Rural goods retailer Tractor Supply (NASDAQ:TSCO) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 3.1% year on year to $3.77 billion. Its GAAP profit of $0.44 per share was 3.3% below analysts’ consensus estimates.

Is now the time to buy Tractor Supply? Find out by accessing our full research report, it’s free.

Tractor Supply (TSCO) Q4 CY2024 Highlights:

- Revenue: $3.77 billion vs analyst estimates of $3.79 billion (3.1% year-on-year growth, in line)

- EPS (GAAP): $0.44 vs analyst expectations of $0.45 (3.3% miss)

- Adjusted EBITDA: $438.4 million vs analyst estimates of $445.7 million (11.6% margin, 1.6% miss)

- EPS (GAAP) guidance for the upcoming financial year 2025 is $2.16 at the midpoint, missing analyst estimates by 2.2%

- Operating Margin: 8.4%, in line with the same quarter last year

- Free Cash Flow Margin: 7.2%, up from 4.6% in the same quarter last year

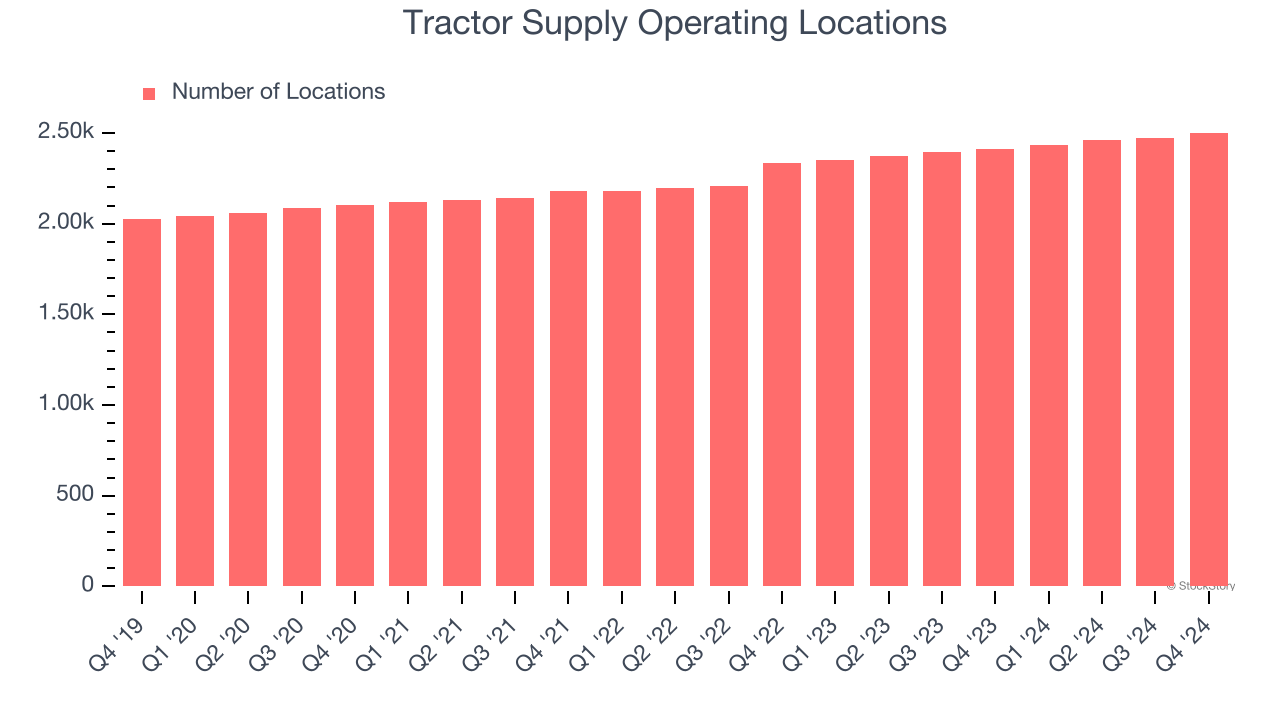

- Locations: 2,502 at quarter end, up from 2,414 in the same quarter last year

- Same-Store Sales were flat year on year (-4.2% in the same quarter last year)

- Market Capitalization: $30.53 billion

“In 2024, our business performed well in a challenging retail environment, and we made significant progress on our Life Out Here strategy. We achieved numerous milestones during the year, including having about half of our stores in the Project Fusion layout and opening our 10th and largest distribution center. The fundamentals of our business remain strong with ongoing market share gains, record Neighbor’s Club members, digital sales in excess of one billion dollars and high-return new store openings. I extend my sincere gratitude to the more than 50,000 Team Members for their steadfast dedication to upholding our Mission and Values and supporting their communities,” said Hal Lawton, President and Chief Executive Officer of Tractor Supply.

Company Overview

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ:TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

Tractor Supply is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences consumer purchasing decisions.

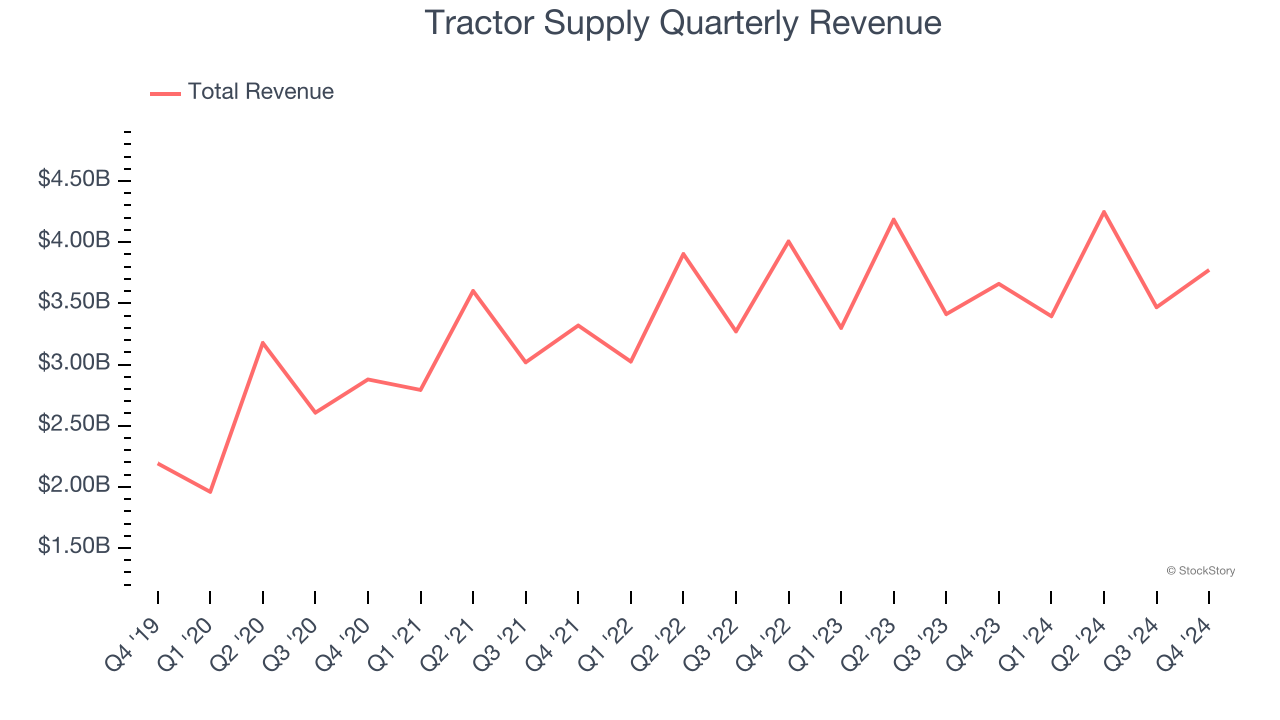

As you can see below, Tractor Supply grew its sales at a decent 12.2% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and expanded its reach.

This quarter, Tractor Supply grew its revenue by 3.1% year on year, and its $3.77 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months, a deceleration versus the last five years. We still think its growth trajectory is attractive given its scale and suggests the market is factoring in success for its products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

Tractor Supply operated 2,502 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 5.3% annual growth, much faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

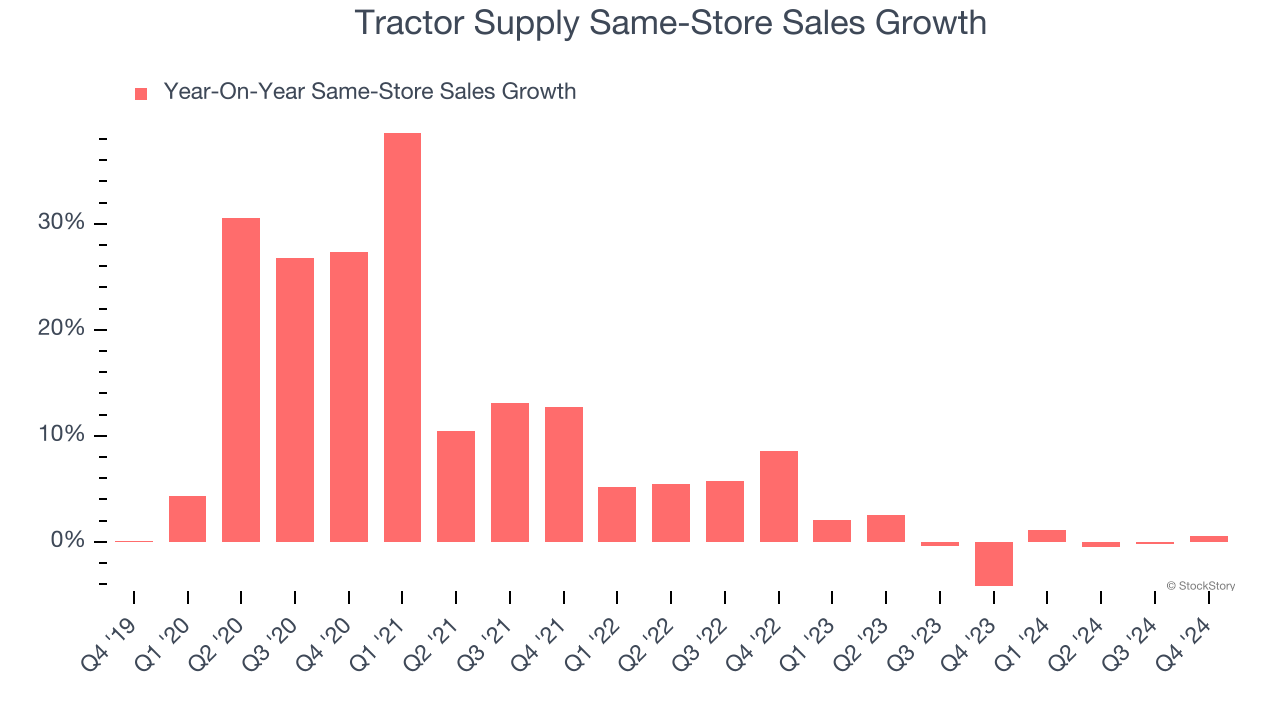

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Tractor Supply’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Tractor Supply should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Tractor Supply’s year on year same-store sales were flat. This performance was more or less in line with its historical levels.

Key Takeaways from Tractor Supply’s Q4 Results

We struggled to find many resounding positives in these results. Its full-year EPS guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 5.7% to $53.75 immediately following the results.

Tractor Supply underperformed this quarter, but does that create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.