Household products company Church & Dwight (NYSE:CHD) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 3.5% year on year to $1.58 billion. On the other hand, next quarter’s revenue guidance of $1.52 billion was less impressive, coming in 2.1% below analysts’ estimates. Its non-GAAP profit of $0.77 per share was in line with analysts’ consensus estimates.

Is now the time to buy Church & Dwight? Find out by accessing our full research report, it’s free.

Church & Dwight (CHD) Q4 CY2024 Highlights:

- Revenue: $1.58 billion vs analyst estimates of $1.56 billion (3.5% year-on-year growth, 1.1% beat)

- Adjusted EPS: $0.77 vs analyst estimates of $0.77 (in line)

- Adjusted EBITDA: $377.6 million vs analyst estimates of $323 million (23.9% margin, 16.9% beat)

- Revenue Guidance for Q1 CY2025 is $1.52 billion at the midpoint, below analyst estimates of $1.55 billion

- Adjusted EPS guidance for Q1 CY2025 is $0.90 at the midpoint, below analyst estimates of $0.98

- Operating Margin: 16.2%, up from 14.1% in the same quarter last year

- Free Cash Flow Margin: 15%, up from 8.7% in the same quarter last year

- Organic Revenue rose 4.2% year on year (5.3% in the same quarter last year)

- Sales Volumes were up 3.3% year on year

- Market Capitalization: $26.24 billion

Matthew Farrell, Chief Executive Officer, commented, “We are thrilled to deliver another year of strong results. Our outstanding full year 2024 results reflect the strength of our brands, the success of our new products, and our continued focus on execution. Volume was the primary driver of organic growth, which we expect to continue in 2025. Marketing as a percentage of sales increased 50 basis points driving consumption and share gains. Global online sales grew to 21.4% of total consumer sales in 2024. Finally, the combination of strong sales, margin expansion, and efficient working capital management resulted in strong cash flow generation, with over $1.1 billion of cash from operations in 2024. The investments we have made behind our brands position the Company well for the future.

Company Overview

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE:CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

Church & Dwight carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

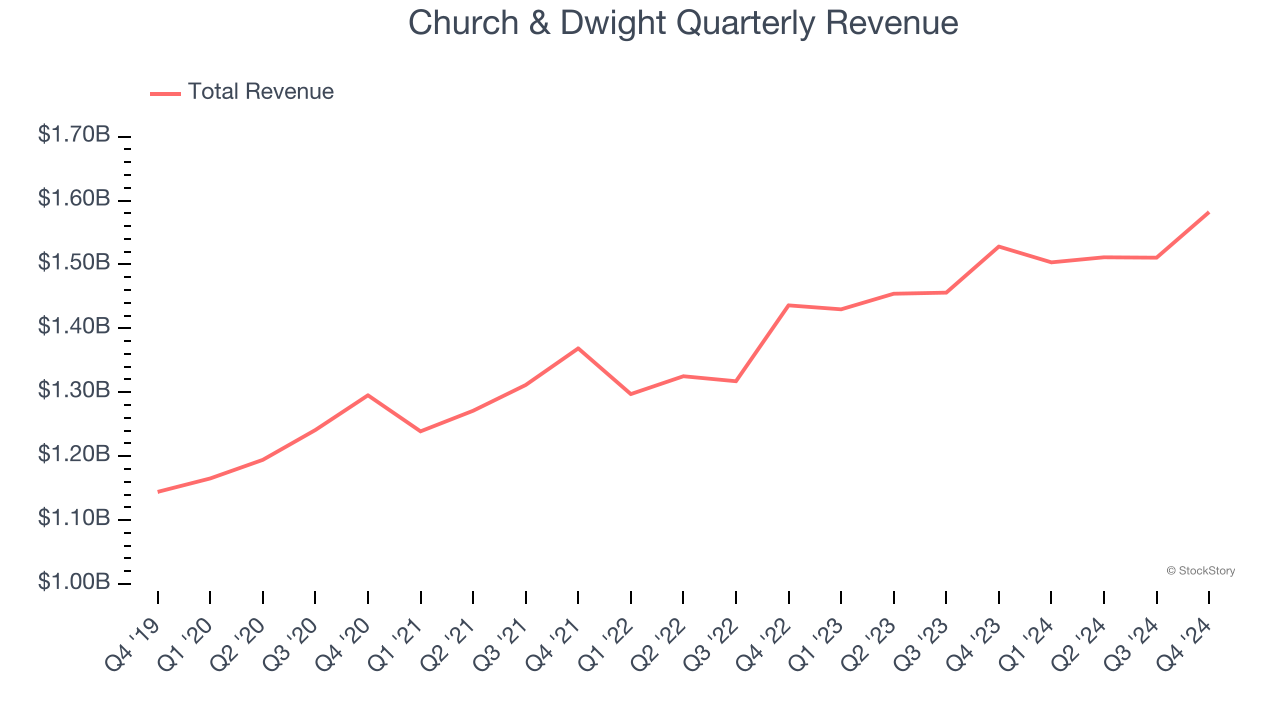

As you can see below, Church & Dwight’s 5.6% annualized revenue growth over the last three years was tepid, but to its credit, consumers bought more of its products.

This quarter, Church & Dwight reported modest year-on-year revenue growth of 3.5% but beat Wall Street’s estimates by 1.1%. Company management is currently guiding for a 1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and implies its products will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Organic Revenue Growth

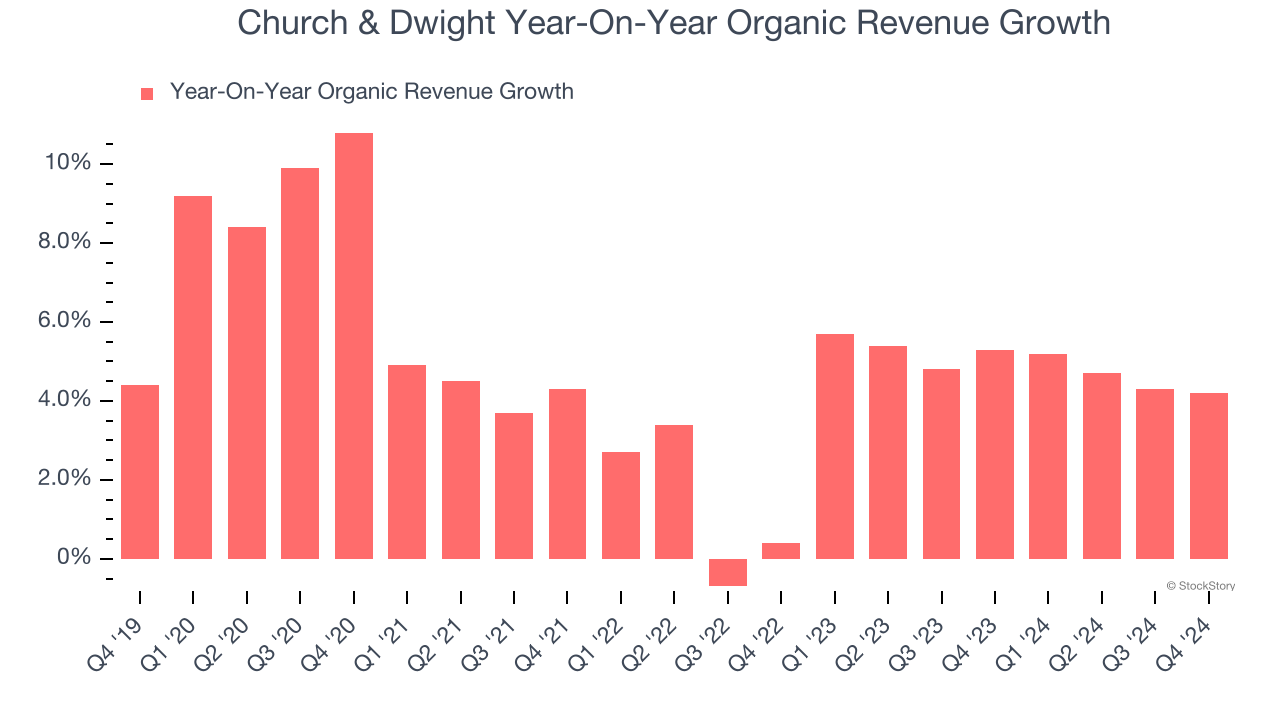

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Church & Dwight’s products has generally risen over the last two years but lagged behind the broader sector. On average, the company’s organic sales have grown by 4.9% year on year.

In the latest quarter, Church & Dwight’s organic sales rose by 4.2% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Church & Dwight’s Q4 Results

We liked that Church & Dwight's organic revenue outperformed Wall Street’s estimates. On the other hand, its revenue and EPS guidance for next quarter both missed. Overall, this quarter was mixed. The stock remained flat at $107.12 immediately after reporting.

Big picture, is Church & Dwight a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.