Industrial products company CSW (NASDAQ:CSWI) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 10.7% year on year to $193.6 million. Its non-GAAP profit of $1.48 per share was 3.2% above analysts’ consensus estimates.

Is now the time to buy CSW? Find out by accessing our full research report, it’s free.

CSW (CSWI) Q4 CY2024 Highlights:

- Revenue: $193.6 million vs analyst estimates of $192 million (10.7% year-on-year growth, 0.9% beat)

- Adjusted EPS: $1.48 vs analyst estimates of $1.43 (3.2% beat)

- Adjusted EBITDA: $42.03 million vs analyst estimates of $41.82 million (21.7% margin, in line)

- Operating Margin: 15.3%, in line with the same quarter last year

- Free Cash Flow Margin: 4.4%, down from 24.6% in the same quarter last year

- Market Capitalization: $5.81 billion

Joseph B. Armes, CSW Industrials’ Chairman, President, and Chief Executive Officer, commented, "I am very pleased to announce record revenue for the fiscal third quarter driven by the strategic acquisitions of Dust Free, PSP Products, and PF WaterWorks during the last twelve months as well as organic volume growth. Impressively, the team also achieved record net income, adjusted earnings per diluted share, and adjusted EBITDA for the fiscal third quarter."

Company Overview

With over two centuries of combined operations manufacturing and supplying, CSW (NASDAQ:CSWI) offers special chemicals, coatings, sealants, and lubricants for various industries.

HVAC and Water Systems

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Sales Growth

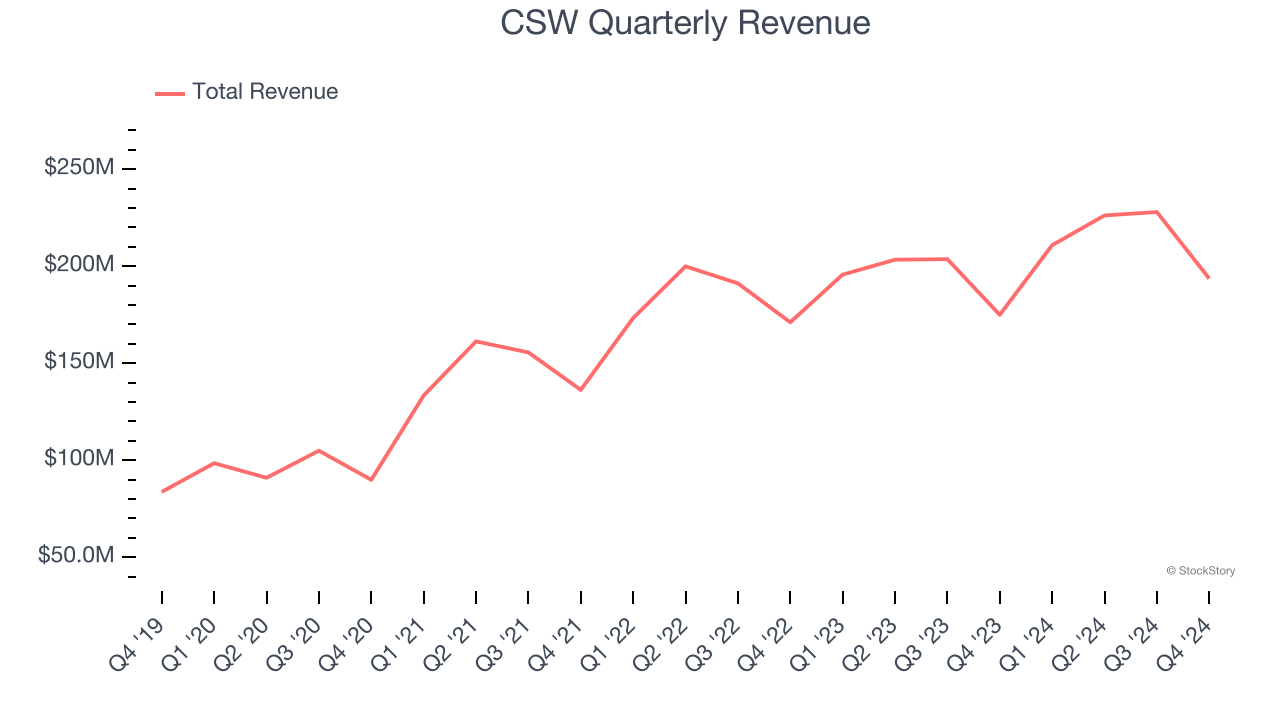

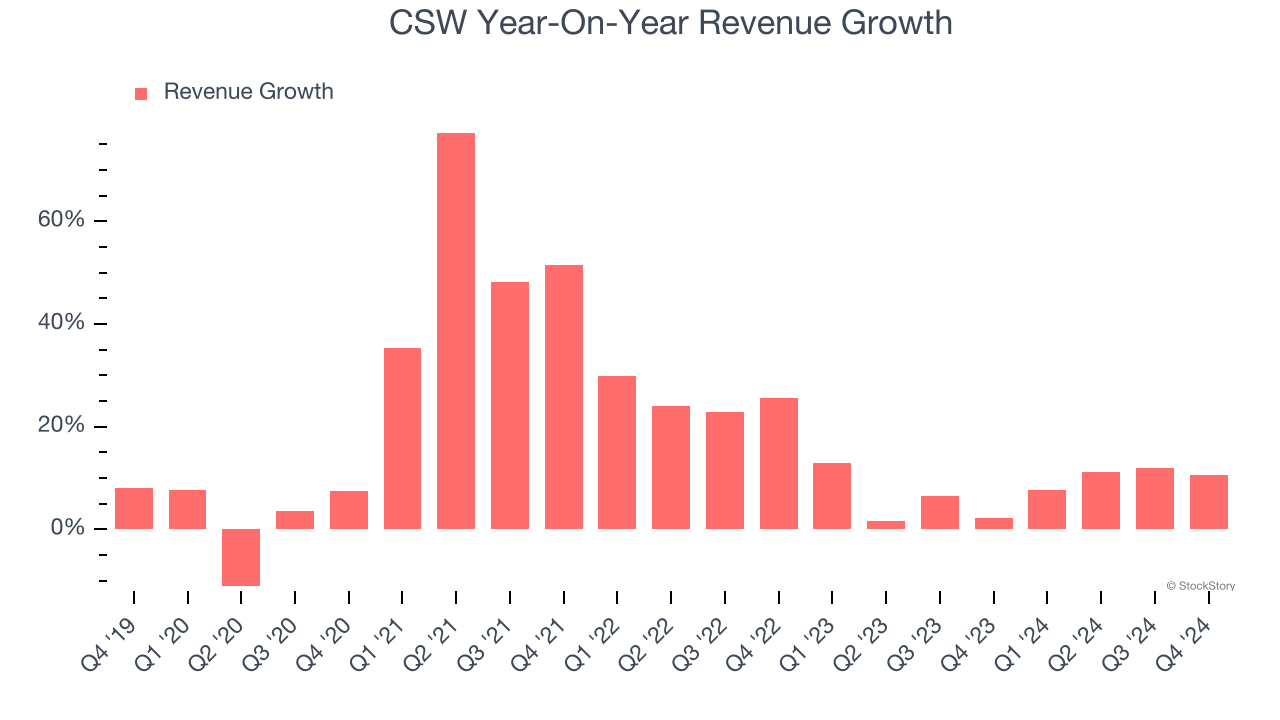

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, CSW grew its sales at an incredible 17.8% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. CSW’s annualized revenue growth of 8% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, CSW reported year-on-year revenue growth of 10.7%, and its $193.6 million of revenue exceeded Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, similar to its two-year rate. This projection is above the sector average and indicates its newer products and services will help sustain its recent top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

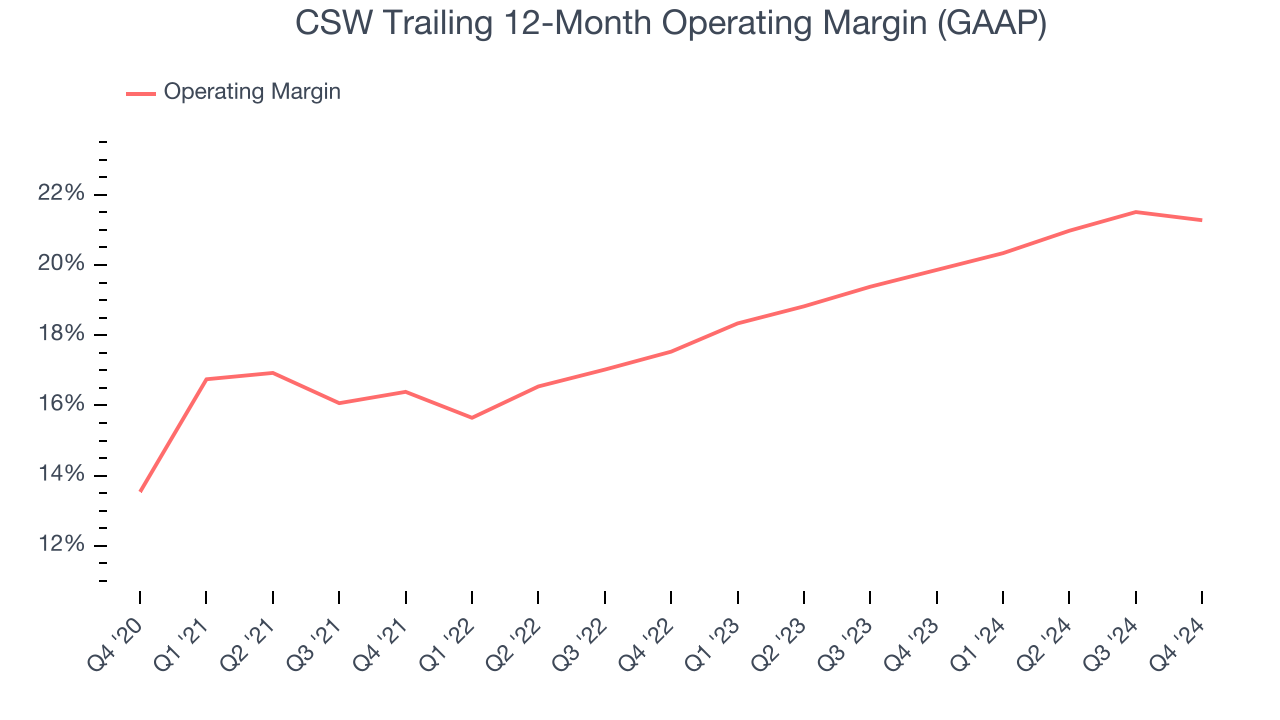

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

CSW has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, CSW’s operating margin rose by 7.7 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, CSW generated an operating profit margin of 15.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

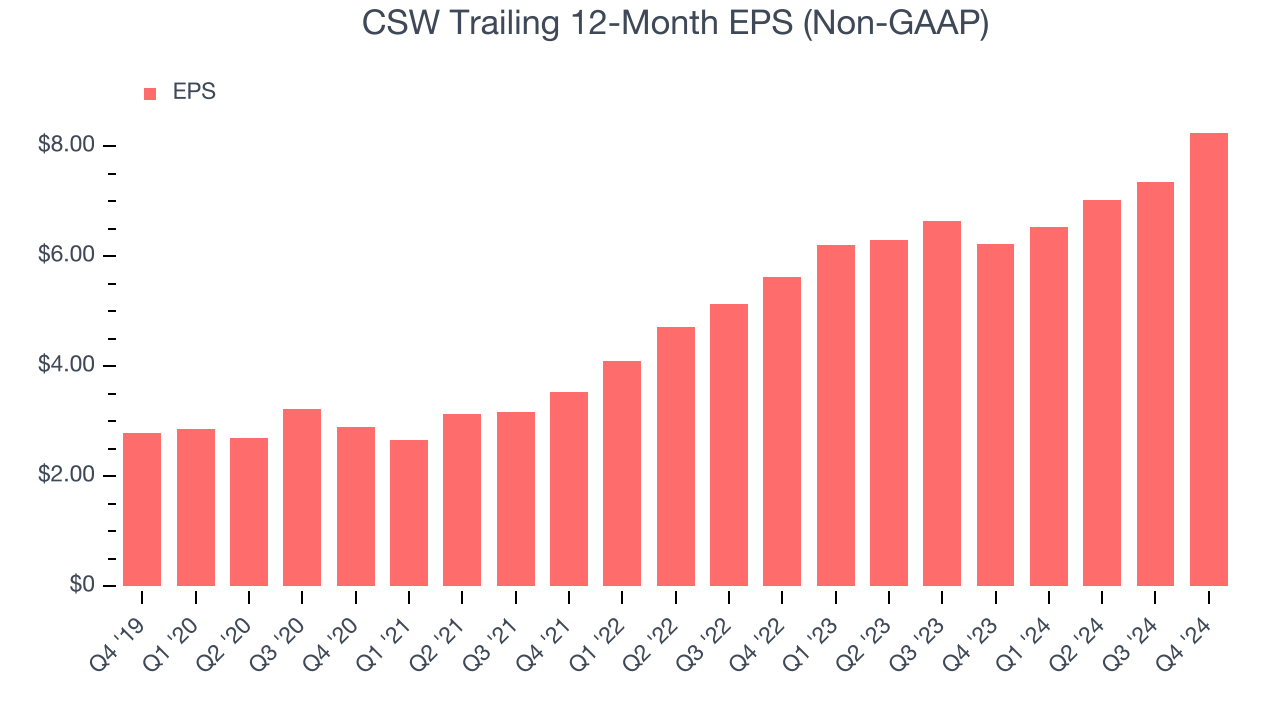

CSW’s EPS grew at an astounding 24.2% compounded annual growth rate over the last five years, higher than its 17.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into CSW’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, CSW’s operating margin was flat this quarter but expanded by 7.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For CSW, its two-year annual EPS growth of 21.1% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, CSW reported EPS at $1.48, up from $0.59 in the same quarter last year. This print beat analysts’ estimates by 3.2%. Over the next 12 months, Wall Street expects CSW’s full-year EPS of $8.25 to grow 12.7%.

Key Takeaways from CSW’s Q4 Results

It was good to see CSW narrowly top analysts’ revenue expectations this quarter, even if my a narrow margin. EBITDA was in line with Wall Street’s estimates. Overall, this quarter wasn't too eventful, although the results didn't seem to be enough for the market. The stock traded down 1.5% to $339.87 immediately after reporting.

So do we think CSW is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.