Upstart has been on fire lately. In the past six months alone, the company’s stock price has rocketed 132%, reaching $64.24 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Upstart, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

We’re happy investors have made money, but we're cautious about Upstart. Here are three reasons why you should be careful with UPST and a stock we'd rather own.

Why Is Upstart Not Exciting?

Founded by the former head of Google's enterprise business, Upstart (NASDAQ:UPST) is an AI-powered lending platform facilitating loans for banks and consumers.

1. Weak Transaction Volumes Point to Soft Demand

Total transaction volumes show the aggregate dollar value of loans processed on Upstart’s platform. This is the number from which the company will ultimately collect fees, and the higher it is, the more accurate its software becomes at assessing credit risk.

Upstart’s transaction volume came in at $1.58 billion in Q3, and over the last four quarters, its year-on-year growth averaged 4.7%. This performance was underwhelming and suggests that competition from other fintechs or internal efforts from its banking partners may be reducing its ability drive incremental loans.

2. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Upstart’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Upstart’s products and its peers.

3. Restricted Access to Capital Increases Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

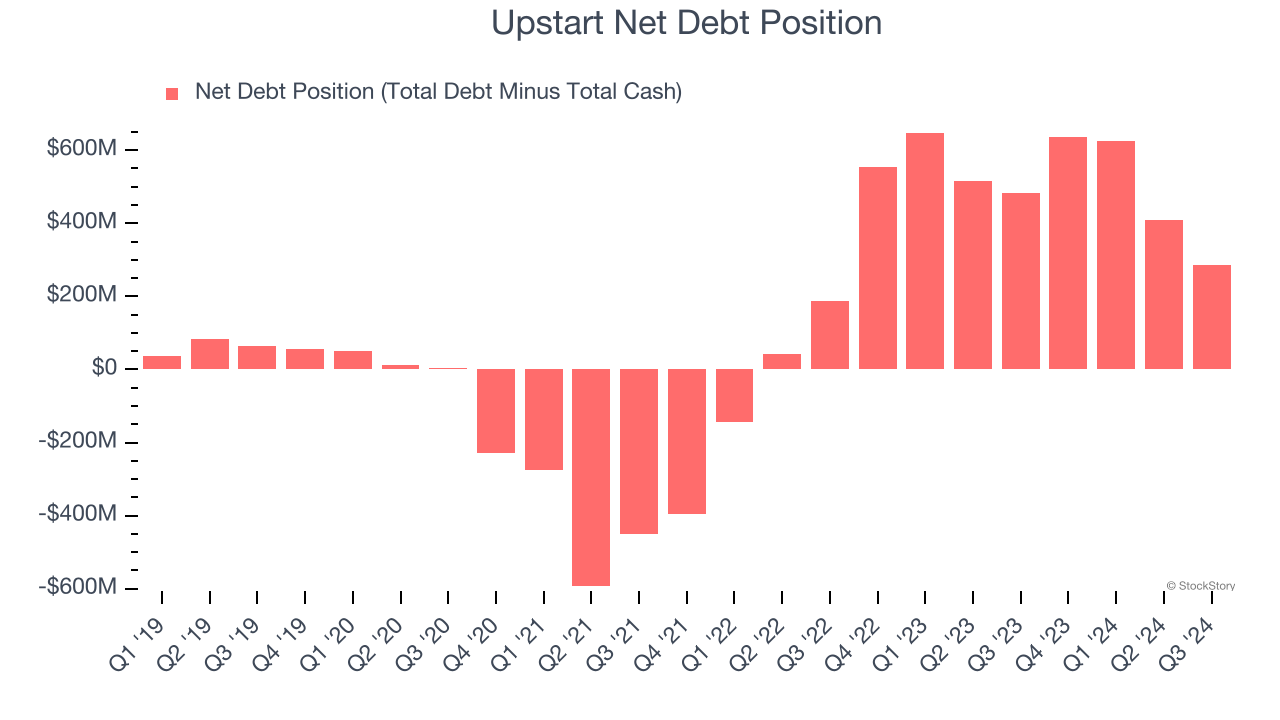

Upstart posted negative $27.56 million of EBITDA over the last 12 months, and its $940.7 million of debt exceeds the $655.8 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade Upstart if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Upstart can improve its profitability and remain cautious until then.

Final Judgment

Upstart isn’t a terrible business, but it doesn’t pass our quality test. Following the recent rally, the stock trades at 8.2× forward price-to-sales (or $64.24 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d suggest looking at Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Like More Than Upstart

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.