Data backup provider Commvault (NASDAQ:CVLT) announced better-than-expected revenue in Q4 CY2024, with sales up 21.1% year on year to $262.6 million. On top of that, next quarter’s revenue guidance ($262 million at the midpoint) was surprisingly good and 4.3% above what analysts were expecting. Its non-GAAP profit of $0.94 per share was 7.6% above analysts’ consensus estimates.

Is now the time to buy Commvault Systems? Find out by accessing our full research report, it’s free.

Commvault Systems (CVLT) Q4 CY2024 Highlights:

- Revenue: $262.6 million vs analyst estimates of $245.6 million (21.1% year-on-year growth, 6.9% beat)

- Adjusted EPS: $0.94 vs analyst estimates of $0.87 (7.6% beat)

- Adjusted Operating Income: $54.58 million vs analyst estimates of $50.39 million (20.8% margin, 8.3% beat)

- Revenue Guidance for Q1 CY2025 is $262 million at the midpoint, above analyst estimates of $251.3 million

- Operating Margin: 0%, down from 9.7% in the same quarter last year

- Free Cash Flow Margin: 11.4%, down from 23% in the previous quarter

- Annual Recurring Revenue: $889.6 million at quarter end, up 18.2% year on year

- Billings: $308.7 million at quarter end, up 24.7% year on year

- Market Capitalization: $6.92 billion

"Once again, Commvault has delivered a record-breaking quarter with accelerating revenue growth," said Sanjay Mirchandani, President and CEO, Commvault.

Company Overview

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention, and compliance.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

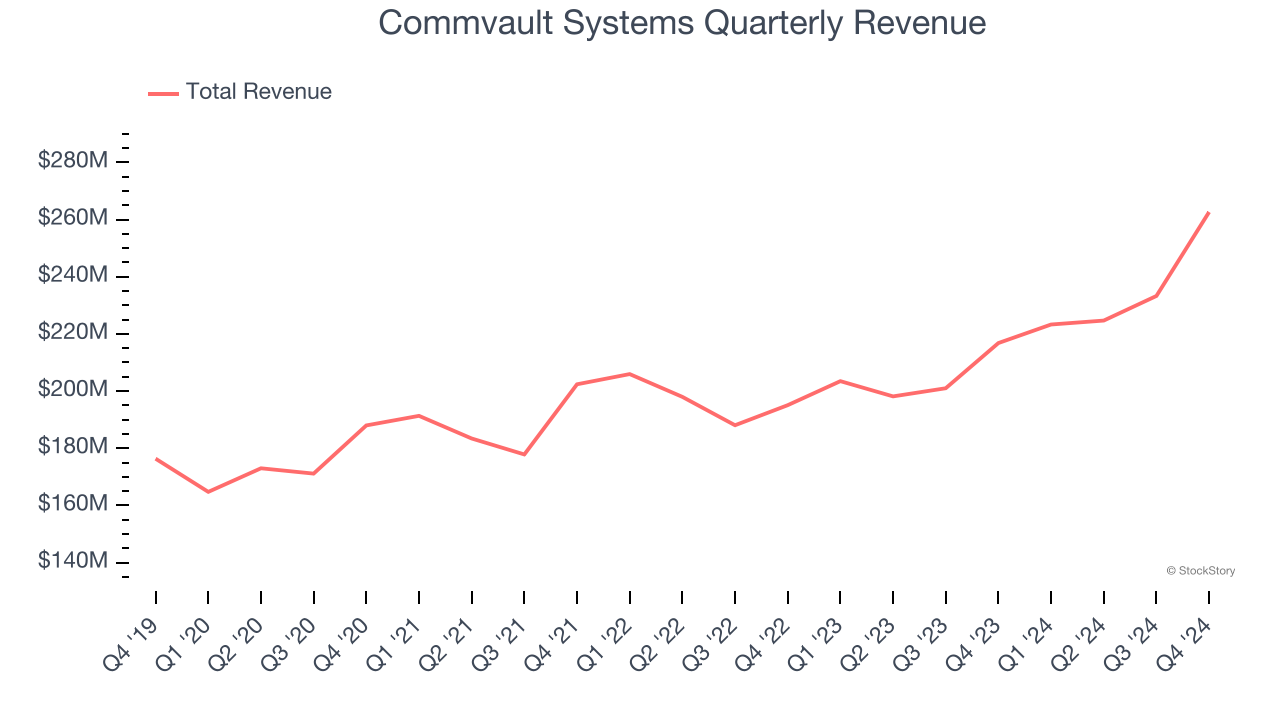

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Commvault Systems’s 7.7% annualized revenue growth over the last three years was weak. This fell short of our benchmark for the software sector and is a poor baseline for our analysis.

This quarter, Commvault Systems reported robust year-on-year revenue growth of 21.1%, and its $262.6 million of revenue topped Wall Street estimates by 6.9%. Company management is currently guiding for a 17.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

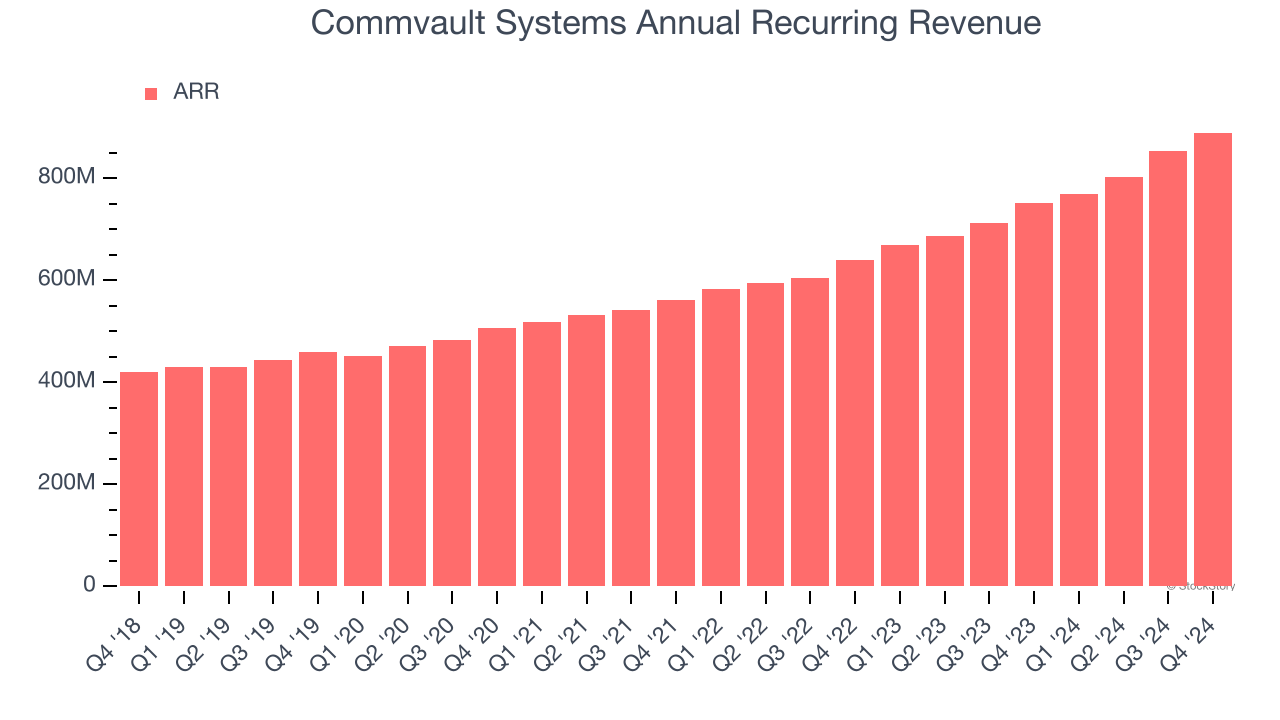

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Commvault Systems’s ARR punched in at $889.6 million in Q4, and over the last four quarters, its growth was solid as it averaged 17.6% year-on-year increases. This alternate topline metric grew faster than total sales, which likely means that the recurring portions of the business are growing faster than less predictable, choppier ones such as implementation fees. That could be a good sign for future revenue growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Commvault Systems to acquire new customers as its CAC payback period checked in at 88.7 months this quarter. The company’s prolonged sales cycles indicate it operates in a competitive market and must continue investing to grow.

Key Takeaways from Commvault Systems’s Q4 Results

We were impressed by how significantly Commvault Systems blew past analysts’ billings expectations this quarter. We were also glad its revenue guidance for next quarter came in higher than Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 4.7% to $166 immediately following the results.

Commvault Systems put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.