Chip designer Allegro MicroSystems (NASDAQ:ALGM) announced better-than-expected revenue in Q4 CY2024, but sales fell by 30.2% year on year to $177.9 million. Guidance for next quarter’s revenue was better than expected at $185 million at the midpoint, 0.7% above analysts’ estimates. Its GAAP loss of $0.04 per share was in line with analysts’ consensus estimates.

Is now the time to buy Allegro MicroSystems? Find out by accessing our full research report, it’s free.

Allegro MicroSystems (ALGM) Q4 CY2024 Highlights:

- Revenue: $177.9 million vs analyst estimates of $175.4 million (30.2% year-on-year decline, 1.4% beat)

- EPS (GAAP): -$0.04 vs analyst estimates of -$0.05 (in line)

- Adjusted EBITDA: $30.32 million vs analyst estimates of $30.18 million (17% margin, in line)

- Revenue Guidance for Q1 CY2025 is $185 million at the midpoint, roughly in line with what analysts were expecting

- EPS (GAAP) guidance for Q1 CY2025 is $0.05 at the midpoint, beating analyst estimates by 346%

- Operating Margin: 0%, down from 14.4% in the same quarter last year

- Free Cash Flow was -$21.8 million, down from $42.16 million in the same quarter last year

- Inventory Days Outstanding: 182, up from 158 in the previous quarter

- Market Capitalization: $4.20 billion

“We delivered on our commitments with third quarter sales of $178 million and non-GAAP EPS of $0.07, both above the midpoint of our guidance,” said Vineet Nargolwala, President and CEO of Allegro.

Company Overview

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ:ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

Processors and Graphics Chips

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

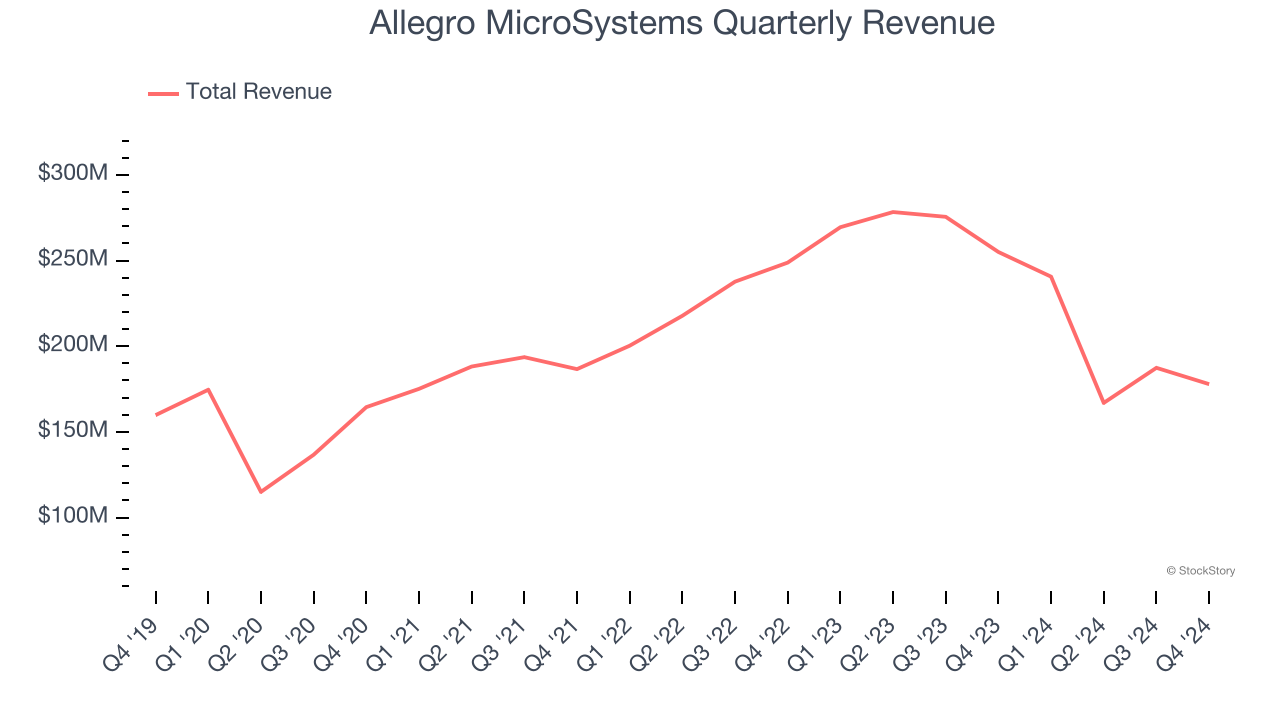

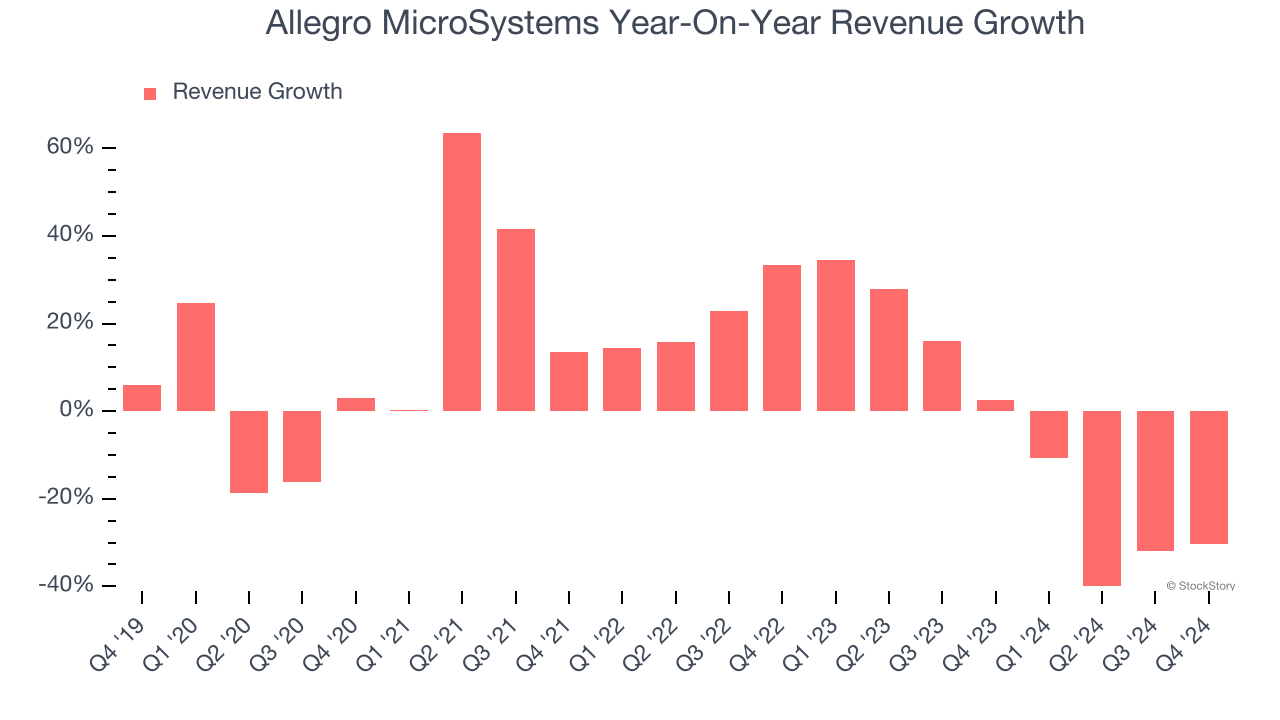

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Allegro MicroSystems’s 5% annualized revenue growth over the last five years was tepid. This was below our standard for the semiconductor sector and is a rough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Allegro MicroSystems’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 7.6% annually.

This quarter, Allegro MicroSystems’s revenue fell by 30.2% year on year to $177.9 million but beat Wall Street’s estimates by 1.4%. Company management is currently guiding for a 23.1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

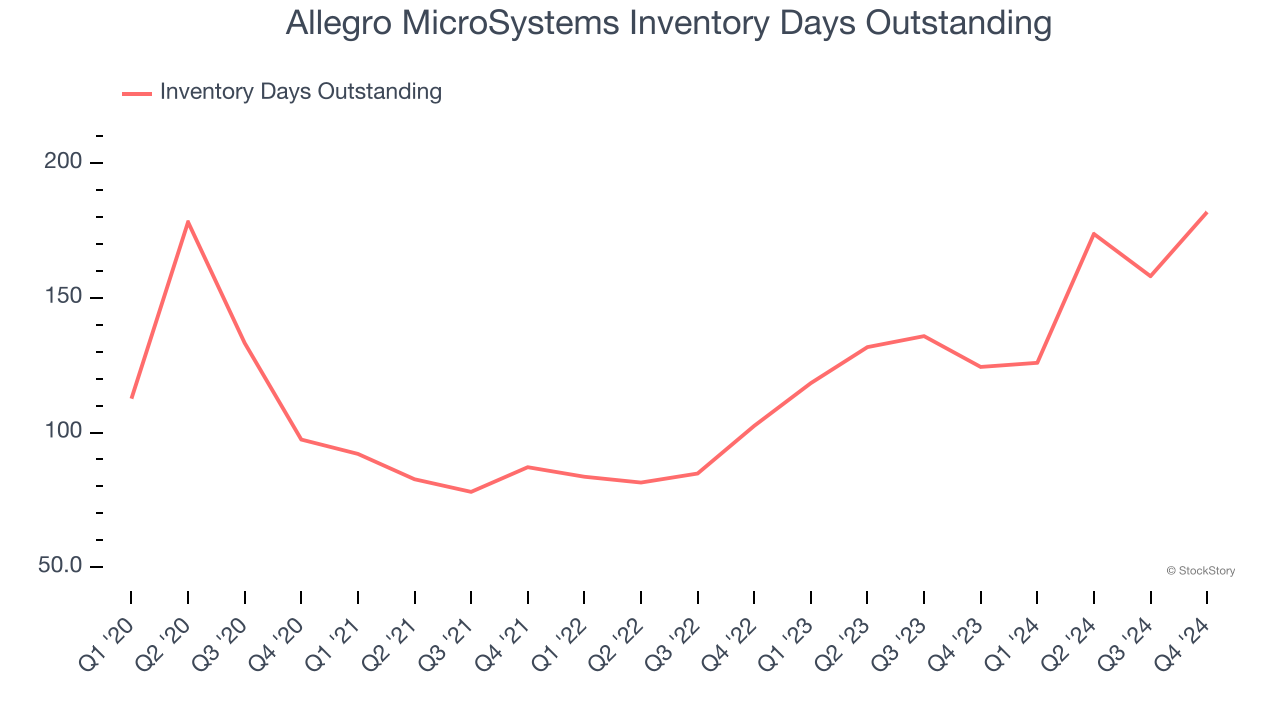

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Allegro MicroSystems’s DIO came in at 182, which is 64 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

Key Takeaways from Allegro MicroSystems’s Q4 Results

We liked that Allegro MicroSystems beat analysts’ operating income and EPS expectations this quarter. On the other hand, its inventory levels materially increased and revenue guidance for next quarter was only in line. Shares traded down 5.5% to $21.60 immediately after reporting.

Big picture, is Allegro MicroSystems a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.