Vocational education company Adtalem Global Education (NYSE:ATGE) announced better-than-expected revenue in Q4 CY2024, with sales up 13.9% year on year to $447.7 million. The company’s full-year revenue guidance of $1.75 billion at the midpoint came in 1.5% above analysts’ estimates. Its non-GAAP profit of $1.81 per share was 32.1% above analysts’ consensus estimates.

Is now the time to buy Adtalem? Find out by accessing our full research report, it’s free.

Adtalem (ATGE) Q4 CY2024 Highlights:

- Revenue: $447.7 million vs analyst estimates of $427.5 million (13.9% year-on-year growth, 4.7% beat)

- Adjusted EPS: $1.81 vs analyst estimates of $1.37 (32.1% beat)

- Adjusted EBITDA: $125 million vs analyst estimates of $97.55 million (27.9% margin, 28.2% beat)

- The company lifted its revenue guidance for the full year to $1.75 billion at the midpoint from $1.71 billion, a 2% increase

- Adjusted EPS guidance for the full year is $6.20 at the midpoint, beating analyst estimates by 5.3%

- Operating Margin: 23.2%, up from 16.7% in the same quarter last year

- Free Cash Flow was -$34.04 million compared to -$22.38 million in the same quarter last year

- Market Capitalization: $3.74 billion

"Growth with Purpose, our operational excellence strategy, has delivered exceptional results—marked by six straight quarters of enrollment growth—while advancing our mission to develop skilled healthcare professionals," said Steve Beard, chairman and chief executive officer, Adtalem Global Education.

Company Overview

Formerly known as DeVry Education Group, Adtalem Global Education (NYSE:ATGE) is a global provider of workforce solutions and educational services.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Sales Growth

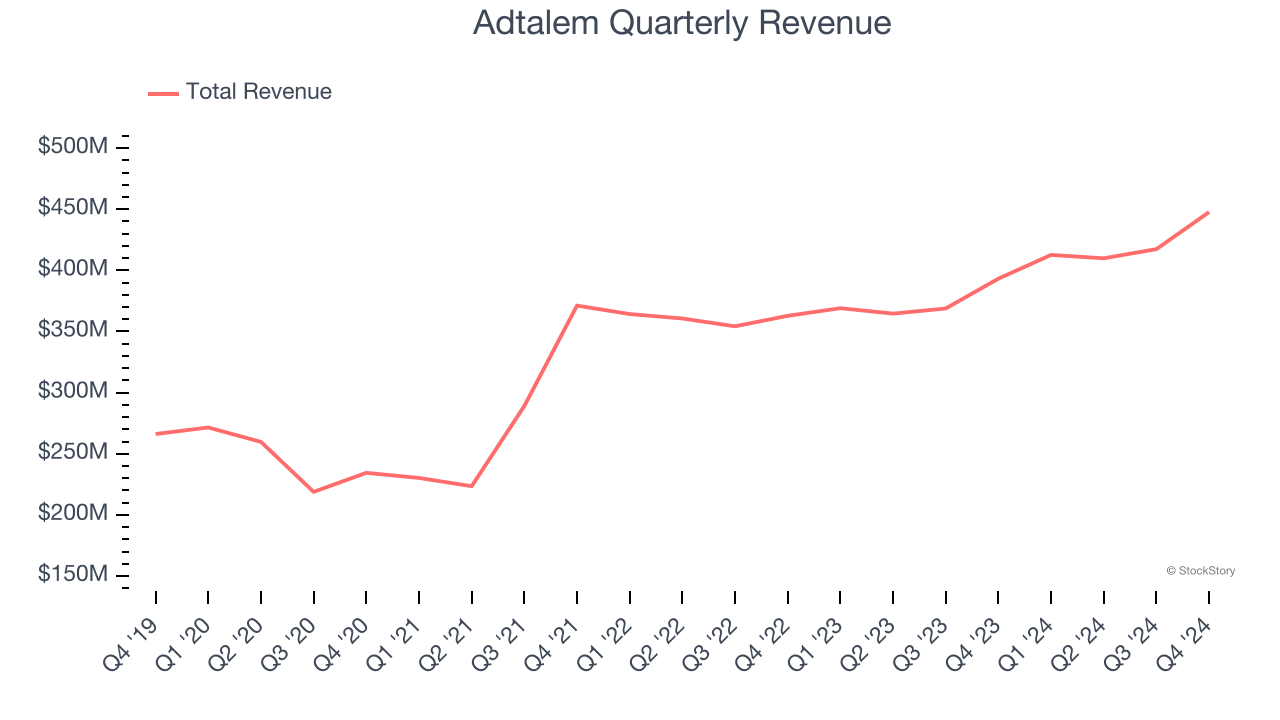

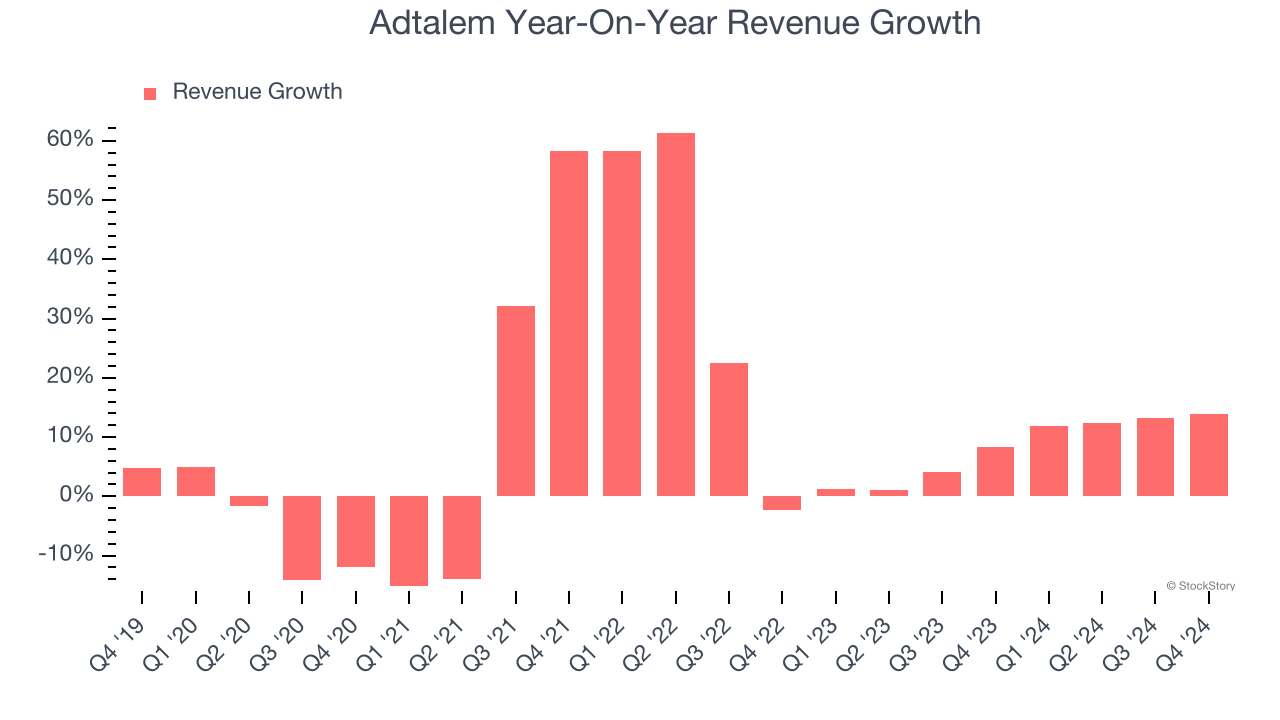

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Adtalem grew its sales at a 10.1% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our benchmark for the consumer discretionary sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Adtalem’s recent history shows its demand slowed as its annualized revenue growth of 8.2% over the last two years is below its five-year trend.

This quarter, Adtalem reported year-on-year revenue growth of 13.9%, and its $447.7 million of revenue exceeded Wall Street’s estimates by 4.7%.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

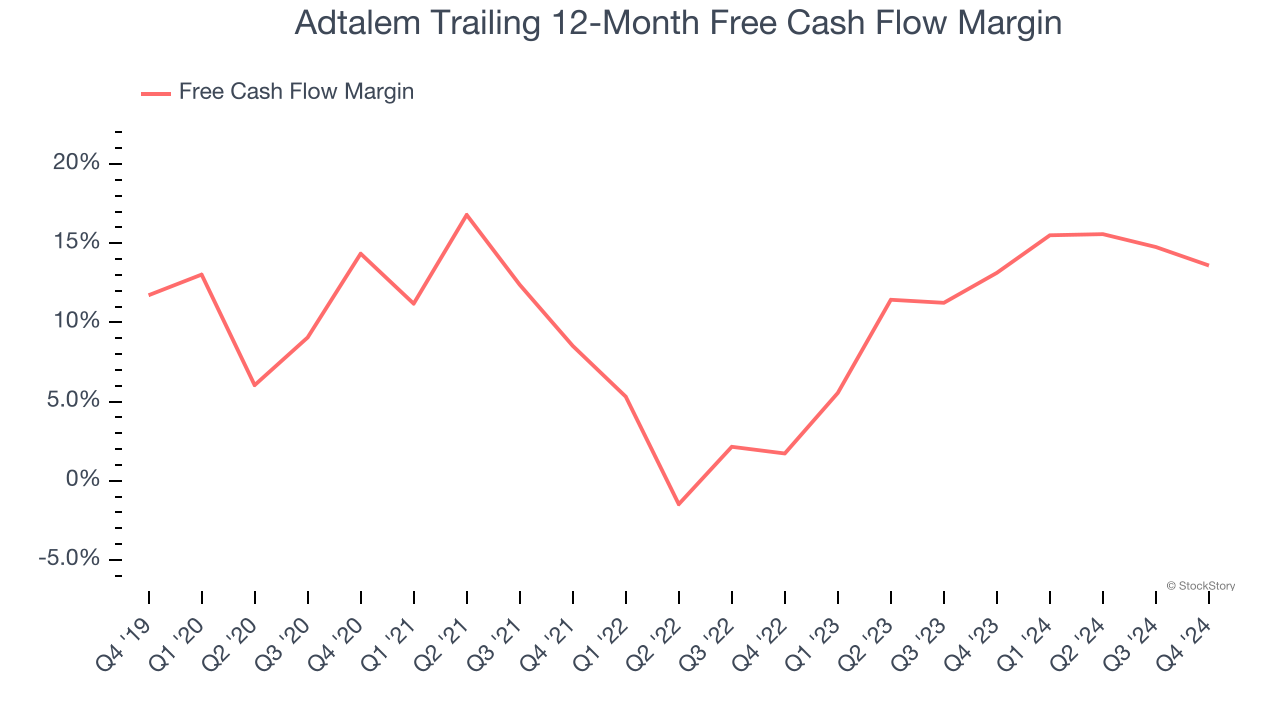

Adtalem has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.4% over the last two years, better than the broader consumer discretionary sector.

Adtalem burned through $34.04 million of cash in Q4, equivalent to a negative 7.6% margin. The company’s cash burn was similar to its $22.38 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Over the next year, analysts predict Adtalem’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 13.6% for the last 12 months will increase to 15.1%, it options for capital deployment (investments, share buybacks, etc.).

Key Takeaways from Adtalem’s Q4 Results

Revenue and EPS both beat convincingly in the quarter, which is a great start. Looking ahead, the company lifted its full-year revenue guidance, which is now above expectations. Full-year EPS also came in ahead. Zooming out, we think this was a very good quarter with some key areas of upside. The stock traded up 5.2% to $107.79 immediately after reporting.

Sure, Adtalem had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.