Auto services provider Monro (NASDAQ:MNRO) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 3.7% year on year to $305.8 million. Its non-GAAP profit of $0.19 per share was 35.6% below analysts’ consensus estimates.

Is now the time to buy Monro? Find out by accessing our full research report, it’s free.

Monro (MNRO) Q4 CY2024 Highlights:

- Revenue: $305.8 million vs analyst estimates of $310.5 million (3.7% year-on-year decline, 1.5% miss)

- Adjusted EPS: $0.19 vs analyst expectations of $0.30 (35.6% miss)

- Operating Margin: 3.3%, down from 6.7% in the same quarter last year

- Same-Store Sales fell 1.9% year on year (-6.1% in the same quarter last year) (miss vs analyst expectations of down 1.3% year on year)

- "Our preliminary fiscal January comparable store sales are down 1%, adjusted for one additional selling day in the month. This is driven by weakness in tire category sales that were impacted by extreme weather, which resulted in temporary store closures and lower store traffic"

- Market Capitalization: $659.2 million

“We drove a sequential improvement in our year-over-year comparable store sales percentage change from the second quarter and returned our business to year-over-year comparable store sales growth in the month of December, when adjusted for a shift in the timing of the Christmas holiday. Importantly, the year-over-year comparable store sales percentage change in both our tire dollar and unit sales improved sequentially from the second quarter and our tire category comped positive in the month of December, when adjusted for the holiday shift, with year-over-year growth in units in the quarter. Our ConfiDrive digital courtesy inspection process and our oil change offer allowed us to drive sequential improvement in our year-over-year service category comparable store sales percentage change from the second quarter. We drove year-over-year growth in both units and sales dollars for batteries, alignments and front/end shocks. Our preliminary fiscal January comparable store sales are down 1%, adjusted for one additional selling day in the month. This is driven by weakness in tire category sales that were impacted by extreme weather, which resulted in temporary store closures and lower store traffic, partially offset by strength in our service categories, including brakes. We believe the extreme weather in January will benefit us in the coming months”, said Mike Broderick, President and Chief Executive Officer.

Company Overview

Started as a single location in Rochester, New York, Monro (NASDAQ:MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

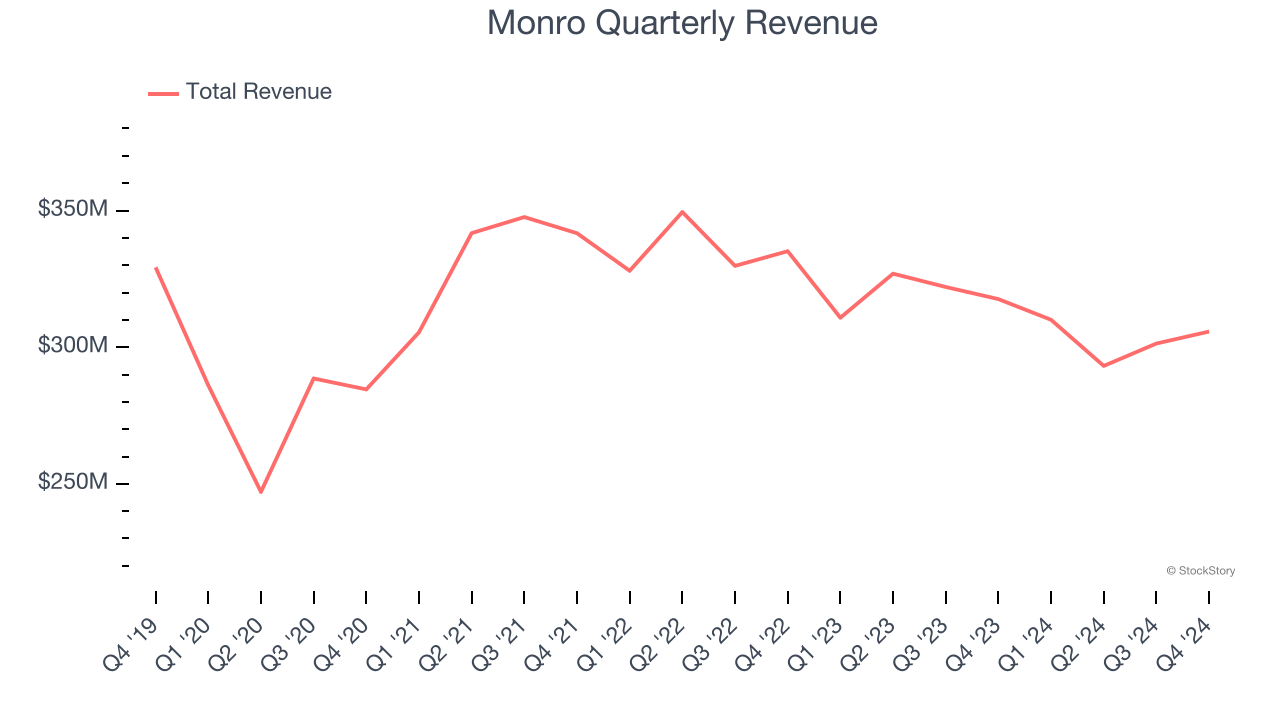

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

Monro is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage.

As you can see below, Monro struggled to increase demand as its $1.21 billion of sales for the trailing 12 months was close to its revenue five years ago (we compare to 2019 to normalize for COVID-19 impacts). This was mainly because it didn’t open many new stores and observed lower sales at existing, established locations.

This quarter, Monro missed Wall Street’s estimates and reported a rather uninspiring 3.7% year-on-year revenue decline, generating $305.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products will fuel better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

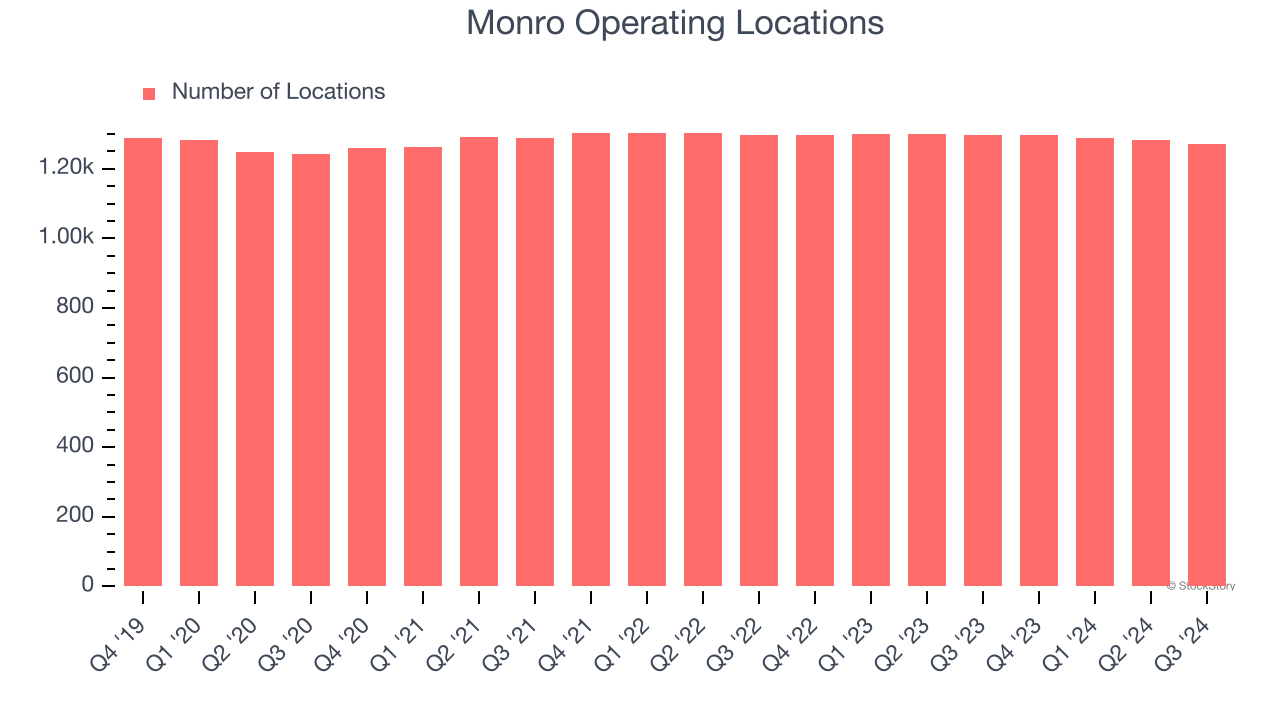

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Monro has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Note that Monro reports its store count intermittently, so some data points are missing in the chart below.

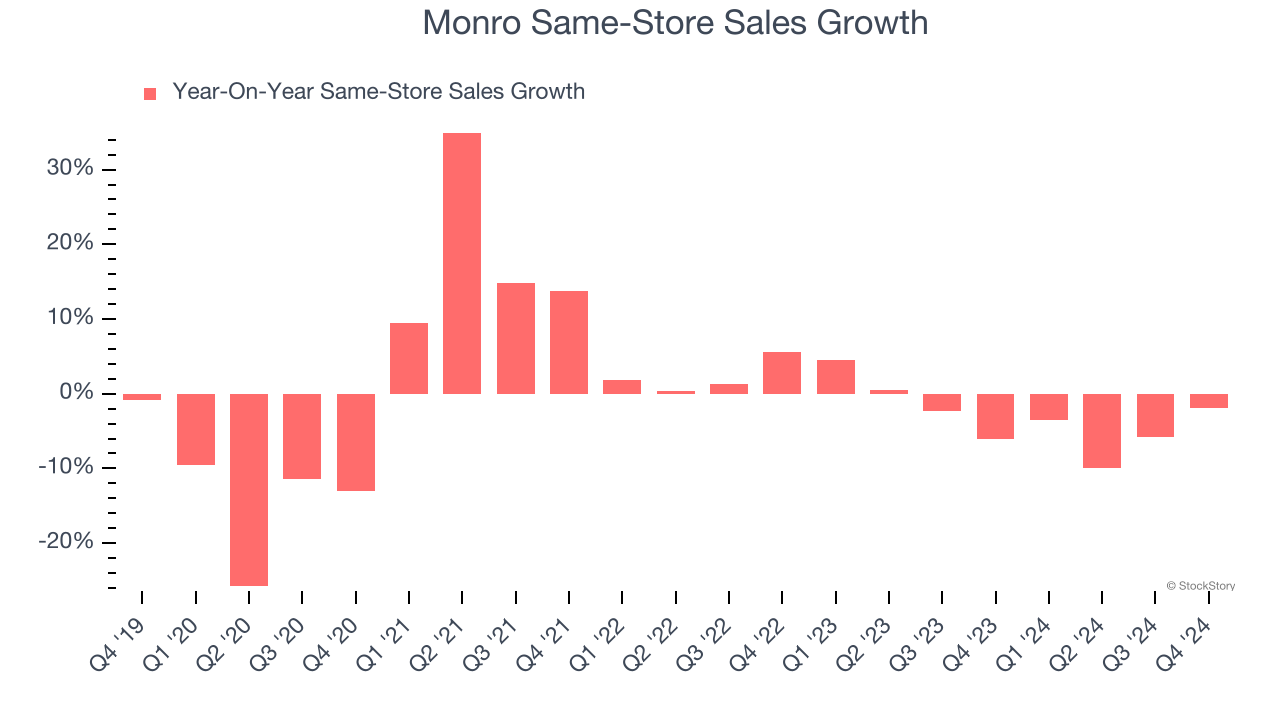

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Monro’s demand has been shrinking over the last two years as its same-store sales have averaged 3.1% annual declines. This performance isn’t ideal, and we’d be concerned if Monro starts opening new stores to artificially boost revenue growth.

In the latest quarter, Monro’s same-store sales fell by 1.9% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Monro’s Q4 Results

We struggled to find many resounding positives in these results. Its same-store sales fell, coming in below expectation. This led to a meaningful EPS miss. Management commented on January trends so far, which are weak due to extreme winter weather that seems to be hurting store traffic. Overall, this quarter could have been better. The stock traded down 9% to $20 immediately after reporting.

Monro’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.