Aerospace and defense company Boeing (NYSE:BA) met Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 30.8% year on year to $15.24 billion. Its non-GAAP loss of $5.90 per share was 82.7% below analysts’ consensus estimates.

Is now the time to buy Boeing? Find out by accessing our full research report, it’s free.

Boeing (BA) Q4 CY2024 Highlights:

- Revenue: $15.24 billion vs analyst estimates of $15.18 billion (30.8% year-on-year decline, in line)

- Adjusted EPS: -$5.90 vs analyst expectations of -$3.23 (82.7% miss)

- Adjusted EBITDA: -$3.16 billion vs analyst estimates of $471.1 million (-20.8% margin, significant miss)

- Operating Margin: -24.7%, down from 1.3% in the same quarter last year

- Free Cash Flow was -$4.10 billion, down from $2.95 billion in the same quarter last year

- Backlog: $521.3 billion at quarter end

- Sales Volumes fell 63.7% year on year (3.3% in the same quarter last year)

- Market Capitalization: $131.1 billion

"We made progress on key areas to stabilize our operations during the quarter and continued to strengthen important aspects of our safety and quality plan," said Kelly Ortberg, Boeing president and chief executive officer.

Company Overview

One of the companies that forms a duopoly in the commercial aircraft market, Boeing (NYSE:BA) develops, manufactures, and services commercial airplanes, defense products, and space systems.

Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Sales Growth

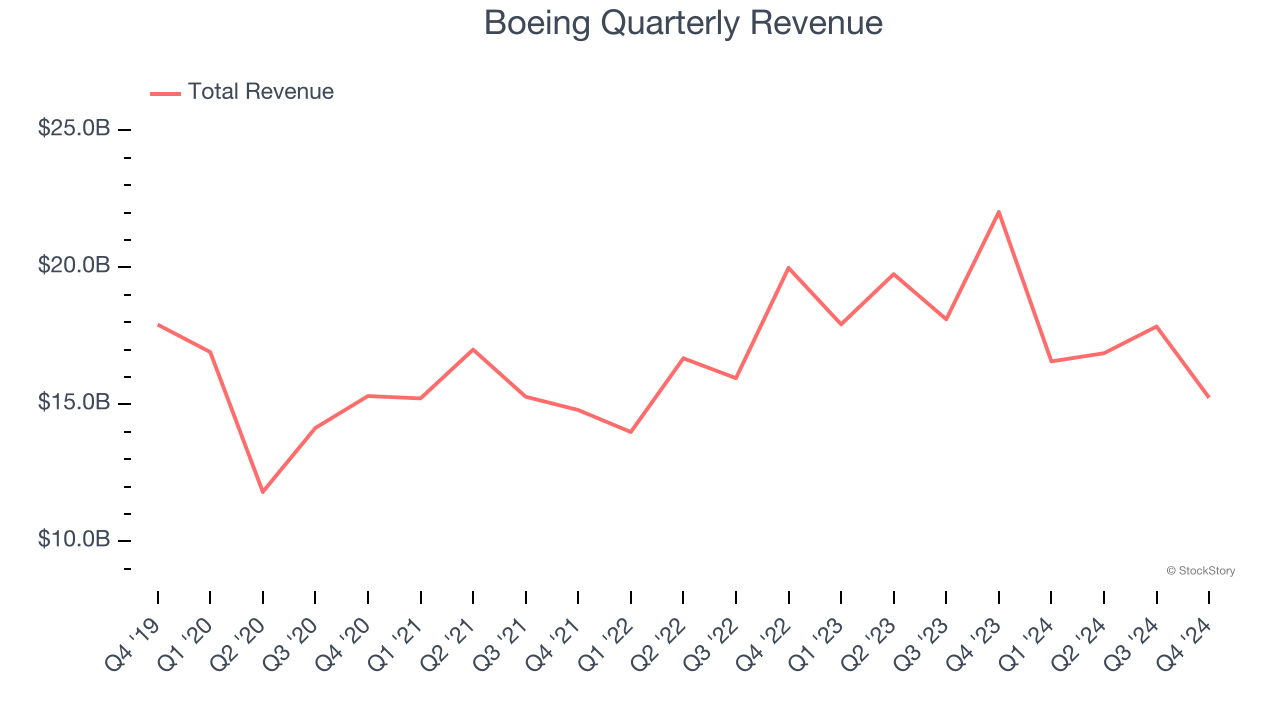

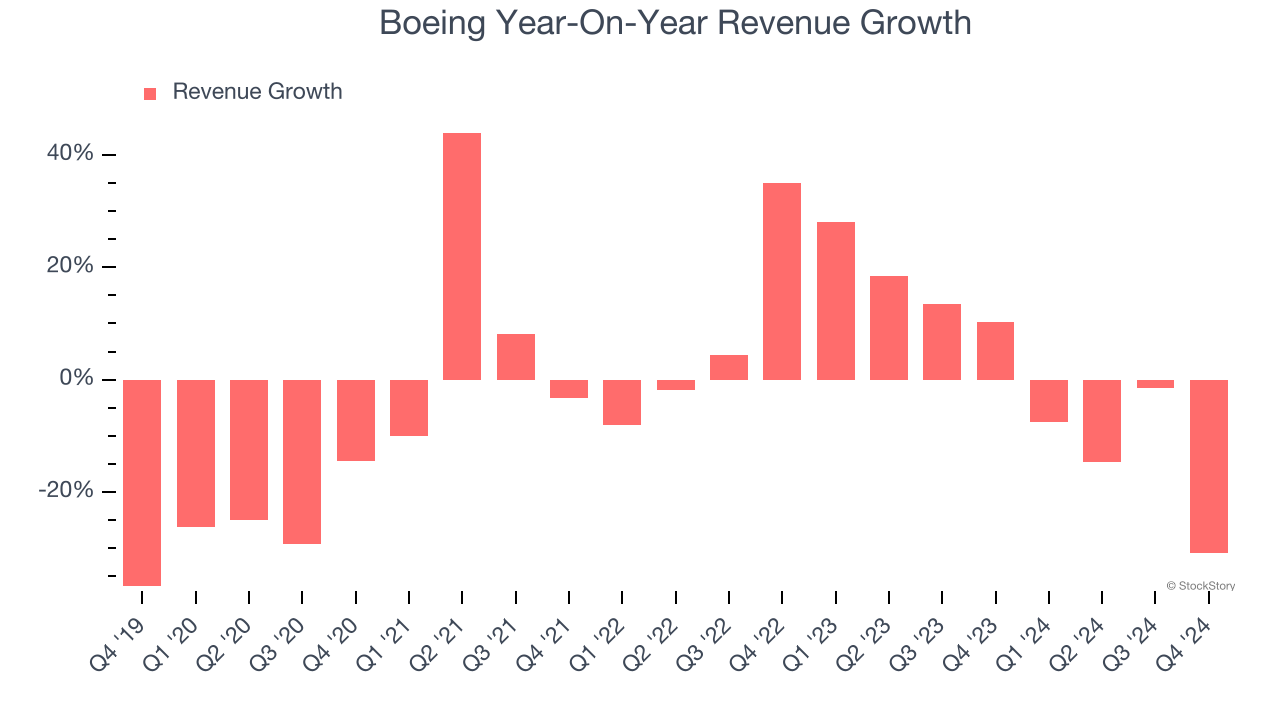

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Boeing struggled to consistently generate demand over the last five years as its sales dropped at a 2.8% annual rate. This was below our standards and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Boeing’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop in sales.

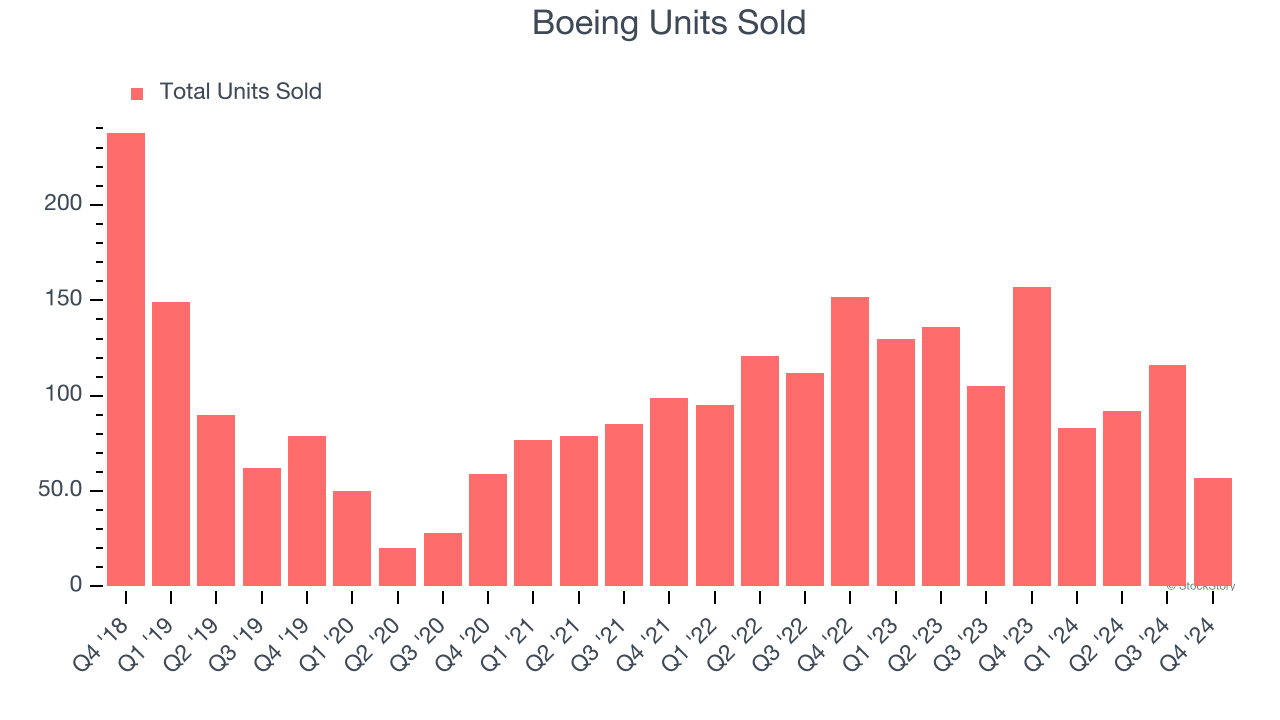

Boeing also reports its units sold, which reached 57 in the latest quarter. Over the last two years, Boeing’s units sold averaged 9.4% year-on-year declines. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Boeing reported a rather uninspiring 30.8% year-on-year revenue decline to $15.24 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 28.1% over the next 12 months, an improvement versus the last two years. This projection is eye-popping for a company of its scale and indicates its newer products and services will spur better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

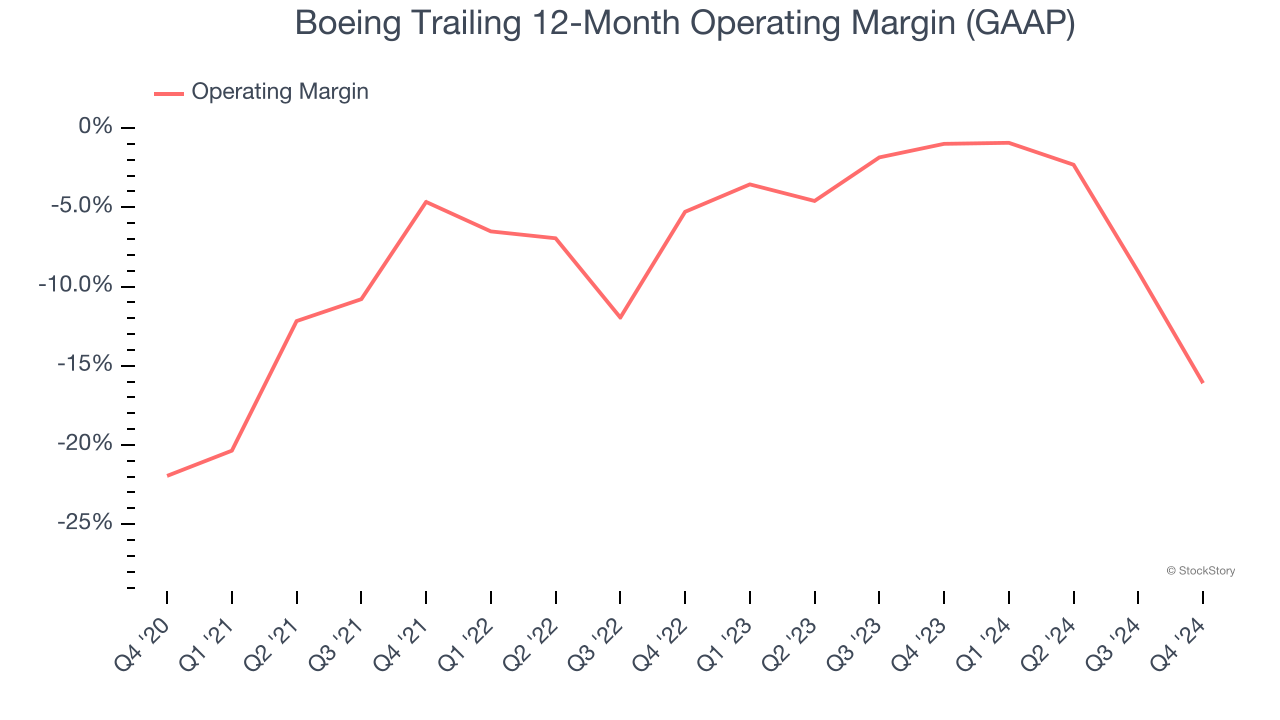

Boeing’s high expenses have contributed to an average operating margin of negative 9.3% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Boeing’s operating margin rose by 5.9 percentage points over the last five years. Still, it will take much more for the company to reach long-term profitability.

Boeing’s operating margin was negative 24.7% this quarter. The company's consistent lack of profits raise a flag.

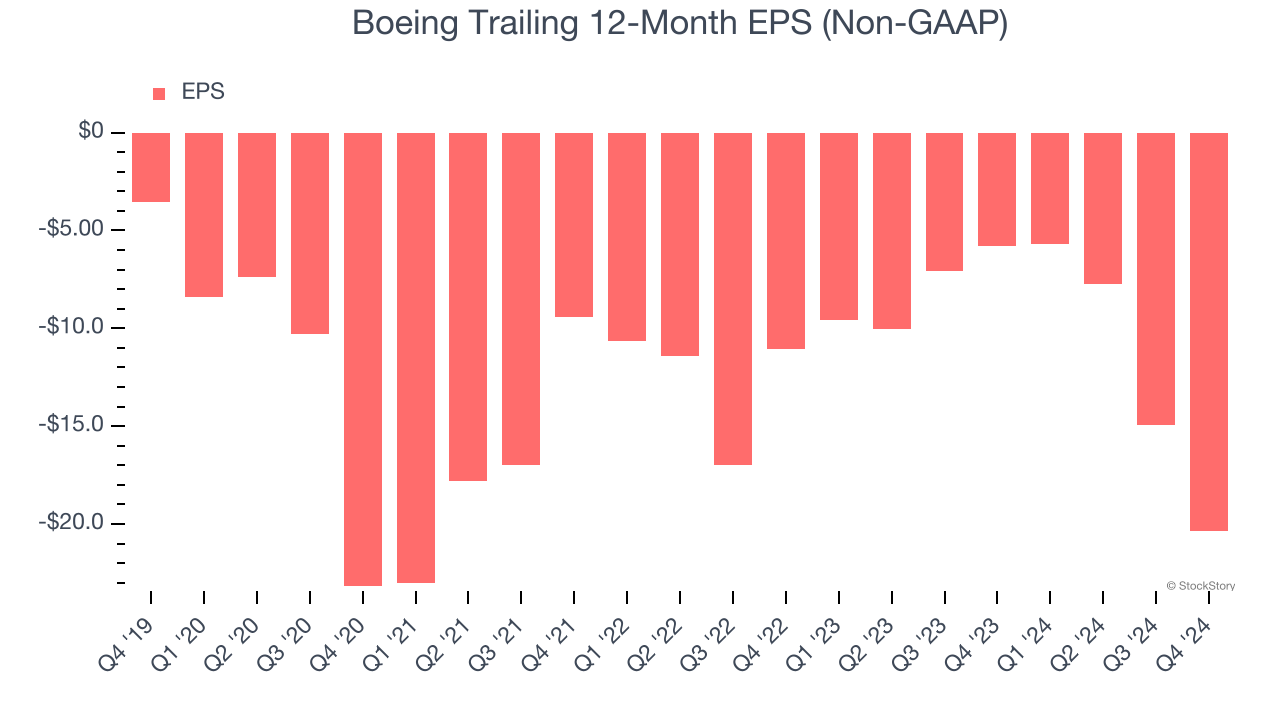

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Boeing’s earnings losses deepened over the last five years as its EPS dropped 42% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Boeing’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Boeing, its two-year annual EPS declines of 35.7% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q4, Boeing reported EPS at negative $5.90, down from negative $0.47 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Boeing’s full-year EPS of negative $20.38 will reach break even.

Key Takeaways from Boeing’s Q4 Results

It was good to see Boeing meet analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter, and the CEO has introduced a recovery plan to stabilize a sputtering business. The stock remained flat at $175.13 immediately following the results.

Boeing’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.