Oracle’s (ORCL) recent selloff may be giving investors a rare chance to buy into the tech giant at an appealing valuation, according to Deutsche Bank. The firm reiterated its “Buy” rating and maintained a $375 price target, arguing that the current share price gives “little if any credit” to Oracle’s expanding partnership with OpenAI.

Oracle stock is up 27% YTD, but is trading nearly 40% below its 52-week high of $345.72. Oracle is set to release its second-quarter fiscal 2026 earnings on Dec. 10.

Let’s find out if Oracle stock is a buy now.

What Is the OpenAI-Oracle Deal?

Oracle builds cloud infrastructure and software that companies use to run their business and manage their data. According to the Wall Street Journal, OpenAI has reportedly signed a massive $300 billion agreement with Oracle to buy cloud computing power over the next five years. This makes it one of the largest tech infrastructure deals in history.

While Deutsche Bank acknowledges that the OpenAI collaboration introduces certain financial and operational risks, it sees these concerns as more than compensated by the “very real opportunity” the deal offers. For Oracle, this is a huge long-term revenue boost and validation of its AI-focused cloud expansion.

The deal positions Oracle as a top-tier AI cloud provider, competing more directly with Amazon (AMZN), Google (GOOGL), and Microsoft (MSFT). This is probably why Deutsche Bank believes the market is underestimating Oracle’s long-term cloud and AI potential, making the current dip an attractive entry point. Wells Fargo echoed the same sentiment, initiating coverage on ORCL with an “Overweight” rating and a $280 price target. The firm argues that Oracle is positioned to be a major winner of the emerging AI “super-cycle,” highlighting the nearly half-trillion dollars in AI deals already secured. Wells Fargo adds that the recent dip in the stock offers a compelling entry point for long-term investors.

Gearing Up for Another Strong Quarter

Oracle is transforming into the infrastructure backbone of the global AI boom. The company is now the go-to platform for AI workloads, evidenced by massive cloud contracts signed with OpenAI, xAI, Meta (META), Nvidia (NVDA), Advanced Micro Devices (AMD), and others. This surge in demand pushed remaining performance obligations (RPO) in the first quarter of fiscal 2026 to a staggering $455 billion, an increase of a massive 359% year over year. Cloud RPO alone increased by roughly 500%, on top of an 83% increase last year, indicating that Oracle's pipeline is expanding at a quick pace.

In Q1, overall cloud revenue was $7.2 billion, a 27% growth, with cloud infrastructure revenue up 54% to $3.3 billion and OCI consumer revenue up 57%.

Despite a 2% decline in total software revenue, Oracle’s overall revenue for the quarter hit $14.9 billion, an increase of 11% from last year. Adjusted earnings per share increased by 6% to $1.47 per share. Oracle stressed that it is creating gigawatt-scale GPU data centers for AI training that are faster and more cost-effective than competitors. Capital expenditures totaled $27.4 billion, owing to significant data center investments that resulted in negative free cash flow during the quarter. However, management reaffirmed that the majority of CapEx is related to revenue-generating equipment, highlighting that every dollar is spent to increase capacity and convert RPO into revenue. Nonetheless, Oracle ended the quarter with a sturdy balance sheet with $11 billion in cash and marketable securities and a deferred revenue balance of $12 billion. The company also returned $5 billion in dividends and $95 million in share repurchases over the last 12 months.

The AI Supercycle: Oracle’s Multi-Year Roadmap

Oracle entered the second quarter from a position of exceptional strength. The company expects 12% to 14% growth in revenue, with 8% to 10% increase in adjusted earnings per share

Management reaffirmed 16% full-year total revenue growth for fiscal 2026 and projected acceleration beyond fiscal 2026. OCI revenue is expected to surge 77% this fiscal year to $18 billion and will eventually climb to $32 billion the next fiscal year before reaching $144 billion in the next four years. Management emphasized that much of this revenue is already embedded in the current RPO and expects that additional multi-billion-dollar customer wins could lead RPO to surpass half a trillion dollars.

With record AI-driven cloud demand, explosive RPO growth, clear multi-year visibility, and strength in both GPU and non-GPU segments, Oracle appears positioned for long-term growth. The second-quarter earnings will showcase the stock’s long-term trajectory.

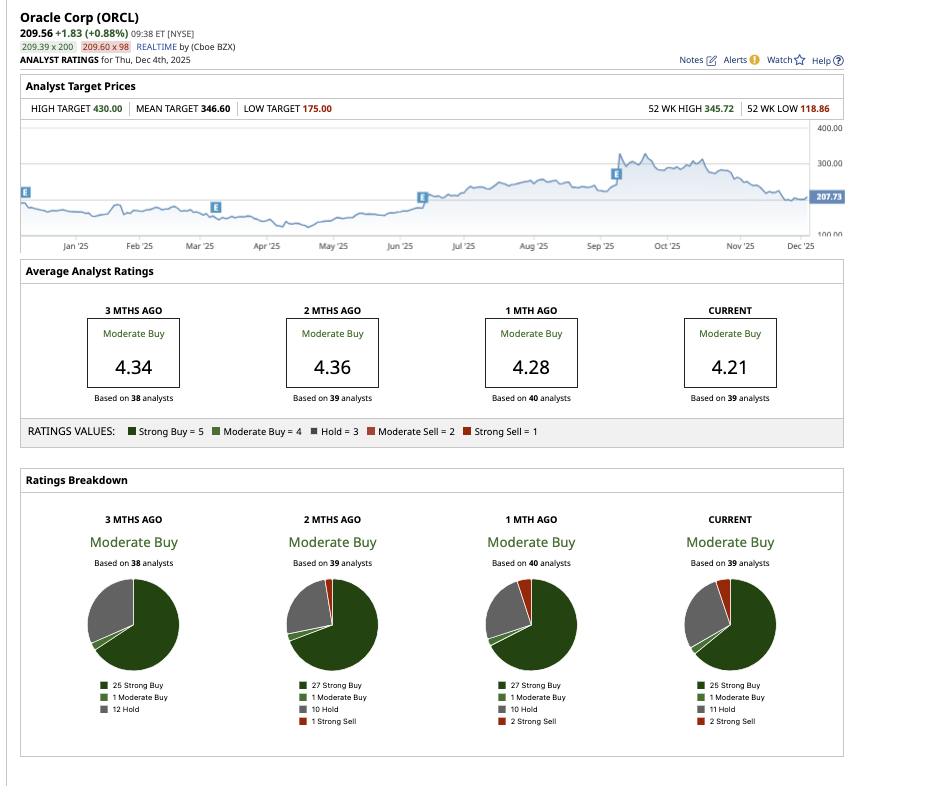

Overall, Wall Street rates Oracle stock a “Moderate Buy.” Out of the 39 analysts covering the stock, 25 rate it a “Strong Buy,” one says it is a “Moderate Buy,” 11 rate it a “Hold,” and two say it is a “Strong Sell.” The average target price for Oracle stock is $346.60, representing potential upside of 67% from its current levels. The high price estimate of $430 suggests the stock can rally as much as 107% this year.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart