Water control and measure company Badger Meter (NYSE:BMI) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 12.5% year on year to $205.2 million. Its GAAP profit of $1.04 per share was 3.7% above analysts’ consensus estimates.

Is now the time to buy Badger Meter? Find out by accessing our full research report, it’s free.

Badger Meter (BMI) Q4 CY2024 Highlights:

- Revenue: $205.2 million vs analyst estimates of $200.6 million (12.5% year-on-year growth, 2.3% beat)

- EPS (GAAP): $1.04 vs analyst estimates of $1.00 (3.7% beat)

- Operating Margin: 19.1%, up from 17.6% in the same quarter last year

- Free Cash Flow Margin: 23.1%, up from 19.7% in the same quarter last year

- Market Capitalization: $6.13 billion

Kenneth C. Bockhorst, Chairman, President and Chief Executive Officer, stated, “We finished 2024 with yet another quarter of excellent results, including solid performance across a variety of operating metrics with continued strong sales growth, expanding operating profit margins, robust EPS growth and record cash flow from operations. We utilized our strong balance sheet and cash flows to expand on the breadth of our BlueEdge suite of solutions, adding real-time monitoring of water collection systems with the acquisition of SmartCover® Systems (SmartCover) which we announced today. Lastly, I’m grateful for the hard work and commitment of the entire Badger Meter team in supporting our customers and delivering on our strategic growth goals and I want to welcome the employees of SmartCover to the Badger Meter team.”

Company Overview

The developer of the world’s first frost-proof water meter in 1905, Badger Meter (NYSE:BMI) provides water control and measure equipment to various industries.

Inspection Instruments

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

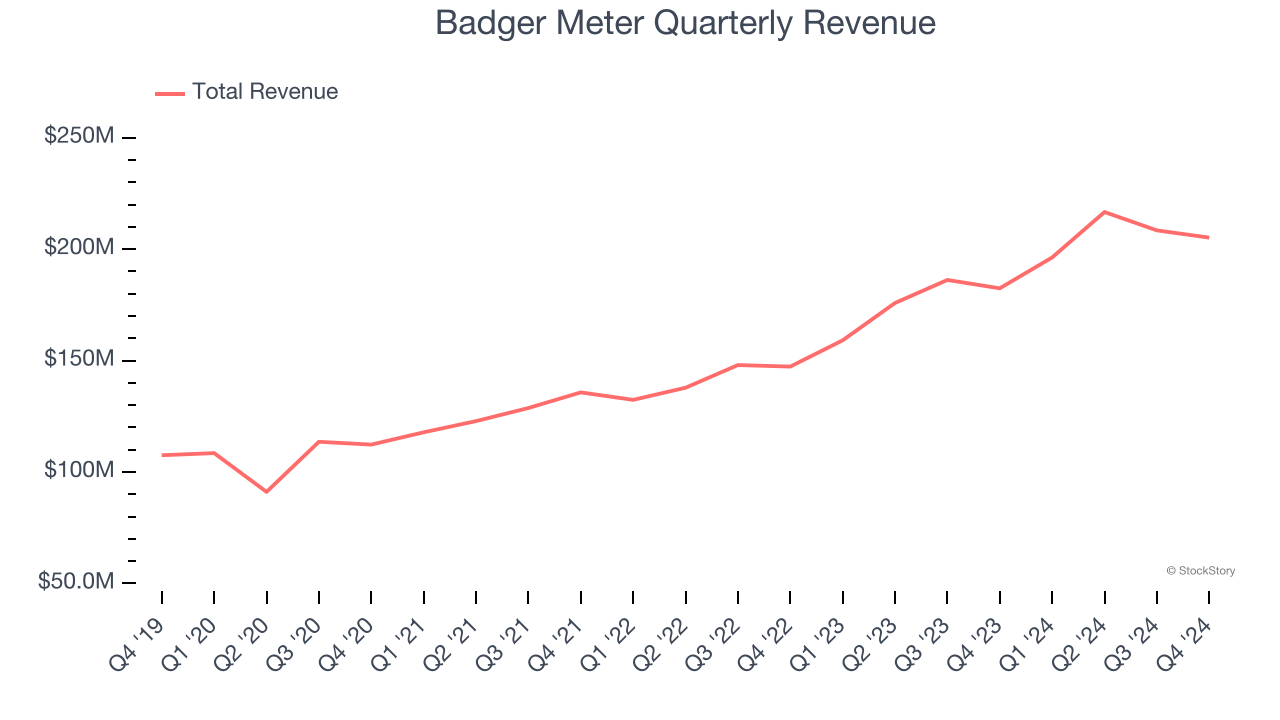

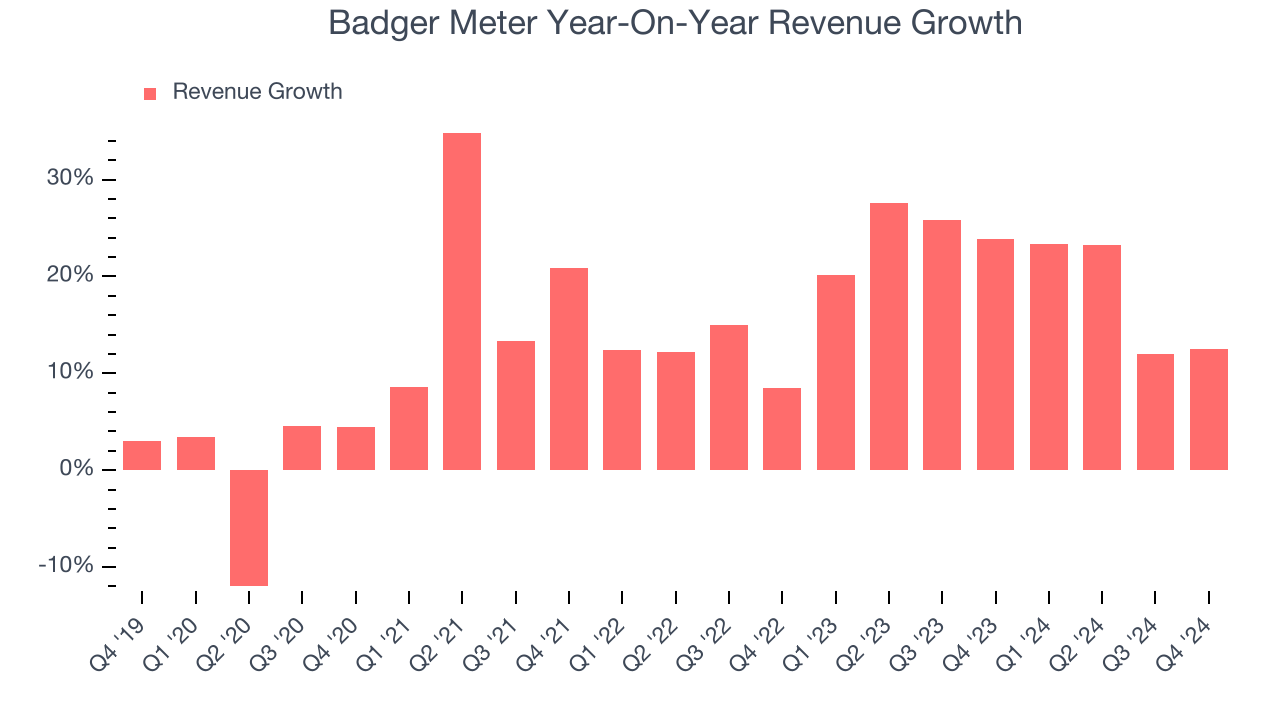

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Badger Meter grew its sales at an exceptional 14.2% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Badger Meter’s annualized revenue growth of 20.9% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated. Badger Meter’s recent history shows it’s one of the better Inspection Instruments businesses as many of its peers faced declining sales because of cyclical headwinds.

This quarter, Badger Meter reported year-on-year revenue growth of 12.5%, and its $205.2 million of revenue exceeded Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 8.1% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above the sector average and suggests the market is baking in some success for its newer products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

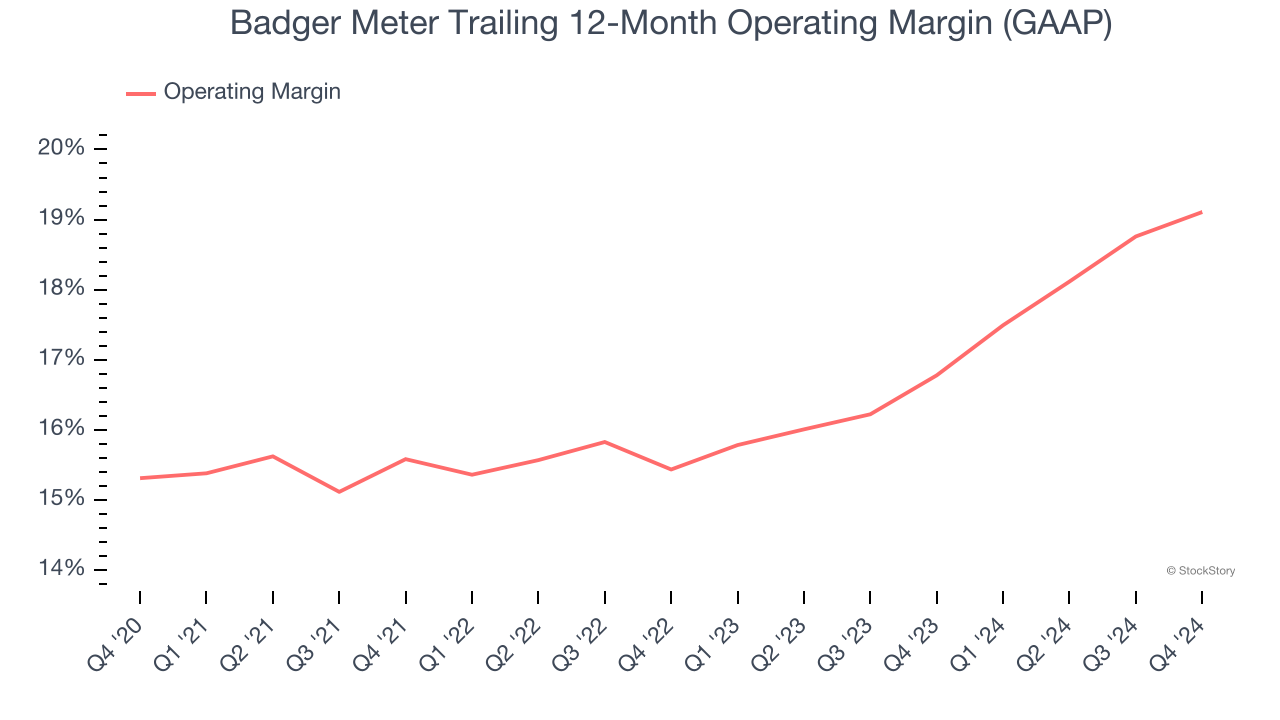

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Badger Meter has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Badger Meter’s operating margin rose by 3.8 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Badger Meter generated an operating profit margin of 19.1%, up 1.5 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

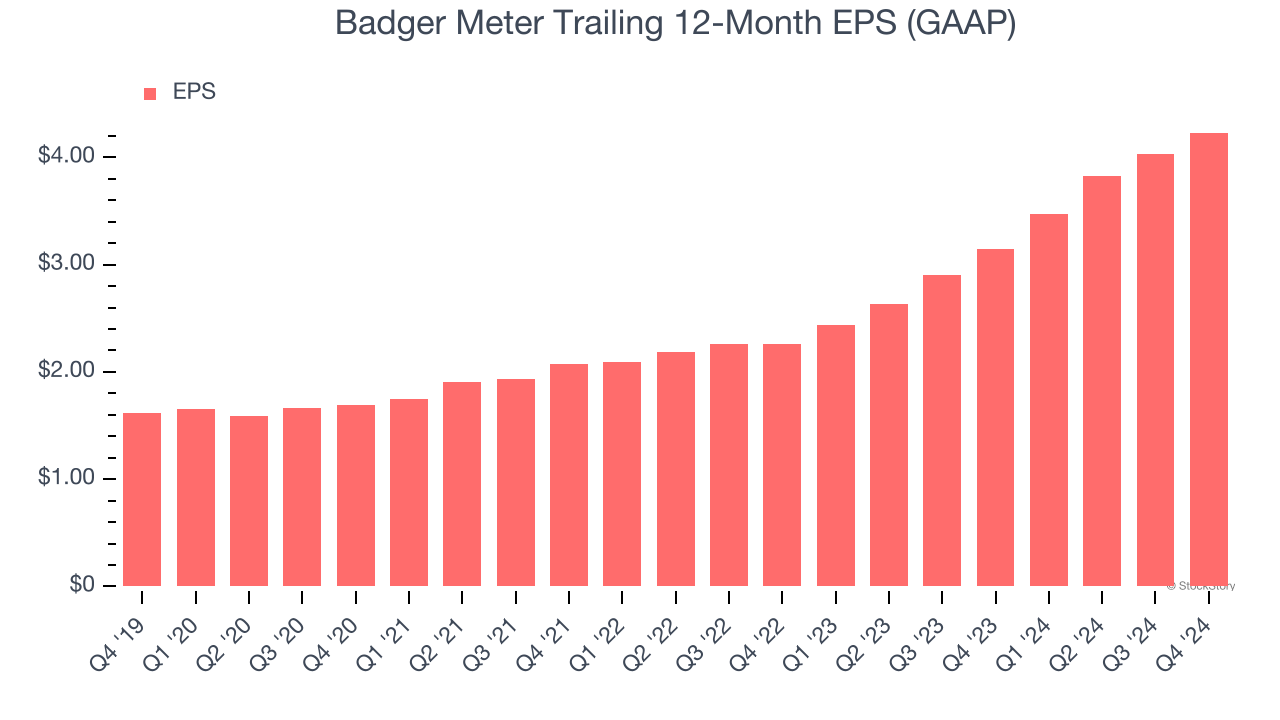

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Badger Meter’s EPS grew at an astounding 21.2% compounded annual growth rate over the last five years, higher than its 14.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Badger Meter’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Badger Meter’s operating margin expanded by 3.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Badger Meter, its two-year annual EPS growth of 36.7% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Badger Meter reported EPS at $1.04, up from $0.84 in the same quarter last year. This print beat analysts’ estimates by 3.7%. Over the next 12 months, Wall Street expects Badger Meter’s full-year EPS of $4.23 to grow 10.8%.

Key Takeaways from Badger Meter’s Q4 Results

We enjoyed seeing Badger Meter exceed analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $208.97 immediately after reporting.

Sure, Badger Meter had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.