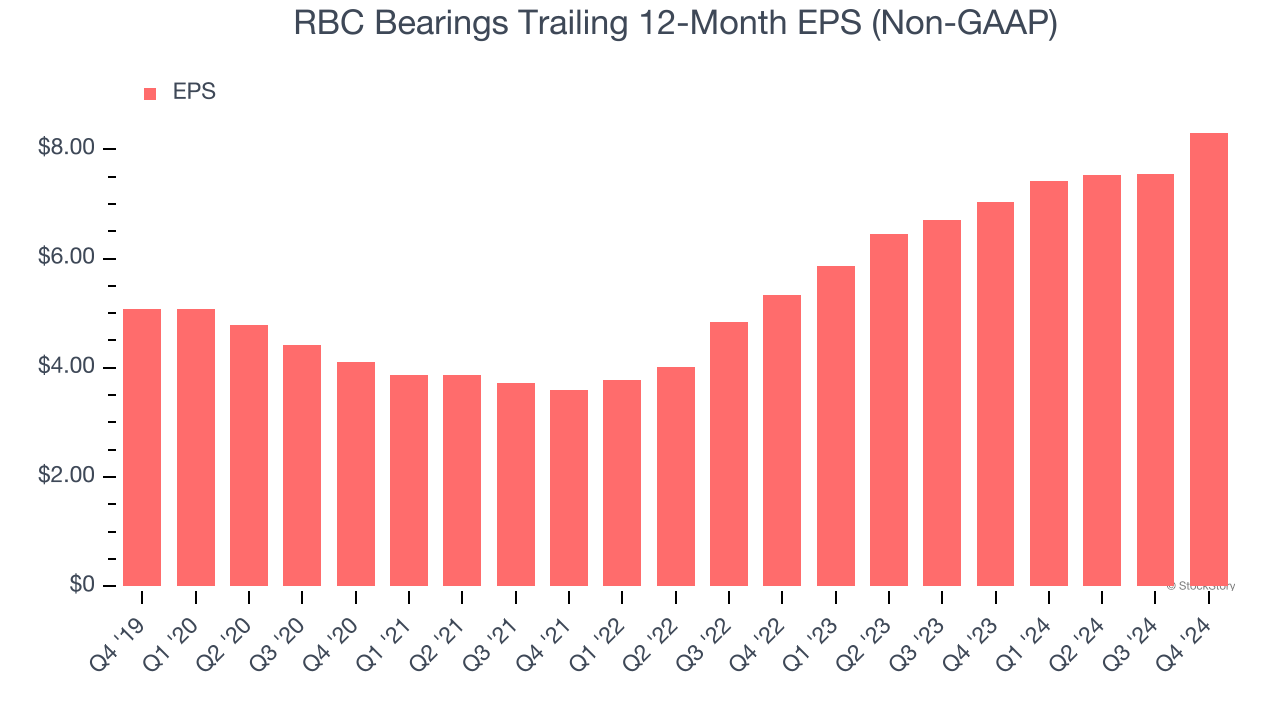

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

RBC Bearings’s EPS grew at a solid 10.4% compounded annual growth rate over the last five years. Despite its operating margin expansion during that time, this performance was lower than its 17.4% annualized revenue growth. This tells us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Diving into RBC Bearings’s quality of earnings can give us a better understanding of its performance. A five-year view shows RBC Bearings has diluted its shareholders, growing its share count by 25%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For RBC Bearings, its two-year annual EPS growth of 24.8% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, RBC Bearings reported EPS at $2.34, up from $1.59 in the same quarter last year. This print beat analysts’ estimates by 6.3%. Over the next 12 months, Wall Street expects RBC Bearings’s full-year EPS of $8.30 to grow 26.2%.

Key Takeaways from RBC Bearings’s Q4 Results

It was encouraging to see RBC Bearings beat analysts’ EBITDA expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The stock remained flat at $325 immediately following the results.

RBC Bearings had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.