IT project management software company, Atlassian (NASDAQ:TEAM) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 21.4% year on year to $1.29 billion. Guidance for next quarter’s revenue was optimistic at $1.35 billion at the midpoint, 2.4% above analysts’ estimates. Its non-GAAP profit of $0.96 per share was 27.1% above analysts’ consensus estimates.

Is now the time to buy Atlassian? Find out by accessing our full research report, it’s free.

Atlassian (TEAM) Q4 CY2024 Highlights:

- Revenue: $1.29 billion vs analyst estimates of $1.24 billion (21.4% year-on-year growth, 3.8% beat)

- Cloud Revenue: $847.0 million vs analyst estimates of $821.1 million (30.0% year-on-year growth, 3.2% beat)

- Adjusted EPS: $0.96 vs analyst estimates of $0.76 (27.1% beat)

- Adjusted Operating Income: $335.1 million vs analyst estimates of $265.2 million (26.1% margin, 26.4% beat)

- Revenue Guidance for Q1 CY2025 is $1.35 billion at the midpoint, above analyst estimates of $1.32 billion

- Operating Margin: -4.5%, in line with the same quarter last year

- Free Cash Flow Margin: 26.6%, up from 6.3% in the previous quarter

- Billings: $1.47 billion at quarter end, up 21.2% year on year (beat)

- Market Capitalization: $70.66 billion

“The Atlassian System of Work is resonating with enterprises all over the globe, as business leaders increasingly turn to the Atlassian platform to help teams across their organization collaborate on the opportunities and challenges they face,” said Mike Cannon-Brookes, Atlassian’s CEO and co-Founder.

Company Overview

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian (NASDAQ:TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

Sales Growth

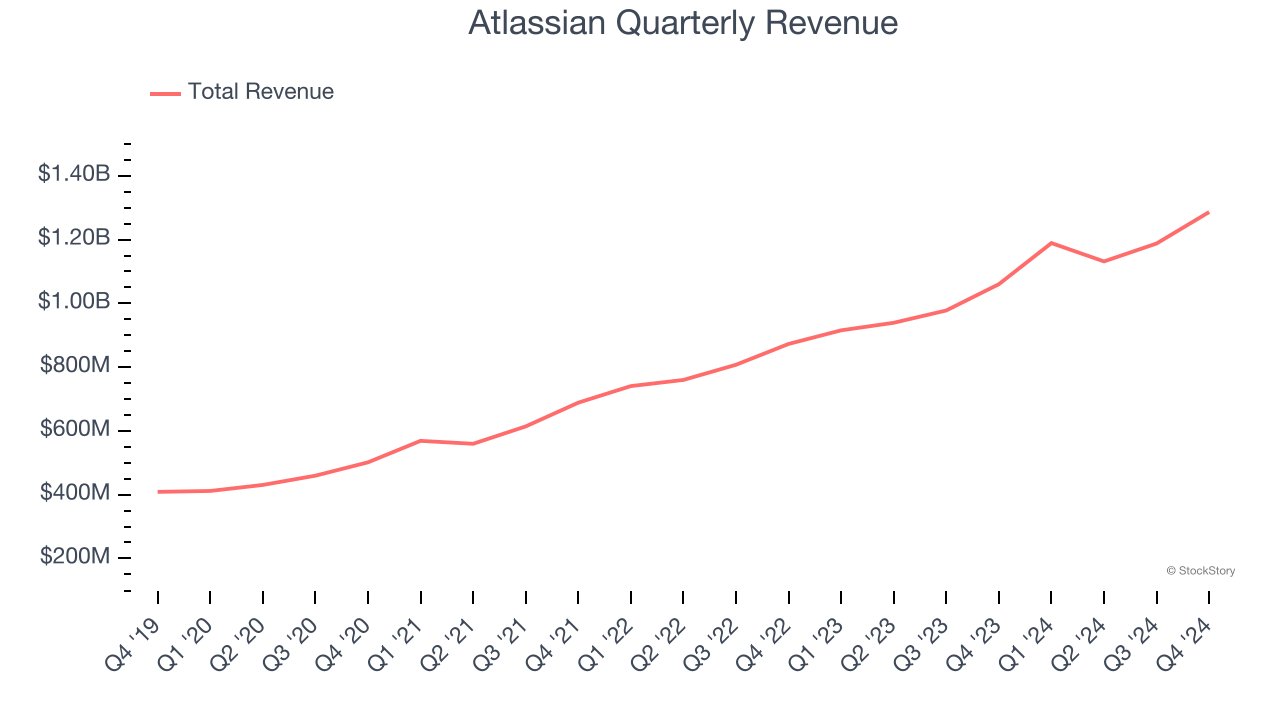

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Atlassian’s sales grew at a solid 25.4% compounded annual growth rate over the last three years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Atlassian reported robust year-on-year revenue growth of 21.4%, and its $1.29 billion of revenue topped Wall Street estimates by 3.8%. Company management is currently guiding for a 13.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.3% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is healthy and indicates the market is factoring in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Atlassian’s billings punched in at $1.47 billion in Q4, and over the last four quarters, its growth was impressive as it averaged 24.9% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Atlassian is extremely efficient at acquiring new customers, and its CAC payback period checked in at 4.2 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Atlassian more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Atlassian’s Q4 Results

We were impressed by how significantly Atlassian blew past analysts’ billings expectations this quarter. We were also glad its revenue beat, with a convincing beat in cloud revenue, which is a key focus of the market. Adding to the good news was that revenue guidance for next quarter came in higher than Wall Street’s estimates. Zooming out, we think this was a very solid quarter. The stock traded up 17.7% to $313.60 immediately after reporting.

Atlassian may have had a good quarter, but does that mean you should invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.