Consumer products company Colgate-Palmolive (NYSE:CL) fell short of the market’s revenue expectations in Q4 CY2024, with sales flat year on year at $4.94 billion. Its non-GAAP profit of $0.91 per share was 2.3% above analysts’ consensus estimates.

Is now the time to buy Colgate-Palmolive? Find out by accessing our full research report, it’s free.

Colgate-Palmolive (CL) Q4 CY2024 Highlights:

- Revenue: $4.94 billion vs analyst estimates of $4.98 billion (flat year on year, 0.7% miss)

- Adjusted EPS: $0.91 vs analyst estimates of $0.89 (2.3% beat)

- Adjusted EBITDA: $1.21 billion vs analyst estimates of $1.25 billion (24.5% margin, 3.1% miss)

- Operating Margin: 21.5%, in line with the same quarter last year

- Free Cash Flow Margin: 21.9%, up from 19% in the same quarter last year

- Organic Revenue rose 4.3% year on year (7% in the same quarter last year)

- Sales Volumes rose 2.5% year on year (0% in the same quarter last year)

- Market Capitalization: $74.26 billion

Colgate-Palmolive Company (NYSE:CL) today reported results for fourth quarter and full year 2024. Noel Wallace, Chairman, President and Chief Executive Officer, commented on the Base Business fourth quarter and full year results, “We are pleased to have delivered another quarter and full year of strong organic sales growth along with increases in gross profit, gross profit margin, net income, earnings per share and cash flow. Our goals for 2024 were to deliver peer leading growth while funding investment for future growth and building flexibility into our P&L to counter macro headwinds. We delivered on those goals, leaving us well positioned to deliver against our guidance in 2025.

Company Overview

Formed after the 1928 combination between toothpaste maker Colgate and soap maker Palmolive-Peet, Colgate-Palmolive (NYSE:CL) is a consumer products company that focuses on personal, household, and pet products.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Colgate-Palmolive is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. To accelerate sales, Colgate-Palmolive must lean into newer products.

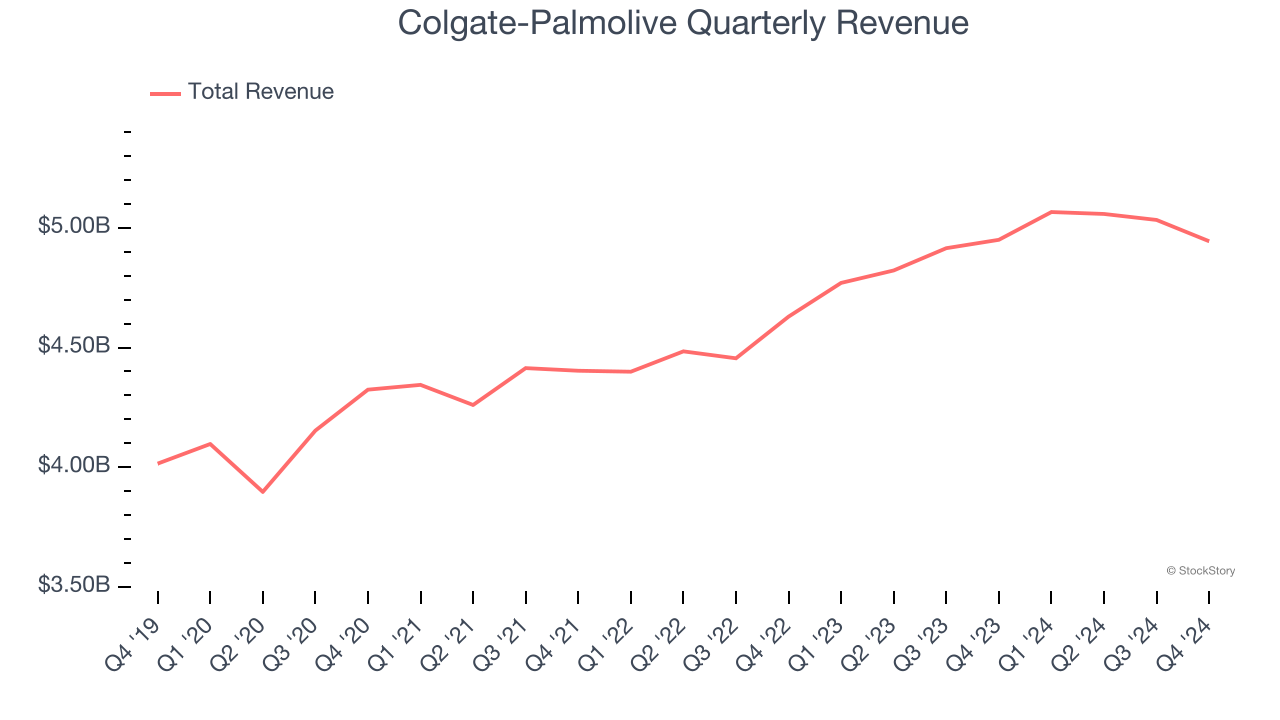

As you can see below, Colgate-Palmolive’s 4.9% annualized revenue growth over the last three years was tepid, but to its credit, consumers bought more of its products.

This quarter, Colgate-Palmolive missed Wall Street’s estimates and reported a rather uninspiring 0.1% year-on-year revenue decline, generating $4.94 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products will face some demand challenges. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Volume Growth

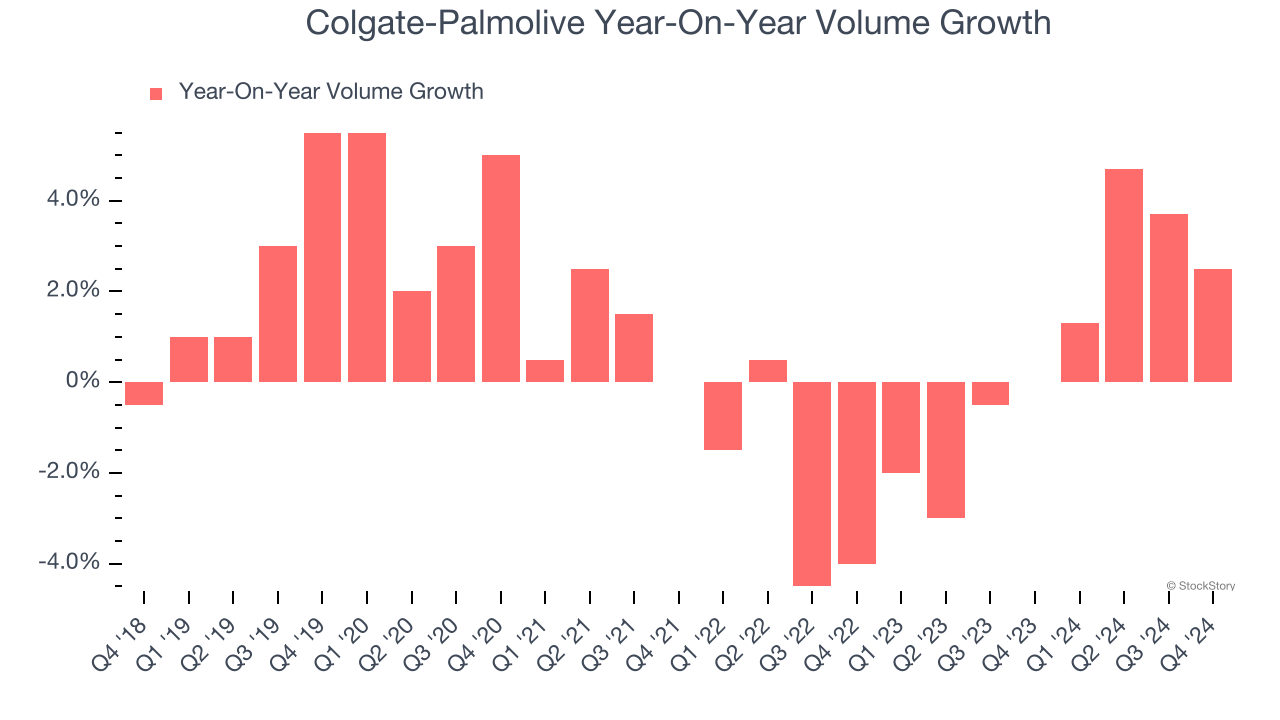

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Colgate-Palmolive generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, Colgate-Palmolive’s quarterly sales volumes have, on average, stayed about the same. This stability is normal as the quantity demanded for consumer staples products typically doesn’t see much volatility. The company’s flat volumes also indicate its average organic revenue growth of 8% was generated from price increases.

In Colgate-Palmolive’s Q4 2024, sales volumes jumped 2.5% year on year. This result was an acceleration from its historical levels, certainly a positive signal.

Key Takeaways from Colgate-Palmolive’s Q4 Results

We struggled to find many resounding positives in these results. Its EBITDA missed and its organic revenue fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.8% to $89.30 immediately after reporting.

Colgate-Palmolive’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.