RTX’s 13.2% return over the past six months has outpaced the S&P 500 by 10.8%, and its stock price has climbed to $115.08 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy RTX, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why RTX doesn't excite us and a stock we'd rather own.

Why Is RTX Not Exciting?

Originally focused on refrigeration technology, Raytheon (NSYE:RTX) provides a a variety of products and services to the aerospace and defense industries.

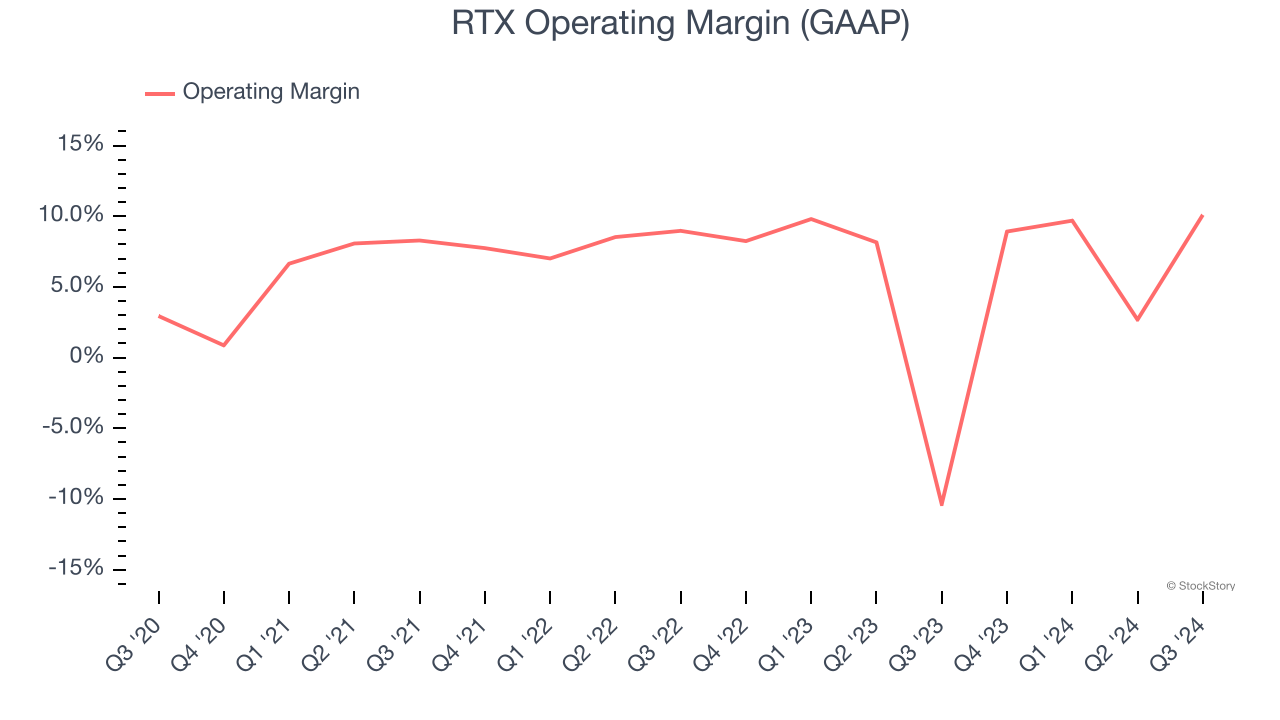

1. Weak Operating Margin Could Cause Trouble

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

RTX was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.3% was weak for an industrials business.

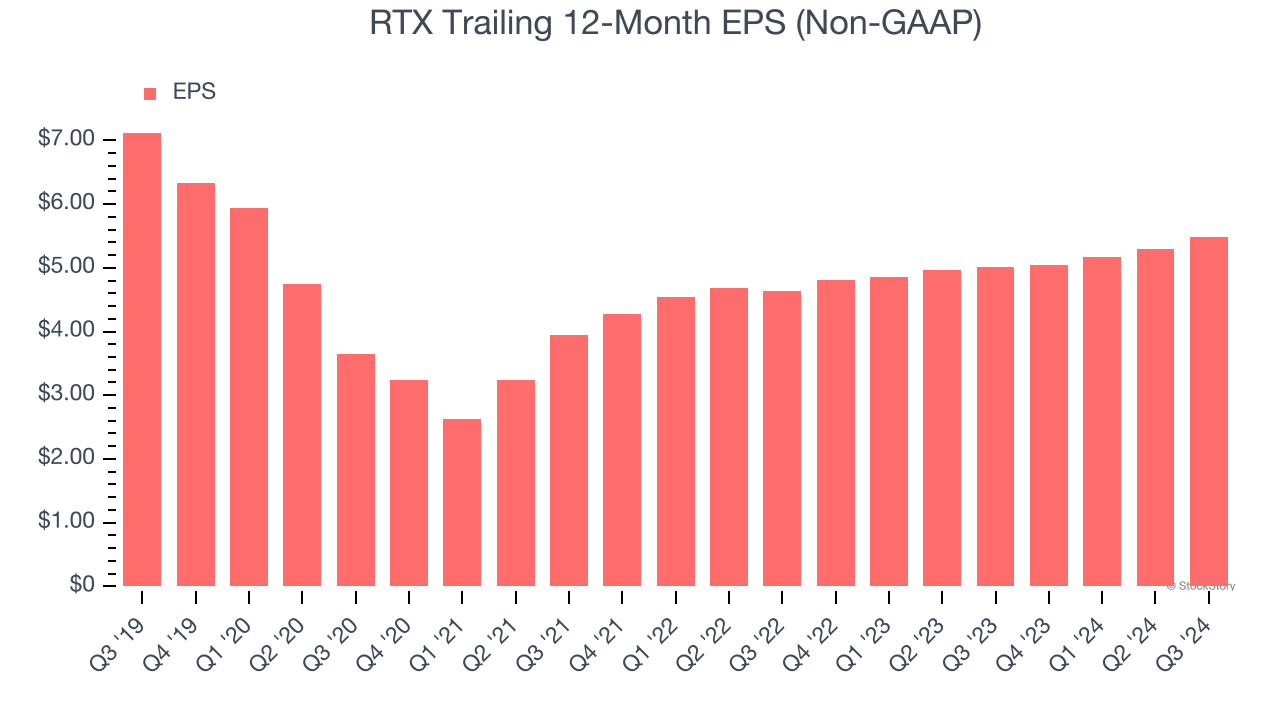

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for RTX, its EPS declined by 5.1% annually over the last five years while its revenue grew by 8.4%. This tells us the company became less profitable on a per-share basis as it expanded.

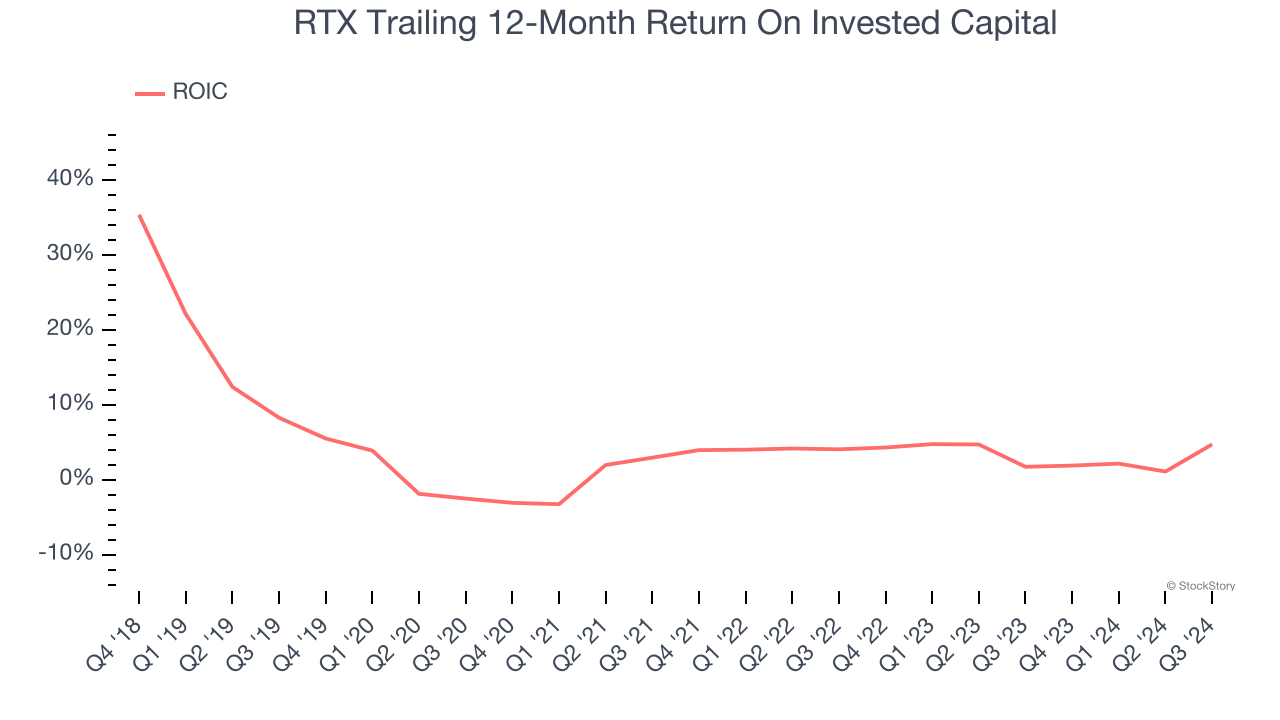

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

RTX historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.2%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

Final Judgment

RTX’s business quality ultimately falls short of our standards. With its shares outperforming the market lately, the stock trades at 19.7× forward price-to-earnings (or $115.08 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Would Buy Instead of RTX

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.