Since July 2024, American Woodmark has been in a holding pattern, posting a small return of 2.3% while floating around $79.35. This is close to the S&P 500’s 4.7% gain during that period.

Is now the time to buy American Woodmark, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.We're cautious about American Woodmark. Here are three reasons why we avoid AMWD and a stock we'd rather own.

Why Do We Think American Woodmark Will Underperform?

Starting as a small millwork shop, American Woodmark (NASDAQ:AMWD) is a cabinet manufacturing company that helps customers from inspiration to installation.

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, American Woodmark’s 1.6% annualized revenue growth over the last five years was sluggish. This fell short of our benchmarks.

2. EPS Growth Has Stalled

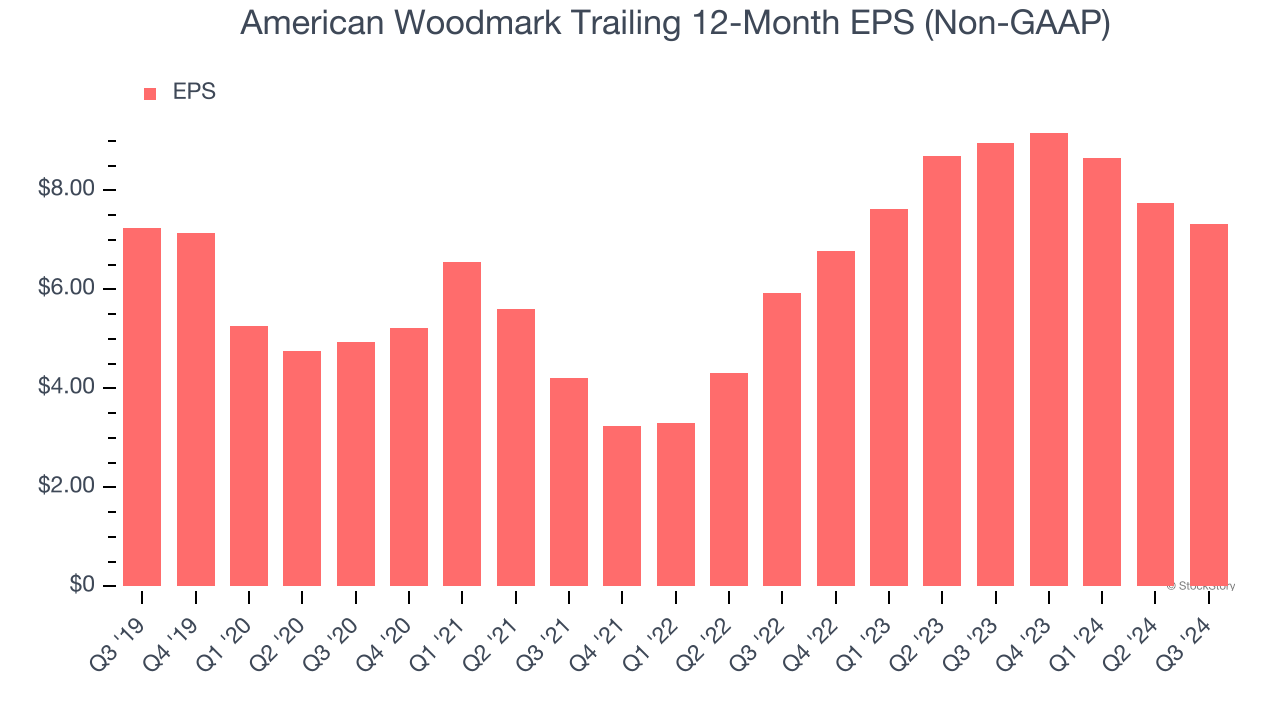

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

American Woodmark’s flat EPS over the last five years was below its 1.6% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

3. Free Cash Flow Margin Dropping

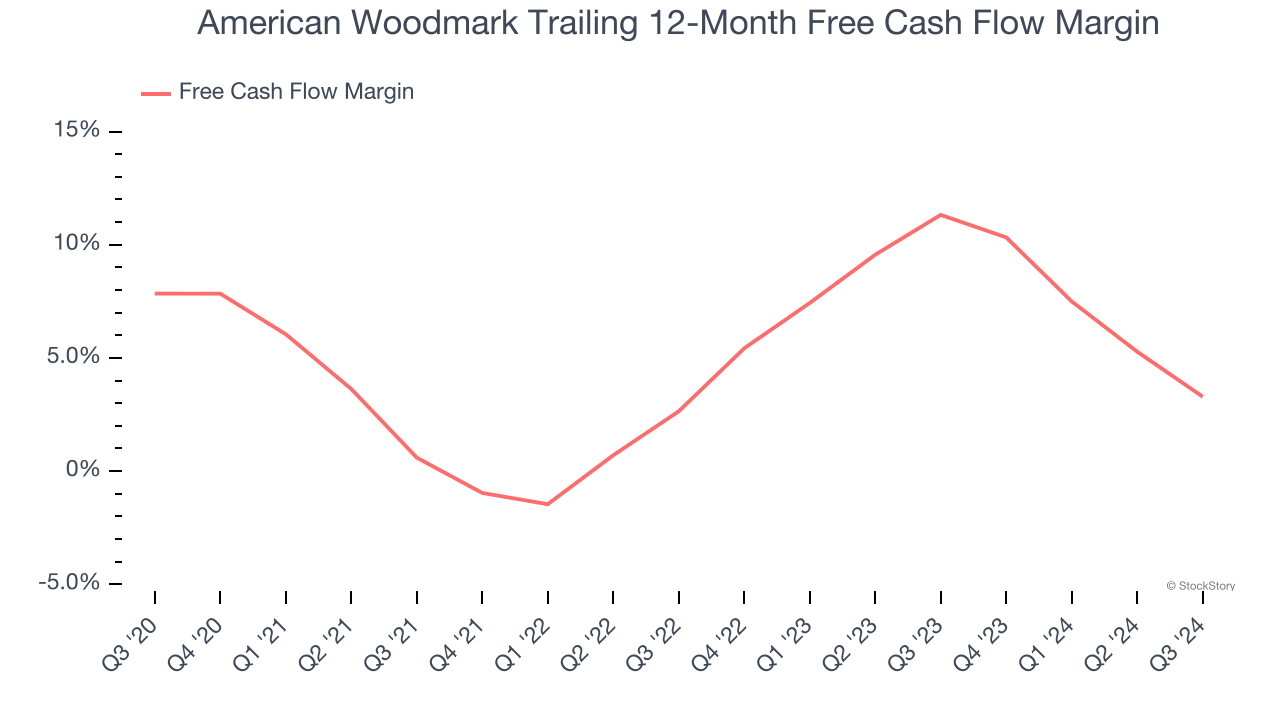

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, American Woodmark’s margin dropped by 4.6 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. American Woodmark’s free cash flow margin for the trailing 12 months was 3.3%.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of American Woodmark, we’ll be cheering from the sidelines. That said, the stock currently trades at 8.3× forward price-to-earnings (or $79.35 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. Let us point you toward KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Like More Than American Woodmark

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.