What a fantastic six months it’s been for Warby Parker. Shares of the company have skyrocketed 76%, setting a new 52-week high of $28.98. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy WRBY? Find out in our full research report, it’s free.

Why Does WRBY Stock Spark Debate?

Founded in 2010, Warby Parker (NYSE:WRBY) designs, manufactures, and sells eyewear, including prescription glasses, sunglasses, and contact lenses, through its e-commerce platform and physical retail locations.

Two Positive Attributes:

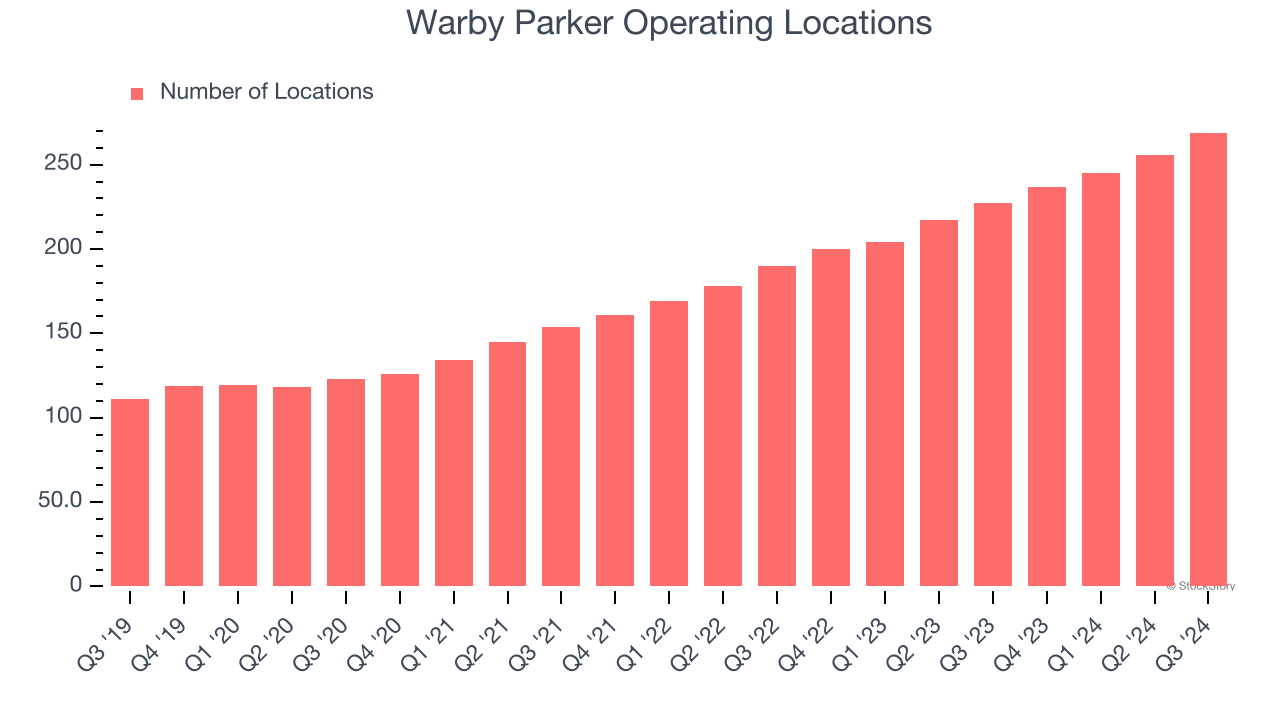

1. New Stores Opening at Breakneck Speed

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Warby Parker sported 269 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 20.2% annual growth, among the fastest in the consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

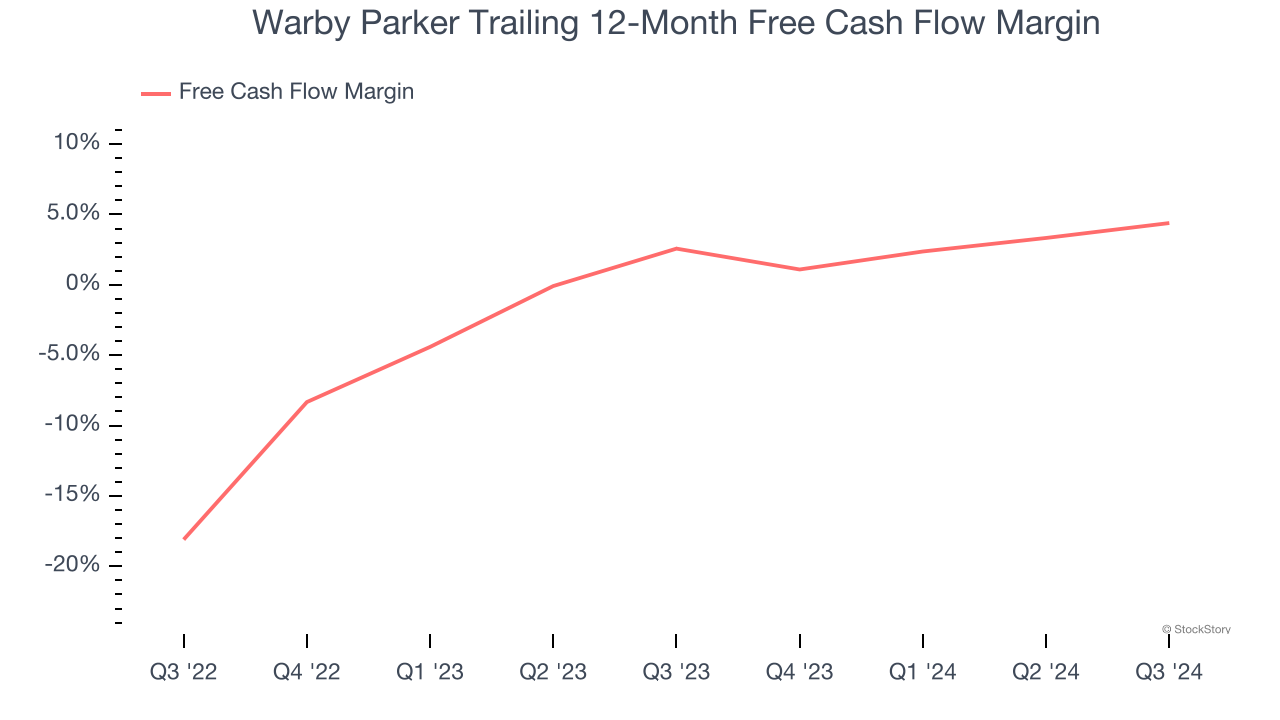

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Warby Parker’s margin expanded by 1.8 percentage points over the last year. This is encouraging because it gives the company more optionality. Warby Parker’s free cash flow margin for the trailing 12 months was 4.4%.

One Reason to be Careful:

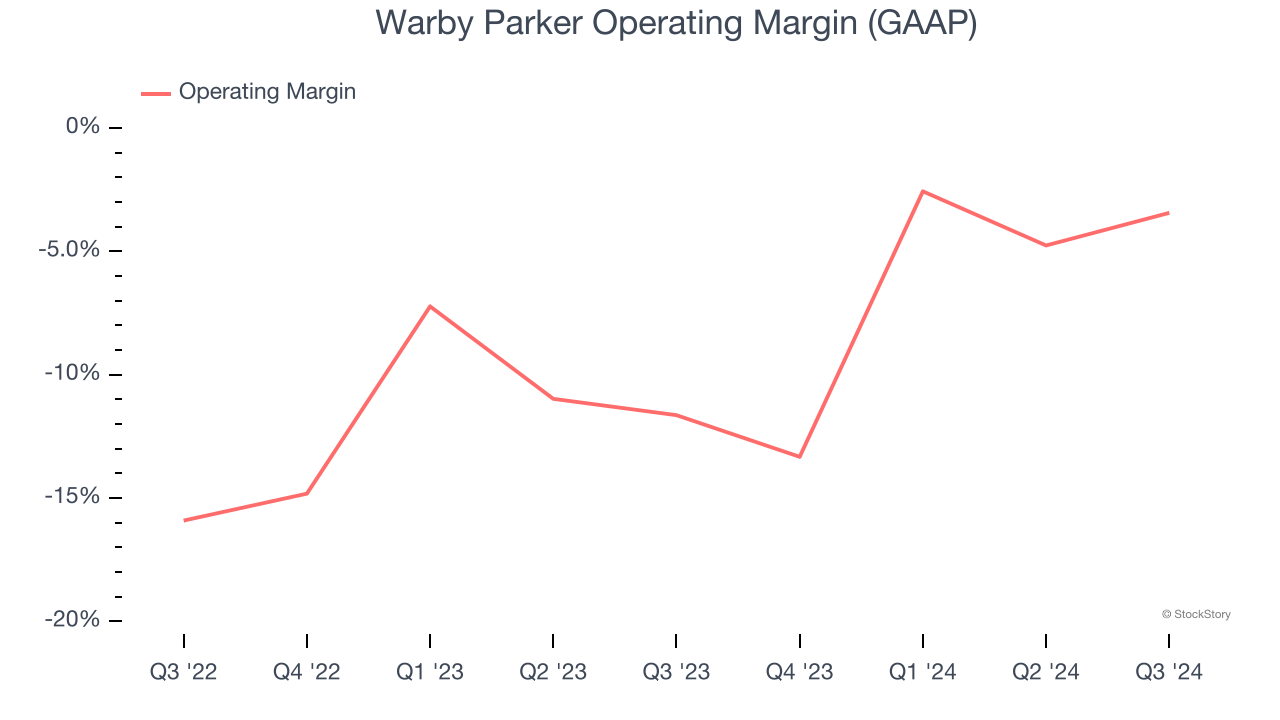

Operating Losses Sound the Alarms

Operating margin is a key profitability metric because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

Despite the consumer retail industry’s secular decline, unprofitable public companies are few and far between. Unfortunately, Warby Parker was one of them over the last two years as its high expenses contributed to an average operating margin of negative 8.2%.

Final Judgment

Warby Parker has huge potential even though it has some open questions, and with the recent surge, the stock trades at 94.1× forward price-to-earnings (or $28.98 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Warby Parker

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.